What is a Compliance Audit?

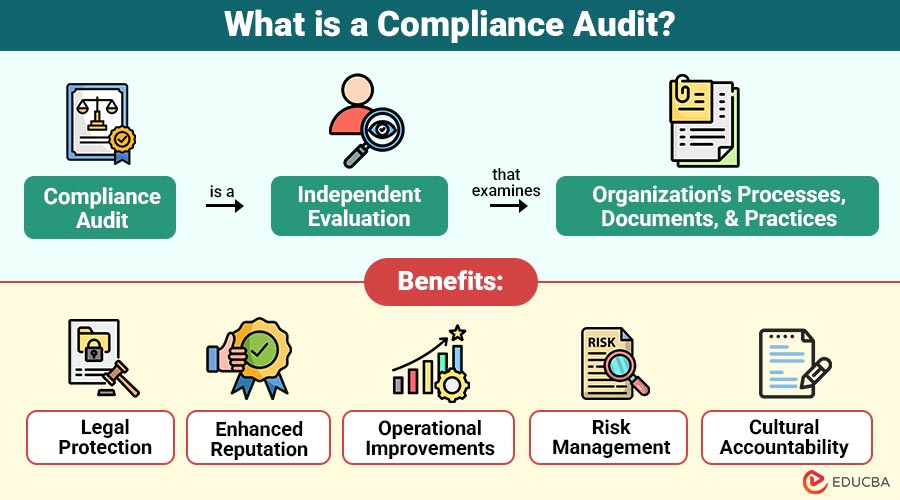

Compliance audit is a independent evaluation that examines organization’s processes, documents, and practices. It determines whether they comply with applicable regulatory requirements, industry standards, and internal policies.

Unlike financial audits that primarily focus on the accuracy of financial statements, compliance audits have a broader scope—covering everything from data security to labor laws and environmental practices.

Table of Contents:

Key Takeaways:

- Compliance audits safeguard organizations by ensuring strict alignment with evolving regulations and industry-wide standards.

- They proactively identify risks, enabling timely corrective actions that prevent legal, financial, or operational setbacks.

- Audits reinforce organizational accountability, fostering employee discipline, customer confidence, and long-term stakeholder trust.

- Effective audits transform compliance into a strategic advantage, driving efficiency, transparency, and sustainable business growth.

Objectives of a Compliance Audit

The primary objectives include:

1. Ensuring Adherence to Laws and Regulations

It ensures that the organization strictly follows applicable government regulations, such as GDPR, SOX, OSHA, tax rules, and environmental laws, to avoid penalties.

2. Risk Identification and Mitigation

Through a detailed review, a compliance audit identifies operational, financial, and reputational risks, enabling organizations to implement proactive measures and minimize the chances of lawsuits, fines, or business disruptions.

3. Internal Policy Enforcement

It verifies that employees consistently adhere to company rules, ethics codes, and operational policies, ensuring organizational discipline, consistency, and proper alignment with strategic compliance standards.

4. Operational Efficiency

Identify redundancies, inefficiencies, and process weaknesses, enabling organizations to optimize workflows, reduce costs, and enhance governance for improved operational effectiveness and better performance outcomes.

5. Building Trust and Transparency

By demonstrating accountability and adherence to regulations, compliance audits foster long-term trust among customers, regulators, employees, and investors, thereby enhancing transparency and reinforcing the organization’s positive reputation.

Types of Compliance Audits

It differs depending on the industry and regulations involved. Below are the major types:

1. Regulatory Compliance Audits

These audits ensure that organizations comply with governmental laws and regulations, including tax obligations, workplace safety rules such as OSHA, and industry-specific legislative requirements.

2. IT & Data Protection Audits

They evaluate cybersecurity policies and data privacy compliance, ensuring organizations follow frameworks like GDPR, HIPAA, and ISO 27001 to protect sensitive information effectively.

3. Environmental Compliance Audits

Focuses on organizational adherence to environmental standards, such as sustainable waste management, carbon emissions control, pollution prevention, and eco-friendly practices required by environmental agencies.

4. Financial Compliance Audits

By confirming the accuracy of financial reporting, adherence to accounting standards, and use of anti-fraud procedures, these assessments offer transparency and confidence in financial statements and business operations.

5. HR & Workplace Compliance Audits

Assesses compliance with labor laws, wage regulations, workplace safety measures, equal opportunity policies, and employee rights, ensuring fairness and ethical practices in employment management.

6. Industry-Specific Audits

Tailored audits address specialized regulations in sectors like pharmaceuticals (FDA guidelines), banking (AML, Basel III), healthcare, or energy industries requiring strict regulatory adherence.

Compliance Audit Process

Conducting a compliance audit follows a systematic approach:

1. Planning

Planning involves defining audit objectives, determining scope, identifying relevant regulations and policies, allocating resources, preparing audit schedules, and assigning responsibilities to ensure systematic and efficient execution.

2. Data Collection

This stage gathers necessary documentation, including contracts, financial records, policies, IT logs, and employee handbooks, while also conducting management and staff interviews to gather comprehensive evidence.

3. Testing & Evaluation

Auditors verify whether business processes and practices align with compliance requirements, conducting sample transaction testing, system reviews, and policy evaluations to identify potential compliance gaps.

4. Reporting

The audit report summarizes findings, highlights areas of concern, documents compliance gaps, identifies risks, and provides clear recommendations for corrective actions and process improvements.

5. Corrective Action & Follow-Up

Organizations take steps to fix areas where rules aren’t followed, and follow-up audits check that these fixes work, improving compliance and preventing future problems.

Benefits of Compliance Audit

Here are the benefits organizations can gain from conducting compliance audits:

1. Legal Protection

It minimize exposure to legal risks by ensuring adherence to regulations, thereby reducing fines, penalties, lawsuits, and potential government enforcement actions.

2. Enhanced Reputation

By demonstrating strong compliance practices, audits help build customer trust, improve brand image, and strengthen investor confidence in organizational accountability and transparency.

3. Operational Improvements

Audits identify inefficiencies and streamline internal processes, resulting in improved workflows, cost savings, more effective resource allocation, and enhanced overall organizational effectiveness.

4. Risk Management

They detect compliance risks at an early stage, allowing timely corrective actions that prevent issues from escalating into serious operational or legal problems.

5. Cultural Accountability

Audits encourage employees to embrace integrity and compliance values, fostering an organizational culture built on transparency, accountability, and ethical business practices.

Challenges in Compliance Audits

Despite their importance, they comes with challenges:

1. Complex Regulations

Organizations must navigate overlapping local, national, and international regulations, making compliance audits difficult as requirements vary across jurisdictions and industries.

2. Resource Intensive

Audits require significant investment of time, financial resources, and skilled auditors, often straining organizational budgets and disrupting normal business operations.

3. Employee Resistance

Employees sometimes perceive audits as intrusive or punitive, leading to resistance, lack of cooperation, and difficulties in obtaining accurate compliance information.

4. Keeping Up with Regulatory Changes

Constantly evolving regulations and standards present challenges for organizations, necessitating continuous monitoring and adaptation to maintain effective and consistent compliance.

5. Data Management Issues

Managing, gathering, and analyzing large volumes of documents, digital logs, and records during audits can be overwhelming without efficient systems or technologies.

Best Practices for Effective Compliance Audits

To maximize the value of compliance audits, organizations should follow these proven best practices:

1. Stay Updated with Regulations

Organizations should continuously monitor regulatory updates, conduct employee training, and adapt policies to ensure compliance with frequently changing legal and industry requirements.

2. Automate Compliance Monitoring

3. Engage Employees

Training programs define roles, teach employees the value of compliance, and create an environment where employees actively promote ethical behavior and adherence to regulations.

4. Conduct Regular Internal Audits

Frequent internal audits allow organizations to identify and correct compliance issues proactively, minimizing risks and reducing surprises during external or regulatory inspections.

5. Document Everything

Keeping records neat and easy to find makes audits simpler, builds accountability, and helps the organization prove it follows rules regularly.

6. Risk-Based Auditing

By focusing audits on the most risky areas, organizations use resources wisely, handle important compliance issues first, and quickly deal with major risks.

Real World Examples

Compliance audits are applied across industries to ensure adherence to regulations and protect organizations from risks:

1. Healthcare Industry – HIPAA Compliance

Hospitals conduct compliance audits to safeguard patient medical data. Failing HIPAA audits can result in fines exceeding $1 million.

2. Banking Sector – Anti-Money Laundering (AML)

Banks undergo AML compliance audits to prevent fraudulent activities. Non-compliance can result in the loss of a license or reputational damage.

3. Technology Industry – GDPR

Tech companies like Google and Meta undergo regular audits to ensure compliance with EU data protection regulations.

Final Thoughts

A compliance audit is more than a regulatory obligation—it is a strategic tool that safeguards legal compliance, enhances efficiency, and strengthens credibility. In today’s trust-driven business world, proactive audits enable organizations to manage risks effectively and demonstrate accountability. By embracing best practices, leveraging technology, and fostering transparency, companies can turn it into drivers of sustainable growth and long-term success.

Frequently Asked Questions (FAQs)

Q1. How often should an organization conduct compliance audits?

Answer: Frequency depends on industry and regulations, but annual or semi-annual audits are common.

Q2. Who conducts compliance audits?

Answer: Compliance audits may be performed by internal compliance teams or external auditors specializing in regulatory compliance.

Q3. What happens if a company fails a compliance audit?

Answer: It may face fines, lawsuits, reputational damage, or operational restrictions until corrective actions are taken.

Q4. Are compliance audits mandatory?

Answer: Yes, in regulated industries such as banking, healthcare, energy, and pharmaceuticals.

Recommended Articles

We hope that this EDUCBA information on “Compliance Audit” was beneficial to you. You can view EDUCBA’s recommended articles for more information.