1 Crore Health Insurance: Overview

Are you tired of worrying about money when it comes to your family’s health? Imagine a future where you can get the best healthcare services without any stress. Yes, it is possible! As we face serious health issues, it is crucial to protect ourselves and our families. 1 crore health insurance is like a shield that secures our finances during these challenging times. However, before purchasing such a profitable plan, especially in India, it is essential to understand the nuances and benefits associated with it. This detailed study aims to help you make an informed decision.

What is 1 Crore Health Insurance?

A health insurance policy with a coverage of ₹1 crore helps cover medical expenses. If you have a family health insurance plan with this limit, you can claim medical costs for yourself and your family.

This type of policy is designed for high-risk individuals and those with significant wealth, as a basic insurance plan may not adequately cover their healthcare costs. It is also beneficial if you have elderly dependent individuals. You can choose 1 crore health insurance for senior citizens to take care of them without exhausting your hard-earned savings.

Why Do You Need 1 Crore Health Insurance?

A Rs. 1 crore health insurance plan provides significant protection within the healthcare system. Healthcare costs in India have increased due to a rise in cases of serious illnesses, making high-coverage plans a prudent choice. Here are some reasons to consider purchasing such a plan:

- Medical Inflation: Healthcare costs are going up, and a Rs. 1 crore insurance cover gives you a strong financial safety net to handle these expenses.

- Lifestyle Diseases: With more people facing lifestyle-related diseases like diabetes, heart issues, and obesity, a Rs. 1 crore insurance cover ensures you are well protected.

- Sufficient Coverage: Choosing a higher sum insured ensures that, regardless of treatment costs, your health insurance will provide comprehensive coverage. Whether you need major surgery, critical care, or emergency medical help, this coverage ensures you have enough money for treatment.

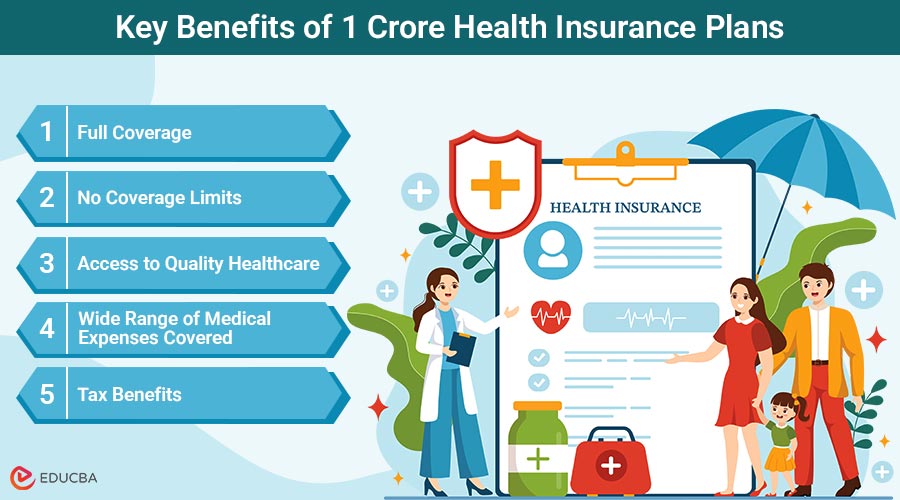

Key Benefits of 1 Crore Health Insurance Plans

Here is a detailed breakdown of the most striking benefits of 1 crore health insurance plans:

- Full Coverage: Get comprehensive protection with a health plan that offers up to ₹ 1 crore in coverage for healthcare expenses.

- No Coverage Limits: No more fretting about running out of coverage. With 1 crore in health insurance, you have sufficient support for your and your family’s healthcare needs.

- Access to Quality Healthcare: Reach out to top healthcare services with zero financial stress. Select reputable hospitals and doctors that prioritize quality without compromising their reputation.

- Wide Range of Medical Expenses Covered: This policy covers various healthcare costs, including inpatient and daycare treatments, pre and post-hospitalization costs, home care, advanced treatments and technology, donor expenses, and ambulance services, both road and air.

- Tax Benefits: You can deduct up to ₹1 lakh from the premiums you pay for a ₹1 crore health insurance policy that covers you, your family, and your elderly parents (those over 60) under Section 80D of the Income Tax Act.

Who Needs This Health Insurance Plan?

This list outlines people who would benefit from a health insurance plan of 1 crore:

- Wealthy Individuals: If you have a lot of money, a regular insurance policy might not cover your medical expenses. Choosing a plan with a high sum insured is a better option for more comprehensive coverage.

- People with Risky Lifestyles: If you misuse substances or work in high-risk jobs, you should consider a policy with a high sum insured. You face a greater chance of serious health problems.

- People with Dependents: If you are looking to ensure that your insurance covers your spouse, parents, and children, opting for a lower sum insured might not be sufficient, particularly in larger cities. Thus, you need a more comprehensive plan, such as the 1 crore insurance.

- People with Pre-existing Conditions: If you have health issues now, they might worsen over time. A health insurance plan of Rs. 1 crore can help protect your finances and your family’s future.

- People with a Family History of Serious Illnesses: If your family has a history of diseases like diabetes or heart problems, you are at a higher risk of facing similar issues. It is wise to take preventive steps by getting a high-sum insured health policy.

Tips to Pick the Best Plan

To find the best Rs. 1 crore health insurance plan, interested individuals can follow these tips:

- Check if your hospital is in your insurance provider’s network.

- Look for extra coverage to remove any limits on room rent if your plan has restrictions on room choices during hospitalization.

- Understand the co-payment clauses fully in your insurance.

- The process for claiming should be simple.

- Review the policy for exclusions and look for additional coverage for anything you want to include.

- When you have a high claim-settlement ratio, it means that your claim is more likely to get approved without any hassle.

- Review the policy documents to check the waiting period for pre-existing conditions.

For example, you can start with a 5 lakh health insurance plan for basic coverage and gradually upgrade to a ₹1 crore plan for comprehensive protection against high medical costs.

How to Buy a 1 Crore Health Insurance?

Here are the steps to follow when buying a high-value insurance policy:

- Step 1: Start by understanding your health needs. Think about your age, medical history, lifestyle, and any existing health issues.

- Step 2: After determining your health needs, compare different policies and their associated costs. Find a policy with good coverage and a high sum insured, like Rs. 1 crore.

- Step 3: Before purchasing health insurance, review the policy’s features. Look for coverage that includes hospitalization costs, expenses before and after hospitalization, daycare treatments, and ambulance fees.

- Step 4: The percentage of claims that an insurance company pays out in a given year is shown by the claim settlement ratio. Star Health, a reputable insurance provider, boasts a groundbreaking record of settling 97% of claims within 3 hours.

- Step 5: Before signing the policy, carefully review the fine print. Look for hidden clauses or exclusions that could affect your coverage.

Which is the Best Health Insurance in India?

If you are interested in buying 1 crore health insurance at a monthly premium, you can consider the Super Star Plan from Star Health Insurance. Here are all the features of the plan:

- Freeze Your Age: This policy maintains your age as it was when you joined, ensuring your premiums remain based on that age until you make a claim or reach the age of 55.

- No Limits, Just Benefits: The policy automatically restores your sum insured up to 100% as many times as needed, immediately after you use any part of your coverage. This applies to all claims for future hospital stays.

- Optional Covers: Super Star offers up to 21 optional covers, enabling you to tailor your policy to meet your specific needs.

Final Thoughts

A 1 crore health insurance is the ultimate fail-safe financial net. If you choose a ₹1 crore health plan from Star Health, you can also enjoy unlimited teleconsultations with various practitioners using the integrated Star Health mobile app. It also features an AI-driven face scan that helps you track key health metrics, including heart rate, oxygen level, and breathing rate. The feature is available up to twice a month for each insured person during the policy year.

Recommended Articles

We hope this guide on ₹1 crore health insurance helps you understand the benefits of high-coverage plans for securing your family’s health and finances. Check out these recommended articles for more insights on choosing the right health insurance policy.