Updated July 21, 2023

Introduction to Dividend Discount Model

Dividend Discount Model (DDM) is a method of valuation of a company’s stock that is driven by the theory that the value of its stock is the cumulative sum of all its payments given in the form of dividends which we discount in this case to its present value.

In simpler words, this method is used to derive the value of the stocks based on the net present value of dividends to be distributed in the future.

Description of Dividend Discount Model

A DDM is a valuation model where the dividend to be distributed related to a stock for a company is discounted back to the cumulative net present value and calculated accordingly. It is a quantitative method to determine or predict the price of a stock pertaining to a company. It majorly excludes all the external market conditions and only considers the fair value of the stock. The two factors it considers are dividend pay-out factors and expected market returns. Suppose the calculated value of the DDM for a stock exceeds its current market trading price. We term a stock undervalued when its value is lower than the current trading price. Conversely, if the calculated value from the dividend discount model is higher than the market price, we term the stock overvalued. This model relies on the concept of the time value of money.

Formula of Dividend Discount Model

The traditional model for dividend discount is shown below with no dividend growth

where,

- P0 = price at time zero, with no dividend growth

- Div = future dividend payments

- r = discount rate

The above formula comes from the formula of perpetuity, where we show that the company is not growing and giving out a steady dividend every year.

P0 = Div/1 + r + Div/(1 + r)2 + Div/(1 + r)3 + ……………. = Div/r

But this is not true as a company will grow over time, and thus, the dividend distribution will also grow. Thus to take into account the growth of the company too in our calculation of the dividend discount model, the formula gets a new shape as follows:

The formula for perpetuity with the growth rate taken into consideration also derives from this.

- P0 = Div/1 + r + Div(1 + g)/(1 + r)2 + Div(1 + g)2/(1 + r)3 + ……………. = Div/(r – g)

- P0 = Price at the initial point of time zero with constant dividend growth

- g = Dividend growth rate

Example of a Dividend Discount Model

Following are the examples of DDM is given below:

Example #1 – Zero Growth Model

Not taking into consideration that the company will grow. If a stock pays dividends of $1.50 per year and the required rate of return for the stock is 9%, then calculate the intrinsic value:

Solution:

The formula to calculate Intrinsic Value is as below:

DDM = Intrinsic Value of Stock = Annual Dividend / Expected Rate of Return

- Intrinsic Value = $1.50 / 0.09

- Intrinsic Value = $16.66

Example #2 – Constant Growth Rate Model

Suppose a stock is paying a $6 dividend the current year, and the dividend sees steady growth of 8% annually. Then what will be the stock’s intrinsic value where we assume the expected rate of return is 10%?

Solution:

DDM = Intrinsic Value of Stock = Div (1+g) / (r-g)

- Intrinsic Value = 6 (1 + 0.08)/(0.10 – 0.08)

- Intrinsic Value = $324

How Does DDM Work?

The dividend discount model works on the principle of the time value of money. The assumption is that the intrinsic value of a stock reflects the present value of all future cash flows or dividends earned from the stock. Dividends are always positive cash flows that a company distributes to its shareholders. The dividend discount model, as such, requires no complex calculation and is user-friendly. It is the easiest way to estimate the fair stock price with minimum mathematical inputs. The model’s number is compared to the current stock price prevailing in the market to determine whether a stock is undervalued or overvalued.

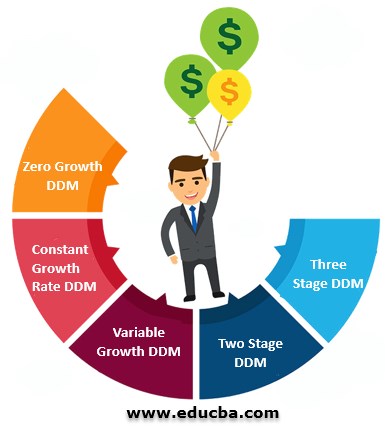

Types of Dividend Discount Model

The different types of DDM are as follows:

1. Zero Growth DDM

The traditional method of the dividend discount model assumes that the company will pay a constant dividend throughout the lifespan of the stock, extending indefinitely. It considers that there will be no growth in the dividend, and thus the stock price will be equal to the annual dividend divided by the rate of returns.

2. Constant Growth Rate DDM

This model assumes that the dividends are growing only at a fixed percentage or on a constant basis annually. There is no variability, and the percentage growth is the same throughout. This is also known as the Gordon Growth Model and assumes that dividends grow by a fixed specific percentage each year. Constant growth models are specific to the valuation of matured companies whose dividends have grown steadily.

3. Variable Growth DDM or Non-Constant Growth

The model assumes it will divide the growth into three or four phases. The first one will be a fast initial phase, then a slower transition phase, and finally, ends with a lower rate for the finite period. This is more realistic when compared to the other two methods. The model solves the problem of a company giving unsteady dividends, which is a true picture during the variable growth phases of a company.

Further, the variable growth rate model is divided into several parts:

4. Two-Stage DDM

Model to determine the value of equity of business with dual growth stage. There is an initial period of faster growth and a subsequent period of stable growth.

5. Three-Stage DDM

Model to determine a business’s equity value with three growth stages. The first one will be a fast initial phase, then a slower transition phase, and finally, ends with a lower rate for the finite period.

Advantages and Disadvantages of DDM

Below are the advantages and disadvantages mentioned:

Advantages of DDM

The advantages are as follows:

- Proven and Sound Logic: The main concept utilized here is considering the time value of money, which is based on future cash flows, specifically dividends. It has very little exposure to some mathematical models or assumptions, which even more makes the model trustworthy.

- Consistency: Many companies pay their dividends in cash; thus, the topic is very close to a company’s fundamentals. Thus the company will never try to manipulate this number as it can hamper their stock price volatility which means this model is a trusted one.

- Matured Business: the payment of dividends, which is happening regularly, always doesn’t means that the company has matured and that there is no volatility involved. Thus this model becomes useful for investors who prefer to invest in a stock that pays regular dividends.

Disadvantages of DDM

The disadvantages are as follows:

- Sensitive Assumptions: The fair price is very sensitive to growth rates and the rate of return required. Thus 1 % increase or decrease in our assumption of both can affect the stock’s valuation.

- May Not Be Earnings Related: Dividends should have a correlation with earnings. On the contrary, companies try to have a fixed or constant dividend pay-out instead of variable pay related to earnings.

- Specific to Mature Companies Only: The model is more specific to mature companies and is limited to high-growth companies.

Conclusion

The dividend growth rate model is a very effective way of valuing matured companies. It is advantageous because it is much more reliable and proven. It is much more realistic since it doesn’t depend on mathematical assumptions and techniques.

Recommended Articles

This is a guide to the Dividend Discount Model. Here we discuss types, how it works, and the advantages and disadvantages of the dividend discount model. You may also look at the following articles to learn more –