What is Buy Now, Pay Later (BNPL)?

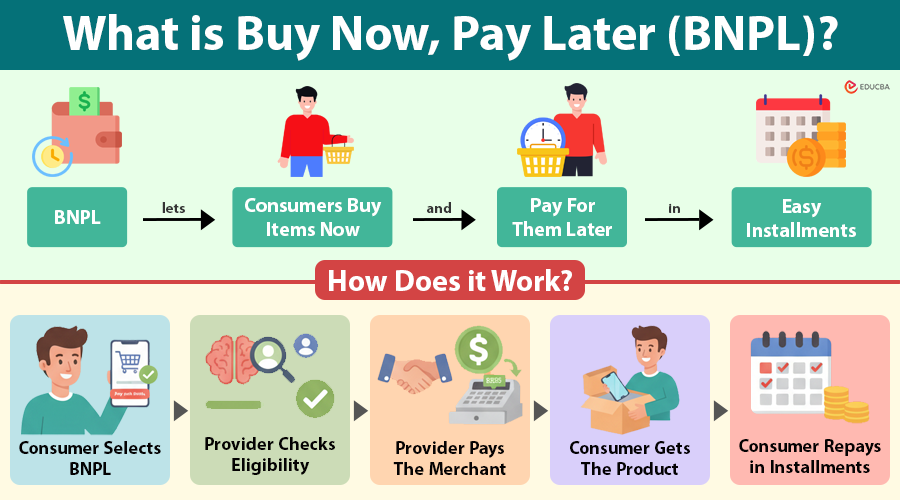

Buy Now, Pay Later is a short-term payment option that lets consumers buy products now and pay for them later, usually in easy installments. BNPL actively supports small to medium purchases, typically covering items ranging from clothing to electronics, unlike traditional credit cards or loans.

For example, a person buys a new smartphone online for $1,200 using Affirm. Instead of paying the full amount upfront, he chooses a 6-month installment plan. He pays $200 per month, while the retailer receives full payment from Affirm immediately. If the shopper pays on time, they avoid all interest charges.

Table of Contents

- Meaning

- Key Features

- How Does it Work?

- Real-Life Examples

- Types

- Advantages

- Risks and Challenges

- How BNPL Affects Credit Scores?

- BNPL vs Credit Cards

- BNPL Market Trends

- Best Practices for Consumers

- The Future of BNPL

Key Takeaways

- BNPL allows immediate purchases with deferred payments.

- Fixed installments and interest-free plans are common, but late fees can apply.

- Responsible use protects credit scores and financial well-being.

- Regulatory oversight is increasing to ensure safer BNPL practices.

- BNPL will continue to grow as fintech innovation and global adoption drive it forward.

Key Features of Buy Now, Pay Later

- Immediate access to products: Consumers can receive or use the product right away without paying the full amount upfront, making purchases more convenient and accessible.

- Flexible installment payments: Users split the total cost into smaller, manageable payments typically scheduled weekly, bi-weekly, or monthly to budget more effectively.

- Interest-free plans: Many BNPL services offer interest-free options, provided payments are made on time, helping consumers avoid additional charges.

- Seamless integration with retail platforms: BNPL is often built directly into online and in-store checkout systems, offering a smooth, hassle-free payment experience.

How Does BNPL Work?

Buy Now, Pay Later operates through partnerships among merchants, consumers, and BNPL providers, creating a seamless payment experience. Here is a step-by-step breakdown of the process:

1. Consumer selects BNPL at checkout

When shopping online or in-store, the consumer chooses a BNPL option among other payment methods. This option often emphasizes convenience and flexibility in payment.

2. BNPL provider evaluates and approves the payment

The BNPL provider conducts a quick credit assessment, usually using soft credit checks or affordability algorithms. Unlike traditional loans, this process is fast, often taking just a few seconds.

3. Purchase is completed immediately

The BNPL provider pays the merchant, either fully or partially, upfront, thereby allowing the seller to avoid the risk of delayed payment. Meanwhile, the consumer gets instant access to the product or service.

4. Consumer repays in installments

The consumer repays the BNPL provider in predefined installments over a few weeks or months. Payments can be weekly, bi-weekly, or monthly, depending on the provider and plan selected. Some providers also offer automatic reminders to help avoid late fees.

Real-Life Examples of Buy Now, Pay Later

BNPL has become widely adopted across sectors, from fashion to electronics. Here are some examples:

- Fashion and apparel: Afterpay in the US and Australia partners with popular brands such as Nike and Urban Outfitters. Shoppers can split their payments into four interest-free installments, making high-priced fashion items more accessible.

- Electronics and gadgets: Affirm collaborates with Apple, allowing customers to purchase iPhones, MacBooks, and other electronics with monthly installments over 6–12 months. This enables consumers to manage large purchases without paying up front.

- Travel and experiences: Companies like Uplift provide BNPL options for flights, hotel bookings, and vacation packages. Travelers can book trips immediately and spread payments over several months, making travel more affordable and flexible.

- E-commerce platforms: Klarna integrates with major online retailers such as ASOS, H&M, and Sephora, embedding BNPL directly into their checkout processes. This seamless integration encourages shoppers to complete purchases they might otherwise delay.

- Everyday purchases: Consumers increasingly use BNPL for everyday items such as groceries, healthcare products, and pet supplies. Services like Zip and PayPal Pay in 4 allow consumers to buy essentials and pay over time without interest.

Types of Buy Now, Pay Later Options

Buy Now, Pay Later comes in several forms, depending on repayment structure and financing terms:

1. Pay in Full Later

- The consumer pays the full purchase amount after a fixed period, typically 14 to 30 days.

- The provider often charges no interest as long as the customer pays on time.

- Ideal for smaller purchases, such as clothing, accessories, or everyday items.

- Example: A shopper buys a $100 jacket today and pays the full amount in 21 days.

2. Installment Plans

- Payments are split into multiple equal installments, typically 3 to 6 installments, over weeks or months.

- Some providers offer longer-term plans (up to 12 or 24 months) with low or no interest.

- Suitable for medium to high-value purchases, such as electronics or appliances.

- Example: You can pay for a $600 laptop in six monthly installments of $100 each.

3. Revolving BNPL

- Functions similarly to a credit card, allowing consumers to carry a balance and pay over time.

- Lenders charge interest on unpaid balances after a certain period.

- Less common but gaining traction for larger or ongoing purchases.

- Example: A consumer buys multiple items totaling $1,000, pays $200 monthly, and accrues interest on the remaining balance if not fully paid.

Advantages of BNPL

Buy Now, Pay Later offers benefits to both consumers and merchants:

For Consumers:

- Financial flexibility: Allows purchases without immediate cash outflow.

- Interest-free options: Many plans are free if payments are on time.

- Easy approval: Minimal credit checks make it accessible to more consumers.

- Improved budgeting: Fixed installments can help plan expenses.

For Merchants:

- Increased sales: Consumers are more likely to buy when they can defer the payment.

- Higher average order value: Shoppers may spend more using installment options.

- Customer acquisition: BNPL options attract new demographics, including younger buyers.

Risks and Challenges of BNPL

Despite its popularity, Buy Now, Pay Later carries risks for both consumers and providers:

1. Consumer Risks

| Risk | Explanation |

| Over-Spending | The convenience of deferred payments can encourage impulse buying or unnecessary purchases. |

| Late Fees | Missing or delaying payments leads to late fees, which can accumulate quickly. |

| Credit Score Impact | Late or missed payments may be reported to credit bureaus, affecting credit health. |

| Debt Accumulation | Using multiple BNPL plans across different merchants can lead to unmanageable financial commitments. |

| Budget Mismanagement | Consumers may underestimate total outstanding BNPL obligations, causing cash flow strain. |

2. Provider Risks

| Risk | Explanation |

| Credit Risk | Users may fail to repay installments, resulting in losses for BNPL providers. |

| Fraud Risk | Fraudulent transactions or identity misuse can cause financial losses. |

| Operational Risk | Managing thousands of micro-loans requires strong systems; failure can disrupt services. |

| Merchant Dependency | Providers rely heavily on merchant fees; changes in partnerships can reduce revenue streams. |

3. Regulatory Concerns

| Concern | Explanation |

| Limited Regulation | BNPL is often less regulated than traditional credit, increasing consumer risk. |

| Responsible Lending Requirements | Countries like the UK, Australia, and the US are tightening rules to ensure clearer disclosures and affordability checks. |

| Transparency Standards | Regulators are pushing for clearer terms on fees, interest, and consequences of late payments. |

| Consumer Protection Measures | Authorities are demanding fair practices, dispute resolution processes, and proper reporting to protect borrowers. |

How BNPL Affects Credit Scores?

Many Buy Now, Pay Later services skip a full credit check, but they still report late payments to credit bureaus. This can affect a user’s creditworthiness. Responsible use of BNPL can help maintain a healthy credit profile, while mismanagement can lead to financial challenges.

BNPL vs Credit Cards

Buy Now, Pay Later appeals to consumers seeking short-term, low-cost financing without revolving debt.

| Feature | BNPL | Credit Card |

| Approval | Quick, minimal credit checks | Requires credit approval |

| Interest | Often 0% if paid on time | Interest charged on unpaid balances |

| Fees | Late fees, minimal other fees | Late fees, annual fees, interest |

| Repayment | Fixed installments | Flexible, minimum payment required |

| Purchase Limit | Small to medium | High depending on credit limit |

BNPL Market Trends

BNPL has grown rapidly, especially among Millennials and Gen Z:

- Global market size: BNPL crossed $120 billion in 2023, and experts expect it to grow much more by 2030.

- Digital-first adoption: Online shopping has accelerated BNPL usage.

- Partnership expansion: BNPL providers are partnering with more merchants, banks, and fintech platforms.

- Embedded BNPL: Increasingly integrated into digital wallets and payment apps.

Best Practices for Consumers Using BNPL

To use BNPL responsibly, consider the following:

- Assess affordability: Only buy what you can comfortably repay.

- Track multiple plans: Record all BNPL purchases to avoid overlapping payments.

- Read the terms carefully: understand interest rates, late fees, and the repayment schedule.

- Prioritize payment deadlines: Late payments can add fees and affect your credit.

- Avoid impulse buying: BNPL may encourage overspending.

The Future of BNPL

The BNPL market is evolving in several ways:

- Integration with traditional banking: Some banks are offering BNPL directly within debit or credit cards.

- Regulation: Governments are likely to increase oversight, introducing interest caps, fee disclosures, and consumer protection rules.

- Global adoption: BNPL is expanding beyond the US, Europe, and Australia into emerging markets.

- Fintech innovation: AI-based credit assessments and personalized BNPL offerings will improve affordability and reduce risk.

Final Thoughts

Buy Now, Pay Later is reshaping modern consumer finance by providing flexible, short-term payment solutions. While it offers convenience, budgeting assistance, and interest-free options, it also requires careful management to avoid overspending and debt accumulation.

For consumers, understanding how BNPL works, its risks, and responsible usage is essential. For merchants and fintech providers, it helps boost sales and attract new customers while staying compliant with regulations.

As BNPL continues to grow, it is likely to become a staple in the payment landscape, bridging the gap between traditional credit and modern, digital-first consumer behavior.

Frequently Asked Questions (FAQs)

Q1. Is BNPL considered a loan?

Answer: Yes. In most countries, BNPL is legally considered a type of short-term credit. Even without charging interest, BNPL still creates repayment obligations, making it a form of financing.

Q2. Can BNPL affect my ability to get a loan or mortgage?

Answer: Yes. Even if BNPL does not appear on your credit report, lenders may still check your bank statements. Multiple BNPL repayments can signal financial stress and may impact loan approval.

Q3. Is BNPL safe to use for essential expenses like groceries or medicine?

Answer: It is possible, but not recommended. Using BNPL for essentials may indicate budget strain and lead to debt accumulation. Financial experts advise limiting BNPL to planned, manageable purchases.

Q4. Is BNPL the same as EMI (Equated Monthly Installments)?

Answer: Not exactly. EMIs are typically linked to banks and credit cards and often involve interest. BNPL offers short repayment periods and usually gives interest-free options when consumers pay on time.

Q5. Can BNPL be used for subscriptions?

Answer: Typically, no. BNPL supports fixed-amount transactions. However, some fintechs are experimenting with installment payments for large annual subscriptions.

Q6. What happens if I return an item after paying installments?

Answer: You get a refund for the amount you have already paid, and the provider cancels your future installments. Refund timing depends on the merchant and provider.

Recommended Articles

We hope this article on Buy Now, Pay Later helped you understand how modern payment options are reshaping consumer spending. Explore the articles below to learn more about personal finance tools, digital payment trends, and smarter borrowing practices.