Updated July 13, 2023

Definition of Corporate Governance

“Corporate governance” refers to guidelines, principles, and practices governing an organization’s day-to-day work. Essentially, it ensures that a company’s activities don’t ignore the interests of its various stakeholders, such as senior management executives, shareholders, customers, the overall community, etc.

Further, it provides the framework that a company can use to attain its objectives, encompassing different management aspects, such as corporate disclosure, internal controls, action plans, performance measurement, etc.

Example of Corporate Governance

There are several examples available to describe it. But first, let us look at two cases that epitomize two ends of the corporate governance spectrum.

Example #1

Let us start with the illustration of this issue with Enron. In this case, the problem was that its board of directors (BoD) ignored major corporate governance red flags (conflict of interest). They allowed the company CFO to create independent private entities that carried out business with Enron. These private entities were used to put Enron’s debt obligations and other liabilities under the veil, positively impacting the company’s profit margins. This is a clear case of a lack of corporate governance. In an ideal scenario, Enron’s management should have prevented the CFO from creating these pretentious entities that helped hide the losses.

Example #2

Let us take PepsiCo’s example, which has consistently upheld good governance. In 2020, PepsiCo incorporated inputs from the investors while preparing the proxy statement. The inputs were primarily about the board’s composition and the company’s leadership structure. Consequently, the proxy statement had a section describing the current leadership and compensation structures.

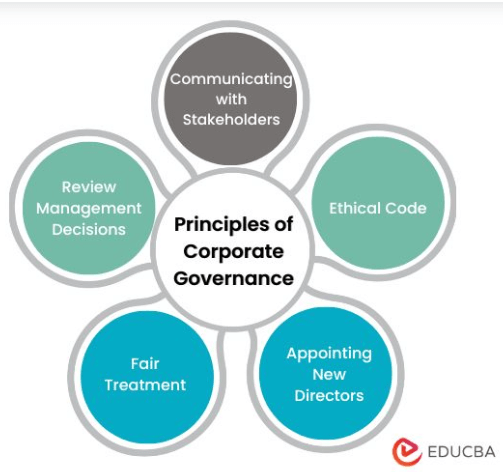

Principles

Several underlying principles lay the foundation of any company’s governance framework. Some of the major principles are as follows:

All important company information should communicate to the stakeholders in a timely manner. These company stakeholders include employees, vendors, customers, lenders, etc.

- The BoD should outline the ethical code for conducting business activities.

- Follow all necessary procedures while appointing new directors and make the process transparent to the stakeholders.

- All the stakeholders should entitle to fair treatment from the management.

- The management should exhibit accountability, transparency, and fairness in all its business activities.

- An auditor should assign to review the management decisions, and the auditor directly reports to the BoD.

Regulation

There have been several instances in the past where the management had breached corporate governance and misused the power given to them by the shareholders. Hence, strict regulations have been introduced to ensure these companies take corporate governance seriously.

- Sarbanes-Oxley Act: It was ordained in 2002 by the US Federal Law to improve it by raising management’s accountability for internal controls and boosting investor confidence in financial reporting. It was enacted to protect investors from scandals like Enron, WorldCom, and Tyco International.

- Gramm-Leach-Bliley Act: It was enacted in 1999 by the US Federal Law mandating financial institutions to disclose how they protect private customer information. The Safeguards Rule outlines the primary data protection propositions, while the additional privacy requirements are covered under the Financial Privacy Rule. This act helped restore public faith in the financial systems.

Conflict Management in Corporate Governance

To manage conflicts within the organization, companies must adhere to a strict corporate governance system covering different spheres of management rights, from corporate disclosure to internal control mechanisms. It is important to make the employees realize that ignoring conflict only aggravates the problem. So the best strategy is to resolve the conflict by dealing with it. One of the most effective conflict management practices is promoting a positive organizational culture that can only achieve by applying uncomplicated and transparent management policies. The best working culture can only mature out of trust, collaboration, mutual respect, and accountability, communicating expectations to the employees. In other words, management practices should help establish a collaborative relationship between managers and employees.

Importance

It is an important aspect of any business as it helps develop a system of rules and regulations that govern company operations while keeping them aligned with the interest of its stakeholders. Good corporate governance reflects ethical and fair business practices, resulting in stakeholders’ satisfaction and better financial viability. On the other hand, inadequate corporate governance often leads to scandals and frauds that eventually result in the downfall of the overall business.

Key Takeaways

Some of the key takeaways of the article are:

- It refers to the guidelines, principles, and practices governing an organization’s day-to-day work.

- A company’s BoD plays a pivotal role in establishing good corporate governance.

- The underlying principles that lay the foundation of corporate governance include accountability, fairness, and transparency.

- Sarbanes-Oxley Act and Gramm-Leach-Bliley Act are two regulations that help boost investors’ confidence in the financial system and protect them against corporate scandals.

- While good corporate governance can enhance the economic viability of a business, inadequate corporate governance can deteriorate a company’s reputation and business.

Conclusion

So, it can be seen that it is a set of guiding principles that leads a company’s operations, ensuring fair treatment and transparent business activities. A company with strong corporate governance invariably makes favorable decisions for all stakeholders, making it an attractive option for investors. On the other hand, a company with bad corporate governance often finds itself involved in scandals that ultimately lead to its downfall.

Recommended Articles

This is a guide to Corporate Governance. Here we discuss the definition, examples, principles, and regulations and their importance. You may also have a look at the following articles to learn more –