What Is Immunization in Finance?

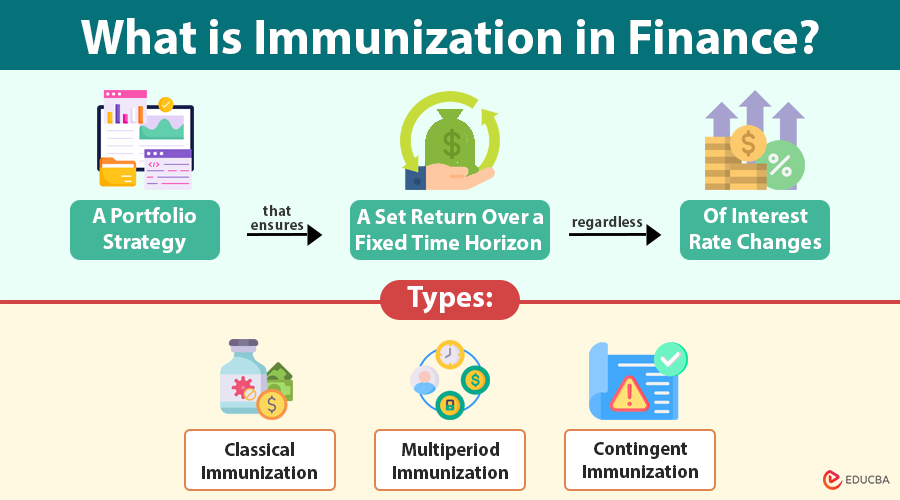

Immunization in finance is a portfolio management strategy designed to guarantee a specific return over a defined time horizon, no matter how interest rates fluctuate. It is most commonly applied to bond portfolios and focuses on aligning the duration of assets with the timing of future liabilities.

For example, suppose an investor in New York knows they will need $50,000 in five years to pay for a child’s college tuition. If they build a bond portfolio with a five-year duration, interest rate movements (up or down) will not affect their ability to reach that $50,000 goal. Even though bond prices and reinvestment returns may fluctuate, the effects will balance out, leaving the investor financially protected through immunization. This approach is widely used in the U.S. by pension funds, insurance companies, and long-term individual investors.

Table of Contents

- Meaning

- Key Risks Protects Against

- The Role of Duration

- Types of Immunization Strategies

- Applications of Immunization in the U.S. Financial System

- Advantages

- Limitations

- Practical Example

- Immunization vs. Other Strategies

Key Risks Immunization Protects Against

Interest rate changes affect bonds in two ways, and immunization tackles both:

1. Price Risk (Capital Loss Risk)

When interest rates rise, existing bonds with lower coupon rates become less attractive, causing their prices to fall.

2. Reinvestment Risk

When interest rates drop, investors must reinvest coupon payments or matured bonds at lower rates, which reduces their income.

Immunization ensures that these two forces cancel each other out. Rising rates hurt prices but boost reinvestment returns, while falling rates help prices but lower reinvestment returns.

The Role of Duration in Immunization

Duration is the core of immunization. It shows how much a bond’s price changes when interest rates move and represents the average time an investor waits to get the bond’s cash flows.

- Key Principle: If the portfolio’s duration equals the investor’s time horizon, the portfolio is immunized.

- Why It Works: At this balance point, the negative effect of interest rate changes on bond prices is offset by the positive effect on reinvested cash flows.

Example:

A U.S. pension fund has to pay $10 million in 12 years. By constructing a bond portfolio with a 12-year duration, the fund ensures that it can meet the liability regardless of interest rate swings.

This is why duration management is considered the “mathematical shield” in bond portfolio construction.

Types of Immunization Strategies

1. Classical (Single-Period) Immunization

- Focuses on one liability due at a fixed date.

- The investor matches the portfolio duration to the liability horizon.

2. Multiperiod (Cash Flow Matching) Immunization

- Investors use it when obligations occur across multiple dates.

- Requires careful construction so that bond maturities and coupons match future payouts.

3. Contingent Immunization

- A flexible strategy combining active management with immunization.

- The manager pursues higher returns actively but switches to immunization if the portfolio falls to a minimum required safety level.

Applications of Immunization in the U.S. Financial System

- Pension funds: Defined-benefit plans, which promise retirees fixed payments, rely heavily on immunization. The strategy ensures that rising or falling rates will not compromise pension checks.

