Updated July 27, 2023

Absorption Costing Formula (Table of Contents)

Absorption Costing Formula

In management accounting, absorption costing is a tool which is used to expense all costs which are linked with the manufacturing of any product. So basically absorption costing is a costing tool which is used in valuing inventory. It is also referred to as full costing because it covers all the direct cost related to manufacturing be its raw material cost, labor cost, and any fixed or variable overheads.

Before we dig in into absorption costing formula, let’s see what all includes in absorption costing. We know that there are multiple ways to find the total cost. For example:

Or

Or

In absorption costing, there are the following cost components:

- Direct Material cost

- Direct Labor

- Variable Overheads

- Fixed Overhead

So Formula for the total cost in absorption costing is given by:

- Total Cost = Total Direct Cost + Total Overhead Cost

- Total Direct Cost = Direct Material Cost + Direct Labor

- Total Overhead Cost = Variable Overheads + Fixed Overheads

Examples of Absorption Costing Formula (With Excel Template)

Let’s take an example to understand the calculation of Absorption Costing in a better manner.

Absorption Costing Formula – Example #1

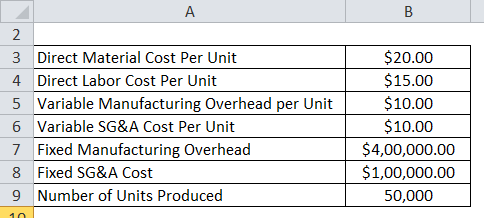

Let say a company X has produced 50,000 and sold 40,000 units this year and has reported the following costs:

For Absorption costing, we need only material cost, labor cost, and overheads. SG&A is not part of absorption costing

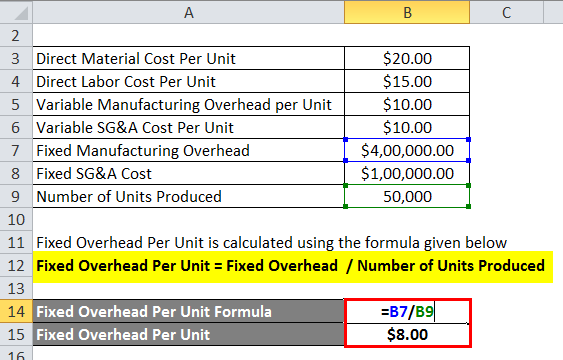

Fixed Overhead Per Unit is calculated using the formula given below

Fixed Overhead Per Unit = Fixed Overhead / Number of Units Produced

- Fixed Overhead Per Unit = $400,000/ 50,000

- Fixed Overhead Per Unit = $8 per unit

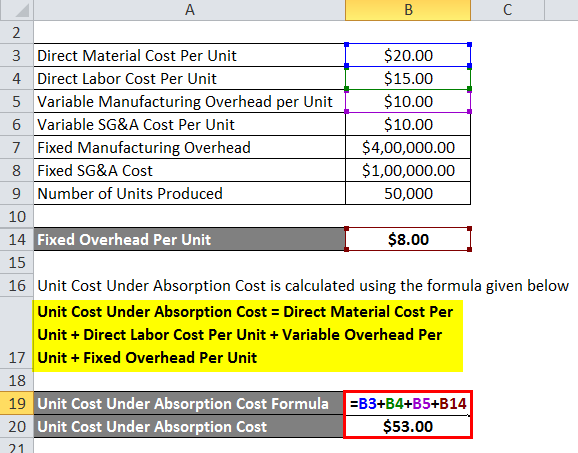

Unit Cost Under Absorption Cost is calculated using the formula given below

Unit Cost Under Absorption Cost = Direct Material Cost Per Unit + Direct Labor Cost Per Unit + Variable Overhead Per Unit + Fixed Overhead Per Unit

- Unit Cost Under Absorption Cost = $20 +$15 + $10 + $8

- Unit Cost Under Absorption Cost = $53

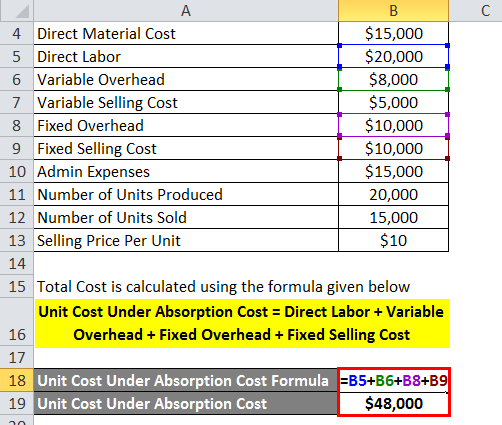

Absorption Costing Formula – Example #2

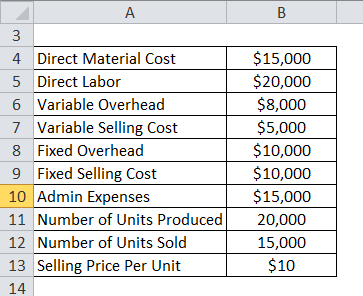

Now let see another detailed example to see the applicability of absorption costing. Let’s say a company ABC has the following cost and sales element reported for last year:

Total Cost is calculated using the formula given below

Unit Cost Under Absorption Cost = Direct Labor + Variable Overhead + Fixed Overhead + Fixed Selling Cost

- Unit Cost Under Absorption Cost = $20000 + $8000 + $10000 + $10000

- Unit Cost Under Absorption Cost = $48000

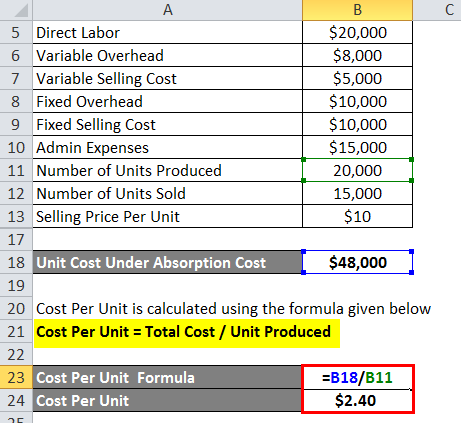

Cost Per Unit is calculated using the formula given below

Cost Per Unit = Total cost / Unit Produced

- Cost Per Unit = $48000 / 20000

- Cost Per Unit = $2.40

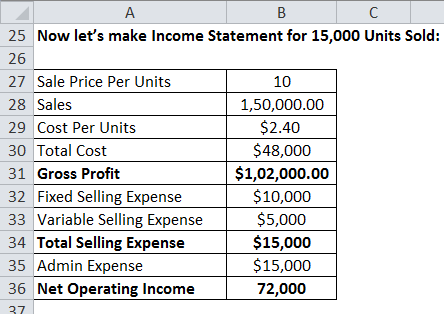

Now let’s make Income Statement for 15,000 Units Sold:

Explanation

Absorption costing is very important tool in management accounting for determining the cost. But there are few limitations associated with this method.

- Since absorption costing distributes fixed overheads to the total production cost, it does not help management in decision making and variable costing is more effective in that case.

- Since not all the cost is subtracted from the revenue while calculating the profit, absorption costing can skew the profits and can show higher profits than actual.

- Also, since only fixed overhead is used here, it is spread on only the number of units sold. Units which are not sold, the fixed overheads will not be allocated to these units. So companies can generate extra profits by manufacturing more products which do not sell.

Relevance and Uses of Absorption Costing Formula

Absorption costing has various advantages associated with it. First and foremost advantage is that it is GAAP compliant. GAAP is Generally Accepted Accounting Principles which companies used while reporting their financial statements. Since absorption costing is GAAP compliant, many companies use this method of costing for financial statements reporting. Also, as we have seen above in the examples, in absorption costing method, all the production cost like fixed operation cost, rent, utility cost, etc. is taken care of and also all the direct costs associated with production. So in nutshell, although it has some limitations associated with it, it is an important costing tool which is used in the industry by many firms.

Recommended Articles

This has been a guide to Absorption Costing Formula. Here we discuss How to Calculate Absorption Costing along with practical examples. We also provide downloadable excel template. You may also look at the following articles to learn more –