How to Use Mutual Funds to Create a Diversified Portfolio?

In the journey towards potential financial stability, spreading your investments wisely is key. This is known as diversification, and one of the simplest ways to reduce risk and aim for steady returns is by building a diversified portfolio with mutual funds. This blog explores what diversification is and why it helps. It also outlines practical steps to create a diversified portfolio using mutual funds.

What is Diversification and Why is it Important?

Investors diversify by putting their money across a mix of asset classes, sectors, or companies instead of relying on a single investment, ensuring that returns do not depend on the performance of just one asset or sector. The main objective is to reduce risk; if one investment fares poorly, others in your portfolio might perform well, balancing out the impact.

In a Diversified Portfolio with mutual funds, diversification is built in. It would be difficult for an individual investor to attain the kind of diversity that a mutual fund can offer, as it combines the money of many investors and invests it in dozens of instruments (such as bonds or shares). This natural spread reduces the risk of major losses from any single security and helps you pursue more relatively stable potential returns over time.

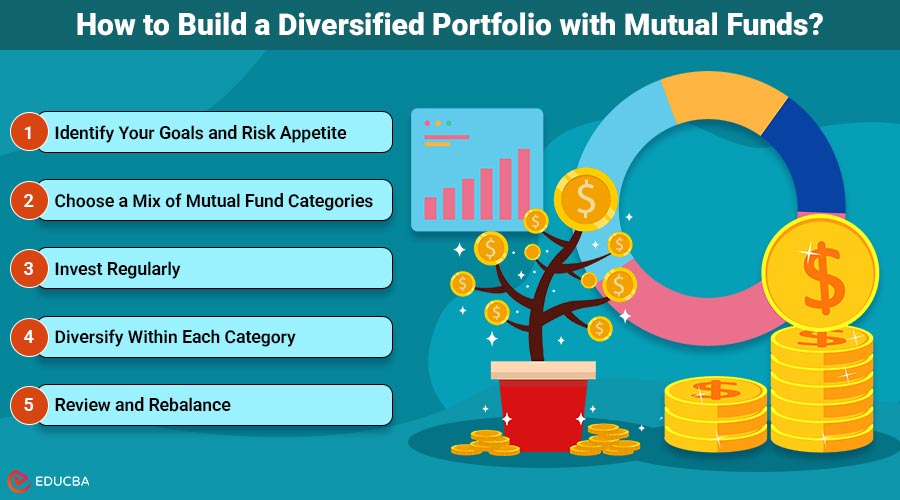

How to Build a Diversified Portfolio with Mutual Funds?

Here is a roadmap to creating a diversified portfolio with mutual funds:

1. Identify Your Goals and Risk Appetite

Before choosing a mutual fund, consider what you want to achieve: are you aiming for potential capital growth or a regular income? Also, think about your comfort with market fluctuations.

2. Choose a Mix of Mutual Fund Categories

- Equity funds: Invest in shares of companies for long-term growth. A diversified portfolio with mutual funds should include large-cap, mid-cap, and small-cap equity funds to spread equity risk.

- Debt funds: Invest in bonds or fixed-income securities. These are less volatile and add relative stability to your portfolio. These investments may suit conservative investors.

- Hybrid funds: Combine equity and debt, giving you a balance of potential reward and risk.

You can also include gold or international funds for extra diversity, if they suit your profile.

3. Invest Regularly

Consistent investing, such as through a Systematic Investment Plan (SIP), can smooth out market ups and downs and help you stick to your investment plan. An SIP calculator online is handy for planning your monthly contributions and estimating how your investments could grow over time.

4. Diversify Within Each Category

Avoid picking funds with similar investments. For example, if you have already invested in a large-cap fund, consider a different sector, a mid-cap, or a hybrid fund for your next investment.

5. Review and Rebalance

Check your mutual fund portfolio periodically. As markets move or your goals change, you may need to shift money between funds to maintain your desired mix.

How a Diversified Portfolio Works?

A diversified mutual fund portfolio can reduce the impact of market shocks on your investments. For example, if stock markets fall but bond markets rise, your debt fund investments can help cushion the fall in your overall portfolio value. Over time, this strategy may lead to relatively steadier potential growth and help you stay invested even when markets are volatile.

Other advantages include:

- Less worry: Your portfolio’s fate does not rest on a handful of securities, which may result in a steadier investing experience.

- Support for long-term goals: A diversified portfolio with mutual funds can help you plan for retirement, home purchase, or education.

- Professional management: Fund managers continuously monitor and rebalance holdings within the fund, helping you achieve diversification without constant effort.

Final Thoughts

Building a diversified portfolio with mutual funds is a smart way to manage risk, pursue stable returns, and achieve financial goals. By understanding your objectives, choosing a balanced mix of funds, investing regularly, and using tools like an SIP calculator online for help with planning, you can make your money work sustainably for you.

Disclaimer: Mutual fund investments carry market risks. Please read all scheme documents carefully before investing.

This document is not an endorsement of any views or investment advice. This is not a research report or a recommendation to buy or sell any security. Use it only for informational purposes, not as a promise of minimum returns or a safeguard of capital. Do not rely on this document alone to develop or implement an investment strategy. The recipient should understand that the information above may not include all details needed to make an investment decision. We advise investors to consult their investment advisor before making any investment decision, considering their risk appetite, investment goals, and horizon. We may change this information at any time without prior notice.

We prepared the content herein using reliable publicly available information. However, Bajaj Finserv Asset Management Ltd. does not guarantee the accuracy of such information, does not assure its completeness, and does not warrant that it will remain unchanged. The tax information (if any) in this article is based on current laws and is subject to change. For the latest information, check current regulations or ask a tax professional.

Recommended Articles

We hope this guide on building a diversified portfolio with mutual funds was helpful. Explore related articles on smart investing, SIP strategies, and wealth management tips for long-term growth.