Introduction to Cross-Border Payments

In a world where capital and commerce flow seamlessly across borders, the speed, cost, and security of cross-border payments have become crucial factors in driving global growth. From small businesses selling internationally to financial institutions moving billions daily, the infrastructure of global payments is undergoing one of its most profound transformations in decades.

Technological innovation, regulatory alignment, and rising customer expectations are converging to shape a future where cross-border transactions are faster, cheaper, and smarter. But the journey is complex, and the stakes are high.

Why Cross-Border Payments Need Reinvention?

Inefficiencies have long plagued traditional cross-border payments. Transactions often pass through multiple intermediaries, each charging fees and adding delays. Settlement can take days, and transparency is limited users typically cannot track the location of their funds, the reason for delays, or the charges that will be applied.

These inefficiencies matter. According to the World Bank, remittances alone topped $860 billion in 2023, while corporations move trillions of dollars annually in cross-border trade and investment. Every percentage shaved off fees or hour saved in settlement translates into significant economic value. The need is evident: both businesses and individuals now expect international payments to be as fast, simple, and reliable as local transactions.

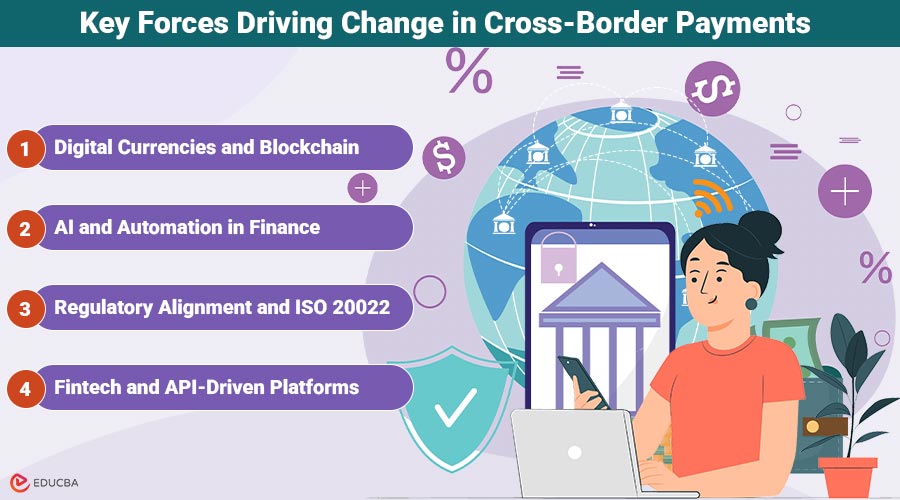

Key Forces Driving Change in Cross-Border Payments

Several key forces are shaping the future of cross-border payments, driving faster, cheaper, and smarter global transactions.

1. Digital Currencies and Blockchain

Blockchain-based systems offer near-instant settlement, full traceability, and reduced reliance on intermediaries. While volatility limits the role of cryptocurrencies like Bitcoin in everyday transactions, stablecoins and central bank digital currencies (CBDCs) are gaining momentum. Initiatives like the Bank for International Settlements’ Project Dunbar show how central bank digital currencies (CBDCs) could create interoperable platforms that support multiple currencies seamlessly. For businesses, this could mean paying suppliers abroad in seconds rather than days.

2. AI and Automation in Finance

Artificial intelligence is transforming not only payments but the entire order-to-cash (O2C) cycle. Platforms like Zenskar show how AI can automate billing, revenue recognition, and analytics, reducing manual friction in global financial operations. By minimizing errors and accelerating financial close processes, companies can adapt to complex multi-currency environments with less human effort.

3. Regulatory Alignment and ISO 20022

Harmonization of financial messaging standards is crucial for interoperability. ISO 20022, the latest global standard for payment messaging, allows transactions to carry more detailed and structured information, improving efficiency and transparency. This enhances compliance, fraud detection, and reconciliation critical for both efficiency and trust.

