What Is Market Appraisal?

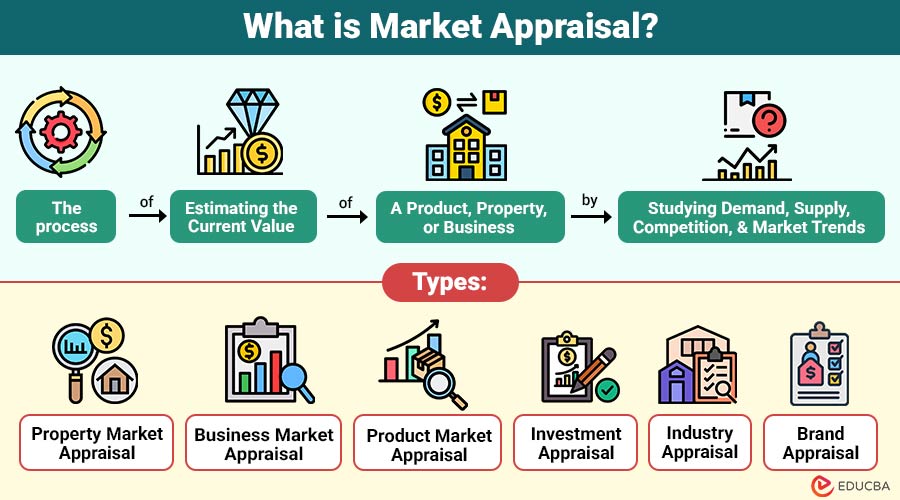

Market appraisal is the process of estimating the current value of a product, property, or business by studying demand, supply, competition, and market trends. It helps you understand what something is realistically worth before buying, selling, or investing.

For example, a homeowner may request a market appraisal to know the fair price of their house based on recent sales in the neighbourhood, property condition, and local demand. This ensures they list it at the right value.

Table of Content:

- What Is Market Appraisal?

- Why Market Appraisal Matters

- Key Components

- Types

- How a Market Appraisal Is Conducted

- Market Appraisal vs. Market Valuation

- Tools and Techniques

- Real-World Examples

- Challenges

Key Takeaways

- Market appraisal provides a clear understanding of an asset’s or business’s current market value.

- It helps make informed decisions, set fair prices, and reduce financial risks.

- Accurate appraisals depend on data analysis, market trends, competitor evaluation, and proper valuation methods.

- Regular updates, expert guidance, and the use of modern tools ensure reliable insights, supporting strategic planning, investment decisions, and business growth.

Why Market Appraisal Matters?

Market appraisal helps you make smarter decisions by understanding the true value of what you own or plan to buy.

- Gives clarity on real value: It provides a clear idea of a property, product, or business’s actual worth, so you do not overpay or undersell.

- Improves decision-making: It helps buyers, sellers, and businesses choose the right time to buy, sell, or invest by understanding market conditions.

- Supports better pricing: With accurate data, you can set fair, competitive prices that align with current market trends.

- Reduces risks: Appraisal protects you from financial loss by avoiding poor or uninformed decisions.

- Boosts negotiation power: A well-documented appraisal helps you negotiate a fair deal with confidence.

- Helps plan future moves: It guides long-term decisions such as upgrading property, entering new markets, or adjusting business strategies.

Key Components of a Market Appraisal

These components help identify the true market value by analysing different factors that influence price and demand.

- Market Trends: This involves analyzing price trends, levels of demand, and general industry changes to determine whether the market is increasing or decreasing.

- Competitor Analysis: It looks at similar products or properties to compare pricing, quality, and features, helping you understand where you stand.

- Customer Demand: This checks what buyers want, what they prefer, and how much they are willing to pay, making the appraisal more accurate.

- Asset or Property Condition: The physical condition, age, features, and performance of the asset play an important role in deciding its value.

- Location and External Factors: Elements like neighbourhood growth, economic changes, and government policies impact pricing and demand.

- Financial Performance (for businesses): Revenue, profit, and operational strength are analysed to estimate business worth.

Types of Market Appraisal

Different types of market appraisals help evaluate value based on the kind of asset or purpose involved.

- Property Market Appraisal: This estimates the value of homes, land, or buildings by checking location, condition, and recent sales in the area.

- Business Market Appraisal: It measures the worth of a business by analysing revenue, assets, market position, and competition.

- Product Market Appraisal: This evaluates the price and demand for a product by studying customer preferences, competitors, and current market trends.

- Investment Appraisal: Used to check the value of financial assets like stocks or projects by reviewing returns, risks, and market performance.

- Industry Appraisal: This examines the overall health and potential of an industry to guide long-term decisions for investors or companies.

- Brand Appraisal: It gauges how much value a brand holds based on reputation, customer loyalty, and market reach.

How a Market Appraisal Is Conducted?

The appraisal process follows a few clear steps to estimate an accurate and reliable market value.

- Data Collection: Experts gather information from sales records, market reports, surveys, and online databases to understand the current market situation.

- Physical or Performance Inspection: The asset, product, or property is carefully reviewed to check its condition, features, and overall quality.

- Market Comparison: The asset is evaluated against similar items that were recently sold or are currently listed to determine a competitive price.

- Demand and Trend Analysis: Analysts examine customer demand, market demand, and price trends to support valuation.

- Use of Valuation Methods: Techniques like cost-based valuation, income-based valuation, or comparative analysis are applied depending on the asset type.

- Final Appraisal Report: All findings are combined into a clear report that shows the estimated value and reasons behind it, helping stakeholders make decisions.

Market Appraisal vs. Market Valuation

Both terms help estimate value, but they differ in purpose, accuracy, and legal importance.

| Factor | Market Appraisal | Market Valuation |

| Meaning | An estimate of value based on market trends and comparisons. | A formal, certified valuation done by a licensed professional. |

| Purpose | Helps buyers and sellers understand the likely market value. | Used for legal, financial, loan, tax, or official purposes. |

| Accuracy Level | Reasonably accurate but not legally binding. | Highly accurate, detailed, and officially recognised. |

| Who Performs It | Real estate agents, analysts, or market experts. | Certified valuers or registered valuation professionals. |

| Use Cases | Pricing decisions, market insights, or pre-sale planning. | Court matters, bank loans, insurance, and taxation. |

| Cost | Usually free or low-cost. | Often paid and more expensive due to formal requirements. |

Tools and Techniques Used in Market Appraisal

These tools and methods help experts assess value accurately and make reliable pricing decisions.

- Digital Market Research Tools: Platforms such as CRM systems, online analytics, and market databases help collect real-time information on prices, demand, and competition.

- Comparative Market Analysis (CMA): This technique compares the asset with similar items that have recently been sold or are currently on the market to estimate a fair value.

- Financial Modelling Tools: Businesses or investors use tools such as ROI calculators, cash flow models, and DCF analysis to evaluate value.

- Surveys and Customer Feedback: Direct opinions from customers help understand demand, preferences, and price expectations.

- Expert Consultations: Real estate agents, industry analysts, and valuation specialists use their experience and knowledge to provide accurate insights.

- Physical Inspection Tools: Measurements, quality checks, and condition assessment help understand the asset’s actual state before deciding its value.

Real-World Examples of Market Appraisal

These two real-world examples show how companies used market appraisal or valuation to estimate value and guide their decisions.

- Flipkart (India-Ecommerce): In 2018, Walmart acquired about 77% stake in Flipkart for roughly USD 16 billion, valuing Flipkart at around USD 20.8 billion, reflecting its strong growth, rising market share, and future potential in India’s online shopping market.

- NVIDIA: Also in 2025, Brand Finance values NVIDIA’s brand at USD 87.9 billion, a remarkable jump of 98% reflecting its growth in technology, especially AI and semiconductor demand. This valuation exemplifies how market appraisal adapts to changing market conditions and potential future growth — helping investors, partners, and markets understand how much a brand is worth beyond current earnings.

Challenges in Market Appraisal

Market appraisal is useful, but several challenges can affect its accuracy and reliability.

- Limited or Outdated Data: Sometimes, accurate market data is unavailable or old, making the appraisal less reliable.

- Rapid Market Changes: Prices and demand can change quickly due to trends, new competitors, or economic shifts, potentially affecting accuracy.

- Subjective Bias: Personal opinions or inconsistent appraisal methods can lead to incorrect estimates.

- Complex Assets: Businesses, intellectual property, or specialized products are harder to evaluate than standard properties.

- External Factors: Economic conditions, government regulations, and unforeseen events such as pandemics can unexpectedly affect market value.

- Cost and Time Constraints: Comprehensive appraisals require resources, and limited time or budget can reduce the quality of the report.

- Technological Limitations: Lack of access to advanced analytics tools or software can affect data analysis and valuation accuracy.

Conclusion

Market appraisal is a vital tool for understanding the true value of assets, products, or businesses. It supports informed decisions, fair pricing, and risk reduction for buyers, sellers, and investors. Despite challenges such as market volatility and data limitations, using appropriate methods, tools, and expert guidance ensures reliable insights, helping businesses and individuals navigate markets confidently and strategically.

Frequently Asked Questions

1. How often should a market appraisal be conducted?

Answer:- It is recommended to update appraisals annually or before major transactions.

2. Is a market appraisal legally binding?

Answer:- No, it provides an estimate, not a legally enforceable value.

3. Can market appraisal predict future market trends?

Answer:-It offers insights, but cannot guarantee exact future prices.

4. Do small businesses need market appraisal?

Answer:- Yes, even small businesses benefit from knowing a realistic market value for growth and planning.

Recommended Articles

We hope this guide on Market Appraisal helped you understand asset and business valuation. For more insights, explore these related articles below: