Updated July 6, 2023

What is Contract Costing?

Contract costing determines costs associated with producing a specific product by the contract agreement with the customer. For instance, Michael wants a new office in Washington, so he approaches Ava, an owner of a construction company, for the project. After discussing the particulars, they arrive at a contract of $25 million (Contract costing), which Michael will be liable to pay to Ava in return for her service.

Contract costing is primarily utilized by contractors engaged in engineering projects, such as the construction of buildings, railway lines, bridges, dams, and similar structures. It involves two parties, the contractor and the contractee. While the contractor undertakes the work, the contractee is the client or individual who owns the project.

Key Highlights

- Contract costing involves the identification and quantification of costs related to the production of a specific product or service as outlined in the contract agreement with the customer

- It is typically divided into two categories: cost-plus contracts and fixed-price contracts.

- The key characteristics include site work, extended time frames, and direct and indirect charges.

- The elements encompass materials, labor, and subcontractor bills.

- It should note that contract costing differs from job costing as it is typically applied to construction projects, while job costing is more appropriate for manufacturing customized products.

Examples of Contract Costing

Example #1

For example, the contract between the NHS and Palantir regarding their data platform service was extended till June 22, 2023. This contract cost was $12.39 million (€11.5 million).

Example #2

Company X has the following data for the year 2022,

|

Particulars |

Amount ($) |

| Direct Material | 1,000,000 |

| Direct Labour | 250,000 |

| Direct Expenses | 350,000 |

| Indirect Expenses | 400,000 |

| Estimated further expenses | 200,000 |

| Contract price as agreed | 3,000,000 |

| Work Certified | 2,500,000 |

| Work Uncertified | 100,000 |

| Cash Received | 2,000,000 |

| Degree of Completion | 90% |

Determine the total expenditure, anticipated costs, revenue, and estimated profit to date. Solution:

Step 1:

First, we will total all incurred direct and indirect expenses to arrive at the total expenditure to date,

= 1,000,000 + 250,000 + 350,000 + 400,000 = 2,000,000

Step 2:

Then we add the estimated expenses to it to determine the total estimated costs till date,

= 2,000,000 + 200,000 = 2,200,000

Step 3:

Let us subtract the derived total estimated costs from the contract price to compute the estimated profit till date,

= 3,000,000 – 2,200,000 = 800,000

Step 4:

We then multiply the degree of completion with the contract cost to derive the recognized revenue,

= $3,000,000 * 90% = 2,700,000

|

Particular |

Amount ($) |

Calculations |

|

| A | Direct Material | 1,000,000 | |

| B | Direct Labour | 250,000 | |

| C | Direct Expenses | 350,000 | |

| D | Indirect Expenses | 400,000 | |

| E | Total Expenditure till date | $2,000,000 | (A+B+C+D) |

| F | Estimated further expenses | 200,000 | |

| G | Total Estimated costs till date | $2,200,000 | (E+F) |

| H | Contract Price | 3,000,000 | |

| I | Estimated Profit till date | $800,000 | (H-G) |

| J | Degree of completion achieved | 90% | |

| K | Revenue to be recognised | $2,700,000 | (H*I) |

Types of Contract Costing

Cost-Plus contract

- Applying a fixed percentage to the contract’s overall value establishes the price, effectively eliminating the risk of a loss.

- The contractor is responsible for paying a lump sum fee for profits.

Fixed Price Contract

- In a fixed-price contract, the price for the work is agreed upon in advance and does not change regardless of the actual costs incurred.

- It provides a clear and agreed-upon price for the work, making it easy for the contractee to budget and plan for the project.

- However, it can be risky for the contractor as they may have to bear the additional costs if the actual costs are higher than the agreed-upon price.

Elements of Contract Costing

- Direct costs: These can be directly traced to the contract or project, such as materials, labor, and subcontractors.

- Indirect costs: These cannot be directly traced to the contract or project, such as overhead expenses.

- Billings and collections: It is the process of billing clients for work completed and collecting payments for the contract or project.

- Progress billing: It is the process of billing clients for work completed to date rather than waiting until the end of the project.

- Change orders: These occur when any changes or additions to the original contract result in additional costs.

- Cost estimating: It is the process of predicting the costs of a contract or project based on past experience and current market conditions.

- Cost control: It is managing costs to ensure they stay within budget.

- Cost reporting: It provides detailed reports on the costs associated with a contract or project.

- Final account: It is the process of settling the final accounts of a contract and verifying the profit or loss on the contract.

- Close out: It is the process of finalizing a contract, including any outstanding issues and payments and archiving the records for future reference.

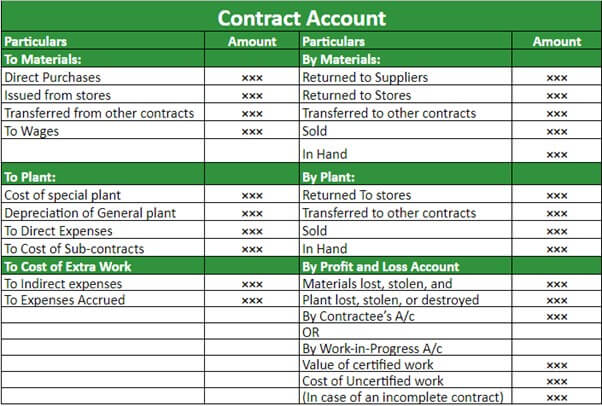

Contract Costing Format

Format Includes:

- Contract details: It includes the name of the contract, the contract date, the contract value, and the name of the contractor and contractee.

- Budget details: It includes the estimated costs for the contract, including materials, labor, and overhead expenses.

- Actual costs: These include the actual costs incurred for the contract, including materials, labor, and overhead expenses.

- Variance analysis: It compares the budgeted costs with the actual costs, highlighting any variances and the reasons for them.

- Revenue and profit/loss: This section includes the revenue generated from the contract and the profit or loss made on the contract.

- Progress of work: This section includes the work progress on the contract, including the percentage of work completed and the remaining work to be done.

- Billings and payments: This section includes the billings made to the contractee and the payments received from the contractee.

- Retention and final accounts: This section includes the contract’s retention amount and final accounts.

Purpose:

- The contract costing format systematically organizes and presents the costs associated with a specific contract or project.

- It helps to ensure that all the necessary information is collected and organized logically.

- It makes it easier to analyze the costs and profitability of the contract.

Features of Contract Costing

- A contract is typically a long-term undertaking that extends beyond a single accounting period.

- Due to the substantial nature of contracts, contractors typically take on a limited number of them annually.

- Each contract is distinct and requires separate accounting.

- With the progress of work, profit or loss, and materials specially procured for each individual contract being tracked and recorded.

- In most cases, companies specially purchase materials for each contract.

Difference Between Job Costing And Contract Costing

|

Job Costing |

Contract Costing |

| Job costing is the determination of costs incurred in completing a specific job. | Contract costing is the determination of costs associated with producing a specific product by the contract agreement with the customer. |

| Job costing is a methodology that is well-suited for the manufacturing of products that are tailored to the specific requirements of customers. | Contract costing, on the other hand, is appropriate for construction projects. |

| This approach involves determining the costs incurred in completing a particular job after the job has been satisfactorily finished. | It is determined as the project is carried out. |

| Job costing involves the production of a product within the company’s premises. | It involves constructing or producing a product at the customer’s preferred site. |

| Job costing requires small jobs that must be completed quickly. | It takes a long time because it involves large jobs. |

Final Thoughts

As the diversity of industries and complexity of business operations continue to evolve, the significance of cost management is becoming increasingly crucial. It is imperative to maintain a focus on the primary objective of contract costing, which is to accurately estimate and track the costs of a contract in order to determine its profitability.

Frequently Asked Questions (FAQs)

Q1. What is contract costing?

Answer – Contract costing is employed in businesses undertaking individual, non-recurring contracts. It monitors costs associated with specific contracts and includes the agreement on a specific product or service with the customer.

Q2. Who are the parties to a contract?

Answer – The contractor and contractee are the two parties in a contract. The individual or organization responsible for the execution of a contract is referred to as the contractor. At the same time, the party for whom the work is performed is known as the contractee. Both the contractor and contractee play a significant role in the contract agreement.

Q3. What role does labor play in contract costing?

Answer – Labor plays a significant role in contract costing as it is one of the major costs incurred during the execution of a contract. It includes the wages, salaries and benefits of the workers involved in the project. The cost of labor is usually estimated in advance and is included in the overall cost of the contract.

Q4. In contract costing, how do indirect expenses work?

Answer -In contract costing, indirect expenses refer to the costs that cannot be directly traced to a specific contract but are still necessary for the completion of the project. These expenses are also known as overhead and include indirect costs such as office expenses, rent, insurance, and other general and administrative expenses.

Q5. Which costing is a variant of job costing?

Answer -Contract costing is a variant of job costing. Contract and job costing determine the costs of specific projects or products. But contract costing is typically used for construction projects, while job costing is more commonly used for manufacturing projects or services performed to the customer’s specifications.

Recommended Articles

We hope this article on contract costing from the EDUCBA guide has been informative and beneficial to you. For further information on topics related to economics, EDUCBA recommends these additional resources.