What is Robo Trading?

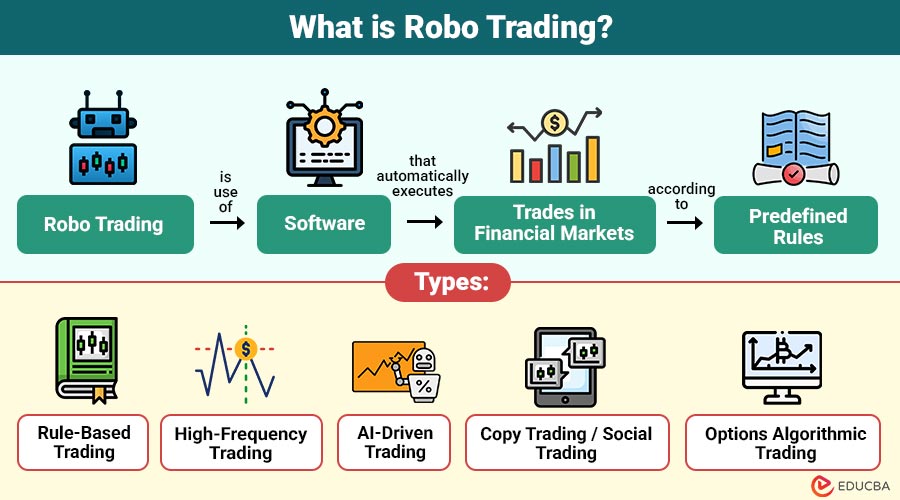

Robo trading (also known as algorithmic trading, automated trading, or algo-based trading) is the use of software that automatically executes trades in financial markets according to predefined rules.

These rules can include indicators, price movements, timing, mathematical models, artificial intelligence, and machine-learning-based patterns. Robo trading eliminates human delays, reduces emotional decision-making, and executes trades with precision—often within microseconds.

Table of Contents:

- Meaning

- Working

- Key Components

- Types

- Benefits

- Limitations

- Real-World Applications

- Examples

- How to Start Robo Trading?

Key Takeaways:

- Robo trading automates market decisions using predefined algorithms, removing emotional bias and ensuring fast, consistent execution.

- Effective robo trading requires robust strategy design, proper coding, thorough backtesting, and disciplined real-time risk management controls.

- While automation boosts efficiency and accuracy, it still faces challenges like technical failures and unpredictable market conditions.

- Beginners can start easily with no-code platforms, gradually scaling after paper trading and thoroughly validating strategy performance.

How Does Robo Trading Work?

Robo trading operates through a combination of technology, data, and strategy:

1. Strategy Development

A trading strategy is designed based on:

- Technical indicators (RSI, MACD, Moving Averages)

- Price patterns

- Market signals

- Statistical models

- Machine learning predictions

2. Coding the Rules

The strategy is transformed into executable code using programming languages such as Python, MQL4/5, Java, C++, or platform-specific scripting languages.

3. Backtesting

The strategy is tested on historical data to measure:

- Profitability

- Drawdowns

- Accuracy

- Risk parameters

4. Automation

After optimization, the software monitors the market 24/7 and automatically executes trades when conditions match the strategy.

5. Live Trading

During live trading, the system:

- Collects real-time data

- Identifies opportunities

- Places buy/sell orders

- Manages positions

- Exits trades based on predefined rules

Key Components of Robo Trading

Here are the essential key components that make automated trading systems function effectively:

1. Algorithm

A predefined set of logical rules that automatically analyzes market conditions and triggers trades without emotional interference.

2. Trading Platform

Software environment offering charting, automation tools, and broker connectivity for executing algorithmic strategies seamlessly across markets.

3. Market Data Feed

Real-time streaming price, volume, and order-book information, enabling algorithms to make accurate, time-sensitive trading decisions.

4. Execution Engine

An automated system that precisely transmits buy or sell orders to the exchange in real time after processing signals.

5. Risk Management Module

Controls exposures, position sizes, stop-loss, and take-profit levels to maintain safety and protect overall trading capital.

Types of Robo Trading

Here are the types of automated trading commonly used across financial markets:

1. Rule-Based Trading

Automates trades using predefined mathematical rules such as moving averages, RSI levels, and breakout-based entry signals.

2. High-Frequency Trading

Executes extremely fast trades using ultra-low latency systems, advanced algorithms, and co-located servers for institutional efficiency.

3. AI-Driven Trading

Predicts prices, finds hidden trends, and continuously modifies tactics using neural networks and machine learning models.

4. Copy Trading / Social Trading

Allows traders to automatically replicate trades of experienced investors, enabling beginners to benefit from expert strategies.

5. Options Algorithmic Trading

Uses options Greeks, volatility models, and delta-neutral techniques to automate complex derivatives trading strategies effectively.

