Definition of Tax Haven

Tax Haven is defined as a country or place with fewer taxes than other countries. Haven means the area with security; in Tax Haven’s case, this security is for the low tax payments. It is also being said that in Tax Haven countries, there are no exchange regulations and rules; therefore, the money can move in or out without any investigations.

Explanation

Tax Haven countries allow investors to move their money from other countries to theirs without formalities. Thus, it became more accessible for the industrialists to move their black money and then finally invest in some countries, such as the Cayman Islands, where they could convert it to white. Although no proof exists to highlight the actual fact, it can be interpreted. Also, in Tax Haven countries, industrial growth is significantly less. The citizens of those countries are advised to import most things, such as expensive cars, machines, or technologies. Now, these tax haven countries can ask for heavy import duty from the customers, and thus this is considered their income.

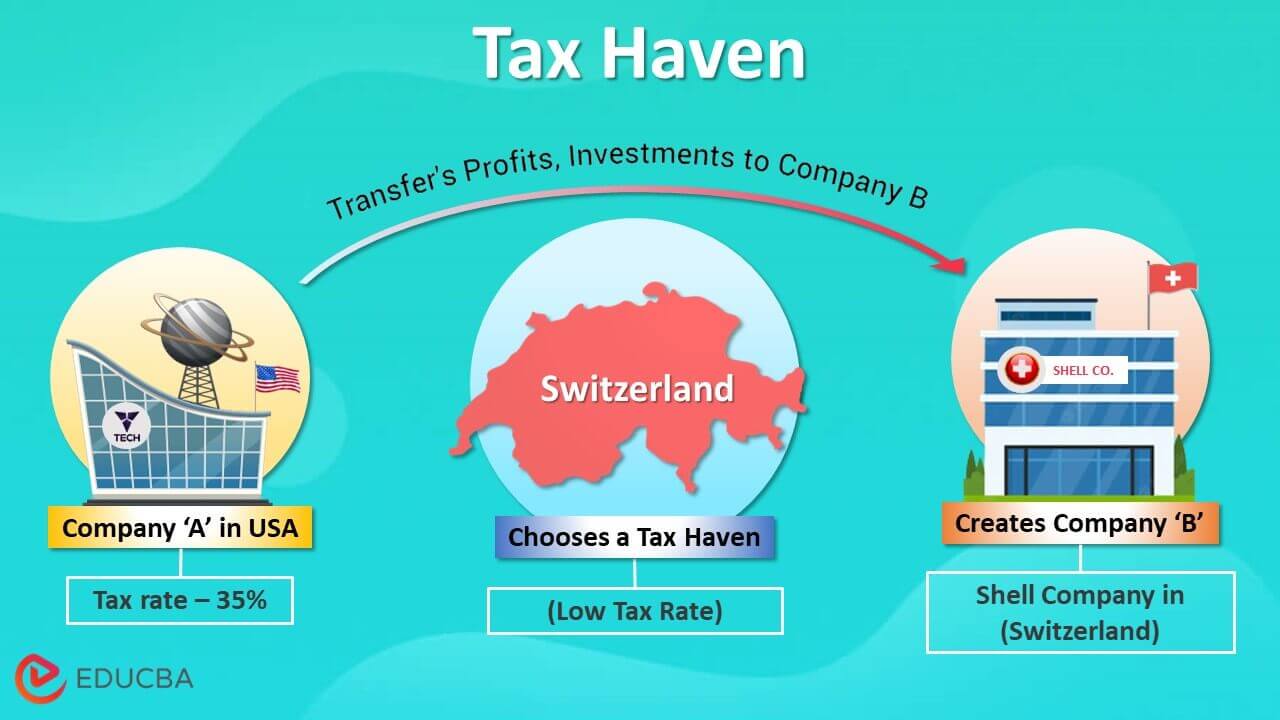

How Does Tax Haven Work?

Tax Haven is a country that imposes fewer taxes as compared to other countries. In tax haven countries, there are no such tax rules and regulations, no exchange regulations. The taxes are not collected from the citizens because there are no regulations for the same, whereas the government makes some heavy duty payments to the citizens in case of import of any goods or services. Most big industries make their subsidiary in these tax-haven countries. These subsidiaries don’t do any business of their own. Instead, all the paperwork is done to pass the money from this subsidiary made. After that, as per convenience, the money is again invested in other countries. This way, the business person can circulate their money in the business with the help of tax haven countries.

Examples of Tax Haven

- Apple uses the benefit of Tax Havens and saves approx. Billions of money.

- Nike is also the one that uses Tax havens countries to safe side its money to pay taxes.

- Goldman Sachs invests in Tax havens countries because it has lots of investments made offshore; therefore, to sidetrack that income, the company invests in Tax haven countries and saves billions each year.

- Microsoft Company also holds maximum business in other countries; they invest in Tax havens and save taxes, saving billions and billions of money.

- Walmart is a company that has its business in many countries; therefore, they must use and take all the benefits of the tax havens countries to save money.

- IBM has a stake in most countries and hence uses Tax havens to slice the tax liability on their income.

- General Electricity also does the same to reduce its tax implication.

- Exxon Mobilis is another company that exemplifies the Tax haven benefits.

- Pfizer also uses the Tax havens benefits and saves its tax liability.

- Chevron also does business offshore and invests in Tax haven countries to offset the heavy tax duty.

Where are These Tax Havens?

- Cayman Islands

- Luxembourg

- Isle of Man

- Jersey

- Mauritius

- Ireland

- Bermuda

- Monaco

- Switzerland

- Bahamas

Who Uses Tax Havens?

Tax havens can be used by individuals, business people, governments, political parties, non-profit organizations, charitable trusts, etc. The only criteria can be the person should know how to rotate the money to take the most benefit from the tax haven countries.

Criteria for Tax Haven

- Less direct and indirect taxes are levied on the customers.

- No exchange regulation is there in these tax haven countries.

- No tax rules are defined, and regulations are made which are to be followed by the country’s citizens.

- The other criteria for tax havens also include the lack of transparency of the business transaction because the individual mainly uses it for money rotation.

Benefits

Some of the benefits are given below:

- The most important benefit of investing in Tax havens is that the company can save taxes and their money.

- There will be the growth of an individual and the nation.

- The process of Tax saving is legal and logical. The investment is safe because the country, considered a Tax haven, has no rules and regulations regarding the tax implication.

- There is no capital gain tax, which encourages the businessman to invest in that country.

- Tax havens also benefit the economy in a big way; they encourage new investment, and hence the country also gains.

Disadvantages

Some of the disadvantages are given below:

- Tax havens can encourage some illegal work also.

- It can be very beneficial, but on the other hand, it can be something that may attract a higher recovery from the citizens by imposing heavy import duty on the items which are imported.

- It may help the big organization, but it is always very beneficial for the citizens of that country.

- Tax havens business transactions are generally fictitious and can be misleading to the other party.

- There is no transparency in the process; therefore, the parties can face betrayal.

Conclusion

Tax havens are beneficial tax-saving options, but the individual should also take some care to understand the dark side of this process. Many individuals, big corporates, and companies get involved in this tax havens process and invest their money or buy some assets to take advantage of the less tax implication but this is also being paid and recovered by the citizens of that country because then they are being retrieved by paying heavy import duties. Although it is a legal process, the investor should understand this very clearly before investing.

Recommended Articles

This is a guide to Tax Haven. Here we also discuss the definition and examples of a tax haven and its benefits and disadvantages. You may also have a look at the following articles to learn more –