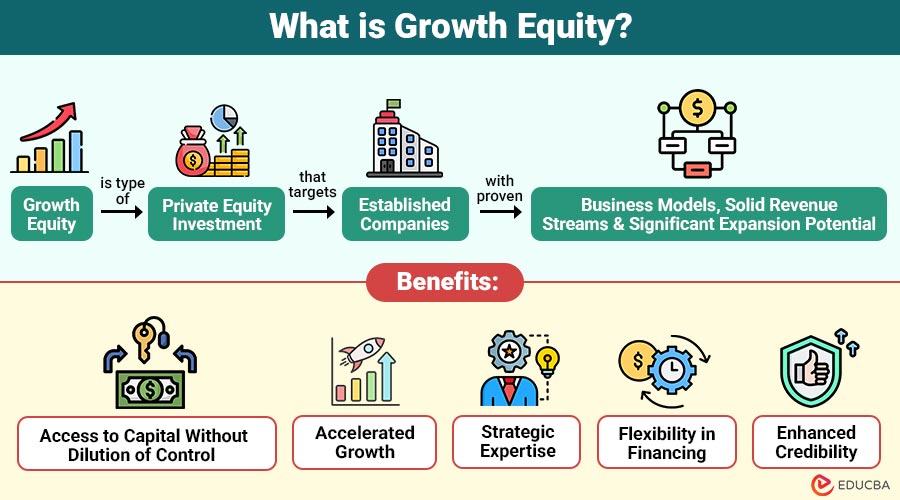

What is Growth Equity?

Growth equity is type of private equity investment that targets established companies with proven business models, solid revenue streams, and significant expansion potential. Unlike venture capital, which focuses on early-stage startups with high risk but high reward potential, growth equity invests in companies that are already profitable or close to profitability.

Typically, growth equity investors provide capital in exchange for minority ownership in the company. This allows business owners to retain control while accessing resources to accelerate growth. The investment can be used for:

- Expanding into new markets or geographies

- Launching new products or services

- Scaling operational infrastructure

- Making strategic acquisitions

Table of Contents:

Key Takeaways:

- Growth equity funds provide minority capital to accelerate expansion without sacrificing founder control and governance.

- It bridges venture capital and buyouts, offering moderate risk, strategic support, and scalable long-term growth opportunities globally.

- Investors contribute expertise, networks, and guidance while expecting strong performance, disciplined execution, and clear exit pathways and timelines.

- Businesses attract growth equity by demonstrating revenue momentum, scalability, transparent finances, capable leadership, and focused strategy execution.

Key Characteristics of Growth Equity

Growth equity investments have distinct characteristics that differentiate them from other types of financing:

1. Minority Stake

Investors generally take a minority position in the company, typically ranging from 10% to 40%. This ensures that founders retain decision-making power.

2. Revenue-Generating Companies

Unlike venture capital, which often targets pre-revenue startups, growth equity focuses on businesses with established revenue streams and a clear path to profitability.

3. Capital for Expansion, Not Survival

Aimed at scaling businesses rather than rescuing struggling ones. The funds are typically used for strategic initiatives rather than covering operating losses.

4. Active Partnership

Investors often provide strategic guidance, industry expertise, and operational support in addition to capital. They may help with marketing strategies, supply chain optimization, and governance improvements.

5. Flexible Exit Timeline

Investments generally have a medium- to long-term horizon, usually between 4 to 7 years, allowing companies time to execute growth strategies before an exit.

Benefits of Growth Equity

It offers several benefits for businesses seeking to expand:

1. Access to Capital Without Dilution of Control

Business owners can secure substantial funding while maintaining operational control, allowing them to make strategic decisions independently.

2. Accelerated Growth

Capital from growth equity can be deployed to scale operations rapidly, enter new markets, or develop new products, giving businesses a competitive edge.

3. Strategic Expertise

Investors often bring industry experience, operational guidance, and network connections that help businesses scale more efficiently.

4. Flexibility in Financing

Unlike debt financing, growth equity does not burden a company with repayment obligations. This reduces financial pressure and allows more freedom to invest in growth initiatives.

5. Enhanced Credibility

Partnering with a reputable growth equity firm can enhance the company’s reputation, attracting top talent, additional investors, and key business partners.

Risks Associated with Growth Equity

While growth equity can be highly beneficial, it is not without risks:

1. Equity Dilution

Minority stakes from growth equity can dilute existing shareholders’ ownership, reducing control and potentially impacting influence over key business decisions.

2. Pressure to Perform

Investors expect significant growth and strong returns, creating pressure on management teams to meet ambitious targets and accelerate business performance.

3. Cultural Clashes

Introducing external investors may lead to conflicts if visions, priorities, or management styles differ, potentially disrupting company culture and teamwork.

4. Market Risk

Expansion efforts may fail if market conditions change or new products underperform, leading to financial losses and stalled business growth.

Real-World Examples

Here are a few well-known companies that used growth equity funding to scale operations while retaining founder control.

1. Spotify

Spotify, the music streaming giant, leveraged growth equity investments during its expansion phase. Investors provided funds to scale globally, enhance technology, and acquire competitors, all while the founders maintained significant control.

2. Airbnb

Before going public, Airbnb secured growth equity funding to support international expansion and platform development. These investments allowed the company to scale operations efficiently and enter new markets rapidly.

3. Casper

Casper, the mattress startup, used growth equity to expand product lines and enter physical retail stores. The infusion of capital enabled faster scaling without relinquishing complete control.

Use Cases for Growth Equity

It is particularly effective in scenarios such as:

1. Geographic Expansion

Supports entering new regions or countries, providing capital and resources to scale operations and capture untapped markets effectively.

2. Product Diversification

Investing in growth equity enables companies to launch complementary or innovative products, expand offerings, and strategically increase revenue streams.

3. Technology Upgrades

Funds can invest in infrastructure, digital platforms, and automation to improve operational efficiency, scalability, and competitiveness in rapidly evolving markets.

4. Strategic Acquisitions

Enables the acquisition of competitors or synergistic companies, strengthening market position, expanding capabilities, and accelerating overall business growth.

5. Talent Acquisition

Companies can leverage growth equity to hire key executives and expand teams, driving growth initiatives, innovation, and organizational effectiveness.

How to Attract Growth Equity?

Companies looking to attract growth equity should consider the following steps:

1. Demonstrate Strong Revenue Growth

Investors seek businesses with a track record of sales growth and strong unit economics.

2. Show Scalability

Businesses must illustrate potential for expansion, including market size, customer demand, and operational scalability.

3. Develop a Clear Strategy

Investors want a clear plan detailing how the capital will be used and the expected ROI.

4. Build a Strong Management Team

Experienced leadership increases investor confidence in the company’s ability to execute growth plans.

5. Maintain Financial Transparency

Accurate financial statements, KPIs, and reporting structures are crucial to secure investment.

Final Thoughts

Growth equity helps established businesses scale efficiently while retaining control. By providing capital, strategic guidance, and expertise, it enables companies to expand, enter new markets, and enhance products. Ideal for growth-stage businesses, it drives sustainable success and long-term value, offering investors attractive high-growth opportunities with moderate risk between early-stage funding and full-scale private equity.

Frequently Asked Questions (FAQs)

Q1. Do growth equity investors take control of the company?

Answer: No, they typically take a minority stake, allowing founders to maintain operational control.

Q2. What industries benefit most from growth equity?

Answer: Technology, healthcare, consumer products, fintech, and SaaS companies are common recipients, but any high-growth sector can benefit.

Q3. Is growth equity suitable for struggling businesses?

Answer: Not usually. Growth equity targets businesses with proven revenue and growth potential rather than turnaround scenarios.

Q4. What is the typical investment size for growth equity?

Answer: Investment size varies widely but generally ranges from $10 million to over $100 million, depending on company size and growth objectives.

Recommended Articles

We hope that this EDUCBA information on “Growth Equity” was beneficial to you. You can view EDUCBA’s recommended articles for more information.