ULIP Plans in 2025

Financial planning in 2025 is increasingly about striking a balance between security and long-term growth. Market fluctuations, inflationary pressures, and evolving family needs have made investors more cautious but also more strategic. One solution that continues to attract attention is ULIP plans, or Unit Linked Insurance Plans. These combine life insurance with investment opportunities, allowing individuals to protect their families while building wealth. What makes them especially relevant today is the variety of types of ULIP plans available, each designed to match different financial goals and risk levels.

What are ULIP Plans?

A ULIP plan is a hybrid financial product that allocates part of the premium to life insurance cover and the remainder to market-linked investments such as equity, debt, or balanced funds. This dual function makes ULIPs distinct from traditional insurance or pure investment products. With the option to switch between funds, ULIP plans are adaptable to market conditions. They also promote disciplined investing due to regular premium payments and offer tax efficiency, making them a comprehensive choice for long-term financial planning.

Why ULIPs Remain Important in 2025?

The popularity of ULIP plans in 2025 reflects the changing needs of investors. Rising inflation has increased the importance of wealth accumulation, while global uncertainty has highlighted the need for financial protection. ULIPs address both concerns simultaneously.

For instance, young professionals use ULIPs to start wealth creation early while securing life insurance coverage. Families with children use them to plan for education, while retirees may prefer them for balanced growth with some protection. The flexibility to customise coverage and investment strategy makes ULIPs relevant across life stages.

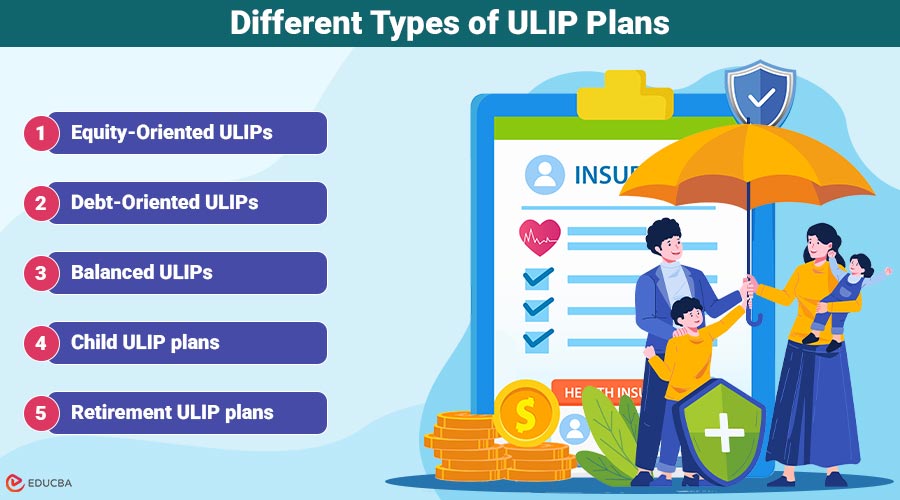

Different Types of ULIP Plans

In 2025, various types of ULIP plans are available, each designed to achieve specific investment objectives. Understanding these categories helps investors choose the most suitable option.

1. Equity-Oriented ULIPs

Equity ULIPs mainly invest in stock markets and are suited for individuals willing to take on higher risks. They offer the potential for high returns but are subject to greater volatility. Young investors with long investment horizons often choose equity ULIPs for wealth creation and retirement planning.

2. Debt-Oriented ULIPs

Debt ULIPs invest in fixed-income instruments such as government bonds or corporate debt. They are lower risk compared to equity ULIPs and provide more stable, predictable returns. These are suitable for risk-averse investors who prefer capital preservation while still benefiting from life cover.

3. Balanced ULIPs

Balanced or hybrid ULIPs split investments between equity and debt, offering a middle ground between growth and stability. This type of ULIP plan is ideal for individuals who want exposure to market growth but also seek to reduce volatility.

4. Child ULIP plans

These plans aim to fund a child’s future needs, including education and marriage. If the policyholder dies, the insurer continues to pay the premiums to achieve the planned goals. Such plans combine protection with goal-specific investing.

5. Retirement ULIP plans

Retirement-focused ULIPs build a corpus over time and provide pension or annuity benefits post-retirement. They ensure financial independence in later years while protecting dependents during the earning phase.

6. Wealth-Creation ULIPs

These ULIPs target high growth by allocating a major share to equities. They target individuals seeking to maximize returns and grow substantial long-term wealth.

Benefits of ULIP plans

The appeal of ULIPs lies not only in their flexibility but also in the range of benefits they offer:

- Dual advantage: Life insurance protection along with investment growth.

- Flexibility: Option to switch between funds based on market outlook.

- Customisation: Ability to choose policy tenure, premium payment mode, and riders.

- Tax efficiency: Premiums and maturity benefits often qualify for tax deductions.

- Discipline: Regular premium payments encourage consistent investing.

- Goal-based planning: Different ULIPs cater to specific needs, such as retirement, wealth creation, or children’s education.

Choosing the Right ULIP Plan in 2025

The choice between different types of ULIP plans depends on individual circumstances:

- Risk appetite: Equity ULIPs for aggressive investors, debt ULIPs for conservative ones, and balanced ULIPs for moderate risk takers.

- Life stage: Child ULIPs are best suited for parents, retirement ULIPs are ideal for older investors, while wealth-creation ULIPs are suitable for younger professionals.

- Financial goals: Consider whether the focus is on wealth accumulation, income security, or goal-based funding.

- Premium affordability: Higher premiums may allow more aggressive fund allocation, while smaller contributions can still grow steadily over time.

Using a ULIP return calculator can help policyholders further project potential maturity values, allowing them to set realistic expectations.

Trends in ULIPs for 2025

Modern ULIPs have evolved with several features that make them more attractive than earlier versions:

- Lower charges: Administrative and fund management fees are more transparent and affordable.

- Digital accessibility: Investors can monitor and switch funds through apps and online dashboards.

- ESG-linked funds: Many ULIPs now offer socially responsible investment options.

- Wellness-linked benefits: Some insurers reward healthy lifestyles with loyalty additions or premium rebates.

These trends make ULIPs more consumer-friendly, aligning them with the modern needs of financial planning.

Final Thoughts

In 2025, ULIP plans continue to play a central role in wealth management by combining life insurance with market-linked investments. The wide range of types of ULIP plans from equity and debt options to child and retirement-focused plans ensures that there is a solution for every investor. With benefits such as flexibility, tax efficiency, and goal-based customization, ULIPs are well-suited to building long-term security in a volatile world. For individuals seeking both protection and growth, ULIP plans remain one of the most comprehensive and adaptable financial tools available.

Recommended Articles

We hope this guide on ULIP plans helps you make informed financial decisions. Check out these recommended articles for more insights and strategies to grow your wealth effectively.