Updated July 19, 2023

Definition of Types of Liabilities on Balance Sheet

A Balance Sheet represents a company’s financial position at a given time. It comprises the company’s assets, liabilities, and stockholder’s equity. Per the International Accounting Standards Board (IASB), a liability is “a present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying economic benefits.”

Explanation

Liabilities are obligations of the company that arise from past transactions. Hence, they usually have the word ‘payable’ in them. Liabilities also arise if an amount is received for goods/services that are yet to be provided. In such cases, the companies ‘defer’ revenue reporting and recognize the amounts earned as a liability named ‘Unearned revenue’.

There are mainly three types of liabilities on a Company’s Balance Sheet:

- Non-Current Liabilities: Non-current liabilities are long-term liabilities. These are payable after a period of 12 months or more from the date of the Balance Sheet.

- Current Liabilities: Current Liabilities are payable within 12 months (or the company’s operating cycle)from the date of the Balance Sheet.

- Contingent Liabilities: Contingent liabilities are those for which the company is still not legally responsible. They can become liabilities in the future and are also called ‘potential liabilities’. If the probability of occurrence is less than 50%, they are depicted as footnotes in the Balance-sheet. Suppose the probability of occurrence is high and can be estimated. In that case, the company actively shows them as liabilities in the Balance Sheet and records the estimated loss in the income statement.

For example, if the company has been sued for $10,000 and there is a 70% probability that it will lose the case and pay the damage amount, it should be recorded in the Balance Sheet as a liability.

Asset accounts usually have debit balances, while liability accounts have credit balances. However, certain accounts known as ‘contra-liabilities’ accounts have debit balances. This explains the usage of the term ‘contra’ since their debit balance is ‘contrary’ to the usual credit balances of liability accounts. Examples include discounts on bonds payable, discounts on notes payable, etc.

For example, if a company issue bonds for $10,000 at a discount of 10%, it would record the following:

- $9000 would be debited to the cash account

- $10,000 would be credited to the Bonds Payable account

- $1000 would be debited to the ‘Discount on Bonds payable’ known as contra-liability and used to adjust the book value of the liability (Bonds Payable in this case).

A company’s commitments (such as a contract that would become effective in case of a future event like the purchase/sale of goods and services) are not considered liabilities. However, they should be disclosed in the notes to the Balance Sheet if the amount of ‘commitment’ is significant.

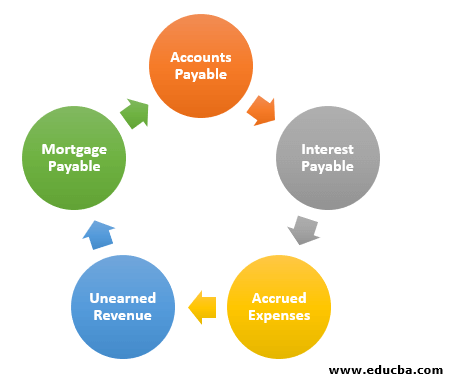

Below is a brief explanation of the most common liabilities on a Company’s Balance Sheet.

Types of Current Liabilities

- Accounts Payable: These are also known as Trade Creditors. They are payable to the suppliers of goods/services for the services utilized by the company.

- Income taxes are payable: This represents the taxes, such as Income Tax, Sales Tax, etc., payable by the firm.

- Interest Payable: This represents the interest on loans taken, bonds issued, etc., payable by the firm. The company does not record the interest on the loan related to the future on the balance sheet. Only the unpaid interest up to the balance sheet date is reported as a liability.

- Accrued Expenses: In the accrual accounting system, the company recognizes expenses when they are incurred, regardless of whether payment has been made. Accrued expenses are expenses that have been incurred and recorded in the balance sheet but are yet to be Examples include salaries for the previous month that are payable in the next month.

- Unearned Revenue: This represents advances received from customers on account of the sale of goods/services. Since the goods/services have not been provided yet by the firm, this is termed as ‘unearned revenue’.

- Mortgage Payable: This is the amount payable on purchasing a long-term property. Suppose the conditions of the mortgage payable include making monthly payments for a period of several years. In that case, the company records only the principal due in the next twelve months as a current liability, while the outstanding principal amount is recorded as a long-term liability.

Below is a brief description of Non-current liabilities found on a Company’s Balance Sheet:

- Bonds Payable: Bonds are financial instruments that represent the Corporate debt taken over by the company. These are usually redeemable after a definite period of time(usually a few years). The company borrows funds by issuing bonds, provides interest on such bonds at a fixed tenure, and redeems the bond to return back the borrowed funds. Such liability is thus a long-term liability.

- Long-Term Notes Payable: Notes are legal instruments in which one party pays a specific amount of money on demand or at a pre-determined time.

- Deferred Tax Liabilities: These are liabilities arising from the difference between a company’s accounting and taxable income. When such a difference results in taxes accrual in the current period but payable later, it is a deferred tax liability.

- Capital Leases: These are also known as finance leases. The company debits the present obligation under a Capital lease arrangement to the fixed asset account and credits it to the capital lease account.

Below are examples of contingent liabilities:

- Pending Lawsuits: Lawsuits, where the company thinks the suing firm has a strong case should be recorded in the Balance sheet.

- Product warranties: These are compensation guarantees provided on the quality of the product. Due to the uncertain outcome, the company typically mentions these in the footnotes of the Balance Sheet.

Conclusion – Types of Liabilities on Balance Sheet

The company utilizes the liabilities on its Balance Sheet to expand and finance its operations. The management and analysts observe short-term liabilities closely since they are indicators of the firm’s short-term liquidity and ability to pay for its obligations. The long-term liabilities are a source of the company’s long-term financing needs, such as the purchase of assets or investments in capital-intensive projects.

Recommended Articles

This is a guide to the Types of Liabilities on Balance Sheet. Here we also discuss the definition and types of current liabilities and examples. You may also have a look at the following articles to learn more –