Updated July 31, 2023

Balance Sheet Formula (Table of Contents)

- Balance Sheet Formula

- Examples of Balance Sheet Formula (With Excel Template)

- Balance Sheet Formula Calculator

Balance Sheet Formula

The balance sheet formula is the accounting equation and is the fundamental and most basic accounting part. The balance sheet will form the building blocks for the double-entry accounting system.

The formula will look like this:

Examples of Balance Sheet Formula (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

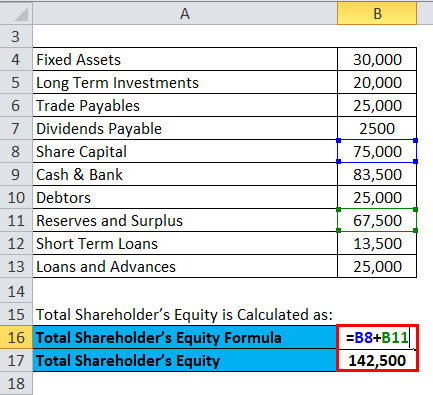

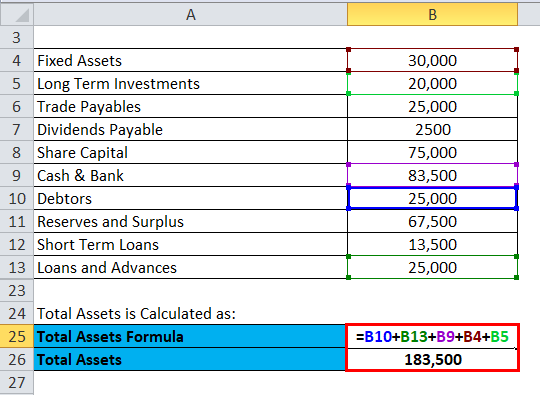

Let’s try to prepare Balance Sheet with a simple example. Following are the extracts and information available from ABC Ltd.

Solution:

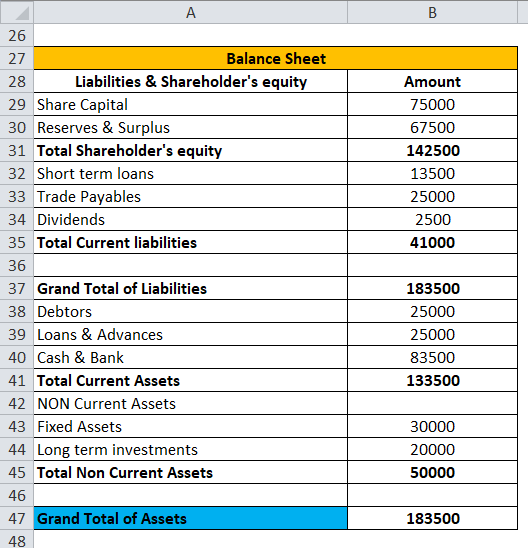

The calculation for Total Shareholder’s Equity is:

- Shareholder’s Equity = 75,000 + 67,500

- Shareholder’s Equity = 142,500

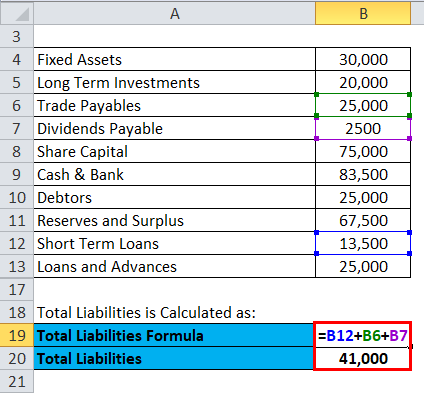

The calculation for Total Liabilities is:

- Total Liabilities = 13,500 + 25,000 + 2,500

- Total Liabilities = 41,000

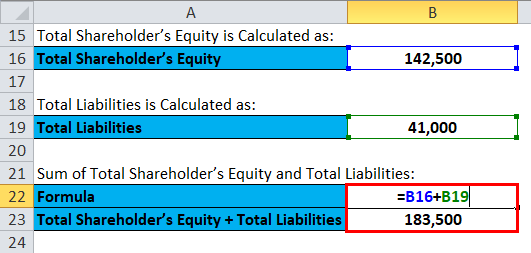

Sum of Total Shareholder’s Equity and Total Liabilities:

- Shareholder’s Equity + Total Liabilities = 142,500 + 41,000

- Shareholder’s Equity + Total Liabilities = 183,500

The calculation for Total Assets is:

- Total Assets = 25,000 + 25,000 + 83,500 + 30,000 + 20,000

- Total Assets = 183,500

So, now we can see that the balance sheet equation says Total assets = Total Liabilities + Total equity shareholders; in this case, it is 183,500.

