Treasury Management

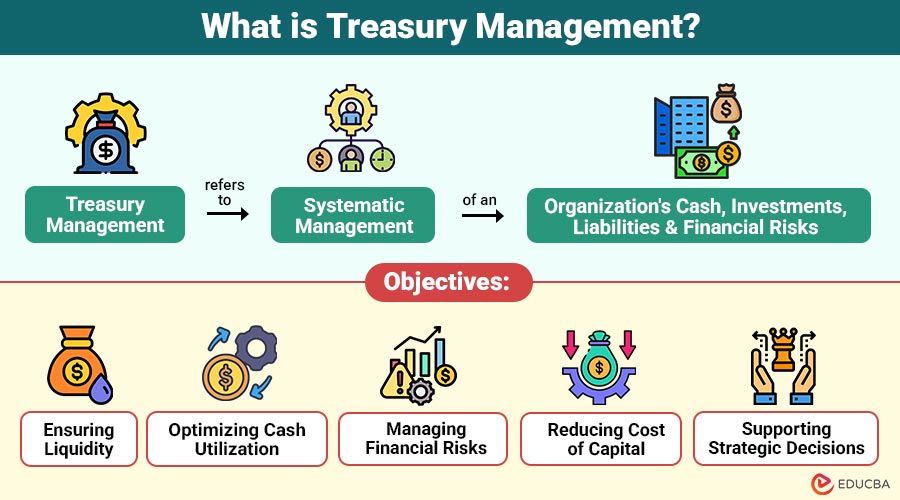

Treasury management refers to the systematic management of an organization’s cash, investments, liabilities, and financial risks. It involves planning, monitoring, and controlling cash inflows and outflows to ensure adequate liquidity while maximizing the efficient use of financial resources. The treasury function acts as a bridge between day-to-day financial operations and long-term financial strategy, ensuring that organization can meet its obligations while pursuing growth opportunities.

Table of Contents:

- Meaning

- Importance

- Objectives

- Key Components

- Process

- Treasury Management in Different Types of Organizations

- Challenges

Key Takeaways:

- Effective treasury management ensures liquidity, stability, and operational continuity while supporting organizational growth and resilience.

- Strong cash forecasting and controls reduce financial risks, borrowing costs, and dependence on emergency funding.

- Integrated treasury processes optimize cash utilization, investment decisions, and funding decisions across diverse organizational structures worldwide.

- Modern treasury management leverages technology, governance, and compliance to enhance visibility, efficiency, and decision-making.

Importance of Treasury Management

Treasury management is essential for businesses due to the following reasons:

1. Financial Stability

Keeps the business running smoothly by having enough cash, paying bills on time, and managing money well across the company.

2. Risk Mitigation

Protects the organization from financial volatility, market uncertainties, currency fluctuations, interest rate changes, and unexpected economic disruptions globally.

3. Cost Efficiency

Lowers borrowing costs, uses cash efficiently, avoids unused funds, and increases returns on short-term investments across the company.

4. Strategic Support

Provides data-driven financial insights to support informed decision-making, long-term planning, capital investments, and sustainable business growth.

Objectives of Treasury Management

The primary objectives of treasury management include:

1. Ensuring Liquidity

Ensure adequate cash and liquid assets are always available to meet payroll, supplier payments, taxes, and short-term debt obligations.

2. Optimizing Cash Utilization

Optimize use of available cash by minimizing idle balances and investing surplus funds safely to earn returns without harming liquidity.

3. Managing Financial Risks

Identify, monitor, and mitigate financial risks, including interest rate, foreign exchange, credit, and market volatility, to protect profitability and stability.

4. Reducing Cost of Capital

Reduce the overall cost of capital by managing borrowings efficiently, selecting optimal funding sources, and continually improving the debt structure and terms.

5. Supporting Strategic Decisions

Support strategic business decisions by delivering accurate cash forecasts, liquidity insights, and financial analysis for investments, expansions, and merger activities.

Key Components of Treasury Management

The key components are structured to ensure effective control, optimization, and strategic use of an organization’s financial resources.

1. Cash Management

Cash management involves monitoring, forecasting, and controlling cash flows, receivables, payables, and balances to ensure optimal liquidity.

2. Liquidity Management

Liquidity management ensures sufficient cash reserves and access to credit to meet obligations during disruptions and crises.

3. Risk Management

Risk management identifies and mitigates financial risks arising from interest rates, foreign exchange, credit, and commodity prices.

4. Funding and Capital Structure Management

Funding and capital structure management optimize financing mix, borrowing costs, maturity profiles, and long-term flexibility.

5. Investment Management

Investment management invests surplus cash in low-risk instruments, balancing safety, liquidity, and returns effectively.

Treasury Management Process

The process typically follows these steps:

1. Cash Flow Forecasting

For efficient liquidity planning, future cash inputs and outflows are estimated in order to predict shortages, surpluses, and time gaps.

2. Planning and Strategy

Defining liquidity targets, risk tolerance levels, funding approaches, and investment policies aligned with organizational goals and market conditions dynamics.

3. Execution

Executing payments, collections, funding transactions, and investments while coordinating with banks, systems, and stakeholders efficiently on daily operational activities.

4. Monitoring and Control

Keeping track of cash flow compared to forecasts, managing differences, and making sure treasury rules are followed throughout the business.

5. Reporting and Analysis

Tracking and reviewing cash, liquidity, risks, and performance to help management make informed decisions across the company.

Treasury Management in Different Types of Organizations

Given below is how treasury management differs across various types of organizations:

1. Small and Medium Enterprises

For SMEs, treasury management focuses primarily on cash flow visibility, working capital optimization, and access to affordable financing.

2. Large Enterprises

Big companies need more advanced ways to handle their money, like managing cash from one central place, making the best use of money across the world, and carefully handling financial risks.

3. Multinational Corporations

Global companies deal with multiple currencies, international rules, and political risks, so managing their finances becomes even more important.

Challenges in Treasury Management

Despite its importance, it faces several challenges:

1. Inaccurate Cash Forecasting

Inaccurate cash forecasting leads to liquidity gaps, inefficient funding decisions, and increased reliance on costly emergency financing.

2. Volatile Financial Markets

Unstable financial markets cause interest rates, currencies, and investments to change unpredictably, which increases the company’s financial risks.

3. Regulatory Compliance Requirements

Regulatory compliance requirements increase operational complexity, reporting burdens, and risk of penalties for noncompliance.

4. Limited Visibility Across Bank Accounts

Limited visibility across bank accounts restricts real-time cash tracking and effective centralized liquidity management.

5. Cybersecurity and Fraud Risks

Cybersecurity and fraud risks threaten financial assets, disrupt treasury operations, and require robust controls and monitoring systems.

Final Thoughts

Treasury management is no longer just a back-office function; it is a strategic pillar of modern financial management. By effectively managing cash, liquidity, risks, and funding, organizations can enhance economic resilience, reduce costs, and support long-term growth. As businesses navigate increasing complexity and uncertainty, a well-structured treasury management framework, supported by technology and best practices, is essential for sustained success.

Frequently Asked Questions (FAQs)

Q1. What is the main role of treasury management?

Answer: The main role is to manage liquidity, cash flows, financial risks, and funding efficiently.

Q2. How is treasury management different from accounting?

Answer: Accounting focuses on recording past transactions, while treasury management focuses on managing current and future financial positions.

Q3. What tools are used in treasury management?

Answer: Treasury management systems, ERP integrations, banking platforms, and financial risk instruments are commonly used.

Q4. Who is responsible for treasury management in an organization?

Answer: Typically, the treasury function is managed by treasurers or finance professionals under the CFO’s leadership.

Recommended Articles

We hope that this EDUCBA information on “Treasury Management” was beneficial to you. You can view EDUCBA’s recommended articles for more information.