Understanding Carry Trades in Forex

Carry trades in the forex market have long been favored by traders seeking to profit from interest rate differences between currencies. While not a beginner-level strategy, carry trades offer a unique blend of yield potential, trend opportunities, and long-term consistency, especially in stable macroeconomic environments. This guide breaks down what carry trades are, how they work, when they perform best, and the risks you must understand before using them in live trading.

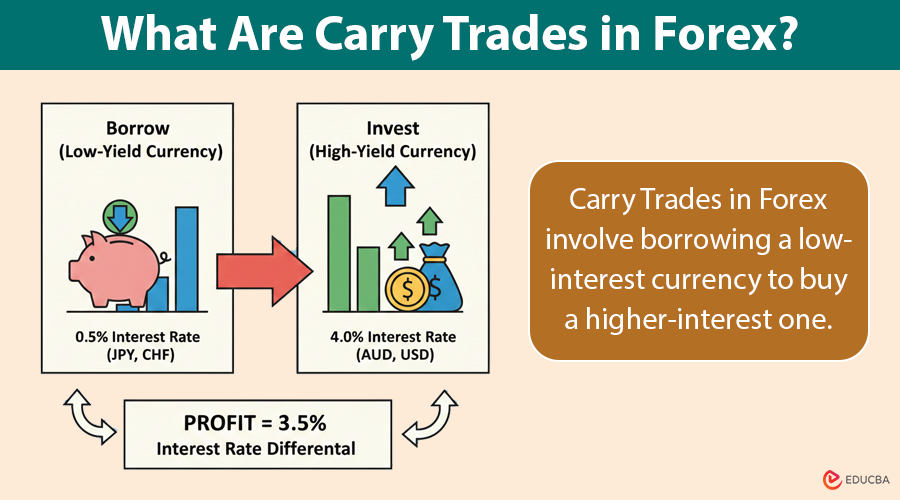

What Are Carry Trades in Forex?

Carry Trades in Forex mean borrowing a low-interest currency and using it to buy a currency with a higher interest rate. The trader then earns the interest rate differential, commonly known as the carry.

In simple terms:

- Borrow a low-interest currency

- Buy a high-interest currency

- Profit from the yield difference daily (swap/rollover interest).

For example, if Currency A has an interest rate of 0.5% and Currency B has 4%, you earn the difference (~3.5%) as long as the position stays open. Carry trades in forex are typically employed in long-term strategies because interest rates accumulate over time.

Why Carry Trades in Forex Are Popular?

Carry trades in forex attract traders for several reasons:

1. Interest Rate Differentials Create Passive Income

The core appeal of carry trades in forex comes from earning the interest rate spread between two currencies. Traders borrow a low-interest-rate currency (e.g., JPY or CHF) and invest in a high-interest-rate currency (e.g., AUD or NZD). This generates daily rollover interest, also known as swap income, which can accumulate into sizable profits.

2. Suitable for Long-Term Trading

Carry trades in forex are favored by swing and position traders because the strategy is most effective over weeks, months, or even years. As long as the interest rate gap remains wide, traders can continue earning daily returns.

3. Works Well in Stable Market Conditions

When markets are calm, volatility is low, and economic policies remain predictable, Carry trades in forex can deliver consistent performance. Investors often “hunt for yield” in such environments, increasing the demand for high-yielding currencies and strengthening the trade.

4. Reinforced by Central Bank Policies

Expectations of interest rate hikes or dovish policies can significantly boost the appeal of Carry trades in forex. If a central bank signals tighter monetary policy, it often increases the demand for its currency, amplifying both interest earnings and potential capital gains.

5. Potential for Dual Gains: Interest + Appreciation

Apart from the interest income, traders might also profit from currency appreciation of the high-yielding currency. This combination of regular income and capital gains makes the strategy more rewarding than simple buy-and-hold approaches.

6. Widely Used by Institutional Investors

Hedge funds, banks, and large investment firms frequently execute large-scale carry trades. Their participation adds liquidity and stability, encouraging retail traders to follow the trend.

7. Simple to Understand and Execute

Unlike complex quantitative models, carry trades in forex do not require sophisticated indicators.

Traders only need:

- Interest rate information

- Basic risk management

- Awareness of macroeconomic trends.

This simplicity makes the strategy highly accessible.