Benefits of Robo Trading

Here are the major benefits that make automated trading highly effective for modern traders:

1. Eliminates Emotional Trading

Removes fear, greed, and panic from decision-making by executing trades strictly based on predefined logic and data-driven strategies.

2. High-Speed Execution

Executes trades within milliseconds, enabling rapid response to market changes and capturing profitable opportunities that humans usually react too slowly to exploit.

3. Consistency

Maintains steady performance by following predefined rules every time, ensuring disciplined trading without deviations caused by human moods or impulses.

4. 24/7 Market Monitoring

Continuously watches global markets, including crypto, forex, and equities, allowing automated strategies to react instantly even when traders are unavailable.

5. Accurate Backtesting

Test strategies on extensive historical data to evaluate realistic performance, optimize settings, and validate the probability of success before live trading.

Limitations of Robo Trading

Here are the key limitations that traders must be aware of when using automated systems:

1. Technical Failures

Internet disruptions, server crashes, or software bugs can disrupt automated execution and lead to missed trading opportunities.

2. Over-Optimization

Strategies may perform excellently in backtests yet fail disastrously in unpredictable real-world market conditions.

3. Limited by Programmed Logic

Robots struggle with unexpected events such as wars, policy shifts, or sudden crashes beyond their coded parameters.

4. Requires Technical Knowledge

Users must understand coding basics or trading logic to build, adjust, and maintain automated trading systems.

Real-World Applications of Robo Trading

Here are the major applications where automated trading systems are widely used today:

1. Stock Market Trading

Automated systems buy and sell stocks using technical indicators, quantitative models, and predefined algorithmic trading strategies.

2. Forex and Commodity Trading

Automation enhances trading in fast-moving forex and commodity markets by executing trades based on programmed rules.

3. Crypto Trading Bots

Crypto trading bots operate continuously on exchanges like Binance, Coinbase, and Bybit, executing automated strategies efficiently.

4. Portfolio Rebalancing

Robotic portfolio tools automatically rebalance asset allocations based on risk tolerance, ensuring disciplined, long-term investment management.

5. HFT in Institutional Trading

Institutions use high-frequency systems to capture micro-profits through ultra-fast execution and advanced algorithms operating at scale.

Examples of Robo Trading

Here are some popular automated trading bots that operate based on predefined strategies:

1. RSI Overbought–Oversold Bot (Momentum Trading)

A popular automated bot that uses the Relative Strength Index (RSI) to detect shifts in market momentum.

How it works:

- Buy Signal: When RSI falls below 30 (oversold zone) and then rises back above 30

- Sell Signal: When RSI rises above 70 (overbought zone) and then drops back below 70

Why traders use it:

It helps capture short-term reversals and avoids emotional “panic buying or selling.”

2. Breakout Trading Bot (Price Action Strategy)

This bot detects strong breakouts from support, resistance, or price ranges.

How it works:

- Buy Signal: When a high volume price breaks above a significant barrier level

- Sell Signal: When a high volume price breaks below a support level

Why traders use it:

Breakouts often lead to powerful trends, and automated bots react faster than humans.

How to Start Robo Trading?

Here are the important steps to begin your journey into automated trading:

Step 1: Select a Market

Stocks, forex, crypto, or commodities.

Step 2: Choose a Strategy

Trend-following, scalping, arbitrage, options trading, etc.

Step 3: Pick a Platform

MetaTrader, Zerodha Streak, TradingView, or custom Python bots.

Step 4: Backtest the Strategy

Test for:

- Profitability

- Sharpe ratio

- Drawdowns

Step 5: Use Paper Trading

Practice without real money.

Step 6: Start with a Small Capital

Gradually scale up.

Final Thoughts

Robo trading is now accessible to everyday traders, offering exceptional speed, consistency, and efficiency in modern markets. While it simplifies execution and enhances decision-making, true success requires strong strategies, thorough backtesting, and continuous monitoring. With proper knowledge and disciplined risk management, robo trading can significantly improve performance, reduce emotional errors, and empower traders to make smarter, data-driven decisions across various asset classes.

Frequently Asked Questions (FAQs)

Q1. Is robo trading legal?

Answer: Yes, it is legal in many countries, including India, US, and Europe, as long as it follows exchange regulations.

Q2. Do I need coding knowledge?

Answer: Not always. Platforms like Streak and TradingView, and no-code bots, enable automation without programming.

Q3. Can robo trading guarantee profits?

Answer: No system guarantees profits. Success depends on strategy quality, risk management, and market conditions.

Q4. What capital is required?

Answer: You can start with small amounts, though some markets have minimum margin requirements.

Recommended Articles

We hope that this EDUCBA information on “Robo Trading” was beneficial to you. You can view EDUCBA’s recommended articles for more information.