Updated July 13, 2023

Is Dividend Expense?

Dividends are an amount that is distributed by the business from the net income it had earned previously to the shareholders and is therefore not classified as an expense. For taxation purposes also, the dividends cannot be classified as an expense. Dividends are never part of operational expenses and cannot be reported under the cost of goods sold. In this topic we are going to see is dividend expenses?

Why is Dividend Expense?

The business regards dividends as the residual profits from the earnings it had earned in the previous financial year. These profits are distributed in the hand of the investors of the business to make investors retain the business as stakeholders. In better terms, this is regarded as a practice to boost investor confidence in the business. Therefore, for the purpose of both taxes and reporting, the dividends are never classified as expenses.

For taxation purposes, the business regards dividends as redistributing the residual earnings from business operations. Therefore, the business is giving dividends from retained earnings and technology. Such profits cannot be regarded as an expense as they are with the business itself. However, if the business is given the authority to regard the dividends as expenses, it would start writing them off and report near-zero values as profits. This would enable them to bypass the taxation liability and distribute nearly all profits to the shareholders.

To avoid such a case, the business has to retain some profits in its savings account, which could be regarded as retained earnings. They have to maintain and keep accumulating the profits in such an account, which would help them make a surplus. From the surplus, they can start the dividend distribution. The retained earnings account has to be presented in the balance sheet account.

Moreover, operational expenses are defined as expenses that the business bears on a day-to-day business. Similarly, the cost of goods sold is the cost of building the finished goods. Therefore, we cannot classify dividends as operational expenses or costs of goods sold since they are typically distributed once or twice a year. Therefore, they have no relevance in building products or are not borne daily. Moreover, the business can always modify or cancel out the dividend policy, and thus such values may go unreported in the business’s financial statements. The dividends, however, influence the cash flow statement of the business. The dividends, therefore, influence the financing activities of the cash flow statement, which reduces the business’s cash balance. Although they cannot be classified as an expense, they reduce the ending balance of the cash.

Example of Dividend Expense

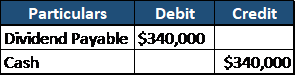

Suppose the business ABC has paid dividends of $340,000 to its shareholders. The business, therefore, would debit the dividend payable account present in the equity account of the business. The corresponding effect would be a credit to the cash account by the $340,000 in the balance sheet, thereby reducing the business’s ending cash balance.

For the above transactions following would be the journal entry: –

Recording of Dividend Expenses

Whenever it declares the dividends to the shareholders, the business generally impacts the cash flow statement. This is because the business has to report dividends under the cash flow statement of the balance sheet under the column of the financing activities. The amount reported under the financing activities then reduces the ending cash balance of the business.

Whenever the business declares dividends, they reduce the balance in the shareholder equity. When declared at the declaration date, the dividends would be a creation in a journal entry. The journal entry would create a debit to the equity account and credit to the dividend payable account. When the dividends are paid out officially on the pay-out date, the dividends will get debited from the dividend payable account. The corresponding journal entry would credit the cash account in the balance sheet.

Therefore, dividends can never be classified as dividend expense because such entries happen at the balance sheet level, and no journal is created on the income statement level. In dividend accounting, the dividend declaration date, dividend date, payment date, and record date are regarded as critical dates. The dividend declaration date is regarded as the date when the board of directors officially declares the net profit value to be declared as dividends. Similarly, the record date is defined as the date when the shareholders are recorded in the book of accounts of the business. Finally, the in-dividend date is the trading day, the final day when the shareholders being part of the business on this specific day are entitled to receive the dividends.

Lastly, the payment date is when the payment is officially disbursed to the rightful and entitled shareholders of the business.

Conclusion

Dividends are residual profits distributed to the shareholders from the retained earnings that the business generates around the year and, therefore, cannot be classified as an expense. Classifying dividends as an expense would allow the business to write them off and report zero profits, potentially evading taxes. The business has to report dividends under the balance sheet’s cash flow statement under the financing activities column. The amount reported under the financing activities then reduces the ending cash balance of the business. Whenever the business declares dividends, they reduce the balance in the shareholder equity. Therefore, dividends can never be classified as dividend expense because such entries happen at the balance sheet level, and no journal is created on the income statement level.

Recommended Articles

This is a guide to Is Dividend Expense? Here we also discuss the introduction and Recording of Dividend Expenses along with examples. You may also have a look at the following articles to learn more –