Introduction to Union Budget 2026–27

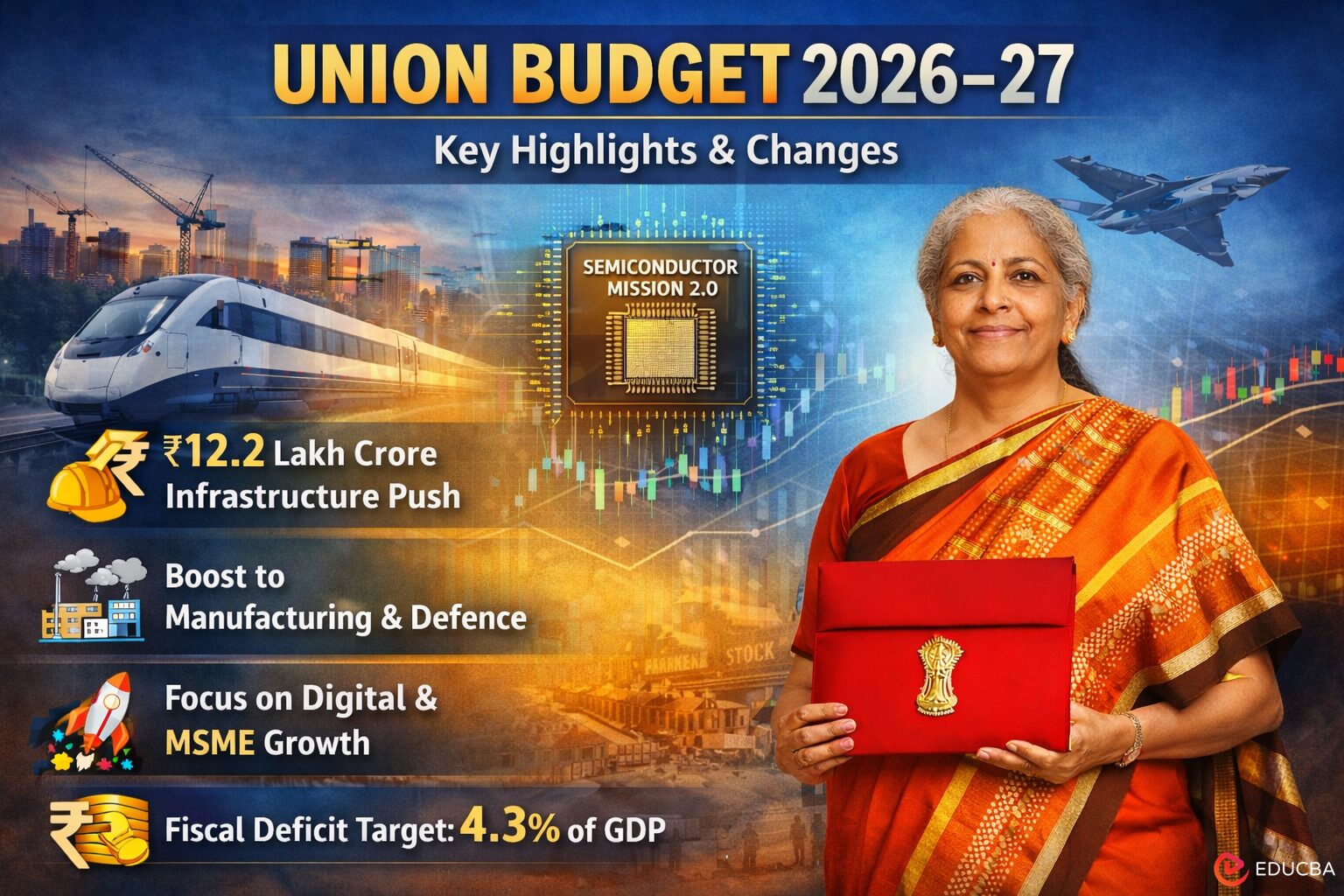

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman, reflects the Indian government’s continued focus on long-term growth, infrastructure development, manufacturing strength, and fiscal discipline. Rather than offering short-term populist relief, the budget prioritizes capital expenditure, strategic sector development, digital transformation, and law simplification.

With stable tax slabs, record infrastructure spending, strong support for manufacturing and services, and reforms in compliance and governance, Budget 2026 positions India for sustained economic expansion while managing fiscal prudence.

This article explains the key changes and announcements in the Union Budget 2026–27 and what they mean for taxpayers, businesses, investors, and the overall economy.

Key Takeaways

- Budget 2026–27 focuses on long-term growth, not short-term tax relief.

- Income tax slabs remain unchanged, prioritizing stability and simplification.

- The New Income Tax Act comes into effect from 1 April 2026, reducing complexity and litigation.

- Record capital expenditure (~₹12.2 lakh crore) drives infrastructure-led growth.

- Strong push for manufacturing and strategic sectors, including semiconductors and defence.

- Clear emphasis on digital, services-led, and MSME growth.

- Commitment to fiscal discipline, with the deficit targeted at around 4.3% of GDP.

Overall Budget Theme and Economic Vision

The central theme of Budget 2026–27 is “growth through investment, efficiency, and simplification.” Instead of direct tax giveaways, the government has emphasized:

- Public investment as a growth engine

- Strengthening domestic manufacturing and strategic sectors

- Expanding digital and services-led growth

- Reducing compliance burden through legal and procedural reforms

- Maintaining fiscal discipline while increasing productive expenditure.

The budget continues India’s journey toward becoming a developed economy (Viksit Bharat) by focusing on productivity, innovation, and infrastructure.

Taxation Changes and Compliance Reforms

No Change in Income Tax Slabs

One of the most notable aspects of Budget 2026 is that income tax slabs remain unchanged for both the old and new tax regimes. While this disappointed some salaried taxpayers who expected immediate relief, the government signaled that stability and simplification are its current priorities.

New Income Tax Act from April 2026

A major structural reform announced earlier now become reality:

The new Income Tax Act, 2025, will come into force from 1 April 2026, replacing the decades-old Income Tax Act, 1961.

Key objectives include:

- Simplified language and structure

- Reduced litigation

- Clearer definitions and fewer exemptions

- Lower compliance burden for individuals and businesses.

Changes in TDS, TCS, and Corporate Taxation

- TCS rates reduced on overseas tour packages, foreign education, and medical remittances, making international education and healthcare expenses less burdensome.

- Minimum Alternate Tax (MAT) has been reduced and simplified for certain companies.

- Share buybacks are taxed as capital gains, aligning them with dividend-style taxation.

- Simplified timelines for return filing, revisions, and automated certificates.

These measures make the tax system more predictable and transparent.

Record Infrastructure Spending and Capital Expenditure

Massive Capex Push

The government has raised capital expenditure to approximately ₹12.2 lakh crore, marking one of the largest infrastructure investments in India’s history. This spending is intended to:

- Create employment

- Crowd in private investment

- Improve logistics efficiency

- Enhance long-term productivity.

Transport and Connectivity Projects

Key infrastructure initiatives include:

- Seven proposed high-speed rail corridors connecting major economic hubs

- Expansion of national highways, expressways, and rail networks

- New dedicated freight corridors to reduce logistics costs

- Development of national waterways and coastal shipping.

Infrastructure remains positioned as the backbone of India’s growth story.

Manufacturing and Strategic Sector Development

Strengthening “Make in India”

Budget 2026 reinforces India’s ambition to become a global manufacturing hub. The government has placed special focus on sectors critical to economic and strategic autonomy.

Semiconductor Mission 2.0

- Launch of India Semiconductor Mission 2.0 with enhanced financial allocation

- Focus on chip fabrication, design, testing, and packaging

- Objective: to reduce dependence on imports and strengthen supply chains.

Other Manufacturing Initiatives

- Incentives for electronics and component manufacturing

- Support for rare-earth magnets and advanced materials

- Container manufacturing programs to reduce logistics imports

- Textile parks and industrial cluster modernization.

These measures aim to move India up the global value chain.

Defence and Security Allocation

The defence budget has seen a significant increase, emphasizing:

- Modernization of armed forces

- Indigenous defence manufacturing

- Procurement of advanced aircraft, naval equipment, and engines.

The budget supports India’s goal of self-reliance in defence production while also enhancing the export potential of defence equipment.

Digital Economy, IT, and Services Sector Push

IT and Cloud Services Support

Recognizing the importance of the services sector, Budget 2026 introduces:

- Safe harbour provisions for IT exporters to reduce tax uncertainty

- Incentives and tax support for cloud service providers using Indian data centres

- Continued investment in digital public infrastructure.

Services-Led Growth Strategy

Beyond manufacturing, the budget clearly acknowledges that:

- Services will also drive India’s future growth

- High-value sectors like IT, tourism, design, sports, media, and creative industries are critical.

The aim is to increase India’s share in global services exports.

