Updated July 21, 2023

Activity Ratio Formula (Table of Contents)

What is the Activity Ratio Formula?

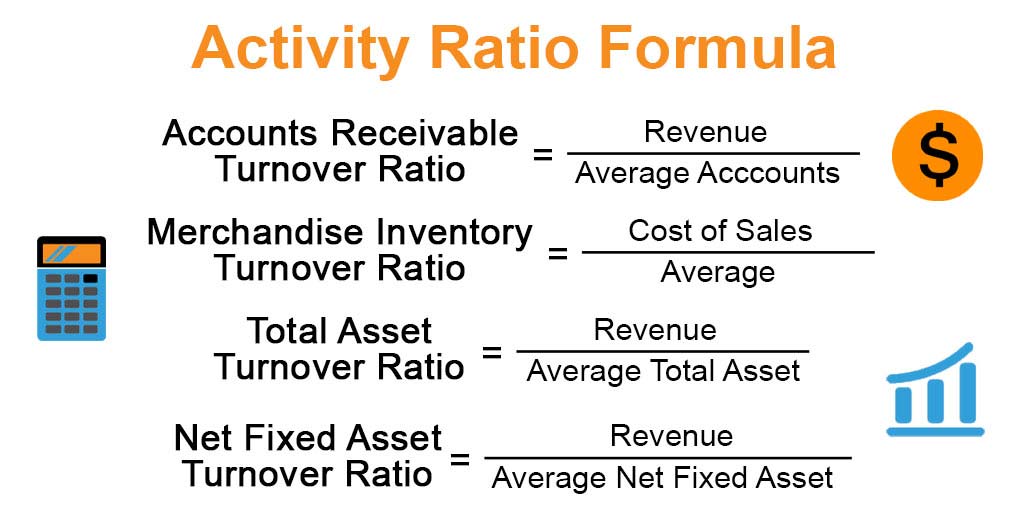

The term “activity ratio” refers to the set of financial ratios that helps determine whether or not a company’s management can efficiently utilize the assets to generate operational cash. In other words, these ratios indicate how effectively the company’s management is converting its assets into cash.

The following four ratios are the primary activity ratios that are predominantly used in financial analysis:

- Accounts Receivable Turnover Ratio

- Merchandize Inventory Turnover Ratio

- Total Asset Turnover Ratio

- Net Fixed Asset Turnover Ratio

Example of Activity Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Activity Ratio in a better manner.

Activity Ratio Formula – Example #1

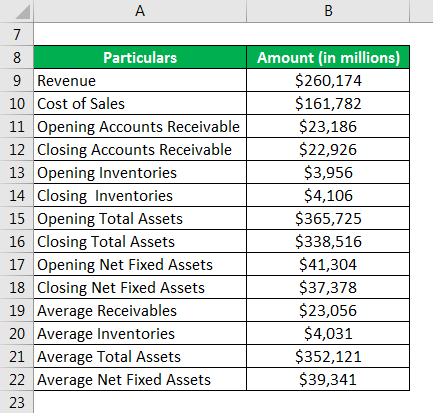

Let us take Apple Inc.’s example to calculate the various activity ratios based on its annual report for the year 2019. During the year, the company booked revenue of $260,174 million against the cost of sales of $161,782 million. At the beginning of the year, the accounts receivable, total assets, net fixed assets, and inventories stood at $23,186 million, $365,725 million, $41,304 million, and $3,956 million. On the other hand, accounts receivable, total assets, net fixed assets, and inventories stood at $22,926 million, $338,516 million, $37,378 million, and $4,106 million, respectively, at the year’s end. Calculate the following activity ratios for Apple Inc:

Solution:

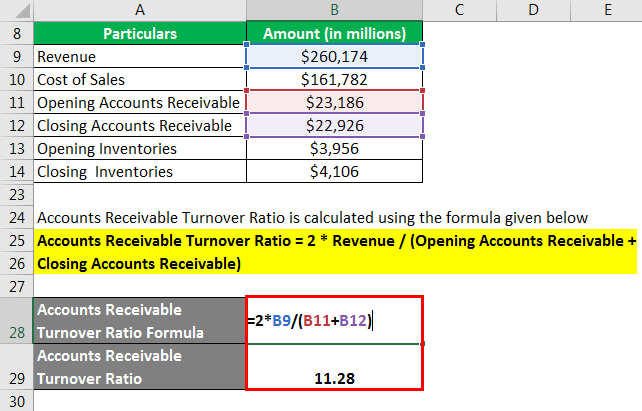

The formula to calculate Accounts Receivable Turnover Ratio is as below:

Accounts Receivable Turnover Ratio = 2 * Revenue / (Opening Accounts Receivable + Closing Accounts Receivable)

- Accounts Receivable Turnover Ratio = 2 * $260,174 million / ($23,186 million + $22,926 million)

- Accounts Receivable Turnover Ratio = 11.28x

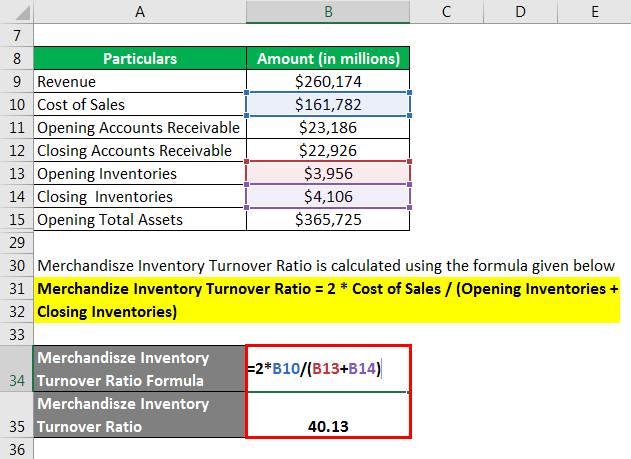

The formula to calculate Merchandize Inventory Turnover Ratio is as below:

Merchandize Inventory Turnover Ratio = 2 * Cost of Sales / (opening Inventories + Closing Inventories)

- Merchandize Inventory Turnover Ratio = 2 * $161,782 million / ($3,956 million + $4,106 million)

- Merchandize Inventory Turnover Ratio = 40.13x

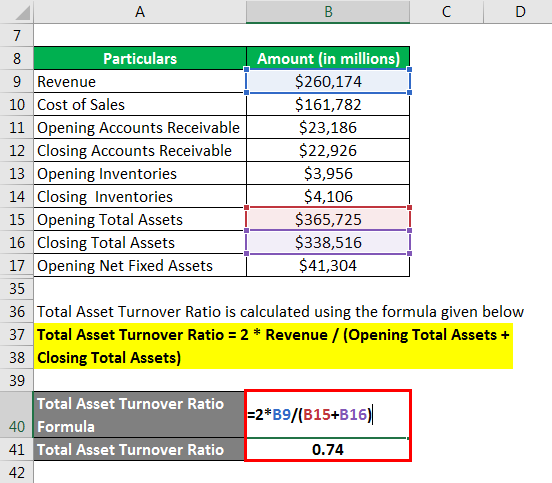

The formula to calculate Total Asset Turnover Ratio is as below:

Total Asset Turnover Ratio = 2 * Revenue / (Opening Total Assets + Closing Total Assets)

- Total Asset Turnover Ratio = 2 * $260,174 million / ($365,725 million + $338,516 million)

- Total Asset Turnover Ratio = 0.74x

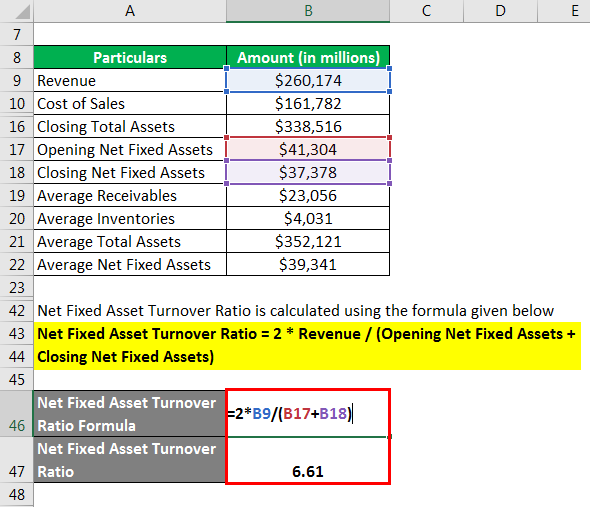

The formula to calculate Net Fixed Asset Turnover Ratio is as below:

Net Fixed Asset Turnover Ratio = 2 * Revenue / (Opening Net Fixed Assets + Closing Net Fixed Assets)

- Net Fixed Asset Turnover Ratio = 2 * $260,174 million / ($41,304 million + $37,378 million)

- Net Fixed Asset Turnover Ratio = 6.61x

Source Link: Apple Inc. Balance Sheet

Explanation

To calculate the Activity Ratio Formula, you can use the following points:

1. Accounts Receivable Turnover Ratio

This ratio is indicative of a company’s credit policies and, in the process, measures its ability to collect its accounts receivable that are created due to credit sales. Typically, a higher value means the company can collect its receivables quickly, indicating strong credit policies and vice versa. The ratio is also known as the debt turnover ratio. The formula for the accounts receivable turnover ratio is expressed as the revenue of the subject company divided by its average accounts receivable. Mathematically, it is represented as,

2. Merchandise Inventory Turnover Ratio

This ratio shows how effectively a company can convert its stock and work-in-progress (WIP) inventory into cash. Typically, a higher value means the company can sell its inventory quickly to generate sales and vice versa. The ratio is also known as a stock turnover ratio. The merchandise inventory turnover ratio formula expresses the ratio as the division of the cost of sales by average inventories. Mathematically, one can represent it as

3. Total Asset Turnover Ratio

This ratio indicates the ability of a company to generate sales by leveraging all the available long-term and short-term assets. Typically, a higher value means that the company can generate higher sales by leveraging its assets which is desirable. The total asset turnover ratio expresses revenue divided by the average value of total assets during the given period. Mathematically, one can represent it as

4. Net Fixed Asset Turnover Ratio

This ratio shows the ability of a company to generate sales by utilizing its fixed assets in the form of plant, property, and machinery. A higher value indicates that the company utilizes its fixed assets very efficiently. The net fixed asset turnover ratio formula expresses revenue divided by the average net fixed assets for the period. Mathematically, one can represent it as

Relevance and Use of Activity Ratio Formula

The formula of activity ratio is very useful as it shows how well a business can convert its available assets into cash or sales. As such, it is considered a good performance metric to check how efficiently a business runs. Accounting departments and management predominantly use these activity ratios to assess business efficiency.

Activity Ratio Formula Calculator

You can use the following Activity Ratio Formula Calculator

| Revenue | |

| Opening Accounts Receivable | |

| Closing Accounts | |

| Accounts Receivable Turnover Ratio | |

| Accounts Receivable Turnover Ratio = | 2 *Revenue /(Opening Accounts Receivable+Closing Accounts) |

| = | 2 *0 /(0+0)= 0 |

Recommended Articles

This is a guide to the Activity Ratio Formula. Here we discuss how to calculate the Activity Ratio along with practical examples. We also provide an Activity Ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –