What is Market Impact?

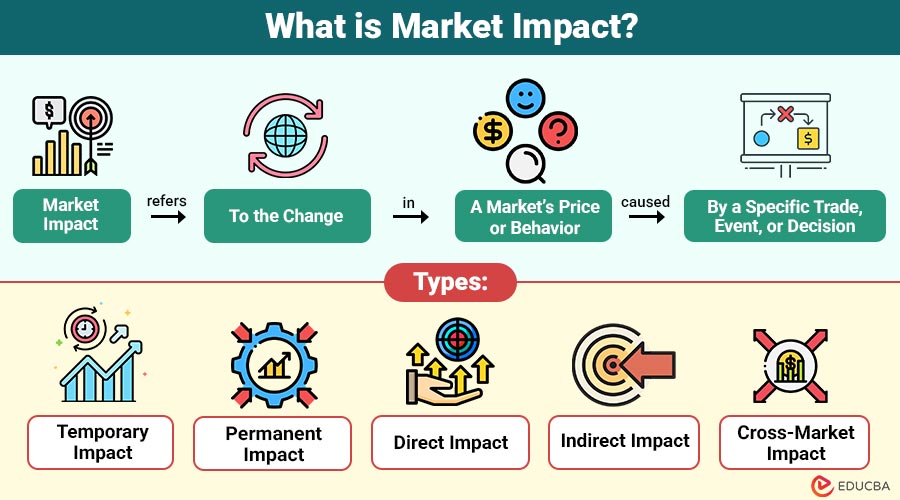

Market impact refers to the change in a market’s price or behavior caused by a specific trade, event, or decision. It shows how actions like buying or selling large volumes can affect overall market value and investor sentiment.

For example, if a big investor buys a large number of shares of one company, the stock price may rise because demand increases, influencing other traders to follow.

Table of Content:

- What is Market Impact?

- Why Market Impact Matters?

- Types

- Factors

- Positive vs. Negative Impact

- Market Impact in Different Contexts

- Reducing or Managing Market Impact

- Future

Key Takeaways

- Market impact shows how trades, events, or decisions influence prices and investor behavior, affecting both short-term and long-term market trends.

- Understanding factors like trade size, liquidity, volatility, and sentiment helps manage risks and make informed investment decisions.

- Strategies such as algorithmic trading, timing trades, and using alternative trading venues can reduce negative market impact.

- Future trends, including AI, global connectivity, ESG investing, and technological innovations, are reshaping market behavior and decision-making.

Why Market Impact Matters?

Understanding market impact is important because it helps traders, investors, and businesses make smarter decisions and manage risks effectively.

- Influences Investment Decisions: Market impact shows how buying or selling assets can affect prices. By understanding it, investors can plan their trades more effectively to avoid unexpected losses or capitalize on favorable price movements.

- Helps in Risk Management: Knowing market impact allows traders to predict potential price changes caused by their own actions or market events. This helps minimize financial risks and protect investments.

- Affects Market Liquidity: Large trades can reduce the availability of assets for other buyers and sellers. Understanding market impact helps ensure smoother transactions without causing drastic price swings.

- Guides Corporate and Policy Decisions: Businesses and policymakers can forecast how announcements or policy changes will affect markets. This insight helps in making strategic choices that minimize negative consequences.

- Enhances Market Efficiency: By considering market impact, participants can trade in ways that stabilize prices, reduce volatility, and maintain fair market conditions.

Types of Market Impact

It can occur in various ways, affecting prices and market behavior in both the short and long term. Understanding these types helps investors and traders plan better.

- Temporary Impact: This type of impact affects prices for a short time. For example, a large buy order may temporarily push a stock price up, but it returns to normal once trading stabilizes. Businesses often use remote team management tools to help maintain stability during short-term market fluctuations.

- Permanent Impact: Permanent impact causes long-lasting price changes. For instance, when a company announces strong earnings, its stock price may rise and stay higher due to increased investor confidence.

- Direct Impact: Direct impact occurs immediately following a specific action, such as a large sale or the purchase of a significant number of shares. The market reacts quickly to the trade, resulting in a noticeable price change.

- Indirect Impact: Indirect impact occurs when market participants respond to broader events or changes in sentiment. For example, news about economic growth can affect many stocks, even if there is no direct trade involved.

- Cross-Market Impact: Certain trades or events in one market can have a ripple effect on another market. For example, rising oil prices may impact transportation stocks or global indices.

Factors Influencing Market Impact

Several factors determine the extent to which a trade or event affects market prices. Understanding these concepts helps traders and businesses make more informed decisions.

- Trade Size and Volume: Large trades tend to have a greater impact on prices than small trades. Buying or selling a huge number of shares can cause noticeable price changes in the market.

- Market Liquidity: Markets with high liquidity, where many buyers and sellers exist, are less affected by single trades. In low-liquidity markets, even small trades can create big price swings.

- Market Volatility: When markets are volatile, prices react more strongly to trades or news. High volatility amplifies the market impact of any action.

- Investor Sentiment: Positive or negative sentiment can magnify market impact. For example, if investors are optimistic, a company announcement can push prices higher than expected.

- Economic and Political Events: News such as interest rate changes, policy decisions, or global events can significantly impact the market by influencing how participants react and trade.

- Timing of Trades: Executing trades during active hours or in bulk can have a greater impact than spreading trades over time, as it affects prices differently.+

Positive vs. Negative Market Impact

It can be beneficial or harmful depending on the situation. Understanding both helps investors and businesses make better decisions.

| Type | Positive Impact | Negative Impact |

| Price Movement | Can increase stock or asset value, benefiting investors. | Can decrease stock or asset value, causing potential losses. |

| Market Stability | Encourages steady growth and investor confidence. | Creates volatility, uncertainty, and panic among traders. |

| Investment Decisions | Helps investors make informed decisions by signaling market trends. | Can mislead investors due to sudden or unexpected price changes. |

| Liquidity | Promotes smoother transactions and active trading. | Large trades in illiquid markets may cause sharp price swings. |

| Market Sentiment | Builds trust in the market and attracts more participation. | It can lead to negative sentiment, reducing confidence and trading activity. |

Market Impact in Different Contexts

It affects various areas, not just the trading sector. Understanding its context helps businesses and investors navigate decisions effectively.

- Financial Trading: In stocks, forex, or commodities, it refers to the extent to which large trades influence prices. Traders must account for it to avoid losses or take advantage of price movements.

- Corporate Announcements: When a company announces earnings, mergers, or new products, market impact can affect its stock value and investor confidence. Strategic communication is crucial in mitigating these effects.

- Economic Policies: Interest rate changes, taxation, or government regulations can impact entire markets. Investors and businesses monitor these policies to predict market reactions.

- Global Events: Natural disasters, geopolitical tensions, or pandemics can cause sudden market shifts. Awareness of these events helps in risk management and planning.

- Consumer Behavior: Changes in demand, trends, or sentiment can have an indirect impact on market prices and corporate performance, underscoring the connection between consumers and markets.

Reducing or Managing Market Impact

Managing market impact is important for traders, investors, and businesses to minimize losses and maintain market stability.

- Trade in Smaller Portions: Breaking large trades into smaller orders reduces sudden price changes, making the market reaction smoother and less noticeable.

- Use Algorithmic Trading: Automated trading systems can optimize order execution, spreading trades over time to minimize impact on prices.

- Trade During High Liquidity Periods: Executing trades when markets are active and liquid helps absorb large transactions without causing drastic price swings.

- Monitor Market Conditions: Keeping track of volatility, sentiment, and news enables traders to plan trades when the market is more stable.

- Utilize Dark Pools or Alternative Trading Venues: Trading on private or less visible platforms can reduce market reaction to large orders, thereby keeping price movements more controlled.

- Strategic Timing: Timing trades based on market trends, announcements, or economic events can minimize negative impacts and enhance efficiency.

Future Trends Influencing Market Behavior

Market behavior is constantly evolving. Understanding future trends enables investors and businesses to prepare for changes and make informed decisions.

- Artificial Intelligence and Automation: AI and automated trading systems are increasingly influencing markets by analyzing data, predicting trends, and executing trades faster than humans.

- Increased Market Connectivity: Global markets are becoming increasingly interconnected, meaning that events in one region can quickly impact others. Investors must closely monitor international developments.

- Sustainable and ESG Investing: Environmental, Social, and Governance (ESG) factors are shaping investment decisions, affecting which companies attract capital and how markets respond.

- Data-Driven Decision Making: Access to big data enables traders and businesses to make more informed choices, thereby reducing uncertainty and informing market movements.

- Technological Innovations: New technologies, such as blockchain, digital currencies, and fintech platforms, are transforming the way markets operate, influencing liquidity, trading methods, and investor behavior.

- Regulatory Changes: Future laws and policies will continue to influence market stability, transparency, and investor confidence globally.

Final Thoughts

Market impact plays an important role in shaping financial markets, business decisions, and investor behavior. By understanding its types, influencing factors, and strategies for managing it, participants can make informed decisions, reduce risks, and navigate market fluctuations more effectively. Staying aware of future trends ensures long-term stability and smarter engagement in ever-changing market conditions.

Frequently Asked Questions

1. How quickly does market impact occur?

Answer:- It can happen instantly for large trades or gradually over time, depending on market conditions.

2. Can small investors cause market impact?

Answer:- Usually, small investors have minimal impact unless trading in very illiquid markets.

3. Does market impact affect all asset types?

Answer:- Yes, stocks, bonds, commodities, and currencies can all experience market impact.

4. Is market impact always negative?

Answer:- No, it can be positive, neutral, or negative depending on the trade or event.

Recommended Articles

We hope this guide on Market Impact helped you understand how trades and events influence markets. For more finance insights, explore these articles: