Updated July 14, 2023

Definition of Proportional Tax

Proportional tax, sometimes called flat tax, is a tax levied on the consumer or the taxpayer such that the tax rate is constant on the income earned irrespective of changes to the taxable income.

Explanation

The guiding principle behind the proportional tax is the notion of socio-economic equality across the income strata in society by making a change in tax rates absent. This means that all the income groups, from lower to higher and very high, pay the same taxes.

Example of Proportional Tax

Proportional taxes find real-world application in a few parts of the globe. Particularly in the United States, a proportional tax is imposed in Colorado, Pennsylvania, Michigan, and Massachusetts. The United States has, in general, a progressive form of taxation, which has been opposed by many analysts and thinkers, citing reasons for the unjust and inequitable imposition of taxes.

Assume the following 3 tax systems and some cooked-up numbers for the illustration purposes

| Income Tax Rates Under | |||

| Regressive Tax | Proportional Tax | Progressive Tax | Income Interval (annual) |

| 20% | 20% | 10% | $80,000 – $100,000 |

| 20% | 20% | 20% | $100,001 – $120,000 |

| 18% | 20% | 25% | $120,001 – $140,000 |

| 15% | 20% | 30% | $140,001 – $160,000 |

Now just see the income taxes paid under these 3 systems,

| Income Taxes Paid Under | |||

| Regressive Tax | Proportional Tax | Progressive Tax | Income Interval (annual) |

| $16,000 – $20,000 | $16,000 – $20,000 | $8,000 – $10,000 | $80,000 – $100,000 |

| $20,000 – $24,000 | $16,000 – $20,000 | $20,000 – $24,000 | $100,001 – $120,000 |

| $21,600 – $25,200 | $16,000 – $20,000 | $30,000 – $35,000 | $120,001 – $140,000 |

| $21,000 – $24,000 | $16,000 – $20,000 | $42,000 – $48,000 | $140,001 – $160,000 |

Observe that Proportional taxes charge the same amount while Regressive taxes charge lower taxes for higher incomes, and Progressive taxes charge higher taxes for higher incomes.

Proportional Tax Rate

Simply put, a proportional tax is a flat tax where everyone pays the same taxes to the tax collector. In contrast, there is 2 other taxation methods, majorly viz. progressive and regressive tax. In the former, the tax rate increases with taxable income. In the latter, the tax rate decreases with the increase in taxable income.

Considering the two extremes of tax classification, we can say that a proportional tax system has a regressive outlook. This is because a flat tax nature of the proportional tax system charges the poor and the rich equally, thus burdening the poor more.

Two important terms to note are the average and marginal tax rates.

The average tax rate is the ratio of total taxes paid to the total income earned.

The marginal tax rate is measured as the incremental taxes paid on the incremental income.

The following example will illustrate the difference between the two:

If John earns $100,000 and pays $18,000 in taxes, the average tax rate is 18%. If John earns an incremental income of $5,000 and is subject to $1,500 in incremental taxes, the marginal tax rate is 30%.

In essence, the marginal tax rate recognizes how the tax rate impacts the taxpayer to earn incentives (by working more for more income). The average tax rate only gives a measure of how the tax rate has impacted the taxpayer. Applying a marginal tax rate is useless in the proportional tax system as it violates the rule of maintenance of equal tax incidence.

Proportional Tax Graph

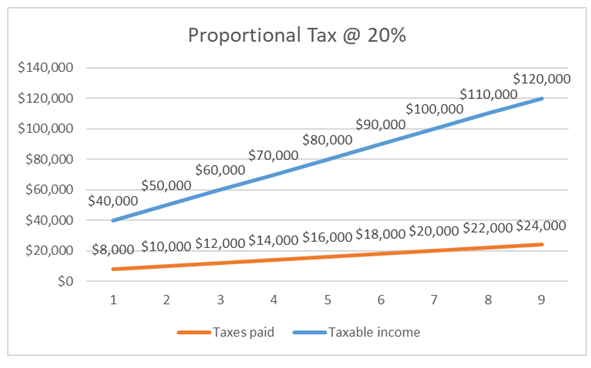

Let us take a small economy with 9 income groups with different incomes each. Below is a graph representing the taxation imposed on this economy and trying to justify how the tax collection is skewed.

| Tax Rate | Taxable Income | Taxes Paid | Income After Tax |

| 20% | $40,000 | $8,000 | $32,000 |

| 20% | $50,000 | $10,000 | $40,000 |

| 20% | $60,000 | $12,000 | $48,000 |

| 20% | $70,000 | $14,000 | $56,000 |

| 20% | $80,000 | $16,000 | $64,000 |

| 20% | $90,000 | $18,000 | $72,000 |

| 20% | $100,000 | $20,000 | $80,000 |

| 20% | $110,000 | $22,000 | $88,000 |

| 20% | $120,000 | $24,000 | $96,000 |

Understanding the Graph

We have assumed a flat tax of 20% applicable for all income groups, 9 groups taken here. Look at the increase in the taxable income represented by the blue line. The taxable income is increasing by $10,000, and the two extremes denote the essence of proportional taxes. The orange line denotes the taxes paid and is calculated as tax rate times taxable income.

The steep increase in the taxable income suggests how the income spread is within the economy. The relatively gradual increase in taxes suggests that tax collection is not as high in the higher-income groups as in the lower-income groups. Remember that the fraction of tax collection is the same at 20% for groups 1 to 9. The amount of taxes collected in absolute terms matters for the tax collector.

If the tax collection needs to be improved, a tax rate based on earnings potential can be imposed so that high-income groups contribute more in absolute terms.

Advantages

Some of the advantages are given below:

- The proportional tax brings the concept of equality into the socio-economic fabric of society.

- A proportional tax is simple to implement, manage and revoke if need be

- It does not incentivize the taxpayers, thereby avoiding any adverse effects such as impacts on work-life, tax evasion, manipulation of taxable income, etc

Disadvantages

Some of the disadvantages are given below:

- As opposed to the notion of equality, the proportional tax system does not take equitable distribution. By imposing a flat tax, the low-income group pays more taxes in absolute terms than the high-income group.

- More often than not, it does not motivate or incentivize the taxpayer or non-taxpaying population of the society to work aggressively to earn more.

- Proportional tax widens the bridge between the rich and the poor as flat taxes take more from the poor and less from the rich.

Conclusion

A proportional tax system essentially follows the rationale of vertical segmentation of the society where all economic classes are subject to the same taxes. In contrast, a horizontal segmentation classifies economic classes based on the economic ability to pay the tax. Thus, most tax systems use a hybrid form where the lower strata are taxed on the ability-to-pay principle while the higher strata are subject to a flat (proportional) tax but above a certain income.

Taxation is a significant tool that helps the world’s governments generate revenue to expend on welfare works, much-needed projects, eliminating poverty, paying its people, etc. However, proportional tax may endanger these goals of the governments, considering the lower taxes that, the richer societies are subject to because of the flat tax. Moreover, a flat tax raises questions that relate to equal inflation and price rise for all income groups, for which activists argue that it becomes unjust to pay a flat tax across different income groups.

Recommended Articles

This is a guide to Proportional Tax. Here we also discuss the definition, example of a proportional tax, and advantages and disadvantages. You may also have a look at the following articles to learn more –