Who is a Finfluencer?

A finfluencer is a content creator who publishes information or opinions about personal finance, investing, trading, budgeting, insurance, taxes, credit cards, or financial markets. Their audience ranges from new investors who require straightforward explanations to experienced traders seeking timely market insights.

A Finfluencer typically operates across:

- YouTube (long-form financial education)

- Instagram (reels, infographics)

- TikTok / Shorts (quick tips, trends)

- X (Twitter) (market commentary)

- LinkedIn (professional financial insights)

- Podcasts/blogs (in-depth discussions).

Table of Contents

- Meaning

- Why are they Popular?

- Types

- How do they Earn Money?

- Benefits

- Risks

- Regulations

- How to Identify Trustworthy Finfluencers?

- Impact

- Future Trends

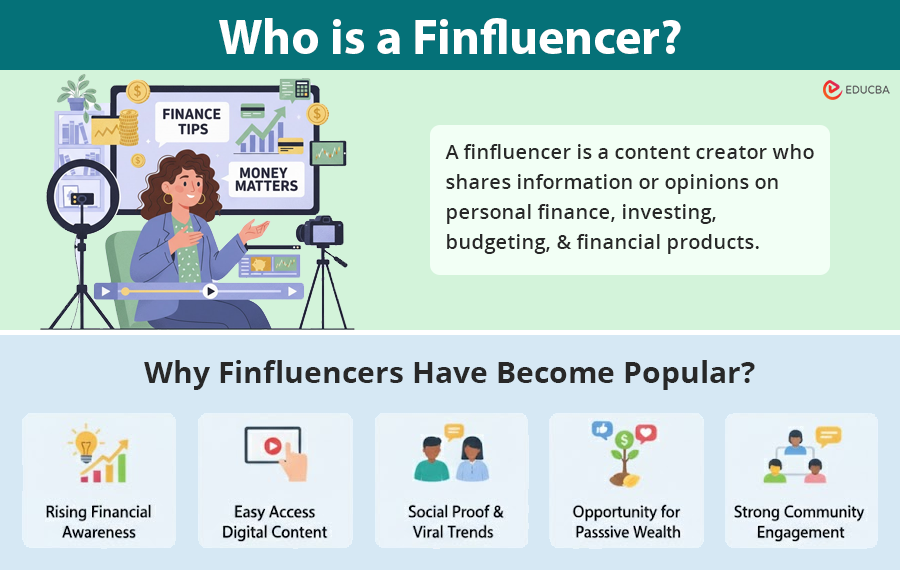

Why Finfluencers Have Become Popular?

Finfluencers have grown because they simplify complex financial concepts into digestible, relatable content. Here are the main drivers:

1. Rising Financial Awareness Among Young People

Younger generations are becoming increasingly curious about money management, investing, and financial independence.

Traditional financial education is limited in schools, so people turn to platforms like YouTube, Instagram, and TikTok for easy-to-understand guidance.

They simplify complex concepts, such as mutual funds, SIPs, cryptocurrency, and stock markets, making them more appealing to new learners.

2. Easy Access to Digital Content

The shift toward short-form content has given them a massive advantage.

Platforms reward bite-sized, engaging videos, exactly the format that makes intimidating financial topics feel simple.

With 24/7 access through smartphones, people can learn about finance at any time and from anywhere.

3. Trust and Relatability

Viewers often perceive them as more relatable than traditional financial advisors.

They share personal stories, wins, mistakes, and learning journeys.

This authenticity builds trust, making audiences feel like they are learning from a friend rather than from a distant expert.

4. Financial Stress and the Need for Guidance

Economic uncertainty, inflation, job instability, and rising living costs have pushed people to seek financial security.

They offer quick tips on saving, budgeting, earning a side income, and navigating debt topics that many people urgently need help with.

5. Simpler Explanation of Complex Topics

Financial products and markets can be confusing.

Finfluencers break these down using analogies, visuals, and real-life examples.

This “edutainment” style makes learning enjoyable and less overwhelming.

6. Social Proof and Viral Trends

Finance-related content often goes viral, such as “How I saved ₹10 lakh in 25 days” or “best investments for beginners.”

Success stories, transformation videos, and money hacks generate strong social proof, attracting millions of views.

7. Availability of Low-Cost Investing Platforms

The rise of discount brokers and zero-commission trading apps has made investing more accessible.

As more people start investing, they look to finfluencers for guidance, tips, and platform tutorials.

8. Opportunity for Side Income and Passive Wealth

People are increasingly searching for ways to earn passive income.

They present investing as a path to financial independence, a prospect that is highly appealing in the gig-driven economy.

9. Strong Community Engagement

Many finfluencers build loyal communities through Q&As, live sessions, newsletters, and courses.

These communities make followers feel supported and part of a larger money-focused movement.

10. Brands and Platforms Fuel Demand

Fintech companies, brokers, and financial brands frequently collaborate with finfluencers.

Sponsored content, affiliate programs, and partnerships boost visibility and create a professional ecosystem around financial creators.

Types of Finfluencers

Finfluencers fall into several categories based on their content:

| Type of Finfluencer | What They Focus On | Typical Content Examples |

| Personal Finance Educators | Budgeting, saving, emergency funds, credit scores | “How to budget your salary”, “Ways to improve your credit score” |

| Stock Market Experts | Equity investing, trading strategies, market analysis | Stock tips, chart analysis, market trend breakdowns |

| Mutual Fund & SIP Educators | Long-term investing, SIP planning, fund recommendations | “Best SIPs for beginners”, “How to choose mutual funds” |

| Crypto Influencers | Blockchain, crypto trading, emerging coins, NFTs | Market updates, crypto predictions, tutorials |

| Financial Planners / Advisors | Holistic wealth planning, retirement, insurance | Financial planning guides, life insurance reviews |

| Business & Economy Explainers | Macroeconomics, business news, policy impact | “What the budget means for you”, economic concept explainers |

| Side Hustle & Income Creators | Freelancing, gig work, online income ideas | “Top side hustles for 2025”, passive income ideas |

| Real Estate Finfluencers | Property investing, rentals, REITs | Home-buying tips, real estate investment tricks |

| Tax & Compliance Experts | Income tax, GST, deductions, filing tips | “Tax-saving hacks”, income tax filing tutorials |

| Financial Product Reviewers | Credit cards, apps, fintech tools | Product comparisons, benefit breakdowns |

| Lifestyle & Money Influencers | Spending habits, money mindset, work-life-money balance | Vlogs, lifestyle advice tied to finance decisions |

How Finfluencers Earn Money?

Here are the main ways finfluencers make money:

1. Brand Collaborations & Sponsored Content

Fintech companies, brokers, insurance firms, and financial apps pay finfluencers to promote their products.

Examples include:

- Promoting a new trading app

- Reviewing a credit card

- Creating educational videos sponsored by financial brands

This is one of the biggest income sources.

2. Affiliate Marketing

They earn a commission when their followers sign up for a product or service using their unique referral link.

Common affiliates include:

- Stock trading platforms

- Mutual fund apps

- Credit cards

- Insurance products

- Books and finance tools

Some brokers offer high commissions per signup.

3. Ad Revenue from Platforms

Platforms like YouTube pay creators for views and engagement through their ad monetization programs.

Finfluencers with large audiences can earn substantial passive income from ads on:

- YouTube videos

- Blogs

- Podcasts.

Financial content often earns higher CPM rates than entertainment content.

4. Online Courses & Workshops

Many finfluencers create their own paid courses or host live workshops on topics such as:

- Stock market basics

- Crypto trading

- Personal finance planning

- Budgeting and money management.

These courses can generate significant recurring income.

5. E-books and Digital Products

They often sell digital resources like:

- E-books

- Budget planners

- Investment guides

- Excel templates

- Financial roadmaps.

You create these products once and then sell them repeatedly.

6. Consulting or Personalized Financial Coaching

Some finfluencers offer 1-on-1 coaching sessions or consulting services for individuals or businesses.

Examples:

- Portfolio review

- Tax planning advice

- Wealth-building strategies.

This is more common among qualified professionals, such as CFPs or CFAs.

7. Memberships & Subscription Communities

They build private communities where users pay recurring fees. These exist on:

- Patreon

- WhatsApp groups

- Discord servers

- Telegram premium channels.

Members get exclusive content, stock insights, Q&As, and early access to resources.

8. Public Speaking & Events

Popular finfluencers often receive invitations to webinars, seminars, conferences, and workshops to speak as speakers.

They earn:

- Speaker fees

- Event partnerships

- Guest appearance charges.

9. Media Deals & Content Licensing

Some finfluencers sell rights to their content or create content for media houses.

This may include:

- Columns for newspapers

- Video series for financial brands

- Collaborations with business channels.

10. Selling Merchandise

A smaller but growing income stream, some finfluencers sell branded merchandise like:

- Finance-themed T-shirts

- Notebooks and planners

- Desk accessories.

Benefits of Finfluencers

Here are the key benefits they offer:

1. Easy-to-Understand Financial Education

Finfluencers simplify complex topics, including investing, taxes, insurance, and budgeting, making them more accessible and easier to understand.

Through short videos, graphics, and real-life examples, they make finance less intimidating and more approachable for beginners.

2. Accessible to Everyone

Traditional financial advice is often expensive or hard to access.

They provide free content across social media platforms, making financial knowledge available to anyone with a smartphone.

3. Real-Time Market Insights

Many finfluencers share quick updates on markets, government policies, interest rates, and economic trends.

This helps audiences stay informed without needing to constantly track financial news.

4. Relatable Learning Style

They often share their personal experiences, successes, failures, mistakes, and lessons.

This relatability fosters trust and makes followers feel comfortable learning from someone who is “like them.”

5. Motivation and Financial Discipline

By showing practical routines such as saving challenges, investment journeys, and monthly budgets, finfluencers inspire people to take action.

Their content often motivates followers to:

- Start investing

- Make budgets

- Reduce debt

- Build emergency funds.

6. Introduction to New Financial Tools

They review and explain new fintech apps, platforms, and financial products.

This helps users discover useful tools for investing, managing money, filing taxes, or making payments.

7. Builds Financial Confidence

Simple explanations and step-by-step guides help people understand money better and make smarter decisions.

This boosts financial confidence, especially among young adults and first-time investors.

8. Community Support

Many finfluencers build interactive communities through comments, Q&A sessions, live sessions, and groups.

These communities give followers a supportive space to learn, ask questions, and grow financially.

9. Encourages Early Financial Planning

By promoting ideas such as SIPs, long-term investing, retirement planning, and insurance awareness, finfluencers help people start planning early, leading to better financial outcomes.

10. Democratization of Finance

They make financial literacy more inclusive.

People from diverse backgrounds can learn about:

- Wealth building

- Investing

- Loans and credit

- Passive income

- Without needing formal financial training.

Risks Associated With Finfluencers

Here are the major risks associated with following finfluencers:

1. Lack of Professional Qualifications

Many finfluencers are not certified financial planners or SEBI-registered advisors.

They often rely on personal experience instead of professional expertise, which increases the chance of giving incorrect or risky advice.

2. One-Size-Fits-All Advice

They offer advice to large audiences, so they cannot tailor it to individual needs.

What works for one person may not suit another’s:

- Risk appetite

- Income level

- Financial goals

- Tax situation

- Debt levels.

This can lead followers to make inappropriate financial choices.

3. Promotion Biased by Sponsorships

Many finfluencers partner with financial brands for paid promotions.

Sponsored content may:

- Hide risks

- Overstate benefits

- Promote products that are not suitable for beginners.

This often creates a conflict of interest that they do not always disclose clearly.

4. Over-Simplification of Complex Topics

Finance often involves complexities, tax rules, market risks, and legal implications.

Finfluencers may oversimplify concepts like:

- Options trading

- Crypto investments

- Futures and margin trading.

Oversimplification can mislead audiences into underestimating risks.

5. Encouragement of High-Risk Investments

Some finfluencers promote:

- Day trading

- Penny stocks

- High-volatility crypto

- Get-rich-quick schemes.

They may tempt followers to chase quick profits without fully understanding the potential losses.

6. Spread of Misinformation

They often produce content quickly to stay trendy, which can lead to:

- Factually incorrect

- Outdated

- Based on rumors rather than research.

This misinformation can lead to poor financial decisions.

7. Psychological Triggers and FOMO

Finfluencer content often triggers emotional responses like:

- Fear of missing out (FOMO)

- Pressure to invest immediately

- Comparison with others’ success stories.

This can lead people to make impulsive decisions rather than thoughtful plans.

8. Unrealistic Expectations

Some finfluencers showcase:

- Massive profits

- Overnight wealth

- Perfect portfolios.

Followers might assume investing is easy or always profitable, which is far from reality.

9. Lack of Accountability

If a finfluencer’s advice leads to financial loss, there is usually no accountability.

Unlike regulated advisors, they are not legally obligated to act in your best interest.

10. Privacy and Security Risks

Some finfluencers encourage the use of referral links or apps without verifying the safety of the platform.

This exposes users to:

- Data misuse

- Fraudulent platforms

- Scam investment products.

Regulations for Finfluencers (India & Global Perspective)

Indian Regulations (SEBI)

SEBI has introduced strict guidelines for finfluencers, including:

- Mandatory disclosure of paid partnerships

- Ban on unregistered advisors giving stock tips

- Prohibition of misleading claims about returns

- Accountability for false or harmful financial advice.

Platforms also need to ensure the responsible dissemination of financial content.

Global Regulations

- US (SEC): Influencers promoting securities must disclose their compensation; violations can result in penalties.

- UK (FCA): Strict rules on financial promotions and approvals.

- Australia (ASIC): Influencers giving financial advice without a licence can face fines.

How to Identify Trustworthy Finfluencers?

Here are key factors to help you identify reliable and trustworthy financial creators:

1. Check Their Qualifications and Background

Trustworthy finfluencers often have formal training or certifications such as:

- SEBI-registered investment advisor (RIA)

- CFP (Certified Financial Planner)

- CFA (Chartered Financial Analyst)

- CA or MBA in finance.

Even if they are not certified, they should demonstrate strong financial understanding and transparency about their expertise.

2. Look for Clear Disclosures

Dependable finfluencers openly disclose:

- Sponsorships

- Affiliations

- Paid partnerships

- Conflicts of interest.

This honesty shows they value transparency and audience trust.

3. They Encourage Research, Not Blind Following

Trustworthy creators never say “invest in this now” or “guaranteed returns.”

Instead, they encourage viewers to:

- Do their own research

- Understand risks

- Assess personal goals

- Consult professionals when needed.

This reduces the chances of impulsive or misinformed decisions.

4. Balanced and Risk-Aware Content

Reliable finfluencers explain both the pros and cons of financial products. They highlight:

- Market risks

- Volatility

- Fees and charges

- Potential losses

- Suitability based on individual profiles

They avoid hype and focus on realistic expectations.

5. Evidence-Based Information

Trustworthy finfluencers support their claims with:

- Data

- Charts

- Reputable sources

- Market research

- Historical trends.

They avoid making sensational predictions without evidence.

6. They Do not Push High-Risk Products Aggressively

Credible creators avoid aggressive promotion of:

- Penny stocks

- Crypto “moonshots”

- Futures and options for beginners

- Quick-rich schemes.

Their advice focuses on sustainable, long-term financial planning.

7. Consistent and Educative Content Style

Reliable finfluencers maintain consistency in:

- Upload frequency

- Financial accuracy

- Tone and messaging

- Educational focus.

They concentrate on genuinely teaching, not just going viral.

8. Responsible Use of Real-Life Examples

They share practical examples without:

- Overstating returns

- Showing unrealistic profits

- Encouraging imitation of their exact portfolio.

They help viewers understand principles, not copy trades.

9. Positive Community Feedback

Check:

- Comments

- Ratings

- Reviews

- Testimonials.

A trustworthy finfluencer fosters a respectful and supportive community, addressing doubts responsibly.

10. No Guarantee of Returns

Credible finfluencers never promise:

- Guaranteed profits

- Risk-free schemes

- “Secret strategies”

- Overnight wealth.

They reinforce that investing involves uncertainty and long-term discipline.

Impact of Finfluencers on Financial Markets

Finfluencers influence:

- Retail investor sentiment

- Trends in stocks, mutual funds, crypto

- Fintech adoption

- Financial literacy standards.

They can democratize access to money and knowledge, but can also cause mass speculation when misused.

Future of Finfluencers

The finfluencer industry will grow, but with more:

- Regulation

- Transparency

- Professionalization

- Partnerships with regulated entities.

Creators who prioritize education, trust, and accuracy will thrive.

Final Thoughts

Finfluencers are transforming the way people learn about money, invest, and manage their financial futures. They are helpful because they make complex financial topics easy to understand, but you should be careful because some may share wrong information or promote products with hidden motives. As their role expands, both investors and creators must prioritize credibility, ethics, and regulatory compliance.

Frequently Asked Questions (FAQs)

Q1. Are finfluencers allowed to give investment advice?

Answer: Most countries, including India, require individuals who give specific investment advice to register with regulatory bodies such as SEBI, the SEC, or the FCA. Finfluencers can share general education, but cannot legally recommend specific stocks or financial products without proper registration.

Q2. Do finfluencers have any legal responsibility if their advice leads to losses?

Answer: In most cases, no. Finfluencers are not liable for viewer losses unless they intentionally mislead audiences or break advertising or financial promotion rules. This lack of accountability makes caution essential.

Q3. Are finfluencers more accurate than traditional financial news?

Answer: Not always. News platforms adhere to journalistic standards and undergo editorial checks. Finfluencer content may lack fact-checking due to the pressure of speed and trends.

Q4. Should you follow multiple finfluencers?

Answer: Yes. Following diverse voices helps avoid biased perspectives and gives you a balanced view of markets, products, and strategies.

Q5. Why do young people trust finfluencers so much?

Answer: Young audiences relate to creators who explain money in simple, friendly, and relatable ways. They prefer peer-style advice over formal financial jargon from banks or institutions.

Q6. Why do some financial influencer tips go viral, even when they are risky?

Answer: Because high-risk content often appears exciting. People tend to engage more with content that promises fast results, even if it is dangerous.

Recommended Articles

We hope this article on Finfluencers helped you understand how online financial creators shape money decisions today. Explore the articles below to learn more about personal finance basics, digital investing trends, and safe online financial practices.