Introduction

A turnover certificate is one of the most critical financial documents your business requires for various institutional and regulatory purposes. Whether you are operating in Bangalore, Mumbai, Pune, or across Karnataka and other metros, this document establishes your business’s annual revenue and financial credibility in official records. Businesses need turnover certificates for multiple purposes participating in government tenders, applying for bank loans, claiming government incentives, or expanding operations. Understanding what a turnover certificate is, who can issue it, and how to obtain it ensures you have the necessary documentation for all business opportunities.

What is a Turnover Certificate?

A turnover certificate is an official document issued by chartered accountants or authorized financial professionals certifying your business’s annual turnover during a specific financial year. It proves your revenue generation, and government agencies, financial institutions, and tender committees across India recognize it.

The certificate contains audited financial information about your business’s sales, services rendered, or revenue earned during the financial year. It is distinctly different from income tax returns while ITRs are tax documents, turnover certificates are statutory financial attestations issued by qualified chartered accountants verifying your actual business turnover.

Who can issue Turnover Certificates?

Only qualified chartered accountants registered with the Institute of Chartered Accountants of India (ICAI) can officially issue turnover certificates. These professionals conduct financial audits and verify business records before issuing the certificate, ensuring authenticity and accuracy.

In some cases, partnerships and individual proprietorships also provide turnover certificates through their auditors, though companies typically require CA certification. For businesses registered in Karnataka, Bangalore, and other metros, ensure your chartered accountant is ICAI-registered and maintains updated credentials with the respective state CA council.

Types of Turnover Certificates

#1. Standard Turnover Certificate

The most common type certifies your business’s total annual turnover based on audited financial statements. Banks, government bodies, and institutions across all metros and regions widely accept this certificate for loans, benefits, and general institutional purposes.

#2. Turnover Certificate for Tender

Specifically formatted and issued for government tender participation. This certificate meets specific government procurement requirements, and Indian agencies often mandate it for e-bidding, construction contracts, and public sector tender submissions.

#3. Turnover Certificate for Loan

Tailored for financial institutions and banks evaluating creditworthiness. Banks often request this certificate along with financial statements to assess repayment capacity and determine loan eligibility and amount.

#4. Turnover Certificate for MSME Registration

Required for micro, small, and medium enterprise registration under government schemes. This certificate verifies your business classification and eligibility for MSME benefits, subsidies, and preferential procurement policies.

Eligibility Criteria

- Businesses must register with the appropriate authorities such as GST, income tax, ROC (for companies), or sales tax departments.

- Business must have completed at least one full financial year of operations

- A company or proprietorship must maintain proper accounting records and financial statements

- The chartered accountant issuing the certificate must be ICAI-registered with a valid practicing certificate

- Business must not be under investigation or have legal disputes affecting financial credibility

Documents Required

Financial Documents

- Audited financial statements

- Balance sheet and profit & loss statement

- Trial balance

- Income Tax Return (ITR)

Business Registration Documents

- GST registration certificate and annual return (GSTR-1)

- Certificate of incorporation/partnership deed

- Business license and professional tax registration (for Karnataka and other applicable states)

Additional Documentation

- Bank statements for the financial year

- Ledger accounts and journal entries

- Signed letter of authorization on company letterhead

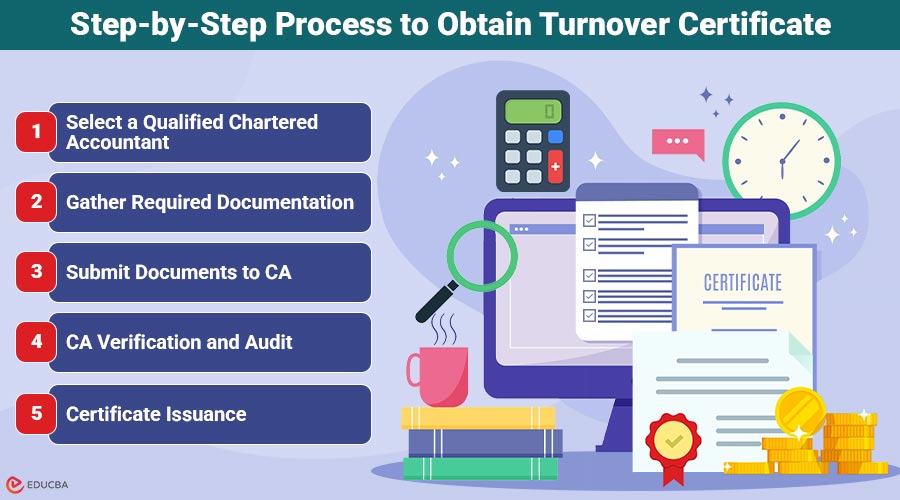

Step-by-Step Process to Obtain Turnover Certificate

#1. Select a Qualified Chartered Accountant

Identify an ICAI-registered chartered accountant with experience in your industry. For businesses in Bangalore, Mumbai, Pune, Karnataka, or other metros, verify the CA’s registration status on the ICAI website and confirm they have previously issued turnover certificates. A reliable CA ensures accurate documentation and timely processing.

#2. Gather Required Documentation

Compile all financial statements, bank statements, GST returns, income tax returns, and business registration documents. Organize these in chronological order with clear labeling, making the CA’s verification process smoother and faster. Incomplete documentation delays the certificate issuance.

#3. Submit Documents to CA

Submit all compiled documents to your chartered accountant along with a formal request specifying the certificate purpose whether for tender participation, loan application, or general business credibility. Clearly mention the financial year for which you need the certificate.

#4. CA Verification and Audit

The CA reviews your financial records, verifies business transactions, and conducts necessary audits. This process ensures the accuracy and authenticity of the certificate. The CA may request clarifications or additional documents during this verification stage.

#5. Certificate Issuance

Once verification is complete, the CA issues the turnover certificate on official letterhead, with the CA’s signature, date, and CA registration number. The certificate includes detailed turnover figures, certification period, and the CA’s professional stamp. You will receive original and attested copies.

Timeline and Fee Structure

| Stage | Timeline | Typical Fees |

| CA Verification | 3–5 days | ₹1,500–₹2,500 |

| Audit & Review | 3–7 days | Included |

| Certificate Issuance | 1–2 days | Included |

| Total Duration | 7–14 days | ₹1,500–₹2,500 |

Common Purposes for Turnover Certificates

- Government tender participation and e-bidding for procurement contracts

- Bank loan and credit facility applications

- MSME registration and subsidy claims

- Trade credit and supplier financing approvals

- Insurance policy applications requiring financial credibility

- Business expansion and partnership opportunities across metros

Turnover Certificate for Tender Participation

For government procurement and tender participation, a specifically formatted turnover certificate for tender documents is essential. Government agencies and tender committees require these certificates to verify contractor financial capacity and sustainability. Tender-specific certificates often include additional declarations and certifications confirming financial stability, no litigation status, and compliance with regulatory requirements. The certificate format may vary depending on the tender-issuing authority whether the central government, a state government, or a public sector undertaking. Ensure your chartered accountant is familiar with specific tender requirements for your industry and jurisdiction.

Turnover Certificate vs Other Financial Documents

| Aspect | Turnover Certificate | Income Tax Return |

| Issued By | Chartered Accountant | Income Tax Department |

| Purpose | Institutional credibility | Tax compliance |

| Processing Time | 7–14 days | Government processing |

| Usage | Loans, tenders, MSME | Tax filing |

Benefits of Obtaining a Turnover Certificate

- Establishes financial credibility with banks, investors, and business partners

- Essential for competitive government tender participation across metros

- Facilitates faster loan approvals and better credit terms

- Unlocks MSME benefits, subsidies, and preferential procurement policies

- Supports business expansion and partnership opportunities with institutional credibility

Turnover Certificate in Karnataka

For businesses operating in Bangalore, Pune, Mumbai, and across Karnataka, state authorities and procurement agencies universally accept turnover certificates issued by ICAI-registered chartered accountants. The Department of Information Technology, Commerce, and Industries in Karnataka, along with the Bangalore Metropolitan Handloom Area Development Authority, frequently requires these certificates for business registrations and subsidy applications.

Karnataka-based exporters particularly benefit from turnover certificates when applying for export incentives and government support schemes. Ensure your chartered accountant is registered with the Southern India Regional Council of ICAI based in Bangalore or Chennai for seamless processing and recognition across the state.

Final Thoughts

Obtaining a turnover certificate is a straightforward process when you partner with a qualified chartered accountant and maintain proper financial documentation. This essential document opens doors for loan approvals, tender participation, and business growth across Bangalore, Mumbai, Pune, Karnataka, and all metros. Whether you need the certificate for institutional credibility, government procurement, or business expansion, the process takes approximately 7-14 days and costs little. Start by gathering your financial documents and connecting with an ICAI-registered CA to ensure your turnover certificate meets all requirements and institutional standards.

Frequently Asked Questions (FAQs)

Q1. What is the difference between a turnover certificate and audited financial statements?

Answer: A turnover certificate is a specific attestation by a CA certifying your annual turnover figures. Audited financial statements are comprehensive documents including balance sheets, profit and loss accounts, and detailed notes. Turnover certificates are simpler, faster to obtain, and specifically designed for institutional credibility purposes.

Q2. Can I obtain a turnover certificate if my business is just one year old?

Answer: Yes, you can obtain a turnover certificate after completing one full financial year of operations. The certificate will certify your turnover for that financial year. Ensure you have maintained proper financial records and have complete documentation for the period.

Q3. How many copies of the turnover certificate do I need?

Answer: Typically, you should obtain multiple attested copies (a minimum of 2-5). Different institutions may require original or certified copies. Ask your CA to provide adequate copies during issuance to avoid requesting duplicates later, which may require additional verification and time.

Q4. Is the turnover certificate valid for multiple purposes?

Answer: Yes, a standard turnover certificate is valid for multiple institutional purposes, such as loans, tenders, MSME registration, and trade credit applications. However, some tender-issuing authorities require tender certificates in a specific format that meets their compliance standards.

Q5. What happens if my financial records are incomplete?

Answer: Incomplete financial records delay the issuance of the certificate. The CA requires comprehensive documentation, including bank statements, GST returns, income tax returns, and accounting records. Arrange all documents properly before submitting to the CA to ensure faster processing and accurate certification.

Recommended Articles

We hope this guide on the turnover certificate helps you understand its importance and the application process. Explore the recommended articles below for more such topics.