- Insurance companies: Life and health insurers often align their bond portfolios with expected claims. For example, an insurer covering 20-year annuities might immunize its portfolio to match those long-term payouts.

- Endowments and foundations: Universities and non-profits in the U.S. sometimes immunize portions of their portfolios to guarantee funding for scholarships or research commitments.

- Individual investors: High-net-worth individuals nearing retirement may immunize a portion of their portfolio to cover fixed expenses like healthcare or housing, while keeping the rest in growth investments.

Advantages of Immunization

- Predictability: Provides certainty in meeting liabilities, even in volatile interest rate environments.

- Dual protection: Guards against both price and reinvestment risk.

- Institutional value: Vital for pensions, insurers, and retirement accounts that cannot afford shortfalls.

- Flexibility: Variants like contingent immunization allow for active management until protection is necessary.

- Stability during volatility: Especially relevant in the U.S., where Fed policy changes often trigger rapid rate swings.

Limitations of Immunization

- Rebalancing needs: Duration naturally declines as time passes, requiring periodic adjustments to stay immunized.

- Transaction costs: Rebalancing incurs trading fees and spreads, which can erode returns.

- Yield curve risk: Immunization assumes parallel yield curve shifts, but in practice, the curve may twist or steepen, leaving gaps in protection.

- Complexity: Requires expertise in bond mathematics and liability forecasting, which can be difficult for retail investors without guidance.

- Inflation risk: Immunization ensures nominal payments but does not protect against the erosion of purchasing power.

Practical Example: Immunization in Action

A U.S. pension fund has an obligation to pay $100 million to retirees in 10 years. It constructs a bond portfolio worth $100 million with a duration of 10 years.

- If interest rates rise: The bonds lose value, but reinvested coupon payments grow at the higher rates, balancing the shortfall.

- If interest rates fall: The bonds appreciate, but coupons reinvest at lower rates, again balancing out.

In either case, immunization guarantees that the pension fund meets its $100 million obligation.

Immunization vs. Other Strategies

| Strategy | Goal | Best For |

| Immunization | Guarantee liability coverage | Pensions, insurers, retirees |

| Active Bond Mgmt. | Outperform the market | Hedge funds, growth-oriented investors |

| Cash Flow Matching | Perfectly align cash flows with needs | Institutions with fixed payment schedules |

| Buy and Hold | Long-term appreciation & income | Individual investors seeking simplicity |

Final Thoughts

U.S. investors use Immunization as a powerful tool to manage interest rate risk and fulfill financial promises. By aligning portfolio duration with investment horizons, immunization provides a “shield” against uncertainty, allowing pensions, insurers, and individuals to secure their financial futures.

While not without its limitations, the strategy remains indispensable in the environment of fluctuating interest rates and economic uncertainty. For anyone responsible for managing long-term liabilities, mastering immunization is not just about portfolio construction—it is about delivering certainty when it matters most.

Frequently Asked Questions (FAQs)

Q1. Is immunization the same as hedging in finance?

Answer: No. While both strategies aim to reduce risk, immunization specifically addresses interest rate risk in fixed-income portfolios. In contrast, hedging is a broader concept that can involve derivatives, options, or other instruments to protect against various risks such as currency fluctuations, commodity prices, or equity market volatility.

Q2. How often should a portfolio be rebalanced under an immunization strategy?

Answer: Rebalancing frequency depends on factors such as interest rate movements and liability timelines. In practice, many institutional investors review duration alignment quarterly or annually, but more volatile environments may require more frequent adjustments.

Q3. Does immunization protect against inflation risk?

Answer: No. Traditional immunization focuses on nominal cash flows and does not shield investors from the erosion of purchasing power caused by inflation. To address this, investors sometimes incorporate Treasury Inflation-Protected Securities (TIPS) into immunization strategies.

Q4. Can immunization be combined with equity investments?

Answer: Yes. Many investors use immunization to secure essential obligations (such as retirement income or pension payments) while allocating the remainder of their portfolio to equities or alternative assets for growth. This creates a balance between safety and upside potential.

Recommended Articles

We hope this guide on Immunization in finance was helpful. Explore related articles on bond strategies, risk management, and portfolio diversification to strengthen your investment knowledge.