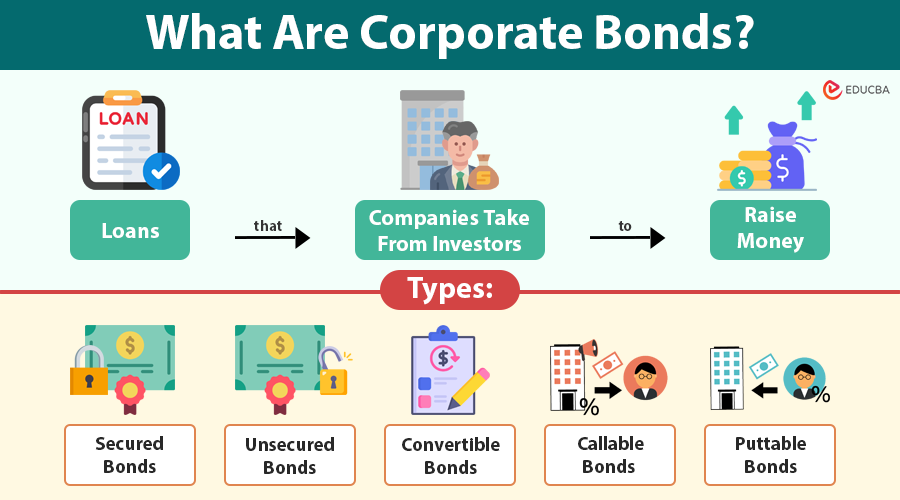

What Are Corporate Bonds?

Corporate bonds are loans that companies take from investors to raise money. In return, investors receive regular interest (coupon) payments and the principal amount at maturity. Unlike stocks, bonds do not offer ownership but are safer in case of company bankruptcy.

Suppose you buy a $10,000 corporate bond from XYZ Corp. with a 7% annual interest rate and a 5-year maturity. You will receive $700 per year as interest income, and after 5 years, the company will repay your original $10,000 unless it defaults.

Table of Contents

- Meaning

- Why Do Companies Issue It?

- How Does it Work?

- Types

- Advantages of Investing

- Risks Associated

- How is it rated?

- Corporate Bonds vs. Other Bonds

- Who Should Invest?

Why Do Companies Issue Corporate Bonds?

Corporate bonds are an essential tool for businesses looking to meet funding needs without giving up equity control. Here are the key reasons why companies issue them:

- Capital expansion: Companies may use bond proceeds to fund new projects, build facilities, or enter new markets.

- Working capital needs: Companies can use bonds to cover short-term expenses like paying suppliers or employee salaries.

- Debt restructuring: Firms often issue new bonds to repay existing, more expensive debt, thereby reducing interest costs.

- Mergers and acquisitions: Bond issues can finance strategic acquisitions without immediate cash outflows or stock dilution.

- Avoiding dilution: Compared to issuing new equity, bonds allow companies to raise funds without reducing ownership for existing shareholders.

Issuing bonds can also be more favorable during periods of low interest rates, enabling companies to secure cheaper financing.

How Corporate Bonds Work?

Here are the key components of how corporate bonds function:

1. Face Value (Par Value)

This is the amount the investor will receive at maturity, typically $1,000 per bond. It determines the interest payments, regardless of the bond’s market price.

2. Coupon Rate

The coupon rate is the annual interest paid to the bondholder, expressed as a percentage of the face value. For example, a 6% coupon on a $1,000 bond pays $60 per year, usually in semiannual payments of $30.

3. Maturity Date

This is the date when the bond ends and the company pays back the original amount to the investor. Bonds can be:

- Short-term: less than 5 years

- Medium-term: 5 to 12 years

- Long-term: more than 12 years.

4. Issue Price

Corporate bonds can be issued at par (equal to face value), at a discount (below face value), or at a premium (above face value), depending on market conditions and investor demand.

5. Yield

Yield is the real return an investor gets, and it can be different from the bond’s interest rate. It depends on the bond’s purchase price, coupon payments, time to maturity, and current market interest rates. Yield is a more accurate measure of the bond’s performance than the coupon alone.

6. Buying and Selling

Investors can buy corporate bonds when companies first issue them (primary market) or later from other investors (secondary market). In the secondary market, bond prices fluctuate based on interest rate changes, the issuer’s credit rating, and market demand.

Types of Corporate Bonds

Corporate bonds vary widely in terms of structure, risk, and investor appeal. Below are common types:

1. Secured Bonds

Secured bonds are supported by company assets, such as buildings or machines, which can be sold to repay investors if the company is unable to pay. If the company defaults, it can sell these assets to repay bondholders. Because of this added security, secured bonds are considered less risky and typically offer lower interest rates.

2. Unsecured Bonds (Debentures)

Unsecured Bonds, also known as debentures, are not supported by any collateral. Instead, their repayment depends entirely on the issuer’s creditworthiness. Since they carry more risk than secured bonds, they usually offer higher interest rates. In the event of default, unsecured bondholders are paid only after secured creditors have been compensated.

3. Convertible Bonds

Convertible bonds let bondholders exchange their bonds for a set number of the company’s shares. These bonds are particularly attractive when stock prices are rising, as they combine fixed interest payments with the opportunity to benefit from share price appreciation. However, they usually pay less interest than regular bonds because they can be turned into company shares.

4. Callable Bonds

Callable Bonds allow the issuing company to repay the bond before its maturity date at a set call price. Companies often exercise this option when interest rates fall, enabling them to refinance their debt at a lower cost. This helps the company, but it can be a problem for investors, who might have to reinvest the money at a lower interest rate.

5. Puttable Bonds

Puttable Bonds allow investors to sell the bond back to the company before maturity, typically for its original amount. This feature is useful for bondholders if interest rates rise or if the issuer’s financial condition weakens. Because of this added protection, puttable bonds tend to offer lower yields compared to standard bonds.

Advantages of Investing in Corporate Bonds

- Steady income: Corporate bonds offer fixed, predictable interest payments, typically twice a year. This makes them ideal for conservative investors or retirees seeking stable cash flow.

- Higher returns than government bonds: Because corporations are riskier than governments, they pay higher interest, which attracts investors willing to take a bit more risk for better returns.

- Diversification: Adding corporate bonds to a portfolio reduces overall risk, especially when combined with stocks and other assets. Bonds often perform well during economic downturns, balancing equity volatility.

- Capital preservation: Bonds are less risky than stocks and help protect your money if you hold them until maturity, especially when issued by strong, reliable companies.

- Market liquidity: High-quality corporate bonds are often actively traded in secondary markets, allowing investors to sell before maturity if needed.

Risks Associated with Corporate Bonds

- Credit risk (default risk): If the company faces financial trouble or bankruptcy, it may fail to meet interest or principal payments. Lower-rated or “junk” bonds carry higher credit risk.

- Interest rate risk: When interest rates rise, existing bond prices fall. Investors holding long-term bonds may face capital losses if they sell before maturity.

- Liquidity risk: Some bonds, especially from smaller or less-known issuers, may not be easily tradable, leading to unfavorable prices or delayed sales.

- Call risk: In callable bonds, issuers may repay early during favorable market conditions, depriving investors of future interest income.

- Inflation risk: Fixed interest payments may lose purchasing power over time if inflation rises, especially in long-term bonds.

How Are Corporate Bonds Rated?

Credit rating agencies evaluate and rate bonds to reflect the issuing company’s ability to repay its debts. Ratings provide a quick snapshot of risk:

- Investment-grade bonds (AAA to BBB/Baa): Considered safe, with low risk of default and issued by financially stable companies.

- High-yield or junk bonds (BB/Ba or lower): Offer higher returns due to elevated risk. Often issued by startups, distressed firms, or companies in volatile sectors.

Investors should review both ratings and financial disclosures (like balance sheets and cash flow) to make informed decisions.

Corporate Bonds vs. Other Bonds

| Feature | Corporate Bonds | Government Bonds | Municipal Bonds |

| Issuer | Corporations | Central/sovereign governments | State/local governments |

| Risk Level | Moderate to High | Very Low (especially sovereign) | Varies (often moderate) |

| Return Potential | High | Low | Moderate |

| Tax Treatment | Taxable | Taxable or tax-free (in some cases) | Often tax-free (especially in the US) |

| Liquidity | High to Medium | Very High | Medium to Low |

Who Should Invest in Corporate Bonds?

Corporate bonds are suitable for a range of investors:

- Income-seeking investors: Those who want predictable, regular cash flows.

- Moderate risk-takers: Investors willing to take more risk for higher yields compared to government bonds.

- Retirees and conservative investors: Especially those interested in high-grade bonds with minimal price volatility.

- Diversified portfolio builders: Those looking to balance risk between equities and safer fixed-income assets.

However, due diligence is crucial. Assess the company’s financials, credit rating, bond terms, and market conditions before investing.

Final Thoughts

Corporate bonds offer a compelling mix of income, stability, and return potential. They serve as a bridge between the safety of government securities and the higher risk-reward profile of equities. Whether you are a beginner or a seasoned investor, understanding the mechanics, types, benefits, and risks of corporate bonds can help you make informed choices and build a well-rounded investment portfolio.

Frequently Asked Questions (FAQs)

Q1. Are corporate bonds suitable for short-term investing?

Answer: Typically, corporate bonds are better suited for medium- to long-term investing. However, some short-term corporate bonds are available. Keep in mind that shorter durations usually offer lower returns.

Q2. Where can I buy corporate bonds as an individual investor?

Answer: You can buy corporate bonds through a brokerage account, either during a new issue (primary market) or from existing holders in the secondary market. Some platforms also offer bond ETFs that provide exposure to a range of corporate bonds.

Q3. Can corporate bonds be included in retirement accounts like IRAs or 401(k)s?

Answer: Yes, you can include corporate bonds and bond funds in retirement accounts like IRAs and 401(k)s. Doing so can help diversify your portfolio and provide steady income within a tax-advantaged environment.

Q4. What happens if a bond issuer gets acquired or merges with another company?

Answer: In most cases, the new company takes over the bond obligations. However, terms may change depending on the deal structure, and bondholders should review any merger or acquisition announcements closely.

Recommended Articles

We hope this guide on corporate bonds was helpful. Explore related articles on fixed-income investing, bond ratings, and building a balanced portfolio.