Updated February 6, 2023

Introduction to Corporate Finance Interview Questions

These are some questions that can test your knowledge about the corporate finance domain of finance and can help you ace an interview and impress your interviewer, as these form the building blocks of the subject. A lack of knowledge of these concepts can get you in the really bad books of the interviewer.

Top 15 Corporate Finance Interview Questions with Answer

Corporate Finance Interview Questions with answers are as per below:

1. What is a Capital Budgeting?

Answer:

Capital Budgeting is the process in which a company formulates its strategies of investment in various capital or long term projects and how much investment is appropriate from the point of view of increasing shareholder’s wealth.

The Process Involves:

- Gathering Investment Ideas

- Analyzing Success Probabilities

- Calculating Costs

- Deciding which Projects to Invest in

- Allocating Funds

- Reviewing and Monitoring the Project at Periodic Intervals

2. What is NPV?

Answer:

NPV stands for Net Present Value. It is the sum of all discounted cash inflows & outflows related to a capital investment project for a company. It helps in deciding whether or not it is profitable for a company to invest in the project.

- Decision Rule: If NPV > 0 then the project is worth investing in while if NPV < 0 then the project is not worth investing in.

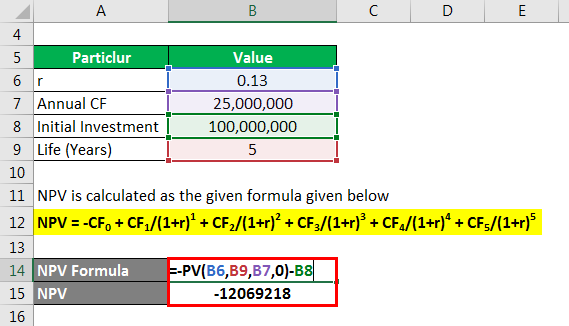

- Example: Suppose a project has an initial investment of $100 million and has a 5 years life in which the CF generated per year is $25 million. The company assumes that the risk of the project requires a required rate of 13%. We need to calculate the NPV and decide whether the project is worth investing in.

Solution:

NPV is calculated as the given formula given below

NPV = -CF0 + CF1/(1+r)1 + CF2/(1+r)2 + CF3/(1+r)3 + CF4/(1+r)4 + CF5/(1+r)5

- NPV = -100 + 25/(1+.013)1 + 25/(1+.013)2 + 25/(1+.013)3 + 25/(1+.013)4 + 25/(1+.013)5

- NPV = -12.069218

As the NPV is -$12.069218 million, the project is not worth investing in.

3. What is IRR?

Answer:

IRR stands for Internal Rate of Return. It is the rate of return where the NPV = 0, which implies that the present value of cash inflows = present value of cash outflows when discounted at the IRR

- Decision Rule: If there are two projects to choose from, the project with a higher IRR should be selected because essentially IRR is a return & higher the return, better the investment is.

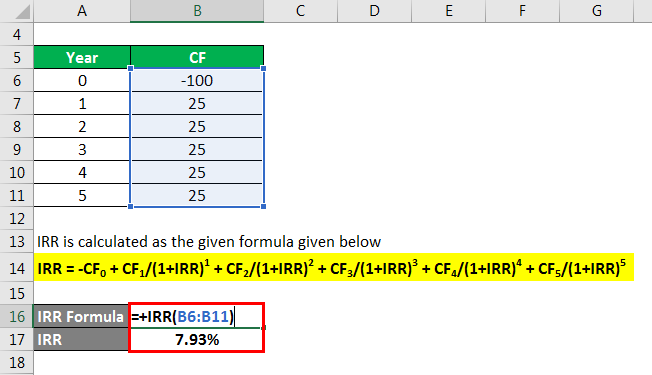

- Example: Suppose for the same project we need to find the IRR. We saw that NPV was negative for a 13% discount rate so the IRR would be lower than that. There is no other easier way than hit and trial method to find the exact IRR, without using a financial calculator or Excel or any other computer software. There is an interpolation method but that is also very time consuming and may not result in an exact answer.

