What is Embedded Finance?

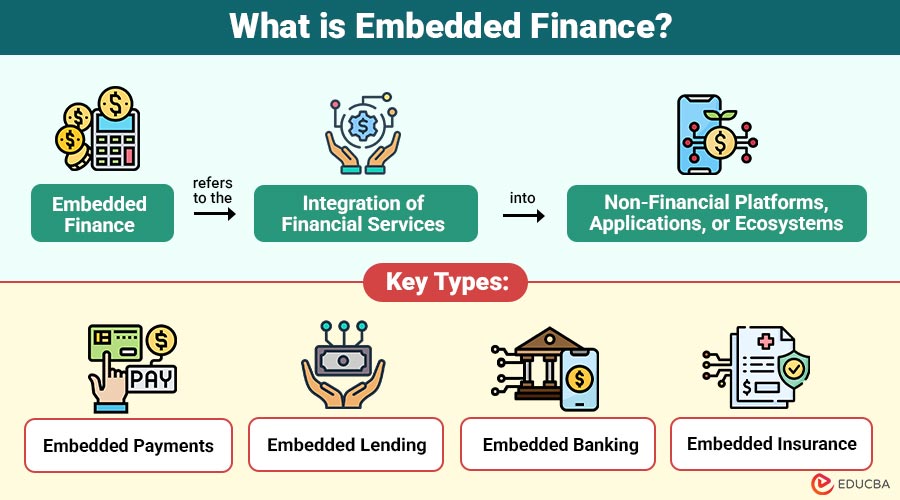

Embedded finance refers to the integration of financial services into non-financial platforms, applications, or ecosystems. These services are delivered contextually at the point of need, without requiring users to interact directly with traditional financial institutions.

Instead of building financial infrastructure from scratch, companies rely on APIs and Banking-as-a-Service (BaaS) providers to embed regulated financial products into their existing user journeys. The result is a smooth, frictionless experience where financial actions feel like a natural extension of the core product.

Table of Contents:

Key Takeaways:

- Embedded finance integrates financial services into platforms, creating seamless experiences without the need for traditional banking interactions.

- It enables businesses to offer payments, lending, banking, and insurance directly within their applications.

- Customers gain convenience, faster access, and better experiences, improving satisfaction and platform engagement.

- Financial institutions expand reach, reduce acquisition costs, and leverage partner ecosystems for wider distribution.

How Does Embedded Finance Work?

The core of embedded finance lies in APIs (Application Programming Interfaces), which enable non-financial platforms to securely access banking and financial infrastructure. A typical embedded finance ecosystem includes three main players:

1. Customer-Facing Platforms

These are businesses that directly interact with end-users, such as e-commerce platforms, mobile apps, or marketplaces. They leverage embedded finance to enhance user experience and create additional revenue streams.

2. Financial Service Providers

Banks, fintechs, and payment processors provide the integrated financial products. These providers manage regulatory compliance, risk, and core financial functionalities.

3. Technology Intermediaries

API platforms or middleware companies connect customer-facing platforms with financial service providers. They simplify integration, handle compliance, and provide a seamless backend infrastructure.

The flow typically involves a user action (e.g., making a purchase), which triggers an embedded financial service (e.g., instant financing). This service operates invisibly, and the user experiences a smooth, intuitive transaction.

Key Types of Embedded Finance

These are the primary key types of embedded finance and the ways in which they are included into common platforms.:

1. Embedded Payments

Embedded payments enable users to pay, receive money, or transfer funds within an application. Examples include in-app checkout, digital wallets, and real-time payouts.

Use Cases:

- One-click checkout in e-commerce

- In-app payments for food delivery and ride-sharing

- Instant payouts for gig workers

2. Embedded Lending

Embedded lending allows platforms to offer credit products such as Buy Now, Pay Later (BNPL), short-term loans, or working capital financing.

Use Cases:

- BNPL options at checkout

- Merchant cash advances for sellers

- Instant credit for small businesses

3. Embedded Banking

Embedded banking provides core banking features like accounts, cards, and money management tools within non-bank platforms.

Use Cases:

- Digital wallets with IBAN or account numbers

- Branded debit or prepaid cards

- Neobanking features inside SaaS platforms

4. Embedded Insurance

Embedded insurance integrates insurance coverage into product or service purchases, offering protection at the point of sale.

Use Cases:

- Travel insurance during ticket booking

- Device insurance when purchasing electronics

- Ride insurance in mobility apps

Benefits of Embedded Finance

It offers significant benefits for customers, businesses, and financial institutions alike:

1. Customers

- Convenience: Financial services are available exactly when needed.

- Faster Access: Reduced onboarding and approval times.

- Better User Experience: No redirection to external financial platforms.

2. Businesses

- New Revenue Streams: Earn fees, commissions, or interest income.

- Higher Customer Retention: Financial services increase platform stickiness.

- Improved Data Insights: Better understanding of customer behavior and needs.

3. Financial Institutions

- Wider distribution: Reach customers through digital-native platforms.

- Lower acquisition costs: Leverage partner ecosystems instead of direct marketing.

Difference Between Embedded Finance and Traditional Finance

Here is a comparison of embedded finance and traditional finance across key aspects:

| Aspect | Embedded Finance | Traditional Finance |

| Customer access | Integrated into daily-use platforms | Separate bank apps or branches |

| User experience | Seamless and contextual | Often complex and fragmented |

| Time to market | Faster with APIs and BaaS | Slow due to infrastructure |

| Innovation | Rapid experimentation and scaling | Limited by legacy systems |

Challenges in Embedded Finance

Despite its advantages, it comes with challenges:

1. Regulatory Compliance

Meeting different financial laws and standards across countries requires constant monitoring, updates, and legal expertise.

2. Data Security and Privacy

Safeguarding sensitive customer financial information from breaches, misuse, and unauthorized access is critical.

3. Operational Risk

Relying on third-party fintech providers can cause disruptions if partners face outages, failures, or instability.

4. Customer Trust

Clear communication of fees, terms, and processes is essential to maintain confidence and avoid misunderstandings.

Future Trends

Here are some key trends shaping the future of embedded finance:

1. AI-driven Personalization

AI-driven personalization uses customer behavior and data insights to deliver highly relevant, contextual financial offers in real time.

2. Expansion Beyond Payments

Embedded finance expands beyond payments into lending, insurance, and investment products, creating comprehensive financial experiences within platforms globally.

3. Industry-specific Solutions

Industry-specific solutions deliver embedded financial services tailored to vertical needs, regulations, and workflows, improving adoption and business efficiency outcomes.

4. Global Scalability

Global scalability enables cross-border embedded financial services, supporting multiple currencies, regulations, and seamless customer experiences worldwide, securely and efficiently.

Final Thoughts

Embedded finance is transforming finance by seamlessly integrating services into everyday digital experiences. It enhances customer convenience, unlocks new revenue opportunities for businesses, and extends the reach of financial institutions. As APIs, cloud platforms, and regulations mature, embedded finance will drive digital commerce and financial inclusion, making adoption a strategic necessity for competitive businesses.

Frequently Asked Questions (FAQs)

Q1. Is embedded finance the same as fintech?

Answer: No. Embedded finance uses fintech infrastructure, but it focuses on integrating financial services into non-financial platforms.

Q2. Do companies need a banking license for embedded finance?

Answer: Typically, no. Licenses are provided by partner banks or BaaS providers.

Q3. Is embedded finance secure?

Answer: Yes, when implemented with regulated partners and strong security practices.

Recommended Articles

We hope that this EDUCBA information on “Embedded Finance” was beneficial to you. You can view EDUCBA’s recommended articles for more information.