MSME and Startup Ecosystem Support

Micro, Small, and Medium Enterprises (MSMEs) remain a priority area.

Key announcements include:

- A dedicated SME Growth Fund

- Improved access to credit and liquidity

- Expansion and strengthening of TReDS (Trade Receivables Discounting System)

- Integration of MSMEs with government procurement platforms.

These measures help MSMEs scale operations, improve cash flow, and formalize business activity.

Agriculture and Rural Development Initiatives

Technology-Driven Agriculture

The budget emphasizes data-driven farming through:

- AI-based platforms such as Bharat-VISTAAR

- Integrated support for horticulture, fisheries, and animal husbandry

- Focus on high-value crops and agri-exports.

Rural Income and Productivity

Instead of direct cash transfers, the approach focuses on:

- Productivity enhancement

- Market access

- Technology adoption.

This aligns rural development with long-term sustainability.

Healthcare and Education Investments

Healthcare

- Increased allocation for public healthcare infrastructure

- Duty exemptions on certain life-saving and cancer medicines

- Expansion of medical facilities and training capacity.

Education

- Focus on employability and skill development

- Expansion of STEM education

- Improved access to hostels and educational infrastructure.

The emphasis is on human capital development rather than short-term subsidies.

Financial Markets and Investment Reforms

Key financial market measures include:

- Increase in Securities Transaction Tax (STT) on derivatives

- Support for bond markets, including municipal bonds

- REIT structures for monetizing public sector assets.

These steps aim to deepen capital markets while ensuring stability.

Fiscal Discipline and Deficit Management

Despite higher spending, the government remains committed to fiscal consolidation:

- Fiscal deficit targeted at around 4.3% of GDP

- Long-term goal to reduce public debt levels

- Focus on productive spending rather than consumption-based expenditure.

This approach balances growth with macroeconomic stability.

Impact on Common Citizens

For individuals, the budget offers:

- Stable tax regime and reduced compliance burden

- Lower costs for foreign education and medical expenses

- Improved infrastructure, healthcare, and digital services over time.

While immediate tax relief is limited, the long-term benefits focus on quality of life and economic opportunity.

Final Thoughts

The Union Budget 2026–27 is a structural, investment-driven budget rather than a populist one. By prioritizing infrastructure, manufacturing, digital services, and compliance simplification, the government aims to lay the foundation for sustained economic growth.

Although taxpayers may not see instant relief through lower tax rates, the budget’s long-term vision focuses on:

- Job creation

- Stronger domestic industries

- Improved public infrastructure

- A more efficient and predictable economic system.

Overall, Budget 2026 positions India for the next phase of development by emphasizing capacity building, innovation, and fiscal responsibility.

Frequently Asked Questions (FAQs)

Q1. Are there any changes in income tax slabs in Budget 2026–27?

Answer: No, income tax slabs remain unchanged under both the old and new tax regimes. The government has chosen stability and simplification over immediate tax cuts.

Q2. What is the new Income Tax Act, and when will it apply?

Answer: The new Income Tax Act, 2025, will come into effect from 1 April 2026. It replaces the Income Tax Act, 1961, and aims to simplify tax laws, reduce litigation, and lower the compliance burden.

Q3. What is the biggest highlight of Budget 2026–27?

Answer: The government’s biggest highlight is the record capital expenditure of around ₹12.2 lakh crore, which will be invested in railways, highways, freight corridors, and waterways.

Q4. Is Budget 2026–27 a people-friendly or growth-focused budget?

Answer: Budget 2026–27 is growth-focused. While it offers limited immediate tax relief, it aims to improve the quality of life and income opportunities through long-term economic growth.

Q5. Will this budget help reduce unemployment?

Answer: Yes, the budget aims to reduce unemployment by boosting infrastructure projects, manufacturing, MSMEs, and services, which are major job creators.

Q6. Is Budget 2026–27 good for startups?

Answer: Yes. The focus on digital infrastructure, MSME funding, and services-led growth creates a supportive environment for startups, especially in tech, logistics, manufacturing, and AI-driven sectors.

Q7. Will common citizens see immediate benefits from this budget?

Answer: Some benefits, such as lower TCS and easier compliance, are immediate. However, most benefits are long-term, such as better jobs, infrastructure, and public services.

Recommended Articles

We hope this guide to Union Budget 2026–27 helps you understand the key changes, infrastructure plans, tax reforms, and sectoral growth initiatives. Explore these recommended articles for expert analysis, practical insights, and the latest updates on India’s economy, finance, and policy trends.