What Are Liberty Bonds?

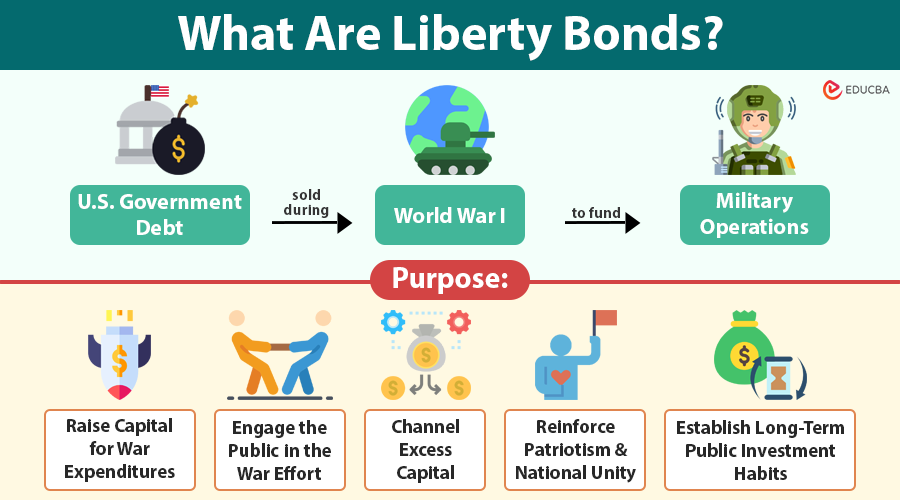

Liberty Bonds were government-issued debt securities introduced during World War I to raise funds from the American public for military operations. Citizens loaned money to the U.S. government with the promise of repayment plus interest after a set period.

These bonds encouraged patriotism and civic involvement, allowing people of all income levels to contribute to the war effort. Rather than focusing on profit, Liberty Bonds were promoted as a national duty to support democracy and freedom.

The program marked the first large-scale use of public debt held by citizens. According to historical estimates, over 20 million Americans bought Liberty Bonds, helping the government raise more than $17 billion to finance the war.

Table of Contents

- What Are Liberty Bonds?

- Historical Context

- Purpose of Liberty Bonds

- Key Features of Liberty Bonds

- Types of Liberty Bonds

- Marketing and Public Campaigns

- Impact of Liberty Bonds

- Challenges and Criticism

- Legacy of Liberty Bonds

Key Takeaways

- Liberty Bonds funded U.S. efforts in World War I and engaged the public in national service through financial contributions.

- Five major drives, including the Victory Loan, offered varying interest rates and maturity periods.

- Emotional appeals, celebrity endorsements, and propaganda fueled one of the most successful public campaigns in U.S. history.

- Introduced millions to investing and normalized public debt held by citizens.

- Strengthened patriotism, volunteerism, and national unity during wartime.

- Set the foundation for future war bonds, U.S. savings bonds, and mass financial participation.

- Some bondholders experienced losses due to inflation or had to sell at discounted prices after the war.

Historical Context

U.S. Entry into World War I

Before 1917, the United States maintained a stance of neutrality in the growing European conflict. However, factors such as the sinking of the Lusitania, German unrestricted submarine warfare, and the Zimmermann Telegram eventually pushed the U.S. to declare war on Germany in April 1917.

Financial Demands of War

War costs a lot. The U.S. had to quickly expand its military, produce weapons, deploy troops, and support allies like Britain and France. The federal budget skyrocketed from $1 billion in 1916 to over $12 billion in 1918.

Raising such vast sums through taxes alone was politically and economically risky. Instead, the U.S. Treasury turned to the American people through bond drives, democratizing war finance and sharing the burden across society.

Purpose of Liberty Bonds

The Liberty Bond program served several strategic, economic, and social purposes that extended far beyond simple fundraising. It became a multifaceted initiative that shaped public sentiment, financial behavior, and national identity during a time of global crisis.

1. Raise Capital for War Expenditures

When the U.S. entered World War I in 1917, it faced enormous financial demands. The government needed to rapidly scale military forces, procure weapons, manufacture ammunition, build ships and aircraft, and provide support to allies.

- Taxation alone could not meet these urgent needs without risking public backlash or economic instability.

- Liberty Bonds allowed the government to quickly access capital without drastically raising taxes.

- The funds raised helped finance major mobilization efforts, including the American Expeditionary Forces (AEF) under General John J. Pershing.

By the end of the war, the bond program had raised over $17 billion, making it the single largest source of wartime funding for the U.S.

