What is Remuneration?

Remuneration refers to the compensation employees receive in exchange for their work, effort, or contribution to the organization. It is not limited to direct financial payments but extends to a complete reward system that balances both tangible and intangible benefits.

The examples of remuneration are:

- A software engineer may receive a fixed salary plus project completion bonuses.

- A sales executive may earn commissions based on sales targets, along with travel allowances.

- The factory pays a worker hourly wages, overtime pay, and provident fund benefits.

Thus, it is a broad concept that integrates financial stability, motivation, recognition, and long-term security.

Table of Contents

- Meaning

- Key Objectives

- Components

- Types

- Importance

- Factors Affecting

- Challenges in Designing Policies

- Best Practices

Key Objectives of Remuneration

The design of a remuneration policy goes beyond just paying employees—it is a strategic decision. The objectives include:

- Attracting talent: Offering competitive pay packages helps organizations attract skilled professionals in a highly competitive job market.

- Retaining employees: A fair and motivating compensation structure helps reduce attrition and fosters long-term loyalty.

- Motivating employees: Performance-based incentives and recognition encourage employees to achieve higher goals.

- Promoting equity: Ensures internal fairness (employees in similar roles earn similar pay) and external fairness (salaries match industry standards).

- Compliance: Remuneration policies must follow government regulations, minimum wage laws, and labor standards to avoid penalties.

- Encouraging productivity: Well-structured pay systems link employee contribution to organizational growth, motivating staff to improve efficiency.

- Supporting career growth: Non-monetary benefits such as training allowances or education reimbursement promote skill development.

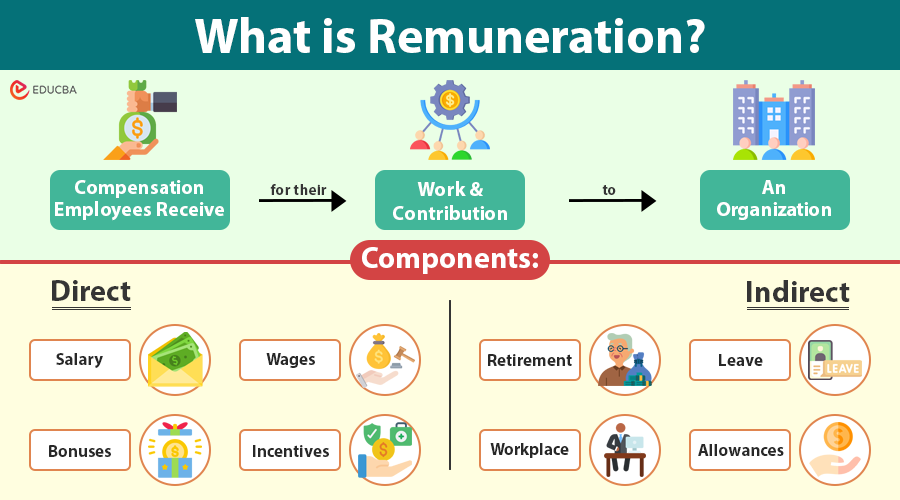

Components of Remuneration

We generally divide remuneration into direct compensation (financial) and indirect compensation (benefits & perks).

1. Direct Compensation

This includes all forms of financial payments:

- Salary: A fixed, pre-determined payment usually made monthly. Example: A marketing manager earning ₹75,000 per month.

- Wages: Payments made to blue-collar workers based on hours or days worked. Example: A factory worker earning ₹500 per day.

- Bonuses: Extra financial rewards linked to performance or company profits. Example: Annual festival bonuses or performance-linked bonuses.

- Incentives: Special payments tied to meeting sales targets, productivity goals, or performance metrics. Example: Sales representatives earn extra commission for exceeding sales targets.

- Overtime pay: Additional pay for working beyond standard hours, often calculated at higher rates.

2. Indirect Compensation (Perks & Benefits)

These include non-monetary advantages that enhance the overall reward package:

- Health and medical insurance: Insurance and care for employees and their families

- Retirement benefits: Provident fund, gratuity, pension, or superannuation schemes.

- Leave benefits: Paid vacation, sick leave, maternity/paternity leave, and casual leave.

- Allowances: House rent allowance (HRA), travel allowance (TA), meal vouchers, and education allowance.

- Workplace benefits: Flexible working hours, remote work options, wellness programs, and training opportunities.

Together, direct and indirect components ensure both short-term motivation (such as salary and bonuses) and long-term security (including pensions and insurance).

Types of Remuneration

Different organizations adopt varied pay structures depending on job type, industry, and business objectives:

- Time-based remuneration: Employees are paid based on time spent at work (hours/days/months). Common in office jobs and government roles.

- Piece-rate remuneration: Employers pay employees based on the output or units they produce, such as a garment worker receiving payment for each shirt they stitch.

- Performance-based remuneration: Organizations compensate employees based on their achievements, KPIs, or goals, making this approach popular in corporate roles.

- Commission-based remuneration: Employees earn a percentage of sales made. Common in real estate, insurance, and retail.

- Profit-sharing remuneration: A portion of the company’s profits is shared with employees, giving them a sense of ownership.

- Equity-based remuneration: Employees are offered stock options or shares, thereby aligning their interests with the company’s growth. Common in startups and tech companies.

- Skill-based remuneration: The organization determines pay based on the employee’s skills and competencies rather than just their role.

- Mixed remuneration: A combination of fixed salary and variable pay, such as incentives, commissions, or bonuses.

Importance of Remuneration

The role of remuneration in human resource management is critical:

- Employee motivation: Competitive pay motivates employees to perform more effectively and achieve organizational objectives.

- Job satisfaction: Adequate pay creates a sense of fairness, recognition, and security.

- Retention of talent: Skilled employees are less likely to leave when rewarded fairly.

- Organizational growth: Motivated employees drive innovation, efficiency, and customer satisfaction.

- Legal compliance: Ensures adherence to labor laws, tax regulations, and minimum wage policies.

- Employer branding: Organizations offering attractive packages build a strong reputation in the job market.

Factors Affecting Remuneration

Several variables influence how companies design pay structures:

- Skill, experience, and education: Higher skills and qualifications attract better remuneration.

- Industry standards: Salaries must be competitive with similar roles across the sector.

- Company’s financial health: Stronger organizations can offer more lucrative packages.

- Cost of living: It varies depending on geographical location. Example: IT professionals in Bangalore may earn higher salaries than in smaller towns.

- Nature of job: Jobs involving risk, creativity, or specialized skills often pay more.

- Government regulations: Minimum wages, tax laws, and social security requirements influence remuneration.

- Performance: Organizations reward high-performing employees with higher increments and incentives.

Challenges in Designing Remuneration Policies

Despite its importance, creating an effective pay structure is challenging:

- Balancing costs vs. employee expectations: Organizations must manage budgets while ensuring fair compensation and employee satisfaction.

- Pay equity issues: Employees may feel demotivated if disparities exist in pay for similar roles.

- Global workforce issues: Multinational companies must navigate diverse labor laws and varying market expectations.

- Retention challenges: The rising competition in industries such as IT and finance makes retention more challenging.

- Linking performance with pay: Creating Fair and Transparent Performance Evaluation Systems Is Often Complex.

Best Practices for Effective Remuneration

- Conduct salary benchmarking: Regularly compare with industry standards to remain competitive.

- Adopt pay transparency: Clearly communicate salary structures to prevent employee dissatisfaction.

- Link pay with performance: Reward employees based on measurable results to encourage excellence.

- Provide non-monetary benefits: Wellness programs, flexible work, and recognition boost employee morale.

- Regular review of policies: Update pay structures to reflect inflation, market trends, and business growth.

- Encourage employee feedback: Involve employees in discussions about compensation policies for trust and fairness.

Final Thoughts

Remuneration is not just a financial exchange between employer and employee it is a strategic tool that drives motivation, loyalty, and organizational growth. A carefully designed remuneration system ensures fairness, compliance, and competitiveness while providing employees with financial stability and recognition.

Organizations that balance direct pay, benefits, and incentives build stronger employer brands, attract top talent, and create a motivated workforce committed to long-term success.

Frequently Asked Questions (FAQs)

Q1. What is the difference between remuneration and salary?

Answer: While salary is a fixed payment for work performed, remuneration is a broader concept that encompasses salary, wages, bonuses, incentives, benefits, and other forms of compensation.

Q2. Can remuneration include non-monetary rewards?

Answer: Yes. Non-monetary rewards, such as flexible work hours, training, career growth opportunities, wellness programs, and employee recognition, are also included in total remuneration.

Q3. What is the role of incentives in remuneration?

Answer: Incentives are performance-linked rewards that encourage employees to achieve specific targets or business goals. They help boost motivation and productivity.

Q4. What is profit-sharing, and how does it benefit employees?

Answer: Profit-sharing is a system where employees receive a portion of the company’s profits. It fosters a sense of ownership, aligns employees’ interests with organizational success, and encourages long-term commitment.

Q5. Is remuneration the same for all employees in an organization?

Answer: No. Remuneration varies based on role, experience, skills, industry standards, and performance levels. Equal pay for equal work is important, but different roles may have various structures.

Recommended Articles

We hope this article on remuneration helped you understand the different types, components, and importance of employee compensation. Explore our related articles on: