What is Fintech?

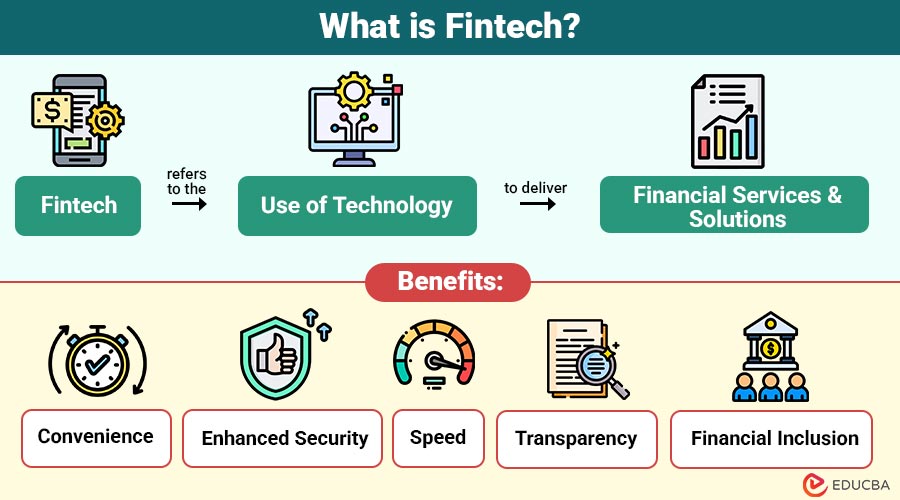

Fintech broadly refers to the use of the technology to deliver financial services and solutions. It blends finance and innovation, leveraging software, algorithms, artificial intelligence, and big data to simplify operations, reduce costs, and improve customer experiences.

Historically, financial services relied heavily on physical infrastructure, manual processes, and intermediaries. Fintech eliminates many traditional barriers by enabling digital payments, online lending, investment platforms, and blockchain-based services.

Table of Contents:

Key Takeaways:

- Fintech integrates technology with finance, creating innovative solutions that enhance efficiency, accessibility, and user convenience globally.

- Digital financial platforms empower underserved populations, offering instant payments, loans, investments, and improved economic participation worldwide.

- Blockchain, AI, and automation transform financial services, enabling secure transactions, personalized advice, and reduced operational costs.

- Future fintech growth relies on sustainable finance, embedded services, regulatory clarity, and the adoption of advanced technologies.

Importance of Fintech

Fintech is no longer optional—it has become essential for modern financial ecosystems. Its significance can be summarized as follows:

1. Accessibility

By offering financial services to underprivileged groups, fintech improves accessibility and closes the gap between traditional banking and the world’s unbanked.

2. Efficiency

Fintech enhances efficiency by automating financial processes, reducing operational costs, accelerating transaction speeds, and minimizing errors caused by human intervention.

3. Personalization

AI-powered fintech tools analyze customer data to deliver highly personalized financial advice, services, and product recommendations tailored to individual needs.

4. Innovation

Fintech drives innovation by creating new financial products and platforms that improve convenience, security, transparency, and overall user experience for consumers.

5. Global Reach

Digital fintech platforms enable cross-border payments, international investments, and global financial inclusion, making financial services accessible to users worldwide seamlessly.

Types of Fintech

Fintech can be classified into several categories based on function and target audience:

1. Payments & Transfers

Focuses on facilitating digital transactions, online payments, and fund transfers between individuals or businesses.

2. Digital Banking

Provides full banking services online without physical branches, including accounts, debit cards, and money management tools.

3. Lending & Financing

Enables digital loans, crowdfunding, and automated credit evaluations for individuals and businesses.

4. Investment & Wealth Management

Offers automated investment solutions such as robo-advisors, trading platforms, and micro-investments.

5. InsurTech

Uses technology to improve insurance processes, including policy management, claims processing, and risk assessment.

6. Blockchain & Cryptocurrency

Focuses on decentralized finance, cryptocurrencies, and blockchain-based smart contracts.

7. RegTech

Provides solutions for regulatory compliance, risk management, and fraud detection in financial institutions.

Benefits of Fintech

The rise of fintech brings multiple advantages to both users and financial institutions:

1. Convenience

Fintech allows users to access banking services, pay bills, transfer money, and invest directly from smartphones anytime, anywhere, efficiently.

2. Enhanced Security

Fintech successfully protects user data and transactions from cyber risks by utilizing encryption, multi-factor authentication, and sophisticated monitoring.

3. Speed

Financial transactions, including payments, transfers, and investments, are processed instantly or within hours, eliminating traditional delays and waiting times.

4. Transparency

Digital records, blockchain, and automated reporting ensure clear, verifiable, and immutable transaction histories for users and institutions.

5. Financial Inclusion

Fintech provides essential financial services to underserved populations, remote areas, and underbanked communities, promoting economic participation globally.

Challenges in Fintech

Despite its advantages, fintech faces several hurdles:

1. Regulatory Compliance

Fintech companies must navigate complex, varying laws across regions for digital payments, lending, investments, and cryptocurrencies to remain legally compliant.

2. Security Concerns

Cybersecurity threats, hacking, and potential data breaches pose significant risks, requiring fintech platforms to implement robust protection measures.

3. Consumer Trust

Users must trust digital financial platforms with sensitive personal and financial information, making transparency and reliability crucial for adoption.

4. Technological Barriers

Not all consumers are tech-savvy, and some lack access to digital devices or a stable internet connection, which limits the reach of fintech.

5. Market Competition

Continuous innovation and new entrants force fintech companies to stay competitive, differentiate offerings, and adapt quickly to market changes.

Real-World Applications of Fintech

Fintech is applied in multiple areas, creating transformative impacts:

1. Peer-to-Peer Lending

Platforms like LendingClub enable individuals to lend or borrow money directly, thereby bypassing traditional banks and reducing financial barriers.

2. Blockchain Finance

Cryptocurrencies like Bitcoin and Ethereum facilitate decentralized, transparent, and secure financial transactions without the need for traditional intermediaries.

3. Robo-Advisory for Retirement Planning

Platforms like Betterment and Wealthfront provide automated, personalized investment and retirement planning, analyzing goals, risk tolerance, and market trends efficiently.

4. Fraud Detection and Risk Management

AI-powered systems by Mastercard and FICO detect suspicious transactions in real-time, preventing fraud, minimizing losses, and protecting sensitive financial data.

5. Cross-Border Remittances

Services like Wise and Remitly facilitate fast, low-cost international money transfers, improving accessibility and convenience for migrant workers and global families.

Future of Fintech

The future of fintech is promising, driven by continuous technological innovations:

1. AI and Machine Learning

Smart algorithms will allow highly personalized financial services, detect fraud instantly, give better investment advice, and provide automated support on different platforms.

2. Blockchain & Decentralized Finance

3. Embedded Finance

Non-financial platforms, including e-commerce and ride-sharing apps, will integrate banking, lending, and payment services directly into their user experiences.

4. Sustainable Finance

Fintech will promote eco-friendly financial solutions, including green investments, carbon credit trading, and banking products designed to support sustainability goals.

5. Regulatory Evolution

Institutions and governments will create more transparent, flexible regulatory frameworks that support innovation while safeguarding consumers and preserving the stability of the financial system.

Final Thoughts

Fintech is redefining the financial world, offering faster, more efficient, and inclusive solutions. Its applications range from mobile payments to blockchain-based platforms, benefiting both consumers and businesses. The future promises even greater integration of technology with financial services. By embracing fintech, individuals, businesses, and financial institutions can unlock new opportunities, improve accessibility, and drive global financial inclusion.

Frequently Asked Questions (FAQs)

Q1. Is fintech safe to use?

Answer: Yes, most fintech platforms use encryption, multi-factor authentication, and secure servers. However, users should exercise caution and choose regulated providers.

Q2. Can fintech replace banks entirely?

Answer: Not entirely. While fintech offers alternatives, banks provide regulatory stability, large-scale infrastructure, and trust, complementing fintech solutions.

Q3. What skills are needed for a career in fintech?

Answer: Careers in fintech require knowledge of finance, programming, AI/ML, blockchain, cybersecurity, and data analytics.

Recommended Articles

We hope that this EDUCBA information on “Fintech” was beneficial to you. You can view EDUCBA’s recommended articles for more information.