What is Risk Mitigation?

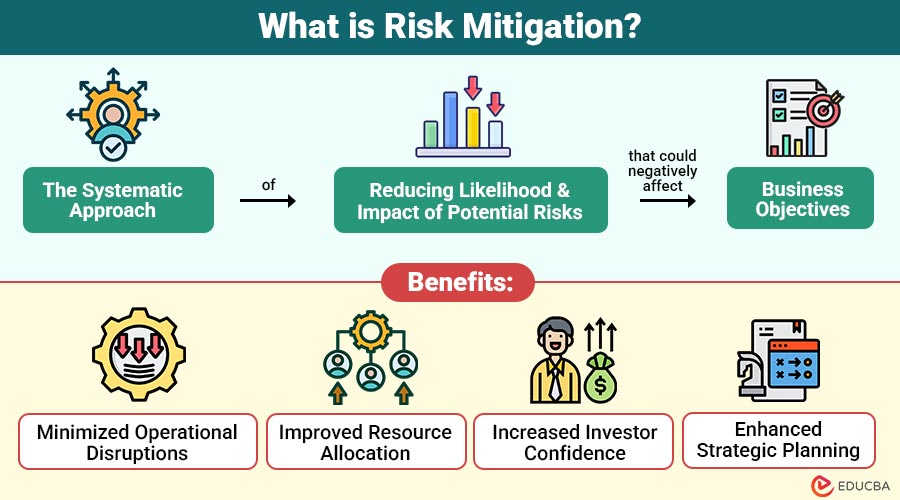

Risk Mitigation refers to the systematic approach of reducing likelihood and impact of potential risks that could negatively affect business objectives. It involves identifying possible threats, evaluating their severity, and implementing measures to either prevent or lessen their consequences.

Table of Contents:

- Meaning

- Importance

- Components

- Types

- Strategies

- Steps to Develop a Risk Mitigation Plan

- Tools

- Benefits

- Challenges

- Real-World Examples

Key Takeaways:

- Risk Mitigation proactively identifies potential threats, minimizing losses and ensuring business continuity during unexpected disruptions.

- Implementing proactive measures reduces potential impacts and protects organizational assets and stakeholder trust.

- Continuous monitoring strengthens risk mitigation by efficiently adapting strategies to evolving operational, market, and regulatory challenges.

- Advanced analytics and planning tools improve Risk Mitigation, enabling organizations to anticipate, prevent, and manage threats effectively.

Why Risk Mitigation is Important?

Here are key reasons why risk mitigation is crucial for organizations and businesses:

1. Prevents Financial Losses

Minimizes potential expenses and economic setbacks by proactively addressing disruptions, damages, or unforeseen events before they escalate.

2. Ensures Business Continuity

Maintains stable operations and service delivery during crises, emergencies, or unexpected challenges, reducing operational interruptions and downtime.

3. Improves Decision-Making

Helps executives make clear and confident strategic decisions by lowering uncertainty and facilitating data-driven, well-informed planning.

4. Strengthens Reputation

Enhances credibility and trust with clients, investors, and employees by consistently managing risks and demonstrating reliability in operations.

5. Enhances Compliance

Supports adherence to legal, regulatory, and safety standards, preventing penalties, fines, and reputational damage while ensuring organizational integrity.

6. Encourages Proactive Culture

This approach fosters foresight, preparedness, and risk-awareness across departments, promoting a mindset of prevention rather than reactive problem-solving.

Components of Risk Mitigation

Here are the key components of Risk Mitigation that organizations should focus on for effective risk management:

1. Risk Identification

Systematically recognizing and documenting both internal and external risks that could negatively impact operations, objectives, or overall organizational performance.

2. Risk Assessment

Carefully evaluate the likelihood, severity, and potential consequences of each identified risk to prioritize mitigation efforts effectively and efficiently.

3. Risk Control Measures

Developing and implementing strategic actions, policies, or processes designed specifically to reduce the probability or impact of potential risks.

4. Monitoring and Review

Continuously tracking, analyzing, and updating risk factors and mitigation strategies to ensure ongoing effectiveness and alignment with changing circumstances.

Types of Risks that Need Mitigation

Risks differ across industries, but most organizations face the following broad categories:

1. Operational Risk

Arises from internal processes, systems, or human factors. This includes equipment failures, procedural errors, or employee mistakes that can disrupt day-to-day operations.

2. Financial Risk

Refers to potential losses caused by market fluctuations, poor financial management, or unexpected economic changes. Examples include credit defaults, liquidity crises, or investment losses.

3. Strategic Risk

Results from poor business decisions or significant shifts in the competitive landscape. It may involve failed product launches, ineffective marketing strategies, or emerging threats from competitors.

4. Compliance Risk

Occurs when a company disregards industry, legal, or regulatory obligations. Tax noncompliance, data privacy infractions, and violations of workplace safety laws are a few examples of this.

5. Cybersecurity Risk

Involves threats to digital systems, networks, and data. Common examples are malware attacks, ransomware incidents, and phishing attempts that compromise sensitive information.

6. Reputational Risk

Affects the perception of a brand among clients, investors, and the public. Negative media coverage, corporate scandals, or poor customer experiences can harm trust and credibility.

Key Risk Mitigation Strategies

Risk mitigation strategies fall into several categories depending on how organizations respond to identified risks. Below are the four primary strategies, often remembered by the acronym TARA—Transfer, Avoid, Reduce, Accept.

1. Risk Avoidance

This strategy involves eliminating the exposure to a particular risk. If a potential activity carries too much uncertainty, an organization may decide to skip it altogether.

2. Risk Reduction

This is the most popular approach, which focuses on taking proactive steps to reduce the risk’s impact or possibility.

3. Risk Transfer

This involves shifting the responsibility or financial burden of a risk to a third party, such as through insurance, outsourcing, or contractual agreements.

4. Risk Acceptance

In certain situations, the expense of risk mitigation surpasses the possible loss. Companies have the option to take on these risks and make backup measures.

Steps to Develop a Risk Mitigation Plan

Developing an effective risk mitigation plan involves a structured, step-by-step approach. Here is how:

1. Identify Risks

Systematically list all potential risks by brainstorming, consulting experts, analyzing past incidents, and examining internal processes and external factors.

2. Analyze and Prioritize

Assess each risk’s likelihood and potential impact using a risk matrix, categorizing them as low, medium, or high priority.

3. Develop Mitigation Strategies

Determine suitable responses for each risk, including avoidance, reduction, transfer, or acceptance, based on severity and organizational priorities.

4. Implement Control Measures

Execute preventive and corrective actions, such as installing safety systems, purchasing insurance, updating policies, or enforcing operational protocols.

5. Monitor and Review

Continuously observe risk indicators, evaluate mitigation effectiveness, and update plans to address evolving threats or changes in circumstances.

Tools for Risk Mitigation

Organizations use various tools to analyze and manage risks effectively. Some popular ones include:

1. Risk Register

A Risk Register serves as a central document that lists all identified risks, their owners, potential impacts, and the mitigation measures assigned to each. It guarantees responsibility and serves as a guide for continuous risk control.

2. SWOT Analysis

A SWOT analysis can be used to find external possibilities and threats as well as internal strengths and weaknesses. Organizations can use this approach to identify possible weaknesses and capitalize on their strengths while reducing risks.

3. Failure Mode and Effects Analysis

Failure Mode and Effects Analysis (FMEA) prioritizes risks by evaluating the severity, likelihood, and detectability of potential failures. The most important danger areas are given more attention thanks to it.

4. Monte Carlo Simulation

Monte Carlo Simulation uses probability modeling to predict the outcomes of uncertain events, providing quantitative insights into potential risk impacts and decision-making scenarios.

5. Scenario Planning

Scenario Planning involves developing alternative strategies for different future conditions, allowing organizations to prepare for best-case, worst-case, and most likely scenarios.

Benefits of Risk Mitigation Framework

Here are the key benefits of an effective Risk Mitigation framework that enhance organizational stability and performance:

1. Minimized Operational Disruptions

This approach reduces interruptions to daily activities by proactively addressing risks, ensuring a smooth workflow, consistent productivity, and uninterrupted service delivery.

2. Improved Resource Allocation

This approach enables optimal use of financial, human, and technological resources by focusing on high-priority risks and avoiding wasteful expenditures.

3. Increased Investor Confidence

Demonstrates strong risk management, building trust with investors and stakeholders, encouraging investment, and enhancing overall financial credibility.

4. Enhanced Strategic Planning

Helps make better decisions by using risk information in planning, making the organization more flexible and ready for the future.

Challenges in Risk Mitigation

Despite its importance, many organizations face obstacles such as:

1. Inadequate Risk Identification

Failing to recognize hidden, emerging, or complex risks can leave organizations exposed to unexpected threats and operational disruptions.

2. Lack of Data

Incomplete or inaccurate information hinders proper risk assessment, resulting in poorly informed decisions and ineffective mitigation strategies.

3. Resistance to Change

Employees may hesitate or resist adopting new safety protocols, compliance measures, or operational procedures, reducing mitigation effectiveness.

4. Budget Constraints

Limited financial or human resources restrict the implementation of comprehensive risk control systems, monitoring tools, and training programs.

5. Dynamic Environment

Rapid technological, market, and regulatory changes create unpredictable risks, requiring continuous adaptation and flexible mitigation strategies to remain effective.

Real-World Examples

Here are some real-world examples demonstrating how different industries implement Risk Mitigation effectively

1. Healthcare Industry

Hospitals back up electronic health records and implement advanced cybersecurity measures to prevent data breaches, protecting patient confidentiality and operational continuity.

2. Financial Institutions

Banks utilize credit scoring, automated monitoring, and compliance systems to minimize default risks while adhering to regulatory and industry requirements effectively.

3. Construction Sector

Companies conduct safety training, provide protective equipment, and perform quality audits to reduce workplace accidents, project delays, and operational hazards.

4. IT and Software

Technology firms employ firewalls, encryption, and two-factor authentication to mitigate cybersecurity risks, prevent data breaches, and minimize system downtime.

Final Thoughts

In today’s unpredictable business environment, risk mitigation is essential. By identifying, evaluating, and managing risks, organizations protect assets, ensure compliance, and support long-term sustainability. Strategies like risk transfer, avoidance, reduction, or acceptance safeguard the enterprise while enabling growth opportunities. A proactive, structured risk mitigation plan forms the foundation of a resilient, forward-looking organization.

Frequently Asked Questions (FAQs)

Q1. How is risk mitigation different from risk management?

Answer: Risk management is the overall process, while risk mitigation is one component focusing on minimizing risk impact.

Q2. What industries need risk mitigation the most?

Answer: All industries require it, but it is especially vital in finance, healthcare, IT, construction, and manufacturing.

Q3. What is a risk mitigation plan?

Answer: It is a documented strategy outlining how an organization will identify, respond to, and monitor risks.

Q4. How often should risk mitigation plans be reviewed?

Answer: Plans should be reviewed at least annually or whenever there are major operational or environmental changes.

Recommended Articles

We hope that this EDUCBA information on “Risk Mitigation” was beneficial to you. You can view EDUCBA’s recommended articles for more information.