Updated July 25, 2023

Definition of Basic EPS

The term “basic EPS” refers to the amount of the company’s net earnings that are allocated to the common stockholders at the end of a specific period (quarterly or yearly). More importantly, basic EPS is built on the premise that none of the convertible securities (such as convertible preferred shares, employee stock options, etc.) will be converted to common stock.

It is calculated based on the company’s net income minus dividends for preferred shares. Basically, for basic Earnings Per Share, it is believed that none of the convertible securities will be exercised during the given period of time. Also, please bear in mind that a company may not pay out the entire net earnings to the shareholders because it may partly distribute the earnings while re-investing the remaining earnings into the business to explore further growth opportunities.

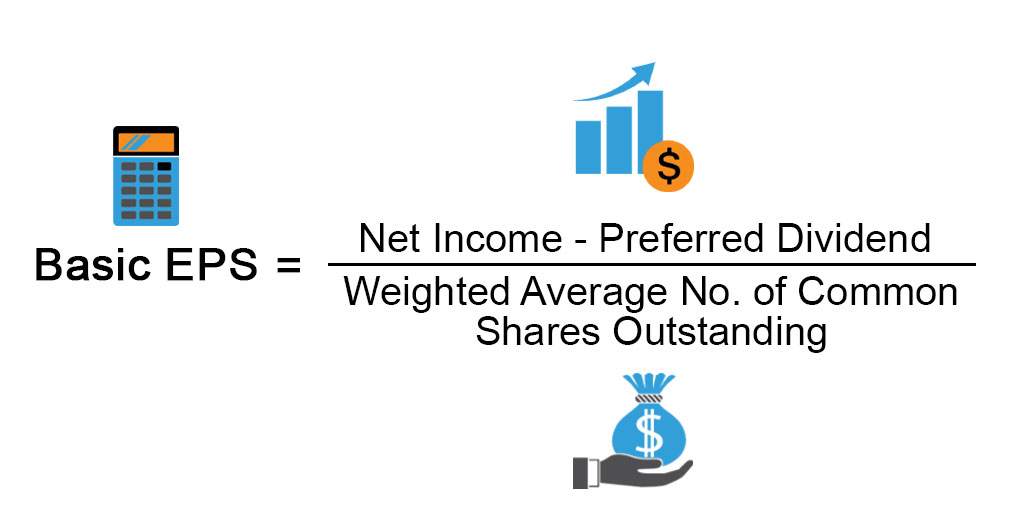

Formula

The formula for basic Earnings Per Share can be derived first by deducting the dividends paid to the preference shareholders from the net income generated by the company and then dividing the result by the weighted average number of common shares outstanding. The Mathematical representation of the formula is as below:

Examples of Basic EPS (With Excel Template)

Let’s take an example to understand the calculation of Basic EPS in a better manner.

Example #1

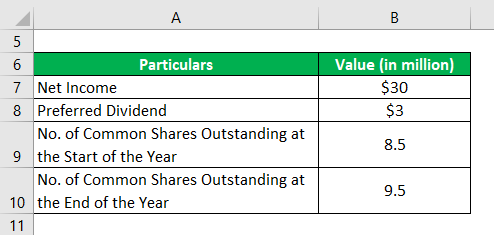

Let us take the example of a company that is engaged in the manufacturing of shoes and has its facility in the village of Wheeling, Illinois (USA). During the year 2018, the company booked a net income of $30 million. Further, it paid out dividends of $3 million to owners of the preference shares. At the start of the year, the company had 8.5 million common stocks, while it issued another 1 million common stocks during the year. Calculate the basic EPS of the company for the year 2018 based on the given information.

Solution:

The calculation for No. Of common shares outstanding at the end of the year is as below:

- No. of common shares outstanding at the end of the year = 8.5 million + 1.0 million

- No. of common shares outstanding at the end of the year = 9.5 million

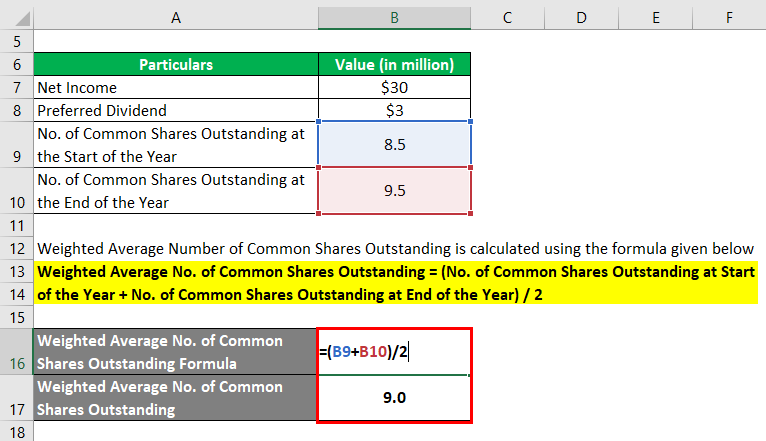

The formula to calculate the Weighted Average Number of Common Shares Outstanding is as below:

Weighted Average No. of Common Shares Outstanding = (No. of Common Shares Outstanding at Start of the Year + No. of Common Shares Outstanding at End of the Year) / 2

- Weighted Average No. of Common Shares Outstanding = (8.5 million + 9.5 million) / 2

- Weighted Average No. of Common Shares Outstanding = 9.0 million

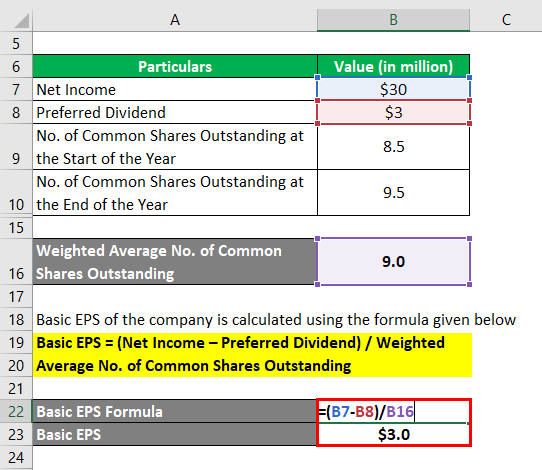

The formula to calculate the Basic EPS of the company is as below:

Basic EPS = (Net Income – Preferred Dividend) / Weighted Average No. of Common Shares Outstanding

- Basic EPS = ($30.0 million – $3.0 million) / 9.0 million

- = $3.0 per share

Therefore, the company managed an Earnings Per Share of $3.0 per share during the year 2018.

Example #2

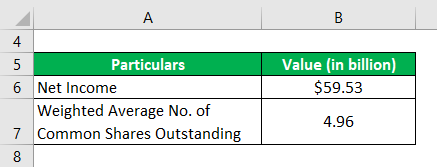

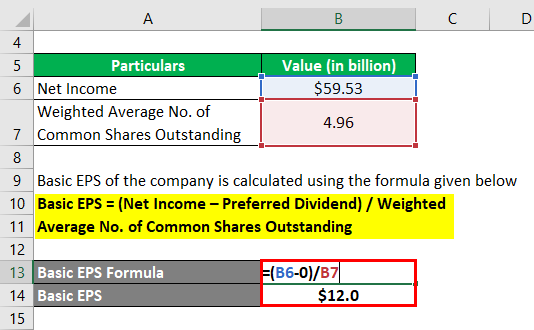

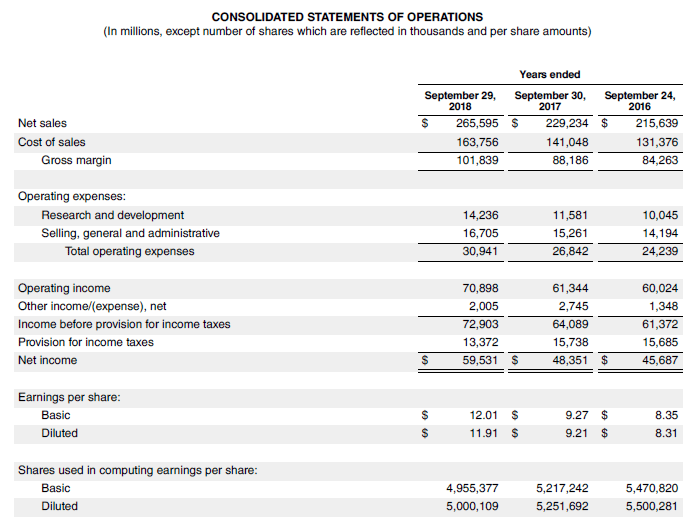

Let us take the example of Apple Inc. to illustrate the computation of basic EPS based on its latest annual report. In 2018, Apple registered a net income of $59.53 billion, and the average number of common shares outstanding during the period was 4.96 billion. Calculate the basic EPS of the company based on the given information.

Solution:

The formula to calculate the Basic EPS of the company is as below:

Basic EPS = (Net Income – Preferred Dividend) / Weighted Average No. of Common Shares Outstanding

- Basic EPS = ($59.53 billion – 0) / 4.96 billion

- = $12.0 per share

Therefore, Apple Inc.’s basic EPS for the year 2018 stood at $12.01 per share.

Source Link: Apple Inc.Balance sheet

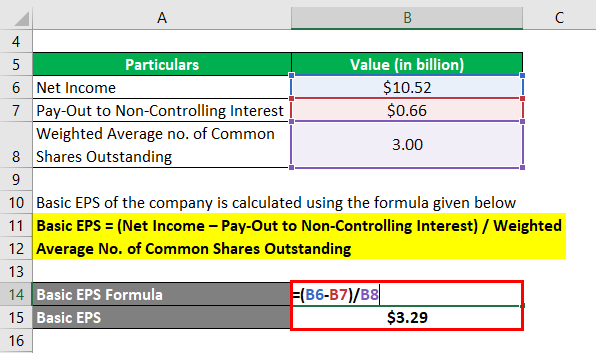

Example #3

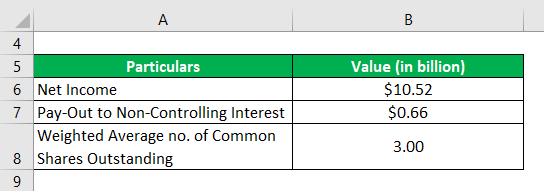

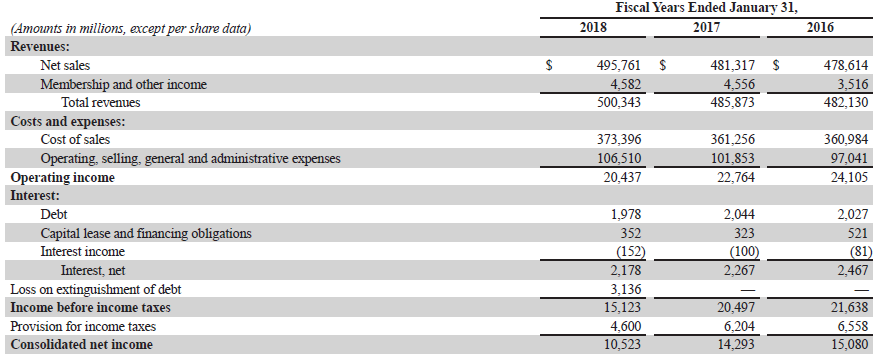

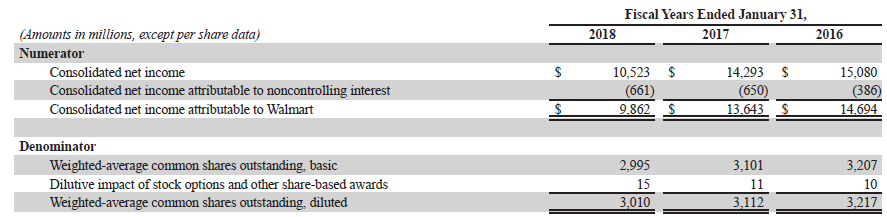

Let us also take the example of Walmart Inc.’s latest annual report for the year 2018 to illustrate the calculation of basic EPS. As per the annual report, the company’s net income for the period stood at $10.52 billion, while it had to pay out $0.66 billion to the non-controlling interest. The average number of common shares outstanding was 3.00 billion during the period. Calculate the basic EPS of the company based on the given information.

Solution:

The formula to calculate the Basic EPS of the company is as below:

Basic EPS = (Net Income – Pay-Out to Non-Controlling Interest) / Weighted Average No. of Common Shares Outstanding

- Basic EPS = ($10.52 billion – $0.66 billion) / 3.00 billion

- = $3.29 per share

Therefore, Walmart Inc.’s managed basic EPS of $3.29 per share for the year 2018.

Source: Walmart Annual Reports (Investor Relations)

Advantages of Basic EPS

- It helps determine the basic earnings per stock, which are good for academic purposes.

- It uses easy calculation steps as it doesn’t involve the complexity of potential earnings dilution due to convertible shares.

Limitations of Basic EPS

- It is less useful for the investors as it fails to capture the impact of the convertible shares if exercised.

- It can be easily manipulated using various techniques. One of the most used techniques is buying back shares.

Conclusion

So, basic EPS is a good indicator of a company’s financial performance. But to better understand, it is important to analyze it with the stock price and an outstanding number of common shares.

Recommended Articles

This is a guide to the Basic EPS. Here we discuss how it can be calculated using a formula, the Advantages and Limitations of Basic Earnings Per Share, and a downloadable Excel template. You can also go through our other suggested articles to learn more –