Why Frequent Travellers Should Switch to Zero Forex Cards?

Travelling abroad is exciting, whether it is for business, study, or leisure. But along with the thrill of exploring new countries comes the challenge of managing money overseas. Payment methods like cash, credit cards, and prepaid cards frequently carry hidden costs, currency conversion fees, and potential security vulnerabilities. This is where zero forex cards have emerged as a smart alternative for frequent travellers. Here, we will explore why frequent travellers should consider switching to zero forex cards and how they can make international travel more convenient, cost-effective, and secure.

What is a Zero Forex Card?

A zero forex card is a type of multi-currency prepaid card designed specifically for international travellers. Unlike regular prepaid or debit cards, zero-forex cards allow users to load foreign currencies at zero markup on conversion. This means you get the exact value of the currency without hidden fees or unfavorable exchange rates. For travellers visiting multiple countries, it offers a single solution to handle various currencies, making money management much simpler.

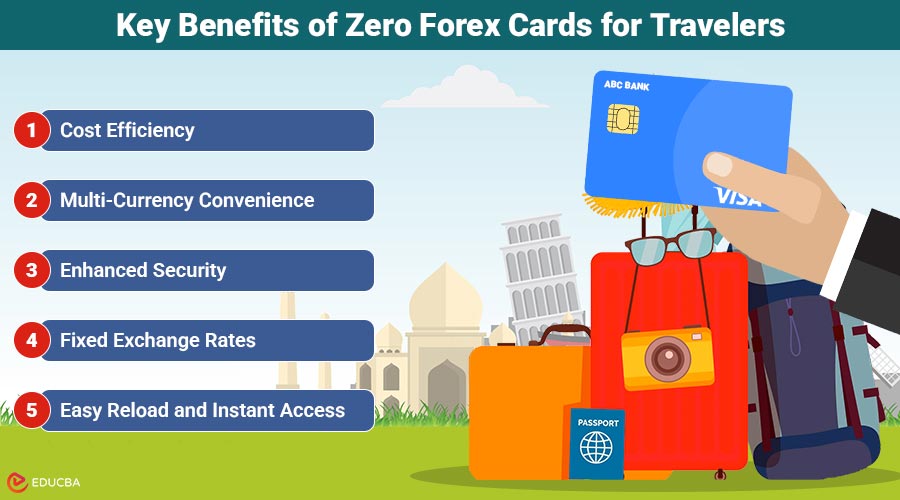

Key Benefits of Zero Forex Cards for Travellers

Here are the main advantages of using a zero forex card that make it a smart choice for frequent travellers:

1. Cost Efficiency

One of the biggest advantages of a zero forex card over traditional prepaid cards is cost efficiency.

- Regular prepaid cards typically charge a 2–3% foreign exchange fee on every transaction.

- With frequent trips or large purchases abroad, these fees quickly add up, costing travellers hundreds of dollars a year.

- Zero-forex cards eliminate or greatly reduce these fees, allowing travellers to save more while spending abroad.

This makes forex cards especially beneficial for business travellers, students studying abroad, and anyone who frequently travels abroad.

2. Multi-Currency Convenience

Imagine travelling across Europe, visiting France, Germany, and Italy in one trip. Managing multiple currencies can be complicated and risky if relying on cash or separate prepaid cards. Forex cards solve this problem by allowing travellers to load multiple currencies on a single card.

- Easily switch between currencies during transactions.

- Avoid the hassle of exchanging money multiple times.

- Lower the risks linked to carrying significant cash balances.

For frequent travellers, this convenience is a major advantage over traditional prepaid cards.

3. Enhanced Security

Carrying cash abroad is risky, and using credit or debit cards can expose you to fraud and unauthorized transactions. They come with robust security features:

- PIN protection ensures only the cardholder can make transactions.

- EMV chip technology minimizes the risk of card cloning or skimming.

- App-based management enables users to lock, unlock, and monitor transactions in real time.

These security measures make forex cards a safer choice for travellers than traditional prepaid or debit cards.

4. Fixed Exchange Rates

One frequently underestimated benefit is the ability to secure exchange rates at the time of loading.

- Traditional prepaid cards charge the exchange rate at the moment of the transaction, which can fluctuate unfavorably.

- Zero forex cards protect travellers from sudden currency swings, offering predictable costs for budgeting purposes.

Whether you are paying for tuition, accommodation, or business expenses abroad, knowing exactly how much you are spending can make financial planning much easier.

5. Easy Reload and Instant Access

Zero forex cards cater to modern travelers who need flexibility:

- Top up your card online from anywhere in the world.

- Access multiple currencies instantly.

- Monitor transactions in real-time via a mobile app.

Prepaid cards, by comparison, may require branch visits or limited reload options. Zero forex cards make managing money on the go simple and hassle-free.

6. Rewards and Perks

Many zero forex cards also come with additional benefits, which traditional prepaid cards often lack:

- Cashback on international spending.

- Reward points for every transaction.

- Airport lounge access for premium cardholders.

- Discounts on travel bookings and partner merchants.

Frequent travellers can enjoy these perks while saving on everyday international expenses, making each trip even more rewarding.

Zero Forex Card vs Prepaid Card

Choosing the right card can save you both money and hassle. Understanding the differences between available options ensures smarter spending abroad.

| Feature | Zero Forex Card | Prepaid Card |

| Forex Markup | Zero or minimal | 2–3% per transaction |

| Multi-Currency Support | Yes | Usually, a single currency |

| Security | High (EMV chip + PIN + app control) | Moderate |

| Exchange Rate | Fixed at top-up | Variable at transaction |

| Reload Options | Online/App anytime | Limited options |

| Rewards & Perks | Often included | Rare |

Who Should Use Zero Forex Cards?

Zero forex cards are ideal for:

- Business Travellers: Save on forex charges, manage multiple currencies effortlessly, and streamline expense tracking while traveling for work.

- Students Abroad: Lock in exchange rates for tuition, daily expenses, and accommodation, providing financial predictability throughout your studies.

- Frequent Tourists: Enjoy convenience, security, and exclusive perks while exploring new destinations, without worrying about fluctuating currency rates.

- International Shoppers: Make online and in-store purchases abroad safely, avoiding hidden fees and conversion hassles.

If you travel internationally even a few times a year, switching to a zero forex card can significantly reduce costs, simplify financial management, and offer peace of mind with secure transactions wherever you go.

Final Thoughts

As international travel becomes more common, choosing the right payment method is more important than ever. While traditional prepaid cards once served this purpose, zero forex cards are now the superior choice. For frequent travellers, a zero forex card is more than just a payment tool; it is a smart travel companion. Switching today means saving money, staying secure, and travelling smarter. Book My Forex Pvt. Ltd. offers these cards with zero-margin rates on select currencies and convenient same-day delivery, making it easier than ever to manage money abroad.

Recommended Articles

We hope this guide helps you travel smarter and save more on your international expenses. Explore these recommended articles for additional insights and tips to enhance your travel and money-management experience.