Best Currency Pairs for Carry Trades in Forex

Not all currency pairs are suitable. Successful carry trades in forex typically involve:

- High-yielding currencies (AUD, NZD, USD, MXN)

- Low-yielding currencies (JPY, CHF, EUR)

Common carry trade pairs include:

- AUD/JPY

- NZD/JPY

- USD/JPY

- MXN/JPY

Among these, USD JPY is one of the most actively traded carry pairs, largely due to the persistent interest rate gap between the U.S. Federal Reserve and the Bank of Japan, as well as its deep liquidity and strong institutional participation.

When Do Carry Trades in Forex Perform Well?

Carry trades in forex thrive under specific macro conditions:

- Risk-on market environment: Investors seek higher yields, pushing money into high-interest currencies.

- Stable central bank policies: Predictable rate paths support long-term carry positions.

- Low market volatility: Sharp risk-off events can damage carry trades, so stability helps positions grow and thrive.

- Strong global growth: High-yield currencies often belong to commodity-driven or emerging markets that benefit from global economic expansion.

Risks Associated with Carry Trades in Forex

Despite their appeal, carry trades in forex carry several risks:

- Exchange rate risk: If the currency you invested in (the high-interest one) falls sharply in value, it could completely erase the profits you earned from the interest.

- Interest rate changes: Unexpected central bank decisions can eliminate the interest rate advantage in an instant.

- Risk-off market crashes: During crises, traders rush into safe-haven assets, causing high-yield currencies to plummet (e.g., the JPY and CHF surge).

- Swap rate fluctuations: Brokers may adjust swap rates in response to changes in liquidity conditions.

Carry trades can be extremely profitable, but only when risk is understood and actively managed.

How to Start Using Carry Trades in Forex?

Here is a step-by-step approach:

1. Understand the Basics of Carry Trades

Carry trades are most effective in stable market conditions. The basic principle involves:

- Borrowing a low-interest-rate currency (funding currency)

- Investing in a higher-interest-rate currency (target currency)

- Earning interest on the difference between the two rates (swap rate).

Example: Borrow Japanese Yen (JPY) at 0.1% and invest in Australian Dollar (AUD) at 4%, profiting from the interest differential.

2. Choose the Right Currency Pairs

The success of a carry trade largely depends on the interest rate differential between currencies.

Common Carry Trade Pairs:

- AUD/JPY

- NZD/JPY

- USD/TRY

- EUR/TRY

High-yield currencies, such as AUD and NZD, and emerging-market currencies, are ideal when paired with low-yield currencies like JPY or CHF.

3. Analyze Market Conditions

Carry trades are sensitive to market volatility and economic events:

- Avoid high volatility or uncertain markets.

- Monitor central bank policies, as interest rate changes directly affect profitability.

- Combine fundamental and technical analysis for optimal entry and exit points.

4. Calculate Potential Returns

Profits are derived from the interest rate differential (the swap) and from potential currency appreciation.

Example Calculation:

- Borrow 10,000 JPY at 0.1% interest.

- Invest in AUD at 4% interest.

- Daily profit ≈ (4% − 0.1%) ÷ 365 × position size.

Note: Actual profits depend on your broker’s swap rates.

5. Implement Risk Management

Carry trades carry risk if currency values move against you. Key strategies include:

- Setting stop-loss orders to limit losses

- Avoiding excessive leverage

- Diversifying positions to reduce exposure.

6. Execute the Trade

- Open an account with a reputable Forex broker offering favorable swap rates.

- Select the currency pair for the carry trade.

- Enter a buy/sell order depending on interest rate differentials.

- Hold the position short- or long-term, depending on the strategy.

7. Monitor and Adjust

- Track interest earnings daily.

- Watch economic announcements and central bank updates.

- Close your trades when market conditions change or you reach your profit target

Practical Example of Carry Trades in Forex

If the New Zealand interest rate is 3% and Japan’s is 0%, a trader might:

- Sell JPY

- Buy NZD

Each day, the broker pays the positive swap (minus fees). If NZD appreciates against JPY, the trader earns both:

- Swap income

- Capital gains

This dual profit potential is why carry trades in forex are highly attractive.

Final Thoughts

Carry trades in forex can be one of the most rewarding long-term forex strategies, but only in the right market conditions. Stable interest rates, strong trends, and low volatility create the ideal environment for earning a steady yield with reduced downside risk. Traders succeed in carrying trades when they understand macroeconomics, central bank actions, and market risk sentiment.

Recommended Articles

We hope this guide helps you master carry trades in forex and make informed trading decisions. Explore these recommended articles for more strategies, tips, and insights to boost your Forex trading skills.