4. Fintech and API-Driven Platforms

Fintech innovators are building payment rails that bypass traditional correspondent banking models. These solutions leverage APIs for real-time data sharing, enabling transparency and faster settlement. Companies no longer need to rely solely on legacy systems; instead, they can tap into modern networks that prioritize user experience.

The Business Perspective: Efficiency Meets Opportunity

For corporations, cross-border payments are not just a back-office function they are a strategic enabler. Delayed settlements can disrupt supply chains, while high transaction costs cut into margins. Modern systems now allow treasury teams to manage multi-currency cash flows with unprecedented precision. They can hedge risks more effectively, forecast liquidity, and optimize working capital all while reducing overhead.

In parallel, accounting and management platforms such as Uku are helping companies gain full visibility into workflows, automate invoicing, and make data-driven financial decisions. As these systems integrate with modern payment infrastructures, they reinforce the same principles driving change in cross-border finance efficiency, transparency, and control. The ability to reconcile payments automatically, detect anomalies through AI, and integrate seamlessly with ERP systems is redefining what finance departments expect from their global payment partners.

The Investor’s View: Unlocking Global Capital

Cross-border payments are also central to global investment flows. Investors across private equity, real estate, and venture capital require seamless methods to transfer funds, manage assets, and track investment opportunities. Platforms like SmartMoneyMatch highlight how digital ecosystems are connecting global investors, service providers, and opportunities under one roof.

The integration of faster, smarter payment rails into such platforms will further streamline the allocation of capital across geographies. For investors, this means more efficient deal execution, better compliance monitoring, and the ability to participate in global markets without the legacy bottlenecks of international transfers.

Challenges of Cross-Border Payments

While the promise of faster, cheaper, smarter cross-border payments is compelling, several challenges must be addressed:

- Fragmented Regulation: Different jurisdictions impose varying compliance and reporting requirements, complicating global adoption.

- Cybersecurity Risks: As systems evolve, robust security testing becomes essential. Partnering with specialized firms like White Knight Labs, which offer advanced network penetration testing, helps organizations detect and fix vulnerabilities before exploited by attackers.

- Legacy Infrastructure: Many banks still rely on systems that are decades old, making integration costly and slow.

- Financial Inclusion: Access to inexpensive cross-border payments remains a barrier for billions of people who are unbanked or underbanked.

Overcoming these barriers will require not only innovation but also strong collaboration between the public and private sectors.

A Glimpse into the Future

The next decade is likely to see a hybrid model:

- CBDCs and Stablecoins coexist with fiat, bridging the gap between traditional and digital economies.

- AI copilots for finance teams are automating not just payments but entire financial workflows.

- Real-time settlement systems are becoming the norm, eliminating the uncertainty of multi-day lags.

- Greater transparency enables businesses and consumers to track cross-border payments, much like they can track parcels in transit.

Ultimately, the future of cross-border payments is not just about technology it is about trust. Transparency, compliance, and user-centric design will determine which platforms and systems achieve widespread adoption.

Building a Smarter Global Payment Network

The evolution of cross-border payments represents more than operational efficiency it is a catalyst for global growth. Whether it is a startup scaling internationally, a corporation optimizing its treasury, or an investor reallocating capital across markets, the infrastructure of global payments shapes outcomes at every level of the economy.

By embracing AI-driven automation, harmonized standards, blockchain innovation, and digital ecosystems, the financial industry is building a payment network that is faster, cost-effective, and smarter. The winners will be those who not only reduce friction but also build trust, resilience, and inclusivity into their solutions.

Final Thoughts

The future of cross-border payments promises a system that is faster, cheaper, and smarter, driven by digital currencies, AI, blockchain, and fintech innovations. Businesses, investors, and consumers can benefit from enhanced transparency, real-time settlement, and lower costs. While challenges such as regulatory fragmentation, cybersecurity risks, and legacy infrastructure persist, ongoing collaboration and technological adoption are paving the way for a more efficient and inclusive global payment ecosystem. Seamless cross-border payments will boost global trade, investment, and economic growth, fostering a truly connected world.

Recommended Articles

We hope this guide to cross-border payments helps you understand the future of global transactions. Check out these recommended articles for more insights and strategies to optimize international payments.