Updated July 13, 2023

What is a Hard Money Loan?

The term “hard money loan” refers to the type of loan secured by real physical property as collateral. These loans are usually issued by non-bank financial companies or private investors who offer short-term bridge financing at relatively high-interest rates. These loans are often used in real estate transactions as a last resort, and their maturity usually falls between one to five years.

For example, hard money loans are often used by property dealers who purchase, renovate, and resell real estate properties within one year or less.

Key Takeaways

Some of the key takeaways of the article are:

- Hard money loans are high-risk and high-interest-rate financing options predominantly used for real estate transactions.

- These loans are usually taken for a short period at a higher cost. The funding time frame is also significantly faster compared to traditional loans.

- In this type of loan, greater importance is given to the collateral rather than the borrowers’ financial position.

- In the case of a default, the lender can still end up with a profitable transaction by foreclosing the property taken as collateral.

How Does Hard Money Loan Work?

Typically, the term of a hard money loan is determined based on the value of the property being used as collateral, while the borrower’s creditworthiness is hardly considered. But the lender usually wants the borrower to have some skin in the game, at least 10% as the down payment. Further, various other credit metrics are considered during the approval, such as home equity, loan-to-value (LTV) ratio, debt-to-income ratio, etc. Once approved, a hard money loan disbursement doesn’t take much time. However, the faster turnaround time comes at a cost, which is a relatively higher interest rate and origination fees.

Example of a Hard Money Loan

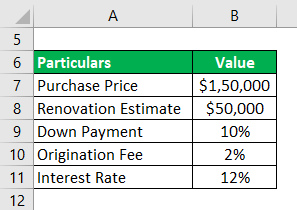

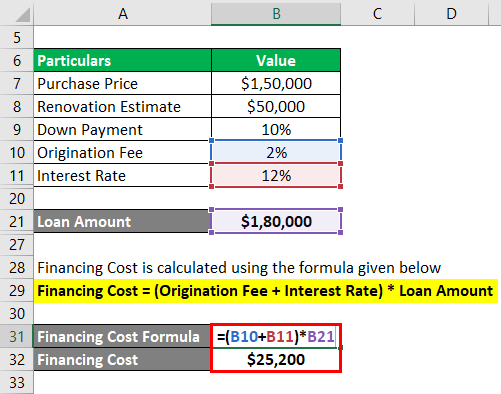

Let us look at the below example of the Hard Money Loan with calculations:

Let us take an example to understand the concept of a hard money loan. Let us assume that David is planning to purchase a fixer-upper for $150,000 with a renovation estimate of $50,000. He decided to make a 10% down payment and fund the rest with a hard money loan for one year. The lender quoted an origination fee of 2% and an interest rate of 12%. Next, determine the LTV ratio of the loan and the total financing cost to be incurred by David.

Solution:

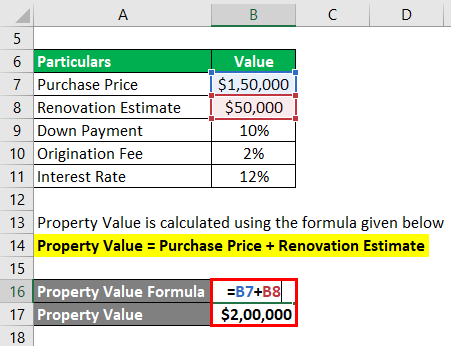

Property Value is calculated using the formula given below

Property Value = Purchase Price + Renovation Estimate

- Property Value = $150,000 + $50,000

- Property Value = $200,000

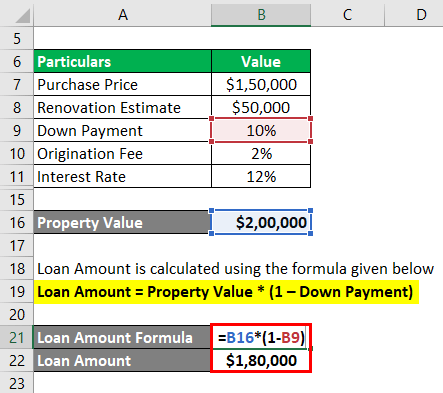

The loan amount is calculated using the formula given below

Loan Amount = Property Value * (1 – Down Payment)

- Loan Amount = $200,000 * (1 – 10%)

- Loan Amount = $180,000

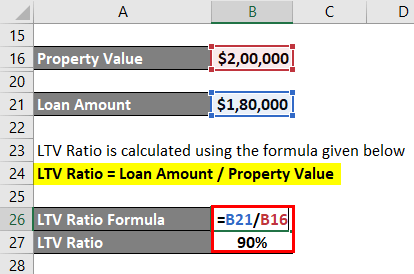

LTV Ratio is calculated using the formula given below

LTV Ratio = Loan Amount / Property Value

- LTV Ratio = $180,000 / $200,000

- LTV Ratio = 90%

The financing Cost is calculated using the formula given below

Financing Cost = (Origination Fee + Interest Rate) * Loan Amount

- Financing Cost = (2% + 12%) * $180,000

- Financing Cost = $25,200

Therefore, the LTV ratio of the loan is 90%, and the financing cost to be incurred by David is $25,200.

The Reputation of Hard Money Loan

Historically, hard money loans have earned a bad reputation among borrowers because several financiers in the past have resorted to predatory lending and lured many borrowers into high-risk, high-interest borrowings. The borrowers had no idea what they had gotten into. The lenders’ ill intention was to offer these real estate-backed loans and eventually foreclose on the properties when the borrowers failed to honor the obligations. Although the Federal Reserve has implemented various regulations to end predatory lending, people still consider these hard money loans with a pinch of salt.

Rates for Hard Money Loan

Typically, a loan approval process involves a review of all background information of the borrower by the lender to determine whether or not the lending can be done with a good sense of comfort. However, in the case of a hard money loan, the lender doesn’t dig into the borrower’s financial background, which means that the lender is taking a higher risk. The risk is offset to a large extent by the collateral that the lender can resell if the borrower fails to make the loan repayments. Nevertheless, since the lender assumes a higher risk, it charges a higher interest rate in the case of a hard money loan. The average interest rate for hard money loans usually falls in the range of 11% to 12%.

Use of Hard Money Loan

Hard money loans are ideal in the following cases:

- Since it focuses on property value, borrowers with lower credit scores can avail of these loans.

- It can be helpful for project finance where funding is needed immediately because these loans disburse faster than traditional loans.

- It is often used by real estate dealers who purchase properties, renovate, and resell them quickly.

Advantages of Hard Money Loan

Some of the significant advantages of a hard money loan are as follows:

- First, it is an easy financing option with less hustle for documentation and legal paperwork.

- The loan approval and disbursal take place at a faster rate.

- Borrowers with lower credit scores can avail of these loans.

Disadvantages of Hard Money Loan

Some of the significant disadvantages of a hard money loan are as follows:

- First, given the higher risk assumed by the lenders, the interest rate and other incidental costs are much higher than the traditional financing options.

- The LTV ratio is maintained relatively lower for the new players, which means many loans are rejected due to lower property value.

Conclusion

So, hard money loans are great financing options for people who don’t qualify for traditional financing due to low credit quality or need immediate funds. But these loans charge higher upfront costs and interest rates in exchange for the higher risk. Hence, the borrowers should evaluate its pros and cons before availing of one.

Recommended Articles

This has been a guide to Hard Money Loan. Here we discuss the definition, working, and example along with a detailed explanation and downloadable Excel template. You can also go through our other suggested articles to learn more –