What Is a Transition Economy?

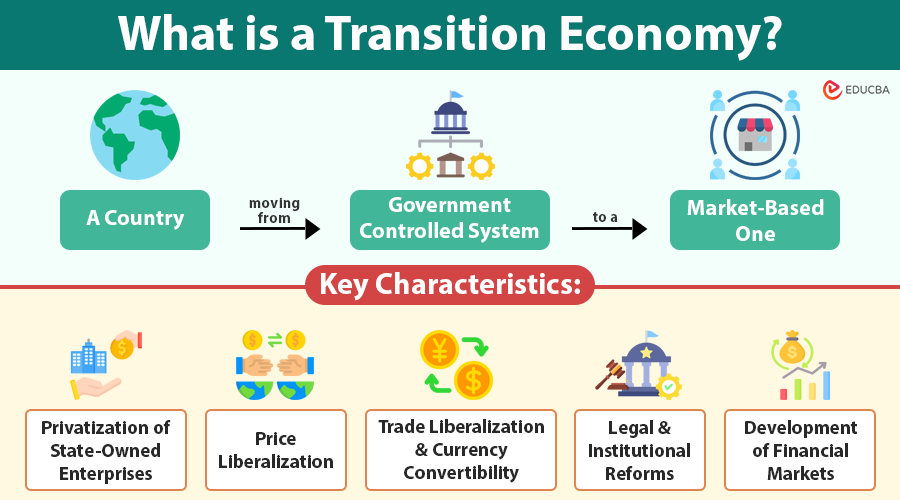

A transition economy is a country moving from a government-controlled economic system to a market-based one. In this new system, businesses and consumers make decisions about prices, production, and trade instead of the state.

For example, Georgia, a country in the South Caucasus, became a transition economy after the Soviet Union collapsed. It introduced major reforms such as privatizing state-owned enterprises, simplifying the tax system, and attracting foreign investment. These efforts helped stabilize its economy and improve growth.

Table of Contents

- What Is a Transition Economy?

- Key Characteristics of a Transition Economy

- Phases of the Transition Economy

- Case Studies of Transition Economy

- Challenges Faced by Transition Economies

- Measuring Transition

- Role of International Organizations in a Transition Economy

Key Takeaways

- A transition economy shifts from a centrally planned system to a market-based one, allowing businesses and consumers to make economic decisions instead of the state.

- Key reforms include privatization of state-owned enterprises, price and trade liberalization, development of financial markets, and legal/institutional restructuring.

- The process typically occurs in three overlapping phases: initial liberalization, institutional building, and deepening of market mechanisms.

- Case studies like Poland, China, Vietnam, and Russia show varied results depending on reform speed, political stability, and institutional strength.

- Transition economies often face inflation, unemployment, corruption, inequality, and political backlash during reform.

- International organizations like the IMF, World Bank, WTO, and EBRD play critical roles through financial aid, technical guidance, and global integration support.

Key Characteristics of a Transition Economy

Here are some key characteristics of a transition economy:

1. Privatization of State-Owned Enterprises (SOEs)

In centrally planned systems, the state controls the majority of economic assets. Transition economies transfer these to private ownership to foster competition and innovation. Methods include:

- Voucher privatization (e.g., Czech Republic)

- Direct sales (e.g., Hungary)

- Employee buyouts.

However, rapid privatization can lead to inequality and corruption if not regulated effectively.

2. Price Liberalization

Prices move from state-fixed to market-driven, allowing supply and demand to guide resource allocation. This often results in short-term:

- Inflation

- Shortages or oversupply.

Stabilization policies are necessary to prevent hyperinflation and ensure consumer confidence.

3. Trade Liberalization and Currency Convertibility

Opening up to global trade involves:

- Lowering tariffs

- Attracting FDI

- Making the currency convertible.

This integration boosts economic growth but also exposes domestic industries to global competition.

4. Legal and Institutional Reforms

Establishing effective legal frameworks is essential for:

- Enforcing contracts

- Protecting property rights

- Reducing corruption.

Without these, markets cannot function efficiently.

5. Development of Financial Markets

Modern economies need:

- Robust banking systems

- Capital markets

- Pension and insurance sectors.

Financial market reforms allow for better credit allocation and investment opportunities.

Phases of the Transition Economy

The transition process typically unfolds in three overlapping phases, each building on the last:

Phase 1: Initial Liberalization

- Macroeconomic stabilization through fiscal discipline and inflation control.

- Price liberalization to correct market signals.

- Removal of subsidies, especially in the agriculture and energy sectors.

- Allowing local and foreign businesses to compete in the market.

This phase often brings high volatility, including GDP contractions and social unrest, but it lays the groundwork for long-term gains.

Phase 2: Institutional Building

- Privatization of large enterprises is often the most complex part of reform.

- Implementing tax and banking reforms to support a functioning public and private sector.

- Creation of social safety nets to address unemployment, poverty, and inequality.

- Building human capital through education and vocational training.

This phase requires deep political will and can take decades, as institutional development is slow and context-dependent.

Phase 3: Deepening of Market Mechanisms

- Focus on innovation, entrepreneurship, and global competitiveness.

- Strengthening corporate governance and labor market flexibility.

- Transitioning from low-cost production to value-added industries.

- Investing in digital infrastructure, green economy, and R&D.

This phase positions the economy for long-term resilience and integration into high-income global value chains.

Case Studies of Transition Economy

Poland: A Model of Gradual Success

- Period of Reform: Early 1990s

- Strategy: Adopted “shock therapy” reforms

- Key Reforms: Rapid liberalization, strong EU integration, and institutional restructuring

- Outcome: Became one of the most stable and prosperous economies in Eastern Europe

Russia: Rapid Reform and Oligarchic Capture

- Period of Reform: Early to mid-1990s

- Strategy: Mass privatization with weak legal controls

- Key Reforms: Quick asset sell-offs, minimal regulation, reliance on natural resources

- Outcome: Rise of oligarchs, widespread corruption, continued dependence on oil exports

China: Gradualism with Chinese Characteristics

- Period of Reform: Starting in 1978

- Strategy: Gradual, dual-track reform process

- Key Reforms: Special Economic Zones, state-private sector mix, export-led growth

- Outcome: Rapid economic growth, though with continued state dominance in key sectors

Vietnam: Steady Liberalization

- Period of Reform: Starting in 1986

- Strategy: Progressive reforms under “Doi Moi”

- Key Reforms: Encouragement of private business, trade liberalization, WTO accession

- Outcome: Fast-growing economy with a globally integrated manufacturing base

Challenges Faced by Transition Economies

Key challenges faced by transition economies are:

1. Macroeconomic Instability

Moving from government-controlled economies to market-based systems often caused major economic problems.

- Hyperinflation: Price liberalization without adequate monetary control caused runaway inflation in many countries (e.g., over 2,000% inflation in some post-Soviet states).

- Fiscal Deficits: Governments struggled with declining revenues and increased spending, especially on subsidies, pensions, and unemployment benefits.

- Economic Contraction: GDP plummeted in the early years of transition due to industrial collapse, trade disruptions, and loss of Soviet-era subsidies.

- Currency Volatility: New or restructured currencies often faced speculative attacks and rapid depreciation.

- Unstable Investment Climate: Uncertainty discouraged both domestic and foreign investment, prolonging stagnation.

2. Institutional Weakness

Strong institutions are key to supporting market economies, but transition states often lacked them.

- Corruption: Absence of oversight mechanisms led to widespread bribery, rent-seeking, and misallocation of resources.

- Weak Rule of Law: Legal systems were often underdeveloped, politicized, or ill-equipped to handle property rights, contracts, and commercial disputes.

- Regulatory Gaps: Many sectors operated without effective regulation, leading to monopolistic practices, unsafe products, and environmental degradation.

- Inefficient Bureaucracies: Many state agencies lacked the capacity or incentives to implement reforms efficiently or transparently.

- Privatization Mismanagement: Hasty or poorly supervised privatization led to asset stripping and the rise of oligarchs.

3. Rising Inequality and Social Tensions

The shift to capitalism produced winners and losers, deepening societal divides.

- Urban-Rural Divide: Cities, especially capitals, attracted investment and jobs, while rural regions lagged in services, infrastructure, and employment.

- Unemployment and Underemployment: The Closure of state-owned enterprises left millions jobless, with few safety nets to support them.

- Brain Drain: Skilled professionals and young people emigrated in search of better opportunities, weakening domestic human capital.

- Poverty and Social Exclusion: Many families fell below the poverty line, especially pensioners, displaced workers, and rural residents.

- Erosion of Social Services: Education, healthcare, and welfare systems faced budget cuts or inefficiencies during restructuring.

4. Political Pushback

The socio-economic pain of transition often triggered resistance to reform.

- Reform Fatigue: After initial enthusiasm, public support waned as economic hardships continued without visible improvements.

- Populist Backlash: Disillusionment with liberalization fueled the rise of nationalist, anti-globalization, and anti-Western political movements.

- Authoritarian Tendencies: Some leaders used crises to centralize power, suppress dissent, and roll back democratic reforms.

- Lack of Consensus: Political divisions between reformists and conservatives created unstable governments and stalled policy implementation.

- Manipulation of Media and Institutions: In several cases, elites captured media and judicial institutions to protect their interests and avoid accountability.

Measuring Transition: Key Performance Indicators

| Indicator | Description |

| GDP Growth | Economic performance and stability |

| Inflation | Price stability |

| Ease of Doing Business | Business environment |

| Corruption Index | Institutional integrity |

| GINI Coefficient | Income inequality |

| HDI | Human development |

Role of International Organizations in a Transition Economy

International organizations played an important part in helping post-socialist countries change their economies and institutions. Their assistance came in the form of financial aid, technical expertise, and integration into global economic systems.

1. International Monetary Fund (IMF)

Primary Role: Macroeconomic stabilization and technical assistance

- Stabilization Programs: Provided emergency loans to address balance-of-payment crises and restore fiscal discipline.

- Structural Adjustment: Imposed conditionalities requiring reforms in exchange for financial support (e.g., reducing subsidies, liberalizing exchange rates).

- Technical Expertise: Helped build central banking capacity, improve tax systems, and modernize monetary policy frameworks.

- Monitoring and Surveillance: Offered regular reviews and policy recommendations to keep countries on a reform path.

2. World Bank

Primary Role: Infrastructure development and institutional reform

- Project Financing: Funded critical sectors like energy, transportation, healthcare, and education to modernize infrastructure.

- Policy Advice: Guided public sector reform, poverty reduction strategies, and human capital development.

- Capacity Building: Helped governments improve governance, public financial management, and regulatory institutions.

- Social Safety Nets: Supported programs to protect vulnerable populations affected by economic restructuring.

3. European Bank for Reconstruction and Development (EBRD)

Primary Role: Investment and private sector development in transition economies

- Focus on Transition: Created specifically to support the shift to market economies in Central and Eastern Europe and the former Soviet Union.

- Private Sector Support: Invested in enterprises, banks, and infrastructure to foster entrepreneurship and competition.

- Good Governance Principles: Promoted environmental sustainability, sound corporate governance, and transparency.

- Policy Dialogue: Worked closely with governments to reform legal and financial frameworks conducive to market operations.

4. World Trade Organization (WTO) and Organisation for Economic Co-operation and Development (OECD)

Primary Role: Global economic integration and policy alignment

- WTO:

- Supported trade liberalization and integration into global markets.

- Helped countries adopt rules-based trade practices and settle disputes transparently.

- Facilitated accession processes for transition economies (e.g., Russia, Ukraine).

- OECD:

- Provided benchmarks and policy standards on tax, investment, education, and governance.

- Assisted in aligning domestic regulations with international best practices.

- Offered peer reviews and research to guide policy reforms.

These organizations help countries access funding, technical expertise, and global markets.

Final Thoughts

Transition economies highlight both the promise and the complexity of moving from central planning to market capitalism. While many have achieved impressive growth and modernization, the journey also brings risks that require careful management. Success depends not just on economic reforms but also on building strong institutions, ensuring social inclusion, and integrating thoughtfully into the global economy.

Frequently Asked Questions (FAQs)

Q1. Can a country reverse its transition and return to a centrally planned economy?

Answer: Yes, reversals are possible. In cases of political instability or economic hardship, some countries have rolled back market reforms, re-nationalized industries, or adopted more state-led economic models.

Q2. Why do some transition economies perform better than others?

Answer: Performance depends on factors like the strength of institutions, leadership, reform sequencing, access to external support, and public trust. Countries with clear strategies and strong institutions tend to transition more successfully.

Q3. How do transition economies affect global trade and investment?

Answer: Transition economies often become emerging markets that attract foreign investment due to their growth potential, new consumer bases, and expanding industrial capacity. They also contribute to global supply chains once integrated.

Q4. Can foreign investment harm a transition economy?

Answer: While FDI brings capital and technology, it can also crowd out local businesses, exploit weak labor laws, or cause economic dependence if not managed with proper policies and oversight.

Recommended Articles

We hope this article helped you understand what a transition economy is and how it works. Check out these recommended articles to learn more about economic change, global trade, and how countries grow.