What is Green Finance?

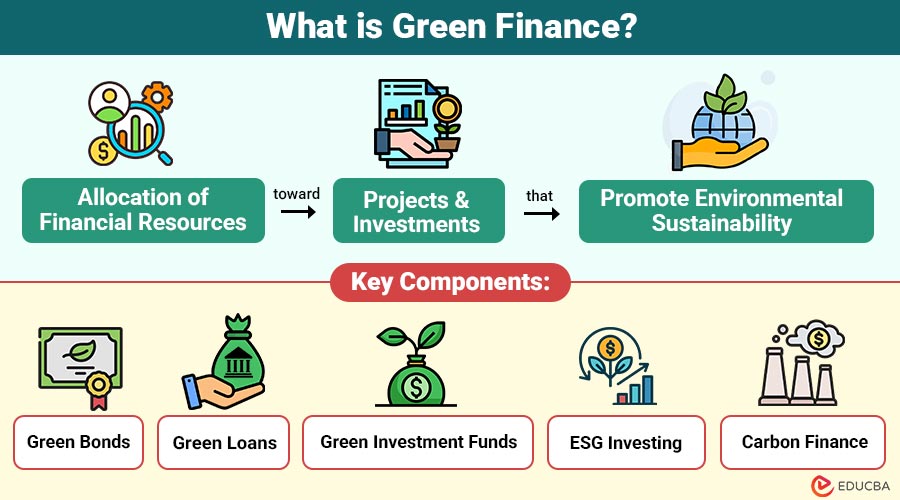

Green finance can be described as the allocation of financial resources such as loans, investments, bonds, or insurance toward projects and investments that promote environmental sustainability.

Green finance involves directing financial resources toward projects, initiatives, or companies that support and advance environmental sustainability. It supports eco-friendly projects, including renewable energy, sustainable farming, energy-efficient infrastructure, and pollution-reduction efforts. Unlike traditional finance, which primarily focuses on financial returns, green finance evaluates both economic benefits and environmental impacts. Its primary aim is to support sustainable development while addressing major environmental issues, including climate change, deforestation, and pollution.

Example:

When a bank provides low-interest loans for installing solar panels or building electric vehicle infrastructure, it is engaging in green finance.

Table of Contents

Key Components of Green Finance

Green finance operates through multiple channels and instruments. Some of the most prominent components include:

1. Green Bonds

Green bonds are fixed-income instruments specifically issued to fund environmentally sustainable projects. Over the past decade, they have seen a significant rise in popularity. For example, the World Bank has issued green bonds to finance renewable energy projects in developing countries, supporting initiatives such as solar power plants in India.

2. Green Loans

These are loans offered to businesses, governments, or individuals to fund projects with positive environmental outcomes. A classic example is providing loans to companies for constructing energy-efficient buildings or installing electric vehicle charging stations.

3. Green Investment Funds

These funds gather capital from investors to finance environmentally responsible companies or projects. For example, BlackRock, one of the largest investment management firms, has launched green investment funds focused on renewable energy, water conservation, and clean technology.

4. Environmental, Social, and Governance (ESG) Investing

While not exclusively a green finance instrument, ESG investing considers environmental, social, and governance criteria alongside other factors when making investment decisions. This encourages companies to adopt sustainable practices, reducing financial risk associated with environmental challenges.

5. Carbon Finance

This mechanism involves trading carbon credits or investing in projects that reduce greenhouse gas emissions. Carbon finance enables companies to offset their carbon footprint by funding renewable energy or reforestation projects.

Fact:

Apple issued a $4.7 billion green bond to support innovations in renewable energy and recycling.

Importance of Green Finance

Green finance is crucial for advancing global environmental and economic objectives. Some of its critical benefits include:

1. Promoting Sustainable Development

By funding renewable energy projects, green infrastructure, and eco-friendly technologies, green finance supports sustainable economic growth. Countries like Germany and Denmark have leveraged green finance to develop their wind and solar energy sectors, creating jobs while simultaneously reducing carbon emissions.

2. Combating Climate Change

Investing in low-carbon technologies and energy-efficient projects helps mitigate the adverse effects of climate change. Green finance ensures that capital flows support projects that reduce greenhouse gas emissions.

3. Risk Management

Environmental risks, such as floods, hurricanes, or resource scarcity, can have significant financial impacts. Green finance motivates businesses to implement sustainable practices, reducing long-term environmental and financial risks.

4. Enhancing Corporate Reputation

Companies adopting green financing strategies often gain a competitive edge. Consumers and investors are increasingly preferring businesses committed to environmental responsibility, which boosts brand value and investor confidence.

Fact:

In May 2021, the IFC partnered with Brazil to support climate-friendly projects, particularly in the energy sector, by providing Sicredi with a green loan of up to $120 million.

Challenges in Green Finance

Despite its potential, it faces several challenges:

- Lack of Standardization: The definition of “green” can vary across regions, resulting in inconsistencies in the classification of green bonds and loans.

- High Initial Costs: Green projects, particularly those in renewable energy and sustainable infrastructure, often require substantial upfront investment.

- Limited Awareness: Many investors and companies still lack adequate knowledge about green finance opportunities.

- Regulatory Hurdles: Different countries have varying regulations, which can complicate cross-border green investments.

Global Examples

Here are some notable initiatives from around the world that demonstrate the impact and scope of green finance:

- European Union Green Deal: The EU has committed billions in green finance to transition toward a climate-neutral economy by 2050. This covers investments in renewable energy, sustainable transportation, and energy-efficient infrastructure.

- China’s Green Credit Policy: China has implemented green credit policies to encourage banks to lend to environmentally friendly projects. This has led to a surge in investments in solar and wind energy across the nation.

- World Bank Green Bonds: Since 2008, the World Bank has issued billions of dollars in green bonds, financing projects that provide clean water, renewable energy, and sustainable transport solutions globally.

- India’s Renewable Energy Funding: India has leveraged green finance tools, such as green bonds and loans, to grow its solar and wind energy capacity, supporting the government’s goal of achieving 500 GW of renewable energy by 2030.

The Future of Green Finance

Key trends shaping the future include:

- Integration with Digital Finance: Fintech solutions will streamline green investments, allowing greater transparency and traceability.

- Stronger ESG Regulations: Governments will enforce stricter environmental reporting standards, encouraging more companies to seek green financing.

- Increased Private Sector Participation: Corporations and institutional investors will play a significant role in funding large-scale sustainable projects.

Fact:

According to the UN, $5–7 trillion annually is needed by 2030 to achieve climate goals highlighting the massive potential of green finance.

Final Thoughts

Green finance is more than just a financial strategy it is a catalyst for sustainable development and environmental stewardship. By directing capital toward environmentally responsible projects, it helps combat climate change, fosters economic growth, and encourages businesses to adopt sustainable practices.

With growing global awareness and increasing regulatory support, green finance will become a cornerstone of the future economy. For businesses, investors, and policymakers, embracing green finance is not just a moral imperative it is a strategic advantage that drives long-term value while protecting the planet.

Recommended Articles

Check out these recommended articles for more insights and tips to grow your eco-friendly investment portfolio.