Balance Sheet:

Now in the above-given balance sheet, we have calculated Grand total of assets using total current assets and total non-current assets.

Example #2

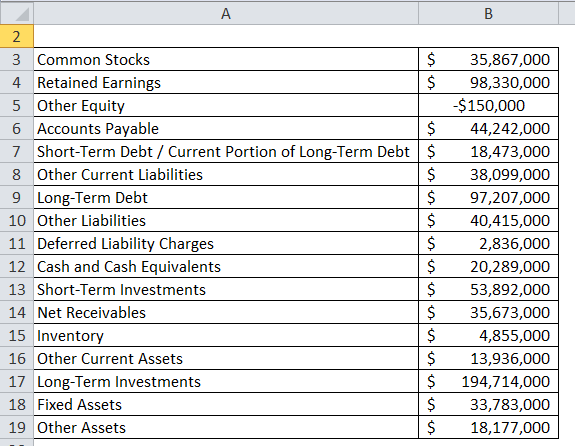

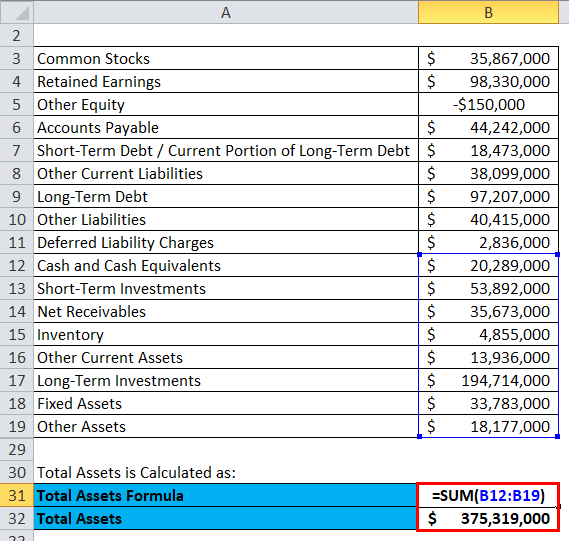

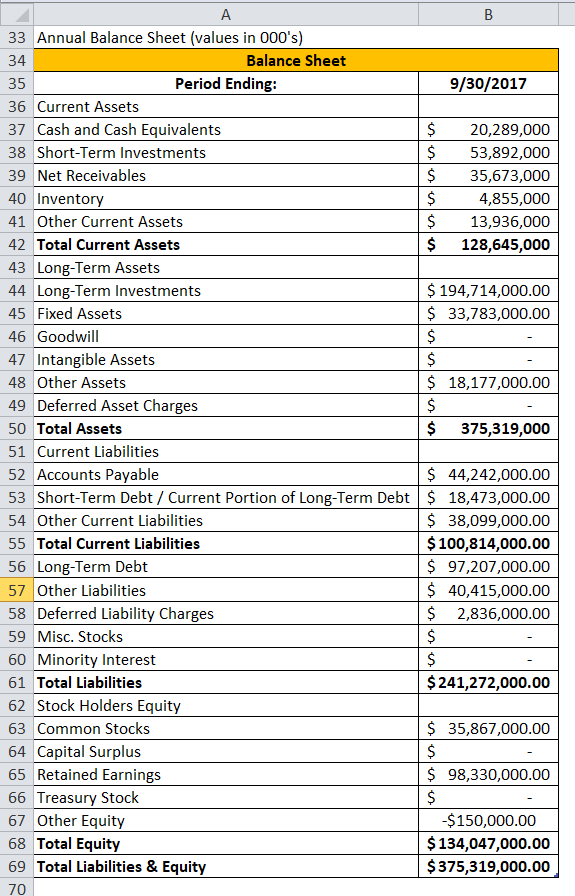

Below is an extract from Apple Inc. financial statements (annual report) as of 09/30/2017

Solution:

The calculation for Total Shareholder’s Equity is:

- Total Shareholder’s Equity = 3,58,67,000 + 9,83,30,000 – 1,50,000

- Total Shareholder’s Equity = 13,40,47,000

The calculation for Total Liabilities is:

- Total Liabilities = 4,42,42,000 + 1,84,73,000 + 3,80,99,000 + 9,72,07,000 + 4,04,15,000 + 28,36,000

- Total Liabilities = 24,12,72,000

Sum of Total Shareholder’s Equity and Total Liabilities:

- Shareholder’s Equity + Total Liabilities = 13,40,47,000 + 24,12,72,000

- Shareholder’s Equity + Total Liabilities = 37,53,19,000

The calculation for Total Assets is:

- Total Assets = 2,02,89,000 + 5,38,92,000 + 3,56,73,000 + 48,55,000 + 1,39,36,000 + 19,47,14,000 + 3,37,83,000 + 1,81,77,000

- Total Assets = 37,53,19,000

Balance Sheet:

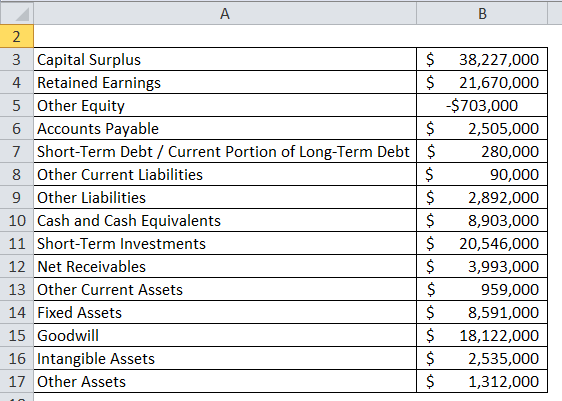

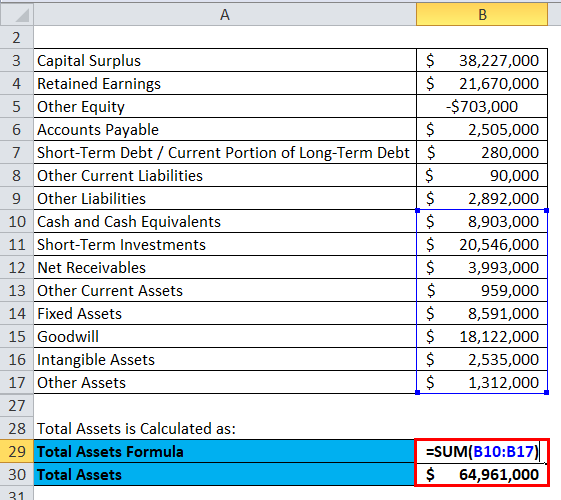

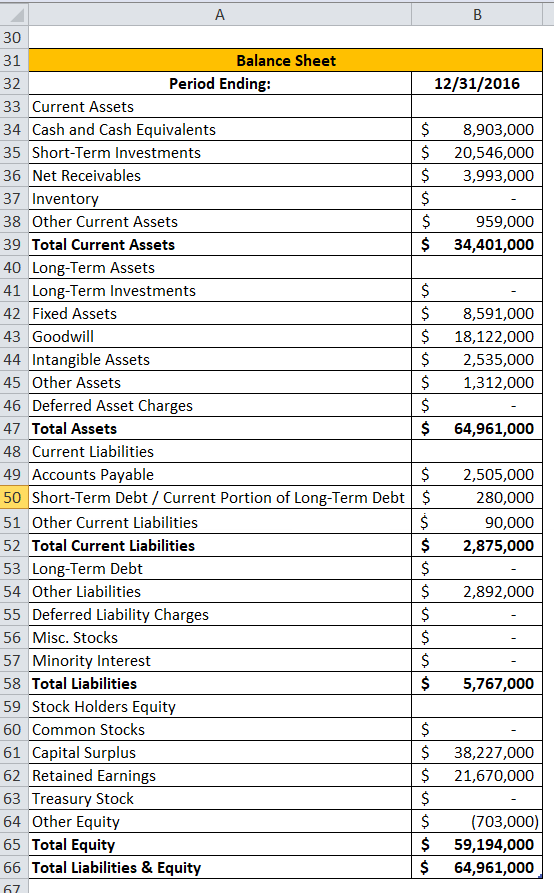

Example #3

Below is an extract from Facebook’s financial statements (annual report) as of 09/30/2017

Solution:

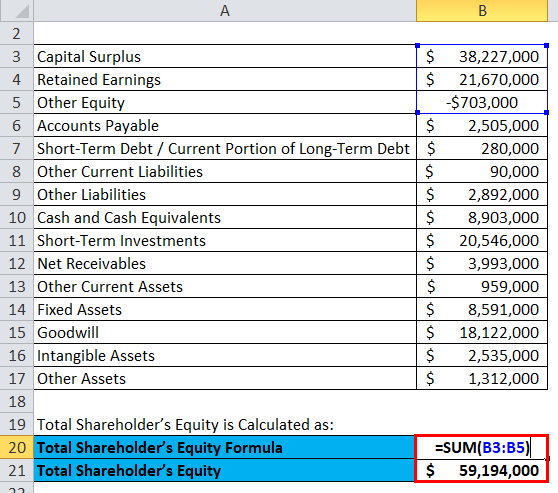

The calculation for Total Shareholder’s Equity is:

- Shareholder’s Equity = 3,82,27,000 + 2,16,70,000 – 7,03,000

- Shareholder’s Equity = 5,91,94,000

Total Liabilities calculation:

- Total Liabilities = 25,05,000 + 2,80,000 + 90,000 +28,92,000

- Total Liabilities = 57,67,000

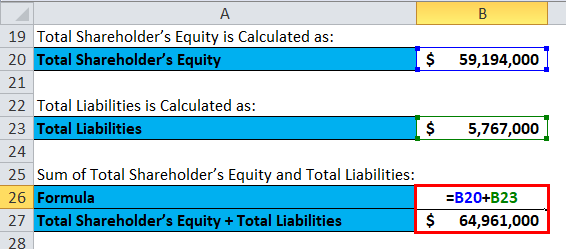

Sum of Total Shareholder’s Equity and Total Liabilities:

- Shareholder’s Equity + Total Liabilities = 5,91,94,000 + 57,67,000

- Shareholder’s Equity + Total Liabilities = 6,49,61,000

Total Assets calculation:

- Total Assets = 89,03,000 + 2,05,46,000 + 39,93,000 + 9,59,000 + 85,91,000 + 1,81,22,000 + 25,35,000 + 13,12,000

- Total Assets = 6,49,61,000

Balance Sheet:

Explanation of the Balance Sheet Formula

In its simplest form, the balance sheet formula will depict what a company will own, what it will owe, and what stake the shareholders or the owners have in the company’s business. If one notices the equation, one can conclude that it will start with the company assets, which are the company’s resources, and the same has to be used in the near future, like the accounts receivable, cash, and fixed assets.

Relevance and Uses

Most of the cases, the company will not own its assets outright. For example, it might have borrowed a loan and be pending on the mortgage on the building or company car, or even it might owe money to its owners or the shareholders. That is why the second part of the balance sheet formula is made up of the claims on assets of the company. All these claims on the company’s assets can be separated into 2 broad categories: equity and liabilities.

Liabilities are the claims on the company’s assets by the people or the other firms. A mortgage or a bank loan is a good example. The bank will have a claim to the company’s land or the mortgaged building. On the other hand, liabilities are usually presented before equity in the balance sheet formula because the liabilities should be repaid before the shareholder’s or the owners’ claims.

Conversely, equity is the owner’s or the shareholders’ claims on the company’s assets. This will be the amount of money the owners or the shareholders have contributed to the company to earn an ownership stake. Equity will also include retained earnings. Once all the claims by outside the companies and claims by the owners or the shareholders are summed up, they will always equal the company’s total assets.

Balance Sheet Formula Calculator

You can use the following Balance Sheet Calculator.

| Total Shareholder's Equity | |

| Total Liabilities | |

| Total Assets Formula = | |

| Total Assets Formula = | Total Shareholder's Equity + Total Liabilities | |

| 0 + 0 = | 0 |

Recommended Articles

This has been a guide to the Balance Sheet formula. Here we discuss How to Calculate Balance Sheet along with practical examples. We also provide a Balance Sheet Calculator with a downloadable Excel template. You may also look at the following articles to learn more –