What is Fractional Ownership?

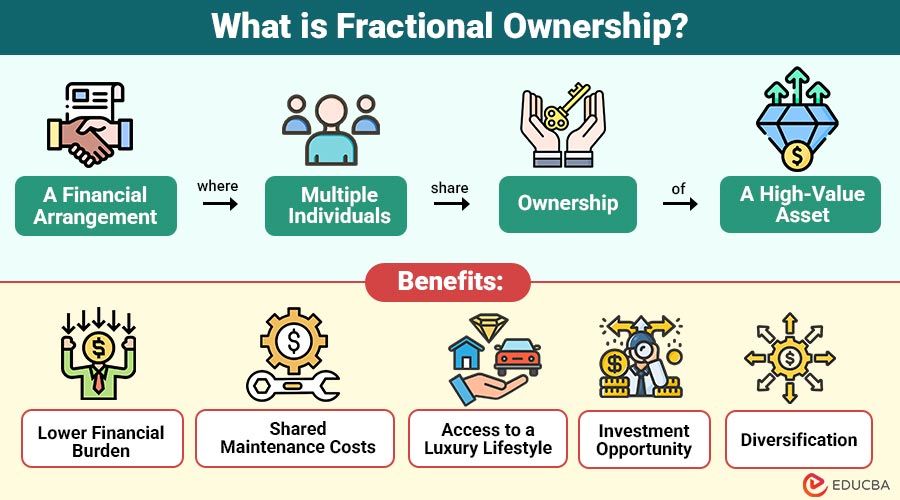

Fractional ownership is a financial arrangement where multiple individuals share ownership of a high-value asset. Instead of one person bearing the full cost, the asset is divided into smaller “fractions” or shares, and each investor owns a part of it.

Think of it like a group of friends buying a pizza together. Each person pays for a few slices and enjoys their share, instead of one person paying for the whole pizza.

In this article, we will explain fractional ownership in detail, demonstrate how it works, discuss its benefits and risks, and provide examples to clarify the concept.

Table of Contents

- What is Fractional Ownership?

- Popular Sectors Using Fractional Ownership

- How Does Fractional Ownership Work?

- Real-World Examples

- Benefits of Fractional Ownership

- Risks and Challenges

- Fractional Ownership vs. Timeshares

- Who Should Consider Fractional Ownership?

- Tips for Beginners

Popular Sectors Using Fractional Ownership

Fractional ownership is not limited to one type of asset. It is growing across multiple sectors:

- Real Estate: This is the most common use. Buyers invest in holiday homes, resorts, or luxury apartments. Platforms like Pacaso in the U.S. and Myles in India make this possible.

- Private Jets and Yachts: Private aviation companies allow multiple individuals to share ownership of an aircraft. Owners get flight hours based on their share, making private travel affordable.

- Art and Collectibles: Investors now share ownership of high-value artworks and collectibles. Platforms like Masterworks allow investors to own fractions of famous paintings.

- Luxury Cars: Collectors often buy shares in vintage or exotic cars, enabling them to access the car occasionally while also benefiting from its appreciation.

- Digital Assets: In the world of blockchain, fractional ownership is possible through NFTs and tokenized real estate. Investors can buy fractions of digital art or virtual land.

How Does Fractional Ownership Work?

Fractional ownership typically operates through a management company that oversees the ownership structure, schedules usage, and handles maintenance. Here is a step-by-step breakdown:

- Asset Purchase: The management company buys or develops a high-value asset (like a villa or private jet).

- Division into Shares: The asset is split into fractions, often ranging from 1/8th to 1/16th shares, making it affordable for multiple investors.

- Legal Framework: Each buyer receives ownership documents, such as a share certificate, or has their share registered under a special purpose company or trust.

- Usage Allocation: The owners establish a schedule that determines when each person can use the asset. For example, one owner might use a holiday home during the summer, while another prefers winter.

- Maintenance & Management: The management company handles repairs, cleaning, taxes, and bookings. The owners share the costs among themselves.

- Exit Options: Owners can sell their shares at market value, just like selling stock or property.

Real-World Examples

To make the concept clearer, let us look at real-world scenarios:

- Real Estate: A group of investors pools funds to buy a beach villa worth $2 million. Each person pays $200,000 for a 10% share. Every year, they each get about 5 weeks to stay at the property and also share any rental income when the villa is not in use.

- Private Jets: Companies like NetJets enable individuals to purchase shares in private aircraft. If you own a 1/16th share, you receive approximately 50 hours of flying time per year, eliminating the need to worry about maintenance or storage.

- Yachts: Instead of buying a yacht outright for millions, a group of owners purchases shares. Each gets a set number of sailing weeks, while a company maintains the vessel.

- Art & Collectibles: Platforms like Masterworks let investors buy fractions of valuable artworks, enabling them to invest in Picasso or Banksy pieces without needing millions of dollars.

Benefits of Fractional Ownership

Fractional ownership is gaining popularity because it offers numerous advantages:

- Lower Financial Burden: Instead of paying millions for full ownership, investors pay only for the portion they own. This makes luxury assets accessible to middle-income investors.

- Shared Maintenance Costs: Owning a villa or a yacht involves ongoing expenses. With fractional ownership, costs such as repairs, insurance, and management are split among co-owners.

- Access to a Luxury Lifestyle: It allows people to enjoy high-end experiences—such as vacationing in prime properties, flying private, or sailing on yachts—without the need to purchase the entire asset.

- Investment Opportunity: Fractional ownership can generate income. For example, when owners are not using a vacation home, they can rent it out and divide the profits.

- Diversification: Instead of investing all money into one asset, investors can buy smaller shares in multiple assets, spreading risk.

Risks and Challenges

While attractive, fractional ownership also comes with challenges that beginners should consider:

- Limited Control: Since the asset is shared, decisions like when to sell or how to use it require agreement among all owners.

- Resale Difficulties: Selling your share may not be as easy as selling the entire asset. The resale market for fractional ownership can sometimes be limited.

- Usage Conflicts: Owners may want to use the property or asset during the same peak periods, leading to scheduling conflicts.

- Ongoing Costs: Although costs are shared, owners still need to contribute regularly. If one owner defaults, others may need to cover the shortfall.

- Market Risks: Like any investment, the value of the asset may rise or fall. Real estate or collectibles can depreciate, affecting returns.

Fractional Ownership vs. Timeshares

It is important to understand the difference between the two:

| Feature | Fractional Ownership | Timeshare |

| Ownership Rights | Actual share of the asset | Right to use, no ownership |

| Value Appreciation | Benefits from the asset value increase | No benefit from appreciation |

| Flexibility | Can rent or sell ownership shares | Limited, usually no resale value |

| Usage Rights | Proportional ownership, more flexible | Fixed weeks each year |

| Example | Buying 1/8 of a vacation villa | Booking 2 weeks every year in the same villa |

Who Should Consider Fractional Ownership?

Fractional ownership is a great option for:

- Frequent Travelers: Those who want a vacation property without full-time costs.

- Luxury Enthusiasts: People who love cars, jets, or yachts but do not want to own them entirely.

- Investors: Those seeking to diversify their portfolio into real estate, art, or collectibles with lower capital requirements.

- Busy Professionals: Those who want access to luxury assets but do not want the hassle of full management.

Tips for Beginners

If you are new to the concept, here are some practical tips:

- Do Your Research: Understand the asset, its potential value, and risks.

- Check Legal Agreements: Ensure the contracts clearly explain your rights and responsibilities.

- Know the Costs: Apart from buying a share, be prepared for annual fees, maintenance costs, and management charges.

- Think Long-Term: Fractional ownership works best when you plan to use or hold the asset for several years.

- Choose Reputable Platforms: Whether it is real estate or collectibles, select trustworthy companies that handle management transparently.

Final Thoughts

Fractional ownership is reshaping the way people invest in and enjoy premium assets. By sharing ownership, costs, and responsibilities, multiple individuals can benefit from assets that might otherwise be financially out of reach. While it comes with considerations such as usage schedules and shared decision-making, the advantages—affordability, access to luxury, and potential income—make it an attractive option for many. Whether you are interested in vacation homes, private jets, yachts, or rare collectibles, understanding fractional ownership can open doors to smart, shared investments and a lifestyle that might have seemed unattainable otherwise.

Recommended Articles

We hope this detailed guide to fractional ownership helps you understand how shared investments work and the opportunities they offer. Check out these recommended articles for more insights and strategies to make informed investment decisions.