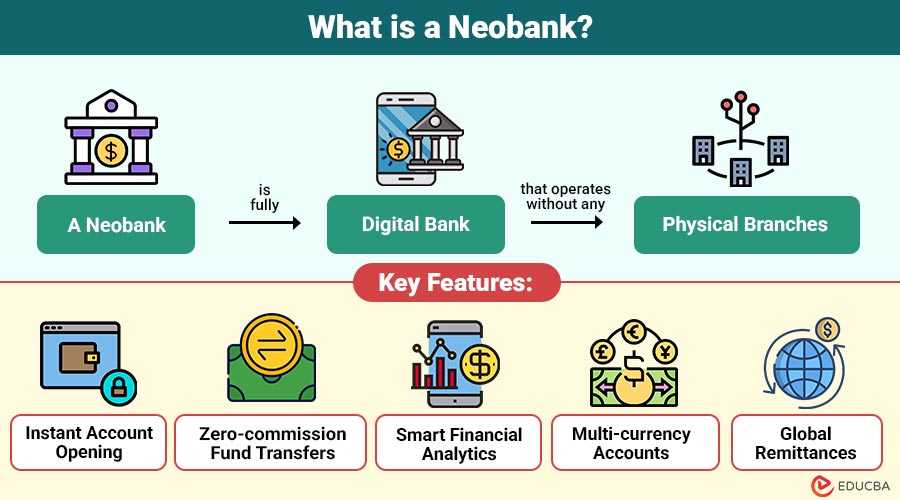

What is a Neobank?

A neobank is fully digital bank that operates without any physical branches. Instead of relying on brick-and-mortar infrastructure, neobanks use mobile apps and web platforms to offer banking services such as:

- Opening a bank account

- Sending and receiving money

- Digital wallets and cards

- Budgeting and financial management tools

- Loans, credit, and investment products (in some regions)

It focuses heavily on UX design, automation, cost efficiency, and real-time services, making them more flexible and user-friendly than conventional banks.

Table of Contents:

- Meaning

- Why Neobank are Becoming Popular?

- Working

- Key Features

- Neobank vs Traditional Bank

- Types

- Use Cases

- Benefits

- Limitations

Key Takeaways:

- Neobanks leverage technology to redefine banking, offering intuitive interfaces, automation, and financial insights for modern users.

- Their digital-first model supports global payments, multi-currency accounts, and seamless international money transfers with low fees.

- Rapid innovation enables it to integrate emerging fintech solutions, including crypto wallets, investment products, and AI-based tools.

- It empowers businesses and freelancers with automated bookkeeping, payroll, and multi-user financial dashboards for efficient operations.

Why Neobanks are Becoming Popular?

Neobanks are surging in popularity because they address common pain points in traditional banking:

1. Digital-first Convenience

It allows users to open accounts instantly, complete KYC digitally, and manage all banking services through mobile apps without visiting physical branches.

2. Lower Fees

Operating without physical branches reduces overhead, enabling neobanks to offer zero-fee accounts, cheaper cards, low FX charges, and affordable international money transfers.

3. Personalized Financial Tools

AI-powered features such as budgeting, expense tracking, smart reminders, analytics, and goal-based savings help users manage their finances efficiently with real-time, personalized insights.

4. Faster Innovation

API-driven fintech architecture lets neobanks update features quickly, integrate new services seamlessly, and deliver modern banking experiences faster than traditional banks.

How Do Neobanks Work?

It operates using a fully digital infrastructure designed to deliver fast, frictionless, low-cost financial services. Here is how they function behind the scenes:

1. Digital Onboarding & e-KYC

Neobanks use paperless onboarding supported by:

- Aadhaar-based verification

- Video KYC

AI identity checks

This eliminates branch visits and speeds up account opening.

2. Cloud-Based Core Banking

Instead of legacy systems, neobanks use cloud-native platforms that enable:

- Real-time transaction processing

- Scalability during peak load

- Rapid feature updates

- Lower operating costs

3. API-Based Banking Architecture

Neobanks integrate with multiple fintech and banking services through APIs:

- Payments gateways

- KYC platforms

- Credit engines

- Partner banks for regulated services

APIs allow instant feature rollout and smooth interoperability.

4. Partner Bank or Licensing Model

Most neobanks (especially in India) don’t hold their own banking license.

They operate on:

- Full-stack model (licensed)

- Partner bank model (unlicensed)

The partner bank handles deposits, compliance, and settlement.

5. AI-Driven Financial Management

AI enhances:

- Spending analytics

- Fraud detection

- Personalized insights

- Automated budgeting

- Risk scoring for loans

6. Secure Digital Payments Infrastructure

Neobanks connect with modern rails like:

- UPI

- IMPS/NEFT/RTGS

- Virtual debit cards

- Tokenized payment

This ensures fast, real-time transactions.

Key Features of Neobanks

Below are the most popular features found across leading neobank platforms:

1. Instant Account Opening

It enables users to open accounts quickly through digital verification, eliminating paperwork and the lengthy in-person onboarding process.

2. Zero-commission Fund Transfers

Users can transfer money instantly without additional fees, making everyday transactions cheaper and more convenient.

3. Smart Financial Analytics

Advanced analytics offer spending insights, categorize expenses, and help users make informed financial decisions using real-time data.

4. Multi-currency Accounts

It support holding multiple currencies in a single account, simplifying international spending and eliminating costly currency conversion fees.

5. Global Remittances

Users can send and receive money internationally quickly with low fees, making cross-border transactions more accessible and affordable.

Neobank vs Traditional Bank

Here is a comparison of key features between neobanks and traditional banks:

| Aspect | Neobank | Traditional Bank |

| Branches | No physical branches | Physical branches |

| Onboarding | Fully digital | Often requires paperwork |

| Services | App-based financial services | In-person + digital |

| Cost | Typically lower fees | Higher maintenance cost |

| Speed | Instant transactions | Sometimes slower |

| Personalization | AI-based insights | Limited personalization |

| Technology | Cloud-native, API-driven | Legacy banking systems |

Types of Neobanks

Neobanks are not all the same. They fall into different categories based on licensing and product models.

1. Full-Stack Neobanks

- Hold their own banking license

- Provide complete banking functions

2. Challenger Banks

- Compete with traditional banks

- Offer improved digital experiences

3. Neobank + Partner Bank Model

- Not licensed directly

- Provide services via a partner bank

4. Business Neobanks

- Specialize in SME banking

- Offer invoicing, expense tracking, and payroll

Use Cases of Neobanks

It delivers value to multiple user groups.

1. For Individuals

- Easy international travel payments

- Better budgeting tools

- Secure and convenient online shopping

- Low-cost remittances

- Instant money transfers

2. For Businesses

- Automated bookkeeping

- Multi-user access

- Invoice generation

- Real-time financial dashboards

- Seamless payroll management

3. For Freelancers

- Earning across global platforms

- Multi-currency wallets

- Simple tax calculation tools

Benefits of Neobanks

Here are the benefits that it offers to individuals, businesses, and freelancers:

1. 24/7 Access

It offers ongoing banking services without the constraints of traditional branches or set hours, enabling users to manage their accounts at any time.

2. Faster Transactions

Instant payments, quicker approvals, and real-time notifications help users complete financial activities efficiently with minimal waiting times involved.

3. More Affordable Banking

Lower operational expenses enable neobanks to provide reduced fees, saving users money on everyday transactions and essential banking services.

4. Personalized Insights

AI tools analyze user spending patterns, offering tailored suggestions that improve budgeting, savings management, and overall financial decision-making.

5. Seamless User Experience

It offers intuitive dashboards, clean interfaces, and smooth navigation, making managing finances simple, convenient, and highly user-friendly.

Limitations of Neobanks

Here are the main limitations:

1. Regulatory Uncertainties

Many countries lack clear regulations for neobanks, creating compliance challenges and limiting their operational freedom significantly.

2. Trust and Adoption

Older customers prefer traditional branch banking, making it harder for fully digital neobanks to gain widespread acceptance.

3. Dependency on Partner Banks

Unlicensed neobanks depend on partner banks for essential banking services, limiting independence and slowing product expansion.

4. Limited Product Range

Compared to major banks, some neobanks offer fewer lending, insurance, and wealth management products overall.

5. Cybersecurity Threats

Digital-only platforms remain vulnerable to sophisticated cyberattacks, requiring strong security measures to protect customer data effectively.

Final Thoughts

Neobanks have transformed modern banking by offering speed, convenience, transparency, and personalization. It will continue to be vital in determining the direction of fintech as customers look for flexible financial solutions and digital adoption picks up speed. Whether you are an individual user, a business owner, or a financial professional, understanding it equips you to take advantage of smarter, more efficient digital financial tools.

Frequently Asked Questions (FAQs)

Q1. Are neobanks safe?

Answer: Yes. Many neobanks partner with licensed banks and are protected by deposit insurance. Fully licensed neobanks are regulated like traditional banks.

Q2. Can I get a loan from a neobank?

Answer: Some offer personal loans, lines of credit, or SME loans, depending on the region and partnerships.

Q3. Do neobanks charge hidden fees?

Answer: Generally, no. They follow transparent pricing models with fewer costs than traditional banks.

Q4. Is a neobank suitable for businesses?

Answer: Yes. Neobanks for businesses provide tools such as invoicing, payment links, payroll, and automated bookkeeping.

Recommended Articles

We hope that this EDUCBA information on “Neobank” was beneficial to you. You can view EDUCBA’s recommended articles for more information.