2. Engage the Public in the War Effort

The Liberty Bond campaign was not just about raising money—it was about fostering national solidarity. While millions of men fought abroad, the bond program gave those at home an active way to contribute to the war.

- People were encouraged to think of their bond purchases as acts of service.

- Even children could participate by collecting “Thrift Stamps” to trade in for bonds eventually.

- Civic organizations, businesses, and schools took part in rallies and competitions to boost sales.

This level of public engagement helped strengthen morale and made the war a shared responsibility, rather than just a military undertaking.

3. Channel Excess Capital

Wartime economies often face a paradox: increased production capacity combined with reduced consumer spending due to rationing, shortages, or economic uncertainty.

- Without proper financial instruments, this surplus money could lead to inflation, driving up prices of scarce goods.

- Liberty Bonds acted as a monetary stabilizer, encouraging people to save rather than spend, thus reducing inflationary pressures.

- The bond drives also redirected capital from private consumption to government war spending, supporting the broader war effort efficiently.

In essence, the bonds helped the U.S. manage its economy during wartime without triggering fiscal chaos.

4. Reinforce Patriotism and National Unity

The government heavily marketed the Liberty Bond initiative as a patriotic duty. Buying a bond was equated with defending freedom, supporting soldiers, and upholding American values.

- Posters, slogans, and films used emotional appeals to stir national pride and civic obligation.

- People often stigmatized non-participants, viewing those who did not buy bonds as disloyal or un-American.

- The campaign unified diverse groups—urban and rural, rich and poor, men and women—around a common cause.

Through this lens, the Liberty Bond program became a powerful social movement, reinforcing the idea that victory required contributions from every citizen, not just soldiers on the battlefield.

5. Establish Long-Term Public Investment Habits

Although not the initial intent, Liberty Bonds had the added effect of introducing millions of Americans to government securities and the concept of investing.

- It was the first time that many working-class families participated in the financial system.

- The program laid the groundwork for postwar bond programs, such as Victory Bonds and later U.S. Savings Bonds.

This early exposure helped build a culture of saving and public finance participation that endured for generations.

Key Features of Liberty Bonds

| Feature | Description |

| Type | Fixed-interest government bond |

| Issuer | U.S. Department of the Treasury |

| Interest Rate | Ranged from 3.5% to 4.25% (lower than market rates but tied to patriotism) |

| Denominations | Started as low as $50, making them affordable for working-class families |

| Maturity | Most bonds matured in 10–20 years |

| Redemption | Guaranteed return backed by the U.S. government |

| Taxation | Interest was exempt from some federal taxes |

This structure allowed the bonds to be widely accessible—even schoolchildren could save pennies to buy war stamps that converted into bonds.

Types of Liberty Bonds

During World War I, the U.S. government conducted five major bond drives:

1. First Liberty Loan (May 1917)

- Amount Raised: $2 billion

- Interest Rate: 3.5%

- Maturity: 30 years (redeemable after 15 years)

- Target Audience: Large financial institutions and wealthy investors

Banks, corporations, and wealthy individuals primarily supported the first Liberty Loan, which the U.S. government launched shortly after declaring war on Germany in April 1917. It laid the groundwork for future drives but had limited public engagement.

2. Second Liberty Loan (October 1917)

- Amount Raised: $3.8 billion

- Interest Rate: 4%

- Maturity: 25 years (redeemable after 10 years)

- Target Audience: Broader public, especially the middle class

With the success of the first loan, the second drive expanded marketing efforts. Patriotic messaging intensified, and more middle-class Americans were encouraged to invest. The bond was exempt from normal income tax, making it more appealing.

3. Third Liberty Loan (April 1918)

- Amount Raised: $4.2 billion

- Interest Rate: 4.15%

- Maturity: 10 years

As U.S. troops began to see combat in Europe, the third Liberty Loan connected emotionally with the public. The Treasury Department leveraged this growing sentiment, featuring themes like “Fight or Buy Bonds” and “Buy Bonds to Help Stop a Bullet.”

Notable Campaign Tools:

- Celebrity tours (e.g., Charlie Chaplin and Mary Pickford)

- Street parades and school competitions

- Strong use of visual propaganda

4. Fourth Liberty Loan (September 1918)

- Amount Raised: $6 billion

- Interest Rate: 4.25%

- Maturity: 20 years

The fourth and largest wartime bond drive emphasized urgency as the war neared its end. Propaganda focused on sacrifice and loyalty, often pressuring citizens to buy more than one bond. This campaign saw door-to-door sales, extensive newspaper coverage, and even pressure from employers.

Innovations:

- Introduction of sales quotas for cities and states

- Creation of “Honor Rolls” for top contributors

- Community-level bond committees and local accountability

5. Victory Loan (April 1919)

- Amount Raised: Over $4.5 billion

- Interest Rate: 4.75% (highest among all issues)

- Maturity: 4 years

The U.S. government issued the Victory Loan after the armistice in November 1918 to help cover postwar expenses such as soldier pensions, equipment returns, and demobilization. It served as a final call to patriotic duty, now focused on rebuilding and honoring veterans.

- Slogan: “Finish the Job!”

- Tone: Gratitude, remembrance, and continued commitment

Marketing and Public Campaigns

Marketers and government agencies widely recognize the Liberty Bond campaigns as one of the most effective marketing efforts in U.S. history.

- Visual Propaganda: Bold, emotional posters featuring soldiers, Lady Liberty, and national symbols urged citizens to “do their part.”

- Media Blitz: Newspapers, cinema reels, and radio ads flooded the public with appeals to patriotism.

- Celebrity Endorsements: Public figures like Charlie Chaplin, Douglas Fairbanks, and Mary Pickford toured the country to promote bonds.

- Children’s Participation: Programs like “Thrift Stamps” enabled schoolchildren to contribute incrementally.

- Social Pressure: Businesses and communities publicly listed bond purchasers and treated non-buyers as disloyal.

This campaign not only raised funds but fostered a sense of shared sacrifice and civic pride during turbulent times.

Impact of Liberty Bonds

1. Economic Impact

- Over $20 billion raised, equivalent to over $400 billion today.

- Boosted industrial production as funds flowed to defense contracts.

- Provided a low-risk savings option during uncertain times.

2. Financial System Development

- Brought millions of Americans into the world of investment for the first time.

- Increased public trust in the financial stability of the federal government.

- Led to the normalization of public debt and federal bond issuance.

3. Social and Psychological Impact

- Encouraged a culture of saving and thrift.

- Fostered a collective national consciousness.

- Sparked volunteerism and grassroots campaigns that brought communities together.

Challenges and Criticism

Despite the program’s success, Liberty Bonds were not free from controversy:

- Inflation and Returns: Many bonds, by maturity, had lost real value due to wartime and postwar inflation.

- Aggressive Tactics: The government’s use of guilt, propaganda, and social pressure drew criticism from civil liberties groups.

- Market Devaluation: Postwar, some bondholders had to sell at a discount, leading to public dissatisfaction.

Nevertheless, the overarching outcome was positive for both the government and most investors, especially those who held the bonds to maturity.

Legacy of Liberty Bonds

Liberty Bonds left an enduring legacy in both the financial and cultural landscape of the United States:

1. Blueprint for Future War Finance

Victory Bonds in WWII followed the Liberty Bond model, and later, the government used Treasury bonds to finance infrastructure, education, and healthcare.

2. Rise of Mass Investment

For the first time, ordinary Americans—housewives, factory workers, children—became investors in the government, setting the stage for the rise of retail investing in later decades.

3. Government-Citizen Financial Partnership

The Liberty Bond program reshaped the relationship between the state and its citizens, showing that national projects could be citizen-funded with mutual benefit.

Final Thoughts

Liberty Bonds were more than a financial tool—they were a symbol of unity, patriotism, and shared sacrifice during one of the most critical moments in American history. While they presented challenges and sparked debates, their overall contribution to the U.S. war effort and financial culture was immense.

They not only funded victory in World War I but also transformed how governments and citizens think about debt, responsibility, and participation in national causes.

Frequently Asked Questions (FAQs)

Q1. Were Liberty Bonds a good investment financially?

Answer: They were not the most profitable investments, as returns were modest and inflation sometimes eroded their value. However, they were safe and government-backed, and many saw them as a moral rather than financial obligation.

Q2. What is the difference between Liberty Bonds and modern U.S. Savings Bonds?

Answer: The U.S. government issued Liberty Bonds to fund the war and evoke strong emotional and patriotic support from the public. Modern savings bonds are issued regularly to finance public debt and are often part of personal savings or retirement plans.

Q3. Are Liberty Bonds still valuable today?

Answer: Most Liberty Bonds have matured and are no longer redeemable. However, unredeemed ones may have collector value, depending on their condition and rarity.

Recommended Articles

We hope this article gave you a complete understanding of Liberty Bonds and their role in U.S. history. Check out these recommended reads to dive deeper into: