What Are Brady Bonds?

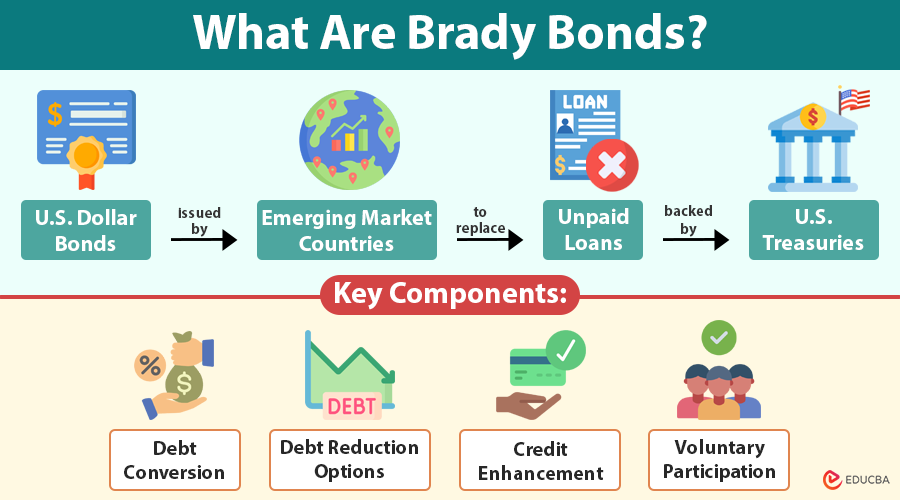

Brady Bonds are U.S. dollar-denominated sovereign debt securities issued by emerging market countries in the late 1980s and 1990s to restructure defaulted commercial bank loans, backed by U.S. Treasury securities to ensure principal repayment.

For example, in 1990, Mexico became the first country to issue Brady Bonds, converting about $48 billion of distressed bank loans into marketable securities as part of its debt relief strategy.

Table of Contents

- Meaning

- 1980s Debt Crisis

- The Brady Plan

- Key Components

- Key Features

- Types

- How Does it Work?

- Benefits

- Criticisms and Limitations

- Impact and Legacy

- Examples

Background: The 1980s Debt Crisis

The idea behind Brady Bonds was born out of the Latin American debt crisis in the 1980s, which followed a decade of heavy borrowing during the 1970s.

Many developing countries had taken large floating-rate loans from international banks to fund infrastructure and development projects. These loans were encouraged by the influx of “petrodollars” after the oil price shocks.

However, in the early 1980s, global interest rates rose sharply due to anti-inflation measures by the U.S. Federal Reserve. At the same time, a global recession and falling commodity prices made it harder for countries to earn foreign currency. As a result, debt repayment became extremely difficult.

In 1982, Mexico announced it could no longer pay its debt. This alarmed international banks and raised fears that more countries would follow. Eventually, over 30 countries, including Brazil, Argentina, the Philippines, and Nigeria, faced similar debt crises.

During the 1980s, countries tried options like loan rescheduling, refinancing, and support from the IMF, but these measures only provided short-term relief. A long-term, market-based solution was needed, leading to the creation of Brady Bonds in 1989.

The Brady Plan (1989)

The Brady Plan, introduced in March 1989, was a debt restructuring initiative led by U.S. Treasury Secretary Nicholas Brady. The plan acknowledged the unsustainable nature of existing debt and advocated for a reduction in the debt stock, rather than just extending payment terms. It was a significant departure from previous strategies that emphasized full repayment without write-downs.

Key Components of the Brady Plan

- Debt conversion: Countries converted old commercial bank loans into new bonds with longer maturities and lower interest rates.

- Debt reduction options: Creditors could choose among instruments that involved a haircut (discount) on the principal or a reduction in interest payments.

- Credit enhancement: Countries used U.S. Treasury zero-coupon bonds to collateralize the principal, and rolling guarantees often backed the interest payments.

- Voluntary participation: Although participation in the plan was voluntary, creditor banks joined in because incentives made it attractive, especially since they had already marked down these bad loans on their balance sheets.

This plan had strong backing from the International Monetary Fund (IMF) and the World Bank, which provided financial and technical support to countries participating in the program. The plan represented a turning point in international finance and led to the creation of a liquid market for emerging market debt.

Key Features of Brady Bonds

| Feature | Description |

| Issuer | Sovereign governments from Latin America, Asia, Africa, and Eastern Europe |

| Currency | Primarily U.S. Dollars (USD) |

| Collateral | U.S. Treasury zero-coupon bonds (to ensure principal repayment) |

| Maturity | Long-term: typically 10 to 30 years |

| Interest Payments | Fixed or floating; sometimes partially guaranteed by international institutions |

| Tradability | Widely traded on secondary markets, improving liquidity |

| Negotiated Terms | Terms were tailored per country depending on their fiscal situation |

| Types | Par Bonds, Discount Bonds, FLIRBs, Debt Conversion Bonds, and more |

Types of Brady Bonds

1. Par Bonds

Par Bonds carried lower-than-market fixed interest rates and matched the full face value of the original loan. The principal fully backs U.S. Treasury zero-coupon bonds to guarantee repayment. They were ideal for countries aiming to keep their total debt unchanged while reducing interest costs.

2. Discount Bonds

Governments issued Discount Bonds at a reduced face value, typically around 65–70% of the original loan amount, and offered interest rates closer to market levels. Like Par Bonds, they were also collateralized for principal protection. These bonds provided an immediate reduction in debt and were favored by banks ready to accept a partial loss in exchange for more secure repayment.

3. FLIRBs (Front-Loaded Interest Reduction Bonds)

FLIRBs offered lower interest payments in the early years, which gradually increased over time, allowing countries some financial relief during recovery. These bonds often came with partial interest guarantees to assure creditors of future payments.

4. Debt Conversion Bonds

Debt Conversion Bonds allowed creditors to exchange debt for equity in state-owned enterprises or for investment in local projects. This encouraged foreign investment and supported economic reforms like privatization.

How Brady Bonds Work?

The implementation of Brady Bonds followed a structured and coordinated process involving debtor countries, commercial creditors, and international financial institutions. Here is how the process typically unfolded:

1. Agreement on Restructuring Terms

The process began with negotiations between the debtor government and its commercial bank creditors, often facilitated and overseen by the International Monetary Fund (IMF). As part of the agreement, debtor countries committed to implement macroeconomic reforms such as fiscal discipline, currency stabilization, and trade liberalization to restore long-term financial stability.

2. Bond Exchange

Once they finalized the terms, countries exchanged their non-performing loans for newly issued Brady Bonds. Creditors were typically given the option to choose from different types of bonds, such as Par Bonds, Discount Bonds, or FLIRBs, depending on their preference for risk, return, and recovery value.

3. Collateral Purchase

To enhance investor confidence, debtor nations used funds from the IMF, World Bank, or their reserves to purchase U.S. Treasury zero-coupon bonds. These were used as collateral to guarantee repayment of the Brady Bonds’ principal upon maturity. The maturity of the collateral matched the term of the bond, ensuring full repayment.

4. Issuance and Trading

After being prepared and secured, Brady Bonds were released and traded in global markets. Their standardized format, combined with U.S. dollar denomination and collateral backing, significantly improved liquidity, transparency, and investor participation in emerging market debt.

5. Monitoring and Reform Continuation

Following issuance, debtor countries remained under regular monitoring by the IMF and World Bank. Debtor countries continued implementing structural reforms, maintained fiscal discipline, and followed policies to support long-term growth and ensure timely debt repayment.

Benefits of Brady Bonds

For Debtor Nations

- Debt relief: Reduced principal or interest eased the repayment burden.

- Return to capital markets: Issuance of Brady Bonds restored access to international finance.

- Increased investor confidence: Collateralized bonds with standardized structures made investment more attractive.

- Macroeconomic stability: Paired with structural reforms, they helped reduce inflation and fiscal deficits.

For Creditors

- Tradable securities: Brady Bonds were more liquid than non-performing loans.

- Collateral assurance: U.S. Treasury securities reduced credit risk.

- Recovery value: Banks recovered more than they might have in default scenarios.

- Regulatory benefits: Cleaned up bank balance sheets and avoided write-offs.

The plan marked a win-win for both sides, resolving a decade-long financial impasse.

Criticisms and Limitations

Despite their success, Brady Bonds were not without flaws:

- Moral hazard: Critics argued that bailing out irresponsible borrowing and lending would encourage future risk-taking.

- Not a universal solution: Some countries, like Argentina and Russia, experienced debt crises even after Brady restructurings.

- Short-term relief: Structural issues, such as corruption, low productivity, and poor governance, were not always addressed.

- Market dependency: Reliance on external markets made countries vulnerable to investor sentiment and global interest rate swings.

- Complexity and cost: Collateralization and negotiation processes were resource-intensive and required sustained political commitment.

Still, the net effect was overwhelmingly positive in terms of financial system stabilization.

Impact and Legacy

Brady Bonds were a transformative development in sovereign finance. They helped resolve a major global crisis, restored investor confidence in emerging markets, and laid the groundwork for modern sovereign debt markets.

Key Legacies:

- Created the modern emerging markets bond asset class: Before Brady Bonds, there was no standardized market for emerging market debt.

- Inspired new structures: Innovations like collective action clauses (CACs) and credit enhancements in future sovereign bonds.

- Demonstrated the power of market-based solutions: Governments, banks, and multilateral institutions successfully collaborated without relying solely on aid.

- Paved the way for eurobonds and global bonds: Countries learned to diversify funding sources and manage debt proactively.

By the early 2000s, most Brady Bonds were retired or swapped for new instruments, but their influence remains visible in the financial frameworks.

Examples of Countries That Issued Brady Bonds

| Country | Year of Agreement | Notable Features and Outcomes |

| Mexico | 1990 | First Brady Bond issuer; used Par and Discount Bonds |

| Venezuela | 1990 | Mixed bond structure with large debt stock covered |

| Argentina | 1993 | Re-entered capital markets; later defaulted in 2001 |

| Brazil | 1994 | One of the largest and most complex deals |

| Nigeria | 1992 | Reduced debt burden significantly, supported economic reform |

| Philippines | Early 1990s | Used Brady Bonds as part of broader liberalization strategy |

Final Thoughts

Brady Bonds were an unprecedented financial innovation that brought order and liquidity to a chaotic sovereign debt landscape. They demonstrated that even the most challenging debt issues can be resolved through teamwork, practical solutions, and a strong commitment to meeting the needs of both borrowers and lenders.

While the specific instruments have faded, the principles behind the Brady Plan continue to guide sovereign debt restructurings, especially in a world still grappling with debt sustainability challenges in emerging and frontier markets.

Frequently Asked Questions (FAQs)

Q1. Are Brady Bonds still traded today?

Answer: No, most Brady Bonds have been retired or exchanged for newer debt instruments by the early 2000s. However, their legacy lives on in how sovereign debt is issued and restructured today.

Q2. How did Brady Bonds affect credit ratings for emerging market countries?

Answer: Brady Bonds often helped improve credit ratings because they reduced default risk through collateral and signaled commitment to reform, making countries more attractive to global investors.

Q3. Did any private investors benefit from Brady Bonds?

Answer: Yes, institutional investors like hedge funds and pension funds purchased Brady Bonds at discounted prices and profited as countries stabilized and bond values rose in secondary markets.

Q4. Were there any tax implications for investors holding Brady Bonds?

Answer: Yes, interest income and capital gains on Brady Bonds were subject to taxation, depending on the investor’s country of residence and the tax treaty terms with the issuing country.

Q5. How did Brady Bonds differ from Eurobonds?

Answer: Brady Bonds were created for debt restructuring and backed by collateral, while Eurobonds are typically used for general sovereign financing and do not include collateral guarantees.

Recommended Articles

We hope this article has deepened your understanding of Brady Bonds and their role in financial history. To explore more, check out: