Introduction to Currency Correlations in Forex Trading

Forex trading is one of the most liquid and dynamic financial markets in the world, with over $6 trillion traded daily. While many traders focus on individual currency pairs, such as EUR/USD or GBP/USD, understanding currency correlations in forex trading can significantly improve trading outcomes.

Currency correlation is the statistical relationship between two currency pairs, indicating whether they tend to move in the same direction, opposite directions, or independently. This concept is crucial because it enables traders to manage risk, diversify their portfolios, and refine trading strategies by analyzing broader market patterns rather than focusing on isolated pairs.

By mastering currency correlations in forex trading, traders can anticipate market movements more accurately, reduce exposure to unexpected swings, and make more informed decisions.

What Are Currency Correlations?

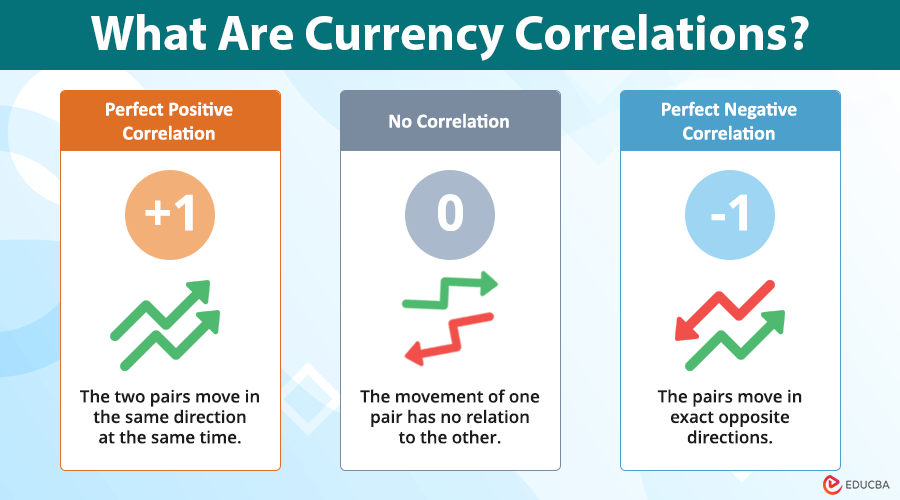

A currency correlation measures how the value of one currency pair moves relative to another. It is expressed numerically between -1 and +1:

- +1 (Perfect Positive Correlation): The two pairs move in the same direction at the same time.

- 0 (No Correlation): The movement of one pair has no relation to the other.

- -1 (Perfect Negative Correlation): The pairs move in exact opposite directions.

For example, if the EUR/USD rises due to stronger European economic data, the GBP/USD often rises as well, because both pairs share the USD as their counter currency. Conversely, the USD/CHF often moves in the opposite direction of the EUR/USD due to historical economic and market relationships.

Understanding these relationships is a crucial aspect of currency correlations in forex trading, enabling traders to avoid overexposure to the same market risk and make more informed hedging decisions.

Types of Currency Correlations

Currency correlations can be grouped into three main types:

1. Positive Correlation

Two currency pairs move in the same direction.

Example:

- EUR/USD and GBP/USD

- AUD/USD and NZD/USD

Why It Happens:

Currency pairs with positive correlations typically share the same base currency or are influenced by similar economic factors, such as interest rates, trade balances, or exports.

Tip:

Traders should avoid opening multiple positions in positively correlated pairs simultaneously unless they are deliberately doubling down on a specific strategy, as this increases risk exposure.

2. Negative Correlation

Two currency pairs move in opposite directions.

Example:

- EUR/USD and USD/CHF

- USD/JPY and GBP/USD

Why It Happens:

Negative correlations often arise because of opposite reactions to economic indicators or risk sentiment. For instance, when the USD strengthens, the EUR/USD tends to fall, while the USD/CHF tends to rise.

Tip:

Traders can use negatively correlated pairs to hedge positions. For example, a trader long on EUR/USD may consider shorting USD/CHF to offset potential losses if the USD strengthens unexpectedly.

3. No Correlation

The movement of one currency pair has little to no predictable relationship with another.

Example:

- GBP/JPY and AUD/CAD

Why It Happens:

Distinct economies, trade relationships, or geopolitical events influence uncorrelated pairs of variables.

Tip:

Using uncorrelated pairs allows traders to diversify their portfolios and reduce overall risk exposure.

Why Currency Correlations Matter in Forex Trading?

Understanding currency correlations in forex trading offers multiple benefits for traders, from risk management to strategy optimization:

1. Risk Management

Correlation analysis helps avoid overleveraging. If a trader holds multiple positions in highly correlated pairs, losses in one trade may coincide with losses in another.

2. Portfolio Diversification

Traders can lower overall risk by including pairs that are uncorrelated or move in opposite directions in their portfolio.

3. Strategy Optimization

Currency correlations can guide trade confirmation and timing.

Key Currency Correlation Examples

Understanding specific correlations helps traders recognize patterns and anticipate market behavior.

| Currency Pair 1 | Currency Pair 2 | Correlation Type | Notes |

| EUR/USD | GBP/USD | Positive | Both are influenced by USD movements and European economies. |

| USD/CHF | EUR/USD | Negative | USD strength often moves these pairs in opposite directions. |

| AUD/USD | NZD/USD | Positive | Both are tied to commodity exports and interest rates in Oceania. |

| USD/JPY | GBP/USD | Negative | USD/JPY often reacts differently to risk sentiment compared to GBP/USD. |

Tools to Track Currency Correlations in Forex Trading

Several tools help traders monitor and analyze correlations effectively:

- Correlation matrices: Show real-time correlations for multiple currency pairs. Traders can identify strong positive or negative relationships.

- Trading platforms: Many brokers provide built-in tools to track correlations. For example, traders can visualize the relationship between GBP and USD movements using a pound dollar chart.

- Excel & statistical software: Advanced traders often download historical price data to calculate correlations and back-test strategies.

These tools are essential for anyone looking to excel at currency correlations in forex trading.

Tips for Using Currency Correlations in Forex Trading Effectively

- Regularly monitor correlations: Currency relationships are dynamic. Central bank decisions, economic data, and geopolitical events can rapidly alter correlations.

- Combine with technical analysis: Confirm correlation insights using trend lines, candlestick patterns, support/resistance levels, and tools like RSI and MACD.

- Avoid overleveraging correlated pairs: Even if two pairs are positively correlated, market surprises can cause unexpected losses.

- Understand the economic drivers: Analyze interest rates, GDP growth, trade balances, and commodity markets that influence each currency.

- Use correlations for hedging: Negatively correlated pairs can help offset losses in volatile market conditions.

Final Thoughts

Currency correlations in forex trading are a valuable tool for Forex traders, enabling them to manage risk, diversify their investments, and make more informed trading decisions. By understanding positive, negative, and uncorrelated relationships, traders can anticipate market movements, optimize trading strategies, and avoid overexposure.

Tools like correlation matrices, statistical analysis software, and platforms such as TradingView, including a pound-dollar chart, can provide actionable insights for better decision-making.

Mastering currency correlations goes beyond predicting price movements; it is about strategic risk management and improved trading outcomes. Traders who incorporate correlation analysis into their trading routines often gain an edge in the highly competitive foreign exchange (Forex) market.

Recommended Articles

We hope this comprehensive guide on currency correlations in forex trading helped you understand their importance in Forex trading. Explore our related articles on: