What is Collateral Management?

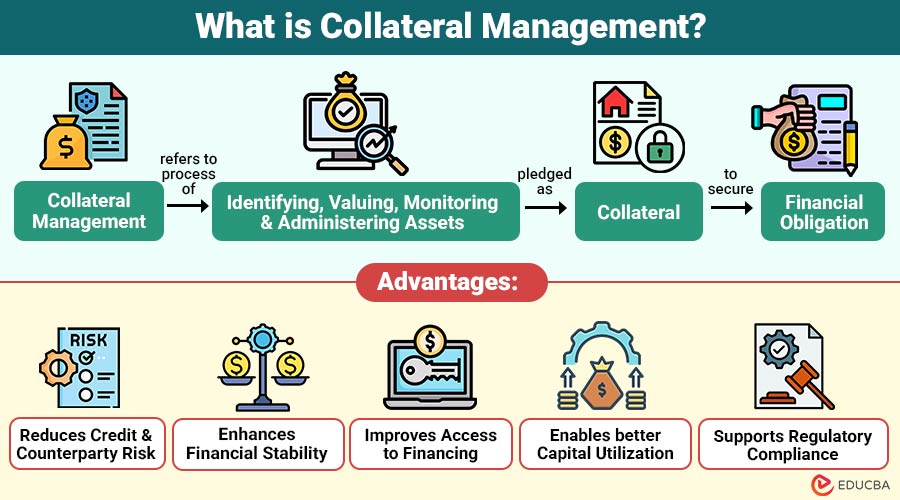

Collateral management refers to the process of identifying, valuing, monitoring, and administering assets pledged as collateral to secure a financial obligation.

The primary objective is to:

- Reduce credit and counterparty risk

- Ensure sufficient collateral coverage at all times

- Maintain regulatory compliance

- Improve liquidity and capital efficiency

Cash, securities, real estate, commodities, and other financial assets can all be used as collateral.

Table of Contents:

- Meaning

- Importance

- Scope

- Process

- Role

- Advantages

- Disadvantages

- Real-World Example

- When is Collateral Management Most Critical?

Key Takeaways:

- Collateral management mitigates credit risk by effectively securing financial obligations and protecting against counterparty defaults.

- Proper collateral practices enhance liquidity, optimize capital usage, and improve access to favorable financing opportunities.

- Technology helps automate tracking, margin calls, and reporting. This makes the process faster, more accurate, and ensures better compliance with regulations.

- Effective collateral management strengthens market confidence, supporting stability, trust, and the smooth functioning of financial and trading systems.

Why is Collateral Management Important?

Here are the key reasons why effective collateral management is important:

1. Risk Mitigation

Effective collateral management protects lenders against borrower or counterparty default, significantly reducing financial losses and exposure.

2. Credit Enhancement

Proper collateral management improves borrowing terms, lowers interest rates, and increases overall creditworthiness for institutions and borrowers.

3. Liquidity Management

It helps organizations quickly access reliable assets during difficult situations, ensuring they have enough cash and can continue operations smoothly.

4. Regulatory Compliance

Meets margin, reporting, and capital requirements under regulations like Basel III, EMIR, and Dodd-Frank frameworks.

5. Market Confidence

Builds trust and confidence between trading, clearing, and lending parties, strengthening stability across financial markets.

Scope of Collateral Management

Collateral management spans multiple financial activities where securing, monitoring, and optimizing collateral is essential.

1. Bank Lending and Loans

Secures bank lending and loan agreements by reducing credit risk and protecting lenders against borrower defaults.

2. Repo (Repurchase) Transactions

In repo transactions, collateral management ensures secured short-term funding while managing valuation, margining, and counterparty risk.

3. Derivatives Trading

Supports derivatives trading by managing margin requirements, collateral valuation, and exposure mitigation under regulatory and contractual frameworks.

4. Securities Lending and Borrowing

Enables secure securities lending and borrowing by tracking collateral, managing haircuts, and ensuring timely returns and settlements.

5. Clearing and Settlement Systems

Strengthens clearing and settlement systems by ensuring collateral availability, reducing settlement risk, and supporting market stability.

Collateral Management Process

The collateral management process involves a structured set of steps to ensure assets are efficiently identified, valued, allocated, and monitored.

1. Collateral Identification

Eligible assets are identified in accordance with contractual terms, regulatory requirements, and internal risk acceptance criteria.

2. Valuation and Haircuts

Assets are regularly valued using market prices, with haircuts applied to cover volatility and liquidity risk exposures.

3. Margin Calculation

Collateral requirements are calculated based on exposure levels, mark-to-market movements, and agreed margin frameworks with contractual terms.

4. Collateral Allocation

Optimal collateral is selected and allocated efficiently to satisfy obligations while minimizing funding and opportunity cost risks.

5. Monitoring and Reevaluation

Collateral values are continuously monitored and revalued to maintain sufficient coverage against changing market conditions and exposures.

6. Substitution and Optimization

Collateral may be substituted or optimized to enhance liquidity, reduce funding costs, and improve portfolio efficiency ratios.

7. Settlement and Reporting

All collateral movements are settled, documented, reconciled, and reported accurately to counterparties and regulatory authorities within timelines.

Role of Technology in Collateral Management

Technology plays vital role in increasing effectiveness, accuracy, and compliance throughout the collateral management lifecycle.

1. Real-time Exposure Monitoring

Technology enables continuous tracking of exposures, market movements, and collateral sufficiency across counterparties in real time.

2. Automated Margin Calls

Automated systems calculate margin requirements and issue margin calls promptly, reducing manual errors and delays.

3. Collateral Optimization Algorithms

Advanced algorithms select optimal collateral assets, minimizing funding costs while meeting regulatory and contractual obligations.

4. Regulatory Reporting Automation

Automation ensures accurate, timely regulatory reports, improving compliance efficiency and significantly reducing operational reporting risks.

5. Integration with Trading and Risk Systems

Integrated platforms connect trading, risk, and collateral systems, ensuring data consistency and faster decision-making.

Advantages of Collateral Management

Here are the key advantages that organizations gain from effective collateral management:

1. Reduces Credit and Counterparty Risk

Effective collateral management mitigates default risk by securing exposures and protecting parties against potential losses.

2. Enhances Financial Stability

Proper collateral practices strengthen financial resilience, ensuring that organizations meet obligations even during periods of market volatility.

3. Improves Access to Financing

Well-managed collateral increases lender confidence, enabling easier access to funding at favorable borrowing terms.

4. Enables better Capital Utilization

Optimized collateral allocation frees up capital, thereby improving liquidity management and overall balance-sheet efficiency.

5. Supports Regulatory Compliance

Collateral management helps organizations follow regulations, meet reporting rules, and manage risks effectively.

Disadvantages of Collateral Management

Despite its benefits, it has limitations:

1. Operational Complexity

Managing collateral is complicated. It involves many steps, regular checks and matching of records, coordination between different parties, and a lot of ongoing operational monitoring across different countries.

2. High Technology and Compliance Costs

Advanced systems, regulatory tools, skilled staff, and maintenance create significant ongoing technology and compliance expenses.

3. Valuation Challenges during Market Stress

Market volatility reduces pricing reliability, making collateral valuation difficult, inconsistent, and riskier during stress periods.

4. Liquidity Constraints for Non-cash Collateral

Non-cash collateral may be illiquid or harder to liquidate quickly, limiting its usability during urgent funding needs.

5. Dependence on Accurate Data and Timely Reporting

Relies heavily on accurate data, timely reporting, and system reliability to ensure effectiveness.

Real-World Example

Here is an example illustrating how collateral management works in practice:

Consider a derivatives transaction between two financial institutions. To mitigate counterparty risk, both parties agree to exchange collateral based on daily mark-to-market valuations.

- If one party’s exposure increases due to market movements, a margin call is issued, requiring additional collateral.

- Conversely, if exposure decreases, excess collateral may be returned.

This ongoing process helps protect both sides for the entire contract period, reduces risk, and keeps finances stable.

When is Collateral Management Most Critical?

Here are key situations where collateral management becomes especially critical:

1. Market Volatility

Collateral management becomes critical during market volatility, ensuring sufficient coverage to effectively mitigate counterparty risk and potential losses.

2. Economic Downturns

During economic downturns, effective collateral management helps prevent defaults and maintain financial stability amid stressed market conditions.

3. High-leverage Transactions

High-leverage transactions increase risk exposure, making proper collateral management essential to safeguard parties and control potential financial losses.

4. Cross-border Financial Deals

Cross-border deals need close monitoring of collateral to manage different regulations, currency changes, and risks from international partners.

5. Large Derivative Exposures

Large derivative exposures require precise collateral management to ensure margin adequacy and efficiently prevent systemic financial risks.

Final Thoughts

Collateral management is a cornerstone of modern finance, safeguarding transactions, mitigating counterparty risk, and optimizing liquidity. By carefully identifying, valuing, and tracking collateral, financial institutions stay financially stable, follow regulations, and use their capital more effectively. During market ups and downs or high-risk deals, good collateral management builds trust, reduces potential losses, and helps financial operations run smoothly across global markets.

Frequently Asked Questions (FAQs)

Q1. Is collateral management only used by banks?

Answer: No. It is used by banks, corporations, asset managers, clearinghouses, and investors.

Q2. What happens if collateral value falls?

Answer: Additional collateral is requested through a margin call to restore coverage.

Q3. Can collateral be substituted?

Answer: Yes. Eligible collateral can often be replaced to improve liquidity or reduce costs.

Q4. Is collateral management mandatory?

Answer: For many regulated transactions, especially derivatives, it is legally required.

Recommended Articles

We hope that this EDUCBA information on “Collateral Management” was beneficial to you. You can view EDUCBA’s recommended articles for more information.