Solution:

IRR is calculated as the given formula given below

IRR = -CF0 + CF1/(1+IRR)1 + CF2/(1+IRR)2 + CF3/(1+IRR)3 + CF4/(1+IRR)4 + CF5/(1+IRR)5

- 100 = 25/(1+IRR)1 + 25/(1+IRR)2 + 25/(1+IRR)3 + 25/(1+IRR)4 + 25/(1+IRR)5

- IRR = 7.93%

Using Excel we get the IRR as 7.93% rounded to 2 decimal places

4. When can IRR be Unreliable?

Answer:

IRR can be unreliable when the CFs are unconventional, which means there is more than one sign change in the CF stream or the outflows are too small for the inflows that there can never be a 0 NPV.

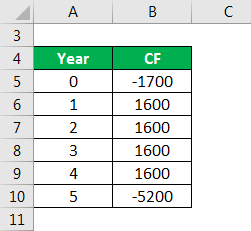

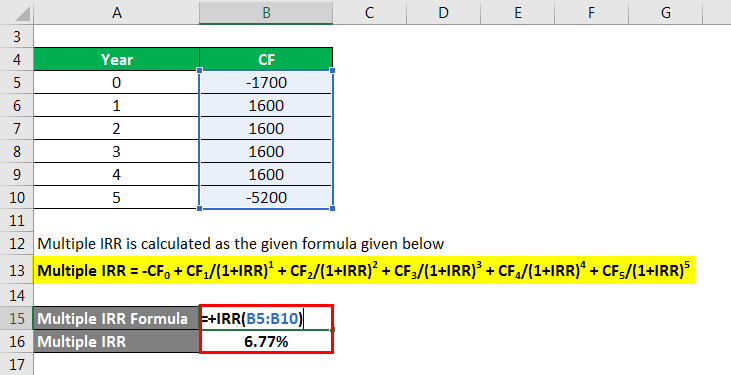

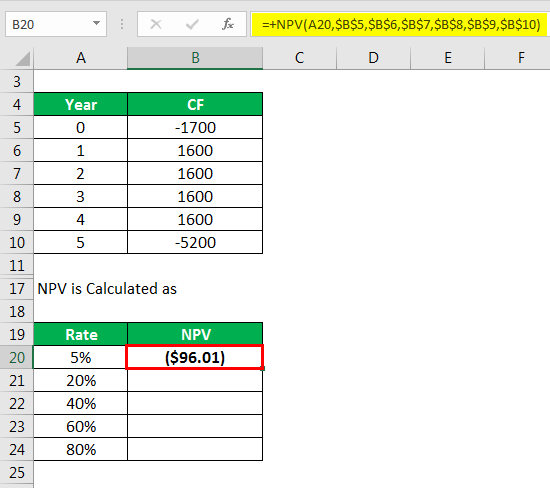

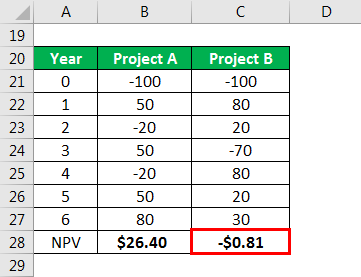

Example: The following are the challenges with IRR for a CF stream if there is: Multiple IRR and No IRR at all. Suppose we have the following CF stream:

Solution:

Multiple IRR is calculated as the given formula given below

Multiple IRR = -CF0 + CF1/(1+IRR)1 + CF2/(1+IRR)2 + CF3/(1+IRR)3 + CF4/(1+IRR)4 + CF5/(1+IRR)5

- -1700 = 1600/(1+IRR)1 + 1600/(1+IRR)2 + 1600/(1+IRR)3 + 1600/(1+IRR)4 + -5200/(1+IRR)5

- Multiple IRR = 6.77%

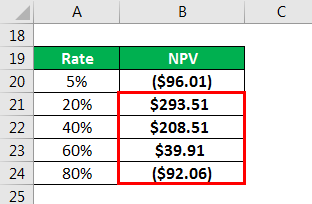

NPV is calculated as

Similarly calculated below,

Graph Explanation

- We can see that the NPV goes negative beyond 2 different rates which implies that the CF stream has multiple IRR

- There can also be a case when there is no IRR, in that case, there is no possible way to decide based on the IRR rule.

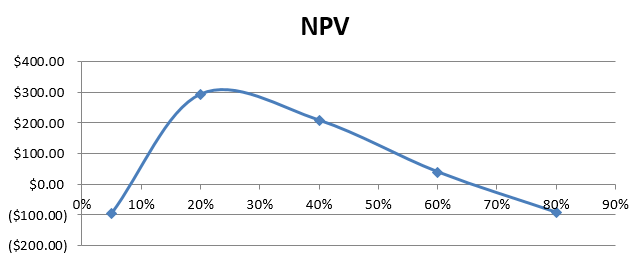

5. How is the Payback Period calculated?

Answer:

Payback Period is the time taken by the Cash inflows to recover the cash outflows of the project. It uses undiscounted cash flows for calculation.

Taking the same example as under NPV, we can calculate the Payback period as follows:

Solution:

Beginning Balance = Previous Year’s Ending Balance

- Ending Balance = Beginning Balance + Investment – CF

- So it takes 4 years to recover the Initial Investment.

6. What are the flaws of the Payback Period?. How can these be avoided?

Answer:

- It uses Undiscounted CFs.

- Ignores the life after the point when the investment is recovered so if beyond that there is a big cash outflow then the method doesn’t account for it.

- At times we use discounted CF to avoid the first flaw but the second flaw is not possible to remove from this method.

7. Which method to go with, If all give Different Answers?

Answer:

If all the methods give different decisions, then we always go with the NPV approach as it is the most comprehensive approach and doesn’t have the flaws of the payback period or the IRR, i.e. it considers the entire life of the project, it considers the time value of money and it can’t be misleading in case of unconventional cash flows.

8. What is Sensitivity Analysis?

Answer:

Sensitivity Analysis finds the percentage changes in the NPV when only one input in the calculation is changed, such as the discount rate or the initial investment or anyone input that goes into the calculation of the CFs

9. What is Scenario Analysis?

Answer:

Scenario Analysis finds the percentage of changes in the NPV when more than one inputs in the calculation are changed. This might be used when we need to see how a project might fare in case of different economic conditions such as boom, normal or recession states and then we may even probability weight each scenario to find out the weighted NPV to get a more comprehensive view of the same.

10. How would you Compare Two Projects with different Lives?

Answer: We may use replacement or the LCM method or an equated annual cost method to see which project has a higher NPV instead of calculating the simple NPV as shown above.

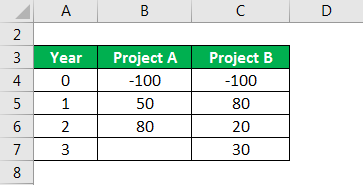

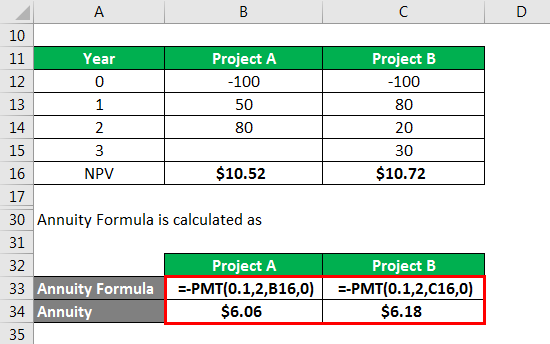

For example, we have the following two projects and their CF stream, The discount rate is 10%.

Solution:

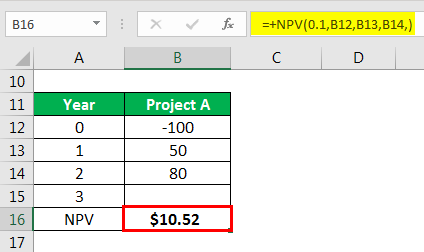

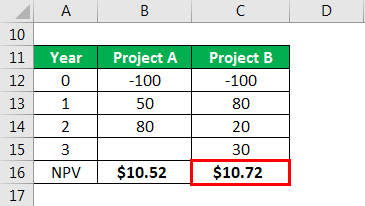

Calculating the NPV Individually

Similarly, calculated for Project B

- This would mean that we should select project B.

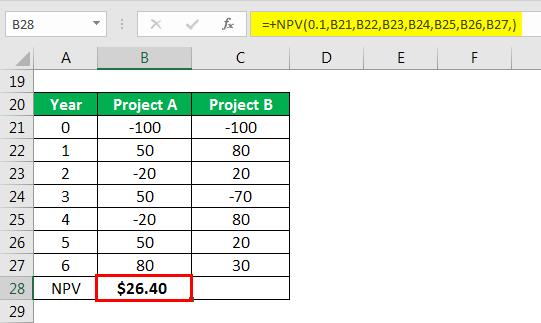

- But if we go by the LCM approach, which implies that the two projects will be replaced and continue till their lives reach the LCM, each project will have a life of 2 x 3 = 6 years

Calculating the NPV by Using LCM approach

Similarly, calculated for Project B

- This implies that over long run project A has a higher NPV and should be selected.

- We should get the same answer from the EAA approach, that is what should be the equated annual cost if the NPV is 10.52 for Project A and 10.72 for project B at 10% discount rate.

Annuity Formula is calculated as

This implies that the annual CF from Project A is higher and should be selected

11. What is Capital Rationing?

Answer:

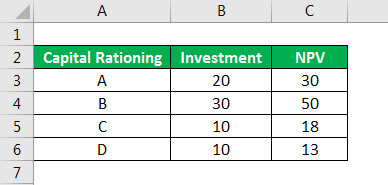

When a company has several projects with positive NPV, but the funds available to invest are limited, the company has to see which projects combined would lead to the highest NPV. The process of this analysis and allocation of funds to the most appropriate projects is known as capital rationing.

Suppose we have $50 million to invest and the NPV and investment (in millions) of 4 projects are as follows:

Solution:

The combination of Projects A & B has an NPV of 50 while that of B, C, D has an NPV of 81 and so the second combination is a better pick. Had we no limitation on funds, we would have selected all the projects.

12. When would you use a Dividend Discount Model and When would you use the FCF Approach?

Answer:

- DDM is used when the company pays a regular dividend while FCF approach is used when the company pays irregular or no dividends and has positive FCF

- If Dividends have a logical relationship with the profits of the company, then it is advisable to use DDM for valuing the stock of the company while if the dividend is constant even when the company is incurring losses then DDM is not a good approach to value the company. FCF is a better approach in this case if it is positive.

13. What is meant by Corporate Governance?

Answer:

- Corporate Governance is a set of policies and practices of a company that leads to the minimization of conflicts of interest between shareholders and the management and ensures that the company resources are used in the best interest of the investors and the stakeholders.

- For example in a company form of organization, the management and shareholders are separated and the shareholders may not have a hands-on the day to day activities of the company, in such cases, management might take the liberty of allowing very high perks to themselves, a good corporate governance system would prevent this to safeguard the interest of the shareholders by putting a cap on the amount of such perks

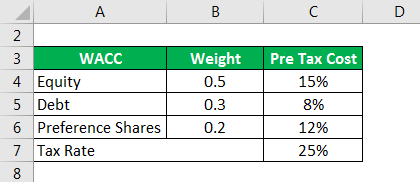

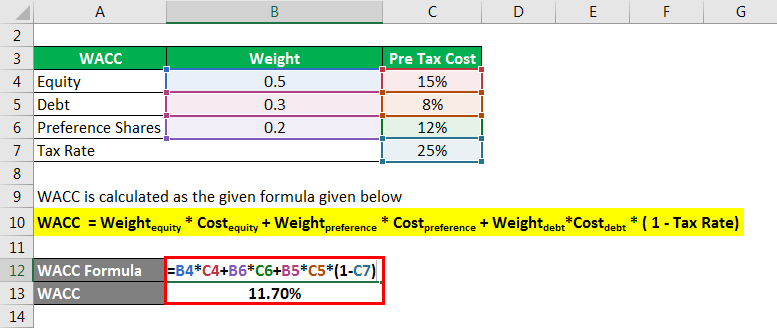

14. How is WACC calculated?

Answer:

WACC stands for the Weighted Average Cost of Capital and it is the weighted cost of all sources of capital.

Suppose we are given the following information:

Solution:

WACC is calculated as the given formula given below

WACC = Weightequity * Costequity + Weightpreference * Costpreference + Weightdebt*Costdebt * ( 1 – Tax Rate)

- WACC = 0.5*15% + 0.2*12% + 0.3*8% * (1 – 25%)

- WACC = 11.70%

15. Why is Cost of Debt Adjusted for Tax?

Answer:

Interest on debt is tax-deductible and therefore the cost of debt is adjusted for the tax to incorporate the tax shield.

Recommended Articles

This has been a guide to Corporate Finance Interview Questions. Here we discuss the introduction and the top 15 Corporate Finance Interview Questions & Answers and we also provide an excel template. You can also go through our other suggested articles to learn more –