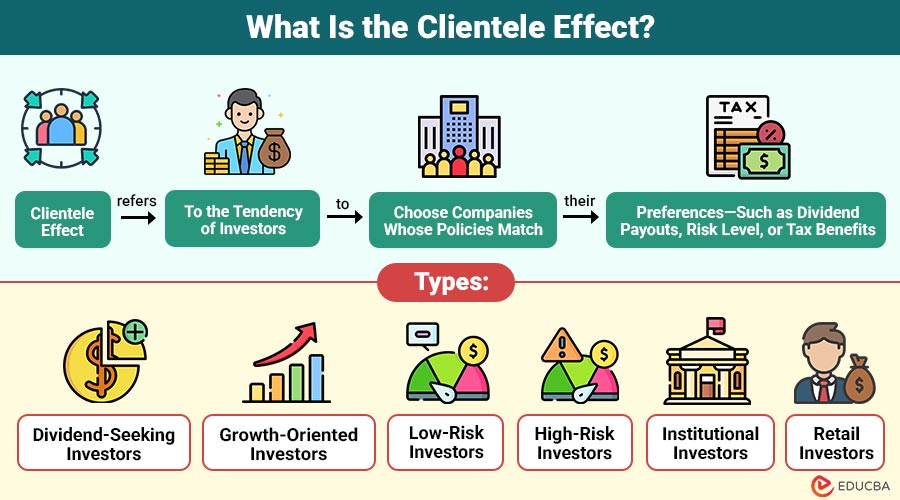

What Is the Clientele Effect?

The clientele effect refers to the tendency of investors to choose companies whose policies match their preferences—such as dividend payouts, risk level, or tax benefits. This means each company attracts a specific “clientele” of investors who feel comfortable with its financial strategy.

For example, investors who prefer regular income choose companies that pay high dividends. If that company suddenly reduces dividends, those investors may sell their shares, causing new investors with different preferences to take their place.

Table of Content:

- What Is the Clientele Effect?

- How the Clientele Effect Works

- Types

- Factors

- Impact

- Real-World Examples

- Clientele Effect vs Other Financial Concepts

- Modern Relevance of the Clientele Effect

Key Takeaways

- The clientele effect explains how investors choose companies that align with their financial goals, such as dividend yields, growth rates, or risk levels.

- Changes in company policies, such as dividend adjustments or risk strategies, can shift the investor base.

- Companies often design policies to attract and retain their preferred clientele, improving market stability and long-term planning.

- Modern trends, including digital trading, AI-driven investing, and ESG preferences, continue to reinforce the relevance of the clientele effect in financial markets.

How Does the Clientele Effect Work?

It explains how investors naturally gravitate toward companies that align with their financial preferences.

- Investor preferences drive choices: People invest in companies whose policies fit their needs—such as stable dividends, low risk, or long-term growth.

- Companies attract specific investor groups: A firm with high dividends attracts income-seeking investors, while a growth-focused company draws investors looking for long-term gains.

- Policy changes trigger investor movement: If a company changes its dividend policy, tax structure, or risk profile, existing investors may sell their shares because the company no longer aligns with their expectations.

- New investors replace old ones: When old investors exit, new investors with different preferences enter, balancing the market.

- Creates market stability: Over time, this matching process helps companies develop a more predictable investor base, making market reactions more stable.

- Influences corporate decisions: Firms often design policies—such as dividend payouts or debt strategies—to keep their preferred clientele satisfied.

Types of Clientele in the Market

Different investor groups group themselves based on their preferences, goals, and comfort levels.

- Dividend-Seeking Investors: These investors prefer companies that pay regular and high dividends. They often include retirees and people who want a steady income.

- Growth-Oriented Investors: They focus on companies that reinvest profits to grow faster. These investors do not mind lower dividends because they expect higher future returns.

- Low-Risk Investors: They choose companies with stable earnings, low debt, and predictable returns. Safety and consistency matter more to them than high profits.

- High-Risk Investors: These investors like companies with high growth potential, even if the risk is greater. They are willing to accept volatility for bigger rewards.

- Institutional Investors: Banks, pension funds, and mutual funds invest large amounts and prefer companies with strong governance and long-term stability.

- Retail Investors: Individual investors with smaller budgets who choose companies based on personal goals, trends, or recommendations.

Factors That Create a Clientele Effect

Several financial and personal factors influence why investors prefer certain companies over others.

- Tax Preferences: Investors often choose companies whose dividend or return structure helps them save on taxes. Higher-tax investors prefer low-dividend firms, while lower-tax investors may prefer high-dividend firms.

- Risk Tolerance: People with low risk tolerance choose stable companies, while risk-takers prefer volatile or fast-growing businesses.

- Dividend Policies: Companies that pay regular dividends attract income-focused investors, while firms that reinvest profits attract growth-focused investors.

- Investment Goals: Short-term traders prefer liquid, fast-moving stocks, while long-term investors choose companies with steady growth plans.

- Transaction Costs: Investors avoid companies with high trading costs or low liquidity because buying or selling shares becomes expensive.

- Regulatory Environment: Government rules, tax laws, and market policies influence which type of investors a company attracts.

Impact of the Clientele Effect on Financial Decisions

The clientele effect influences how both investors and companies make important financial choices.

- Shapes Company Policies: Companies design dividend payouts, risk levels, and debt strategies to satisfy their existing investors and keep them loyal.

- Affects Stock Price Movements: When a company changes its policies, investors who oppose the change may sell their shares, leading to short-term price fluctuations.

- Influences Investor Selection: Investors choose companies that match their goals—such as income, growth, or low risk—making their financial planning easier.

- Improves Market Stability: Over time, the right investors stay with companies whose policies they prefer, reducing unnecessary market volatility.

- Guides Long-Term Strategy: Firms maintain consistent policies to attract the right investor groups for stable funding.

- Impact Capital Allocation: Investors may shift their capital across sectors or companies in response to policy changes, thereby affecting market capital flows.

Real-World Examples of the Clientele Effect

The clientele effect can be observed in how investors respond to corporate policies in real markets.

- Dividend Policy Changes: When a company like Apple increases dividends, income-focused investors buy shares, while growth-focused investors may shift to other companies.

- Corporate Bond Issuance: Companies issuing long-term bonds attract risk-averse investors, while short-term or high-yield bonds appeal to risk-takers.

- Tech Startups vs. Established Firms: Investors looking for high growth prefer tech startups, while conservative investors stick to stable, established companies like Coca-Cola or Procter & Gamble.

- Mergers and Acquisitions: Policy changes after a merger can prompt investors to sell if the company no longer aligns with their preferences, attracting new investor groups.

- Global Tax Impact: International investors may avoid companies in high-tax countries, preferring firms that provide tax-efficient returns.

- ESG Investing: Investors focused on environmental, social, and governance (ESG) shift their funds toward companies with strong ESG practices, demonstrating a modern clientele effect.

Clientele Effect vs Other Financial Concepts

| Feature | Clientele Effect | Other Financial Concept |

| Meaning | Investors choose companies that align with their preferences, such as dividends, risk, or tax benefits. | Concepts such as the Bird-in-Hand Theory, Signaling, and the Efficient Market Hypothesis focus on general investor behavior, valuation, and market efficiency. |

| Focus | Matches company policies with specific investor groups. | Focuses on overall market behavior, valuation theories, or signaling between the company and investors. |

| Investor Role | Investors move in or out in response to policy changes. | Investors react to information, market trends, or risk-return theories rather than specific policies. |

| Corporate Strategy | Companies design policies to attract or retain their preferred clientele. | Companies may focus on maximizing value, signaling quality, or minimizing the cost of capital. |

| Market Impact | Can gradually stabilize or shift the investor base. | Influences market efficiency, pricing, or perceived company value. |

| Example | A high-dividend company attracts income-seeking investors. | The Bird-in-Hand Theory suggests that investors prefer dividends to uncertain future gains. |

Modern Relevance of the Clientele Effect

The clientele effect still plays an important role in today’s fast-changing financial markets.

- Digital Trading Platforms: Easy access to stocks enables investors to switch between companies that match their preferences quickly.

- Algorithmic and AI-Driven Investing: Automated systems can track company policies and investor behavior, reinforcing the clientele effect.

- Global Investor Base: International investors consider tax laws, dividend policies, and risk levels, creating diverse clienteles worldwide.

- Corporate Strategy Adaptation: Companies maintain consistent dividend, growth, and risk policies to retain their preferred investors.

- Impact on Volatile Markets: Even in fast-moving markets, investors seek companies aligned with their goals, stabilizing long-term investment patterns.

- Influence on ESG and Thematic Investing: Investors now prefer companies that meet ethical, environmental, or social criteria, reflecting a modern form of the clientele effect.

- Future Trends: As technology and data analytics evolve, the clientele effect will continue to guide investor decisions and corporate policies.

Conclusion

The clientele effect highlights the strong link between investor preferences and company policies. It shows how changes in dividends, risk, or growth strategies influence who invests in a company. Understanding this effect helps businesses retain the right investors and guides individuals in making smarter investment choices, ensuring a stable and efficient market over time.

Frequently Asked Questions

1. What is the primary purpose of the clientele effect?

Answer:- It helps companies attract and retain investors whose preferences match their policies.

2. Can the clientele effect impact bond investments?

Answer:- Yes, investors prefer bonds that align with their risk and income needs.

3. Does market size affect the clientele effect?

Answer:- Larger markets can have more diverse clienteles, increasing investor shifts.

4. Is the clientele effect permanent for a company?

Answer:- No, changes in policies or market conditions can alter the investor base over time.

Recommended Articles

We hope this guide on Clientele Effect helped you understand investor behavior and corporate policies. For more finance insights, explore these articles below: