What is Staking?

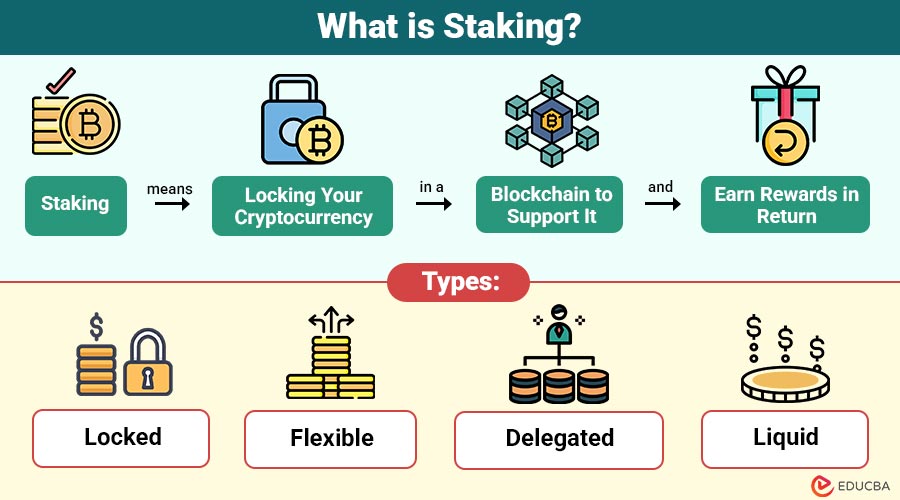

Staking means locking your cryptocurrency in a blockchain to support it and earn rewards in return. It is mainly used in Proof-of-Stake (PoS) blockchains. Unlike Proof-of-Work (PoW) (used by Bitcoin), where miners use powerful computers to validate transactions, PoS blockchains rely on people who “stake” their coins.

By staking, you are basically saying:

- “I trust this network.”

- “I’m putting my coins as a guarantee.”

The network then uses your staked coins to validate transactions. If you act honestly, you get rewarded. If you attempt to cheat, you risk losing your staked funds.

Table of Contents:

- Meaning

- Working

- Why do People Stake Crypto?

- Types

- Benefits

- Risks

- Popular Cryptocurrenies

- Real-World Example

- Tips

Key Takeaways:

- Staking enables cryptocurrency holders to earn passive rewards while actively contributing to security of blockchain networks.

- Choosing trusted platforms and understanding coin lock-up periods ensures safer and more effective outcomes.

- Investors can select strategies that align with their risk tolerance, reward expectations, and liquidity requirements.

- It supports long-term investment strategies by combining network participation with the potential growth of cryptocurrency holdings.

How does Staking Work?

Here is a step-by-step breakdown:

1. Choose a Coin that Supports Staking

Not all cryptocurrencies allow staking. Popular examples are Ethereum (ETH), Cardano (ADA), Solana (SOL), and Polkadot (DOT).

2. Select a Wallet or Exchange

You can stake using a crypto wallet or through exchanges like Binance, Coinbase, or Kraken.

3. Lock Your Coins

You commit your coins to the blockchain network for a specific time. Some networks allow you to withdraw at any time, while others require a fixed lock-up period.

4. Earn Rewards

As long as you stake your coins, you earn rewards. These rewards are usually distributed daily, weekly, or monthly, depending on the blockchain.

Why do People Stake Crypto?

People stake crypto for two main reasons:

1. Earn Passive Income

Staking crypto enables investors to generate passive income by earning additional tokens. Rather than leaving assets unused, staking rewards holders can consistently provide a steady return while maintaining ownership of their digital coins.

2. Support the Network

Users actively contribute to blockchain security, validating transactions, and maintaining decentralized consensus. This process enhances network reliability, mitigates the risks of attacks, and ensures efficient, trustless operation while rewarding participants for their essential contributions.

Types of Staking

Here are the main types, each offering unique benefits and flexibility for investors:

1. Locked

Holding coins for a predetermined amount of time—such as 30, 60, or 90 days—is necessary for locked staking. Rewards are higher, but flexibility and liquidity become significantly limited.

2. Flexible

Allows investors to unstake at any time, offering greater liquidity and convenience. However, the tradeoff is usually lower rewards compared to fixed or locked staking methods.

3. Delegated

Enables you to assign coins to a validator, who handles technical tasks on your behalf. You share rewards with them, making accessible without needing to run nodes yourself.

4. Liquid

Allows users to stake coins while retaining tradable “liquid tokens.” These tokens can be used in DeFi or traded, offering flexibility and rewards simultaneously.

Benefits of Staking

Here are the key benefits that make it attractive for cryptocurrency investors:

1. Passive Earnings

Lets investors earn steady rewards, similar to earning interest. Depending on the cryptocurrency, annual returns typically range from 3% to 20%, and sometimes higher.

2. Simple and Accessible

Exchanges simplify staking by offering one-click options. Even complete beginners without technical expertise can easily participate, making it widely accessible and user-friendly for everyone.

3. Lower Energy Use

Unlike mining, staking requires no high-performance hardware or massive electricity consumption. It is more eco-friendly, enabling blockchain networks to operate sustainably with a significantly reduced environmental impact.

4. Long-Term Growth

Rewards believers in a project’s future by providing income while holding coins. Investors benefit from both staking rewards and potential price appreciation of the cryptocurrency.

Risks of Staking

Here are the main risks that investors should carefully consider:

1. Price Fluctuations

The biggest risk is price volatility. Even with rewards, if the value of the staked coin drops sharply, investors may still face significant financial losses overall.

2. Lock-Up Periods

Many programs impose lock-up periods lasting weeks or months, preventing investors from selling coins—even during sharp market downturns or unexpected price crashes.

3. Technical Risks

Staking via validators carries risks. If they act irresponsibly, face penalties, or make errors, participants could lose part of their earned rewards.

4. Scam Platforms

Fraudulent staking services exist. Some lure investors with unrealistically high returns, then disappear with deposited funds, causing victims to lose their entire investment.

Popular Cryptocurrencies for Staking

Here are some widely used cryptocurrencies that offer reliable opportunities for investors:

1. Ethereum (ETH)

After transitioning to Proof-of-Stake in 2022, Ethereum enables staking with a minimum of 32 ETH, although exchanges allow smaller participant amounts.

2. Cardano (ADA)

Cardano emphasizes a research-driven, scientific approach and benefits from a passionate global community, making it a reliable, widely trusted option.

3. Solana (SOL)

Solana offers fast and scalable blockchain performance, ideal; however, past network outages have highlighted occasional reliability concerns for investors and users.

4. Polkadot (DOT)

Polkadot prioritizes interoperability, enabling seamless communication between multiple blockchains, and offers robust opportunities that support its expanding ecosystem of connected networks.

5. Tezos (XTZ)

Tezos, one of the earliest Proof-of-Stake blockchains, remains popular for its sustainable governance, rewarding long-term holders through secure and consistent opportunities.

Real-World Example

Imagine you have 1000 Cardano (ADA) and you decide to stake them. The network offers an annual reward of 5%.

1000 ADA × 5% = 50 ADA earned in a year.

If ADA’s price is $0.50, that’s $25 worth of rewards.

Now imagine ADA’s price increases to $1 in a year. Your rewards are worth $50 instead. This shows how staking combines passive income with potential growth.

Tips for Safe Staking

Here are some essential tips to ensure your experience remains secure and profitable:

1. Do Research

Always choose trusted wallets or exchanges for staking; researching platforms reduces risks of scams, hacks, and potential financial losses.

2. Understand Lock-Up

Before staking, confirm whether the coins are locked and for how long, as restrictions can affect liquidity and the ability to sell quickly.

3. Diversify

Spread your staked funds across different coins or platforms; diversification minimizes risks and protects against price drops or technical failures.

4. Stay Updated

Crypto markets and blockchain rules evolve quickly; staying informed ensures safer decisions and helps maximize returns without unnecessary risks.

Final Thoughts

Staking is a widely used way for crypto investors to earn passive income while aiding blockchain networks. It is simpler and greener than mining, helping long-term holders maximize returns. But it carries risks—coin values may drop, and some platforms lack trust. Always research carefully and stake only what you can afford to lose.

Frequently Asked Questions (FAQs)

Q1. Can I lose money while staking?

Answer: Yes. If the coin’s price drops or if you stake on a scam platform, you could lose money—even if you earn rewards.

Q2. How much can I earn from staking?

Answer: It depends on the coin and platform. Typical annual returns range from 3% to 20%.

Q3. Is staking better than mining?

Answer: For beginners, yes. It is cheaper, easier, and eco-friendly. Mining requires costly hardware and electricity.

Q4. Do I need technical skills to stake?

Answer: No. Most exchanges and wallets make staking as simple as depositing coins.

Recommended Articles

We hope that this EDUCBA information on “Staking” was beneficial to you. You can view EDUCBA’s recommended articles for more information.