What is Debt Consolidation?

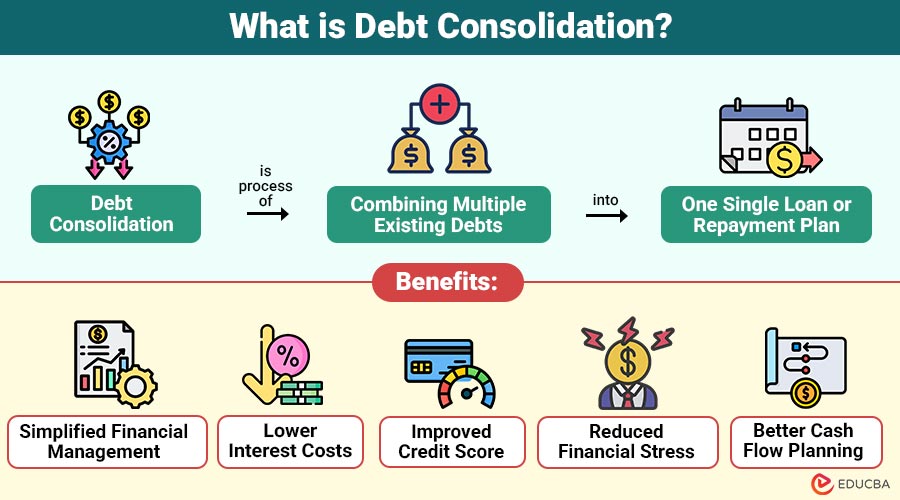

Debt consolidation is the process of combining multiple existing debts into one single loan or repayment plan. Instead of making several monthly payments to different lenders, the borrower makes a single consolidated payment, usually with a fixed interest rate and a defined repayment period.

Table of Contents:

- Meaning

- Working

- Types

- Key Features

- Benefits

- Limitations

- Difference

- Real-World Use Cases

- When Should you Consider Debt Consolidation?

Key Takeaways:

- Debt consolidation combines multiple debts into single repayment plan, simplifying financial management.

- It can reduce interest costs and improve cash flow when structured responsibly.

- Consolidation does not eliminate debt but restructures it into a more manageable format.

- Credit scores may improve over time with consistent, on-time repayments.

How Does Debt Consolidation Work?

Debt consolidation generally follows a structured process:

1. Assessment of Existing Debts

The borrower reviews all outstanding debts, comparing balances, interest rates, repayment schedules, and total obligations carefully before proceeding.

2. Selection of a Consolidation Method

The borrower selects an appropriate consolidation option, such as a personal loan, a balance transfer card, or a home equity loan.

3. Payoff of Existing Debts

Uses funds from the consolidation loan to repay existing debts across multiple creditors efficiently and promptly.

4. Single Monthly Repayment

The borrower makes a single monthly payment, simplifying budgeting, improving cash flow, and significantly reducing overall repayment complexity.

Types of Debt Consolidation

Below are the most common types of debt consolidation:

1. Personal Loan Consolidation

The borrower uses a fixed-rate personal loan to pay off multiple debts. This option offers predictable monthly payments and is suitable for unsecured debt.

2. Balance Transfer Credit Cards

For a brief time, high-interest credit card balances are moved to a card with a low or 0% introductory APR.

3. Home Equity Loan or HELOC

Homeowners can use their property’s equity to consolidate debt, often at lower interest rates but with higher risk due to the collateral involved.

4. Debt Management Plans (DMPs)

Offered by credit counseling agencies, DMPs negotiate lower interest rates and structured repayment plans without taking new loans.

5. Business Debt Consolidation

Businesses combine multiple loans or vendor payables into one financing arrangement to improve cash flow and reduce administrative burden.

Key Features of Debt Consolidation

The following key features highlight how debt consolidation simplifies debt repayment while improving financial control and long-term stability.

1. Single Payment

Simplifies repayment and lowers the possibility of missing payments by replacing several monthly responsibilities with a single consolidated payment.

2. Interest Optimization

Often lowers the overall interest burden by combining high-interest debts into a single loan with a better rate.

3. Fixed Tenure

Provides a clearly defined repayment period, helping borrowers plan finances with predictable monthly installments.

4. Credit Impact

Timely repayments can positively influence credit scores by improving payment history and reducing credit utilization.

5. Financial Discipline

Promotes structured money management by encouraging consistent payments and better control over overall debt.

Benefits of Debt Consolidation

The following benefits explain how debt consolidation can improve financial stability, reduce repayment burden, and enhance long-term money management.

1. Simplified Financial Management

Managing a single consolidated payment reduces missed deadlines, avoids late fees, and simplifies overall personal financial tracking.

2. Lower Interest Costs

Compared to credit cards, consolidation loans usually have lower interest rates, which greatly lowers the total cost of repayment.

3. Improved Credit Score

Regular, timely payments enhance credit utilization ratios and strengthen payment history, supporting gradual credit score improvement.

4. Reduced Financial Stress

A structured repayment plan reduces uncertainty, easing anxiety and providing greater confidence and control over finances.

5. Better Cash Flow Planning

Fixed monthly installments support accurate budgeting, predictable expenses, and more effective long-term cash flow planning overall.

Limitations of Debt Consolidation

Despite its benefits, debt consolidation has certain limitations that borrowers should carefully evaluate before choosing this approach.

1. Extended Repayment Period

Lower monthly payments can extend the loan tenure, resulting in higher total interest paid over time.

2. Risk of Accumulating New Debt

Lack of spending discipline may encourage borrowers to incur new debts alongside consolidated obligations.

3. Collateral Risk

Secured consolidation options, such as home equity loans, may put valuable personal assets at risk.

4. Fees and Charges

Consolidation methods may include origination fees, balance transfer charges, processing costs, or early repayment penalties.

5. Not a Solution for Severe Debt

For overwhelming debt situations, options like debt settlement, counseling, or bankruptcy may be more suitable.

Difference Between Debt Consolidation and Debt Settlement

The table below highlights the key differences between debt consolidation and debt settlement:

| Aspect | Debt Consolidation | Debt Settlement |

| Credit Impact | Generally neutral to positive | Often negative |

| Repayment | Full repayment | Partial repayment |

| Risk Level | Moderate | High |

| Time Horizon | Medium to long term | Short to medium term |

| Legal Risk | Low | Higher |

Real-World Use Cases

The following use cases demonstrate how debt consolidation is applied across different borrower profiles to improve repayment efficiency and financial stability.

1. Salaried Professionals

Consolidating credit card and personal loan debt into a single EMI for easier budgeting and monthly cash flow.

2. Small Business Owners

Combining short-term business loans to stabilize cash flow, reduce interest burden, and improve operational liquidity management planning.

3. Freelancers

Managing irregular income by locking into predictable monthly repayments that support stability, budgeting discipline and financial confidence.

4. Homeowners

Using home equity loans to refinance high-interest consumer debt while lowering interest costs and simplifying repayment obligations.

When Should You Consider Debt Consolidation?

Debt consolidation may be an appropriate solution in the following situations:

1. Multiple High-Interest Debts

If you are managing several credit cards or loans with high interest rates, consolidation can reduce the overall interest burden.

2. Difficulty Managing Multiple Payments

When tracking several due dates becomes confusing or leads to missed payments, a single monthly installment can simplify budgeting.

3. Stable Income Source

Borrowers with predictable income can consistently make fixed monthly repayments.

4. Good or Improving Credit Profile

A reasonable credit score increases access to lower interest rates and better consolidation terms.

5. Desire for Structured Financial Planning

If your goal is long-term financial discipline and predictable cash flow, consolidation provides clarity and control.

Final Thoughts

Debt consolidation is powerful financial tool that helps individuals and businesses regain authority over their finances by simplifying repayments and optimizing interest costs. While it is not a one-size-fits-all solution, disciplined use of debt consolidation can lead to improved financial stability, reduced stress, and better credit health. Careful evaluation, responsible spending habits, and long-term planning are key to making debt consolidation successful.

Frequently Asked Questions (FAQs)

Q1. Does debt consolidation eliminate debt?

Answer: No, it restructures debt but does not erase the total amount owed.

Q2. Is debt consolidation good for a credit score?

Answer: Yes, when managed responsibly, it can improve credit health over time.

Q3. Can I consolidate debt with bad credit?

Answer: Options exist, but interest rates may be higher or require collateral.

Q4. How long does debt consolidation take?

Answer: Typically ranges from 2 to 7 years, depending on loan terms.

Recommended Articles

We hope that this EDUCBA information on “Debt Consolidation” was beneficial to you. You can view EDUCBA’s recommended articles for more information.