What is Fitch Ratings?

Fitch Ratings, a subsidiary of the Fitch Group (majority-owned by Hearst Corporation), is a globally recognized company that provides independent assessments of creditworthiness. Its core function is to evaluate the ability and willingness of an entity, such as a corporation, financial institution, structured finance product, or government (sovereign), to meet its financial obligations fully and on time.

The Fitch ratings it assigns are not investment recommendations; instead, they serve as a standardized measure of credit risk. This risk assessment helps investors gauge the likelihood of an issuer defaulting on its debt instruments, such as bonds.

Table of Contents

- What is Fitch Ratings?

- Types of Fitch Ratings

- The Fitch Rating Scale

- The Rating Process and Methodology

- Fitch vs. The Competition

- The Significance and Influence of Fitch Ratings

- Criticisms of Fitch Ratings

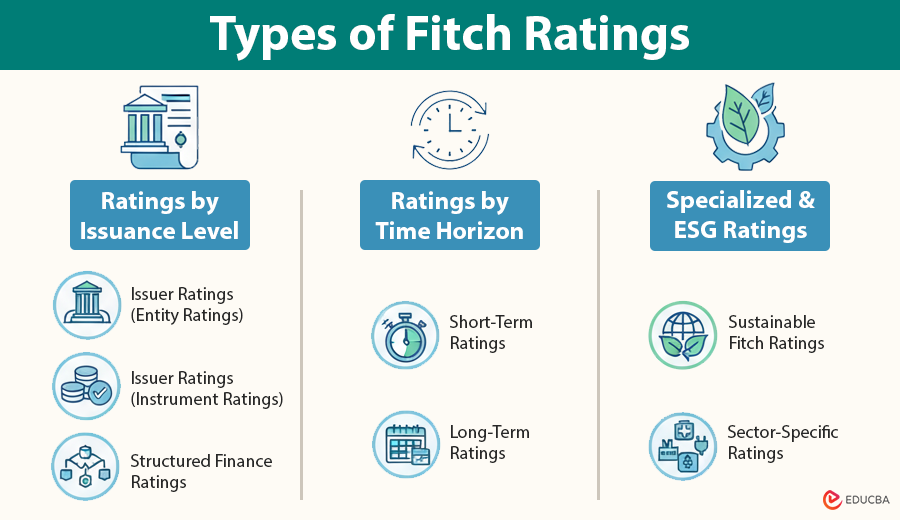

Types of Fitch Ratings

Fitch Ratings covers a wide array of financial instruments and issuers, categorizing its assessments primarily based on the issuance level and the time horizon of the debt obligation.

1. Ratings by Issuance Level

These categories define whether the rating applies to the overall financial health of an entity or to a specific debt product.

- Issuer ratings (entity ratings): This is the core assessment of an entity’s overall creditworthiness. It assesses the fundamental capacity of a corporation, financial institution, or sovereign government (e.g., the USA, India, or Brazil) to fulfill all its financial obligations promptly.

- Issue ratings (instrument ratings): The agency assigns this rating to a specific financial instrument, such as a bond, note, or loan. It indicates the likelihood of timely repayment for that particular security and often considers the structure of the debt relative to other obligations of the same issuer.

- Structured finance ratings: This specialized category evaluates complex financial products that derive repayment from the cash flows of a dedicated pool of underlying assets, rather than the general credit of the issuing entity. Examples include Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS), and Collateralized Debt Obligations (CDOs).

2. Ratings by Time Horizon

Rating agencies evaluate debt based on how long the issuer needs to stay solvent and maintain liquidity.

- Short-term ratings: These ratings assess a borrower’s ability to meet obligations within a short time horizon, typically defined as less than 12 months. They help investors assess the immediate liquidity and near-term default risk of the issuer, using a distinct scale (e.g., ‘F1’ for the best quality).

- Long-term ratings: This is the most common and widely cited rating, assessing obligations with maturities exceeding one year. Investors use them to assess the issuer’s long-term solvency and financial health, applying them to corporate bonds, long-term loans, and government debt. The scale ranges from ‘AAA’ (Highest Quality) down to ‘D’ (Default).

3. Specialized and ESG Ratings

Reflecting the evolving landscape of global finance, Fitch also offers specialized assessments:

- Sustainable fitch ratings: These are independent assessments focused on Environmental, Social, and Governance (ESG) performance. They provide investors with a view of an entity’s commitment to sustainability and the impact of its business activities, operating separately from the traditional credit rating to help manage non-financial risk.

- Sector-specific ratings: Fitch provides highly specialized analysis and ratings for distinct sectors, such as insurance, utilities, and project finance, utilizing methodologies tailored to the unique regulatory and operational risks inherent in those industries.

The Fitch Rating Scale

Fitch uses a letter-based rating system to classify the credit quality of long-term and short-term debt obligations. These fitch ratings are universally accepted and are critical for determining the cost of borrowing for issuers and the required yield for investors.

1. Long-Term Credit Rating Scale

The long-term scale ranges from the highest quality, ‘AAA’, down to ‘D’, indicating an entity is in default. Fitch categorizes this scale into two primary categories: Investment Grade and Speculative Grade (also referred to as Non-Investment Grade). Modifiers like ‘+’ and ‘-‘ are used for fitch ratings between ‘AA’ and ‘CCC’ to denote relative standing within the major category.

| Rating | Description | Category |

| AAA | Highest credit quality, lowest expectation of default risk. | Investment Grade |

| AA | Very high credit quality, very low default risk. | Investment Grade |

| A | High credit quality, low default risk, but somewhat more vulnerable to adverse business or economic factors. | Investment Grade |

| BBB | Good credit quality, low expectation of default. Vulnerability to adverse conditions is higher than higher-rated categories. | Investment Grade |

| BB | Elevated vulnerability to default risk, particularly in the event of adverse business or economic conditions. Highly speculative. | Speculative Grade |

| B | Material credit risk; capacity for financial commitments is limited. Highly speculative. | Speculative Grade |

| CCC | Substantial credit risk. Default is a real possibility. | Speculative Grade |

| CC | Very high level of credit risk. Default is highly probable. | Speculative Grade |

| C | Default or default-like process has begun (e.g., bankruptcy petition filed). | Speculative Grade |

| D | Default. Issuer has formally defaulted on a material financial obligation. | Default |

2. Short-Term Credit Rating Scale

This scale assesses the capacity to make timely payments on short-term financial commitments, typically those due within 12 months.

| Rating | Description |

| F1 | Strongest intrinsic capacity for timely payment. A ‘+’ modifier indicates an exceptionally strong credit feature. |

| F2 | Good intrinsic capacity for timely payment. |

| F3 | Adequate capacity for timely payment, but more susceptible to near-term adverse changes. |

| B | Minimal capacity for timely payment; heightened vulnerability to adverse changes. |

| C | Default is a real possibility. |

| D | Default. |

The Rating Process and Methodology

Fitch’s ratings are the product of a rigorous, multi-step process that combines quantitative financial analysis with qualitative judgment, all overseen by an independent rating committee.

1. The Analyst Team

The process begins when an entity (the issuer) or a transaction arranger requests a rating (the issuer-pay model), though Fitch may also initiate unsolicited ratings. An analytical team is assigned to conduct an in-depth review.

2. Quantitative and Qualitative Analysis

Analysts use specific, published criteria and methodologies relevant to the sector (e.g., corporates, banks, sovereigns).

- Quantitative factors: Financial statements analysis, debt structure, cash flow projections, leverage ratios, and sensitivity to interest rate and currency fluctuations.

- Qualitative factors: Industry dynamics, competitive position, quality of management, regulatory environment, and macroeconomic factors (e.g., political stability for sovereign ratings).

Fitch also incorporates ESG (Environmental, Social, and Governance) factors into its credit analysis, utilizing ESG Relevance Scores to demonstrate the impact of these factors on an entity’s creditworthiness.

3. The Rating Committee

The analytical team presents its findings and a rating recommendation to an independent Rating Committee. This committee, composed of experienced analysts, discusses and votes on the final rating. This committee-based approach ensures objectivity and consistency across ratings.

4. Monitoring and Surveillance

After assigning a rating, the agency monitors the issuer’s performance and market developments to ensure the rating remains accurate and up-to-date. This surveillance can lead to three key actions:

- Rating change: An upgrade or downgrade if creditworthiness has fundamentally shifted.

- Rating outlook: Shows the likely trend of a rating over the next 12–24 months: Positive, Negative, or Stable.

- Rating watch: Shows a higher chance of the rating changing soon (Positive, Negative, or Evolving).

Fitch vs. S&P vs. Moody’s

Fitch is an integral part of the “Big Three,” and while their fundamental role is the same, there are differences in their rating scales and, at times, their methodologies.

| Feature | Fitch Ratings | S&P Global Ratings | Moody’s Investors Service |

| Highest Rating | AAA | AAA | Aaa |

| Rating Notches | Uses ‘+’ and ‘-‘ modifiers (e.g., A+, A, A-). | Uses ‘+’ and ‘-‘ modifiers (e.g., A+, A, A-). | Uses numerical modifiers (1, 2, 3) where 1 is highest (e.g., A1, A2, A3). |

| Methodological Focus | Typically views ratings through-the-cycle, prioritizing long-term stability. | Generally viewed as focusing on the probability of default. | Focuses on expected loss, incorporating both probability of default and expected loss given default (recovery rate). |

| Investment Grade | AAA to BBB- | AAA to BBB- | Aaa to Baa3 |

The Significance and Influence of Fitch Ratings

Credit ratings from Fitch have a profound impact on global financial markets:

1. Investment Decisions

Fitch ratings play a key role in the research process for institutional investors such as pension funds and insurance companies. Many of them can only invest in debt that has an Investment Grade rating, such as BBB- or higher.

2. Cost of Capital

A higher credit rating directly translates into a lower borrowing cost for the issuer. A favorable Fitch rating reduces the perceived risk associated with a bond or loan, enabling the issuer to offer a lower interest rate (yield) and attract investors.

3. Regulatory Compliance

Credit ratings are often embedded in national and international regulatory frameworks (like the Basel Accords for banks). Regulators use fitch ratings to establish minimum capital requirements for financial institutions that hold certain debt securities.

4. Market Access

For developing nations and smaller corporations, securing an investment-grade rating from a globally recognized agency, such as Fitch, is crucial for accessing international capital markets and attracting foreign direct investment.

Criticisms of Fitch Ratings

This section is crucial for a balanced view, as it addresses the fundamental conflicts of interest inherent to the industry and the pivotal role of CRAs in global financial crises.

1. The “Issuer-Pay” Model and Conflict of Interest

- Conflict explained: The issuer pays Fitch for the rating service, rather than the investor who relies on the rating.

- Incentive bias: This model creates an incentive for the CRA to assign a higher rating to secure or retain lucrative business, a practice known as “ratings shopping,” where issuers play the “Big Three” off one another.

- Historical context: Note that this model replaced the older “investor-pay” model in the 1970s to combat the “free-rider” problem (ratings being photocopied and shared).

2. Role in the 2008 Financial Crisis

- Catastrophic failure: Explain that Fitch, along with Moody’s and S&P, assigned high investment-grade ratings (often ‘AAA’) to complex, illiquid structured finance products like Collateralized Debt Obligations (CDOs) and Residential Mortgage-Backed Securities (RMBS).

- Core problems: The analysts failed to conduct proper due diligence, relied excessively on data from issuers, and employed weak models that overlooked the declining underwriting standards and risks associated with the housing market bubble. The lucrative nature of this structured finance business led to a prioritization of market share over rating accuracy.

3. Post-Crisis Regulatory Reforms

- Dodd-Frank Act (U.S.): Mention that the crisis led to significant regulatory scrutiny and reforms aimed at increasing transparency and reducing the excessive reliance on CRA ratings for regulatory purposes.

- NRSRO designation: Briefly reference the designation of Nationally Recognized Statistical Rating Organizations (NRSROs) by the SEC, which sets the regulatory standard for the agencies.

Final Thoughts

Fitch Ratings remains a cornerstone of the global credit rating system. By providing reliable, transparent, and structured assessments of creditworthiness, it empowers investors, issuers, and financial institutions to make informed decisions. Understanding Fitch Ratings enables individuals and businesses to navigate the complex world of finance, manage risk effectively, and capitalize on investment opportunities.

Frequently Asked Questions (FAQs)

Q1. Are Fitch Ratings always accurate?

Answer: While Fitch Ratings are widely respected, they are still opinions rather than guarantees. Their accuracy depends on the availability of data, models, and assumptions. Rating agencies adjust ratings when market shocks or sudden economic events occur that they did not initially anticipate.

Q2. Can individuals access Fitch Ratings reports?

Answer: Yes. While detailed reports may require a paid subscription, Fitch provides free access to certain ratings, press releases, and summaries on its official website. This lets both institutional and retail investors access key information.

Q3. Does political pressure influence Fitch Ratings?

Answer: Fitch maintains strict governance practices and independence policies to minimize political influence. However, like all rating agencies, it may face scrutiny when downgrades or upgrades carry geopolitical implications.

Q4. What happens if an issuer refuses to be rated by Fitch?

Answer: Issuers can choose not to seek a Fitch rating. However, Fitch also issues unsolicited ratings based on publicly available data if it believes the information is relevant to the market.

Q5. How transparent is Fitch’s rating methodology?

Answer: Fitch publishes detailed methodologies for each sector on its website, including criteria documents that outline the models, ratios, and qualitative factors used in assigning ratings.

Recommended Articles

We hope this detailed guide on Fitch Ratings helped you understand their role in assessing credit risk and shaping global financial markets. Explore our related articles on: