Introduction to Central Bank Digital Currency

Recent technological advancements have transformed the way we handle money, opening up new possibilities for sending money, exploring international investments, and accessing financial services without the need for traditional banks. This shift is a hot topic at blockchain conferences, posing a significant challenge for traditional financial institutions striving to remain relevant in this evolving landscape. Central bank digital currency (CBDC) stands out as a groundbreaking innovation driving this transformation.

What is Central Bank Digital Currency?

A country’s central bank creates and oversees a digital version of money called Central Bank Digital Currency (CBDC). It offers a secure and reliable means for online transactions.

CBDCs can transform the financial system, change the roles of traditional intermediaries, and impact societal structures.

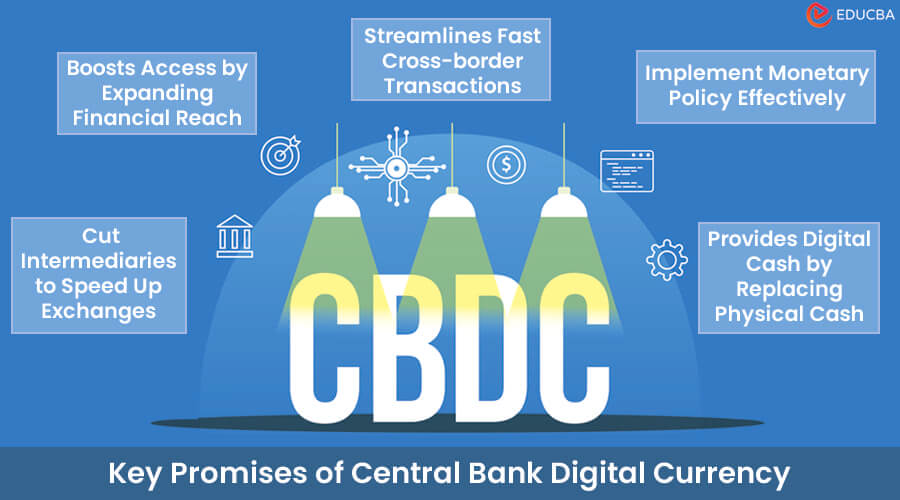

Key Promises of Central Bank Digital Currency

CBDCs are set to revolutionize finance in several ways. Here’s how they will make a difference:

1. Boosts Access by Expanding Financial Reach

CBDCs are like a digital upgrade to regular money but with extra benefits. Imagine a neighborhood where there are not many regular banks. People might find it hard to get basic financial services like loans or savings accounts in such places.

Now, with CBDCs, things get easier. These digital currencies are safe and supported by the government. It means that even in areas without many banks, people can use their smartphones or computers to do all sorts of money-related things. They can manage their money, make payments, and even save for the future.

2. Implement Monetary Policy Effectively

Central banks use interest rates as a tool to manage the economy. When they want to boost growth, they lower interest rates. They raise interest rates if they want to prevent too much spending during a busy period.

CBDCs make it easier for central banks to adjust interest rates quickly. It allows them to control how much people borrow and spend. Central banks can influence economic stability and respond to evolving conditions by regulating borrowing and spending, thereby impacting the overall well-being of the economy.

3. Cut Intermediaries to Speed Up Exchanges

Unlike regular transactions that involve intermediaries (traditional banks and payment processors), CBDCs allow direct peer-to-peer transactions. It simplifies the process, making transactions faster and more seamless. With CBDCs, you can send money or make payments with just a few clicks, eliminating the complications and delays associated with traditional financial mediators.

4. Provides Digital Cash by Replacing Physical Cash

CBDCs can revolutionize how we handle money by going fully digital. Unlike physical cash, CBDCs are electronic, eliminating the need for printing, transporting, and securing physical currency. This shift translates to significant cost savings for governments and financial institutions.

These savings can boost the economy by reducing overall costs, making transactions more efficient, and promoting financial innovation.

5. Streamlines Fast Cross-border Transactions

CBDCs make global trade easier by providing a universally accepted digital currency. When businesses engage in cross-border transactions, there are typically complex steps involving mediators like clearinghouses and correspondent banks. These intermediaries can be expensive and slow down the process.

CBDCs simplify this by allowing direct digital transactions that anyone can use internationally. It makes international trade faster, more efficient, and more cost-effective.

Final Thoughts

Central Bank Digital Currency marks a big shift in how money works. This innovation tackles important issues in finance and is driven by collaboration between central banks and financial institutions.

Embracing CBDCs means we are shaping a financial future that’s fair, transparent, and more efficient. It is a game-changer, making money digitally and improving how it is created, used, and governed.

Recommended Articles

We hope this “Central Bank Digital Currency” article was informative and beneficial. To learn more, refer to the below articles.