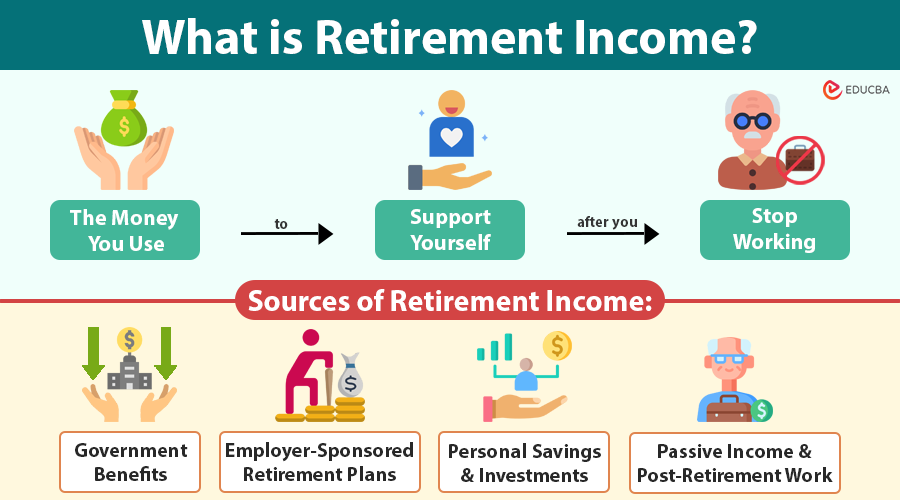

What is Retirement Income?

Retirement income is the money you receive after you stop working full-time, used to cover your living expenses in retirement. It can come from sources like government pensions, employer retirement plans, personal savings, or investments.

For example, after retiring at 62, Meera receives ₹25,000 per month from her government pension, ₹10,000 from rental income, and withdraws ₹15,000 from her retirement savings—making up her monthly retirement income of ₹50,000.

Table of Contents

- Meaning

- Why Does Planning Matter?

- Primary Sources

- Types of Strategies

- How Much Income Do You Need?

- Risks

- Taxation

- Retirement Budgeting and Expense Management

- Real Estate and Home Equity

- An Alternative Strategy

- Family and Legacy Planning

- Real-Life Examples

- Global Snapshot of Retirement Readiness

- Tools and Resources

- Final Checklist

Why Retirement Income Planning Matters?

Many individuals underestimate the amount of money they will need after retirement. Retirement may last 20 to 30 years, and without a good income plan, your savings might run out.

Key Reasons to Plan:

- Longevity: Global life expectancy averages 73 years (World Bank, 2023), and in many developed countries, it exceeds 80 years.

- Retirement Age: Most people retire between the ages of 60 and 67, meaning you may need to fund 25 years or more of retirement.

- Rising Costs: Inflation, particularly in healthcare and housing, can significantly erode purchasing power.

- Reduced Support: Employer pensions are declining, and government benefits alone may not be enough.

Primary Sources of Retirement Income

1. Government Benefits

These are state-sponsored pensions or social security payments.

- United States: Average Social Security benefit in 2024 is $1,907/month.

- India: EPS offers fixed pensions; NPS offers market-linked returns.

- UK: The full new State Pension is £221.20 per week (2024–25).

Tip: Check your eligibility and expected benefit amount regularly using official portals.

2. Employer-Sponsored Retirement Plans

These are retirement plans your employer offers, such as a pension (defined benefit) or a savings-based plan (defined contribution).

- Defined Benefit (DB): Fixed pension based on years worked and salary.

- Defined Contribution (DC): Includes 401(k) in the U.S., Provident Fund in India, and Superannuation in Australia.

3. Personal Savings and Investments

Your savings often form the bulk of retirement income.

- Instruments: Mutual funds, stocks, bonds, fixed deposits, real estate

- Annuities: Insurance products offering a guaranteed monthly income

Rule of Thumb: Save at least 10–15% of your income during your working years.

4. Passive Income and Post-Retirement Work

Some retirees supplement their income through freelance work, rental properties, or side businesses.

- Examples: Consulting, tutoring, e-commerce, dividend-paying stocks, REITs.

Types of Retirement Income Strategies

1. Income Floor Strategy

Cover essential expenses using guaranteed income sources, such as Social Security, pensions, and annuities, to ensure financial stability.

2. Bucket Strategy

Divide retirement savings into three buckets:

- Short-term (1–3 years): Cash and savings

- Mid-term (3–10 years): Bonds and income funds

- Long-term (10+ years): Equities and growth investments.

3. Systematic Withdrawal Strategy

Set aside a fixed percentage of your savings each year, such as 4%, to cover living expenses.

4. Total Return Strategy

Focus on maximizing returns from a diversified portfolio, adjusting withdrawals based on performance.

How Much Retirement Income Do You Need?

80% Replacement Rule

You will need around 80% of what you earned before retiring to keep your current lifestyle.

- If you earn $75,000 annually, aim for $60,000 per year in retirement.

Estimate Based on Expenses

Calculate your expected monthly expenses:

| Expense Category | Monthly Estimate |

| Housing (Rent/Mortgage) | $1,200 |

| Utilities & Maintenance | $300 |

| Food & Dining | $600 |

| Healthcare & Insurance | $500 |

| Travel & Leisure | $400 |

| Miscellaneous | $200 |

| Total | $3,200 |

Risks That Affect Retirement Income

- Longevity Risk: Outliving your savings.

- Inflation Risk: Erosion of purchasing power.

- Market Risk: Volatility in investment returns.

- Healthcare Risk: Rising medical expenses.

- Withdrawal Risk: Taking out too much, too quickly.

- Policy Risk: Changes in tax or pension laws.

Tip: Diversify your income streams and consider inflation-adjusted products.

Taxation of Retirement Income

Tax rules vary by country and the source of income.

- S.:

- Social Security: Up to 85% taxable

- 401(k)/IRA: Fully taxable upon withdrawal

- Roth IRA: Tax-free withdrawals.

- India:

- EPF: Tax-free if held for 5+ years

- NPS: 60% lump sum withdrawal is tax-free; 40% annuity is taxable.

Plan withdrawals to minimize tax liability and extend savings.

Retirement Budgeting and Expense Management

Creating a retirement budget helps manage cash flow and prevent overspending.

- Use budgeting tools like Mint, YNAB, or Excel

- Track fixed and variable costs

- Review annually to reflect inflation and lifestyle changes.

Include emergency funds, healthcare buffers, and discretionary spending in your plan.

Real Estate and Home Equity

- Downsizing: Sell a larger home for a smaller one to free up cash.

- Reverse Mortgages: Access Home Equity While Staying in Your Home (U.S., Canada, Australia)

- Rental Property: Provides regular income but comes with upkeep and tax considerations.

Retirement Abroad: An Alternative Strategy

Retiring in a country with a lower cost of living can stretch your retirement savings.

Popular Retirement Destinations:

- Portugal: Low tax and affordable healthcare

- Thailand: Inexpensive lifestyle and expat communities

- Mexico and Costa Rica: Proximity to the U.S. and lower living costs.

Ensure you understand the laws regarding residency, taxation, and access to medical care.

Family and Legacy Planning

Planning your estate helps you pass on your wealth exactly as you intend.

- Wills and Trusts: Legal tools to distribute assets

- Power of Attorney: Authorizes someone to act on your behalf

- Life Insurance: Provides financial support to dependents

- Gifting Strategy: Reduce taxable estate by gifting assets while alive.

Real-Life Retirement Income Examples

Case 1: Indian Government Employee

- Sources: Pension + EPF + rental income

- Monthly Income: ₹60,000

- Strategy: Income floor for essentials, rental income for discretionary spending.

Case 2: American Couple with $1.2M in Savings

- Sources: Social Security + 401(k) + annuity

- Monthly Income: ~$6,000

- Strategy: Bucket strategy with long-term growth assets.

Global Snapshot of Retirement Readiness

| Country | Avg Retirement Age | Pension Coverage (%) | Avg Monthly Pension |

| USA | 66 | 90% (Social Security) | $1,907 |

| India | 60 | 20% (formal sector) | ₹2,000 – ₹15,000 |

| Germany | 65–67 | 85% | $1,400 |

| Japan | 65 | 100% | ¥55,000–¥160,000 |

| Australia | 66.5 | 100% (Super + Pension) | AUD $1,096/fortnight |

Tools and Resources

- gov: U.S. Social Security estimator

- gov: Retirement planning resources

- NPS Trust India: Manage Indian NPS account

- Budgeting Tools: Mint, YNAB

- Investment Platforms: Vanguard, Fidelity, Zerodha

Final Checklist: Retirement Income Planning

- Start early and invest consistently

- Estimate and update future expenses

- Diversify your income sources

- Factor in taxes and inflation

- Review your plan annually

- Work with a financial advisor if needed.

Final Thoughts

Retirement income planning is about more than saving—it is about creating a strategy that gives you financial independence and peace of mind. By understanding your income sources, risks, taxation, and lifestyle goals, you can build a plan that supports your golden years with confidence.

Whether you are decades away from retirement or already there, it is never too late to refine your plan. Make informed decisions, stay proactive, and enjoy the secure, fulfilling retirement you deserve.

Frequently Asked Questions (FAQs)

Q1. What is the best age to start planning for retirement income?

Answer: It is ideal to start in your 20s or as early as you begin earning. The earlier you start, the more time you have to benefit from compounding interest and build a sizable nest egg. However, it is never too late—starting in your 40s or 50s still allows for effective planning with the right strategies.

Q2. How does early retirement impact your income?

Answer: Retiring early reduces your accumulation period and increases the number of years your savings must last. You may also receive reduced government benefits (like Social Security) if claimed before the full retirement age. Proper planning and increased savings are essential for early retirees.

Q3. Should I keep investing after retirement?

Answer: Yes, but your strategy should shift from growth to preservation and income generation. A mix of income-generating and low-risk investments helps support withdrawals without rapidly depleting the principal.

Q4. Can digital tools help in retirement income planning?

Answer: Absolutely. Tools like robo-advisors, budgeting apps, and online retirement calculators can simplify planning, track expenses, and simulate different retirement scenarios based on your savings, expenses, and market projections.

Recommended Articles

We hope this comprehensive guide to retirement income empowers you to plan confidently for a financially secure future. Explore these recommended articles for deeper insights into pension planning, investment strategies, and retirement budgeting techniques.