What Is Climate Investment?

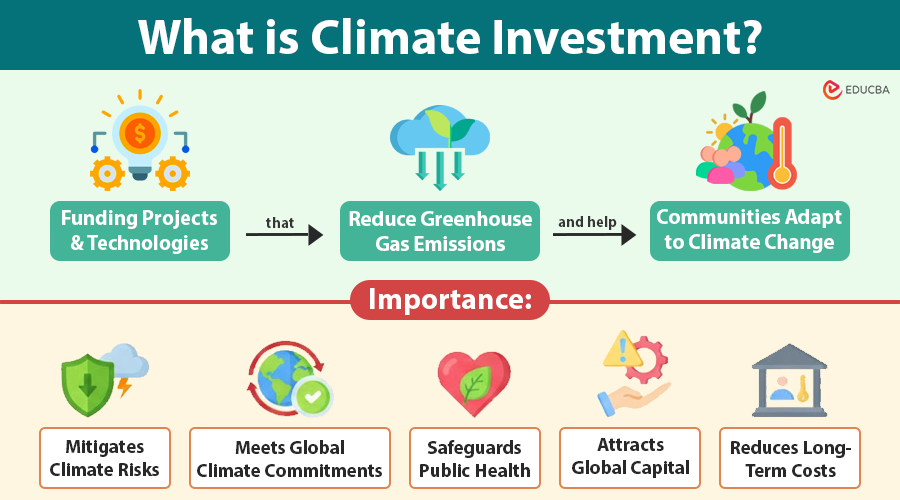

Climate investment involves allocating funds to projects and technologies that reduce emissions, assist communities in adapting to climate change, and foster a cleaner, lower-carbon economy.

Climate investment helps mitigate the impacts of climate change, enhances environmental resilience, and supports long-term economic growth.

A government invests in installing large-scale solar farms to replace coal-based power plants. This reduces carbon emissions, generates clean energy, and supports national climate goals.

Table of Contents

- Meaning

- Why does it matter?

- Key Areas

- Types

- Strategies for Organizations

- Challenges

- Global Trends

- Future Trends

Why Climate Investment Matters?

The following reasons highlight why climate investment is essential:

1. Mitigates Climate Risks

Climate change causes more frequent and stronger floods, heatwaves, droughts, and storms. These events disrupt supply chains, damage infrastructure, and impose severe economic costs. Climate investment helps mitigate these physical risks by supporting clean energy, resilient infrastructure, and early warning systems.

2. Promotes Environmental Sustainability

Investments in renewable energy, sustainable land use, and resource-efficient technologies help reduce greenhouse gas emissions and environmental degradation. This supports global efforts to limit temperature rise and preserve ecological balance.

3. Supports Sustainable Development Goals (SDGs)

Climate investment aligns closely with several SDGs, especially those related to clean energy (SDG 7), industry and innovation (SDG 9), sustainable cities (SDG 11), responsible consumption (SDG 12), and climate action (SDG 13). Allocating capital to climate initiatives accelerates progress toward these global development objectives.

4. Drives Economic Growth and Job Creation

The green economy, encompassing renewable energy, electric mobility, sustainable agriculture, and climate technology, offers enormous economic potential. Investments in these sectors stimulate innovation, create new industries, and generate millions of jobs worldwide.

5. Enhances Corporate Competitiveness

Businesses that invest in climate-smart technologies and low-carbon operations gain competitive advantages. They reduce operational costs, meet regulatory expectations, appeal to sustainability-focused consumers, and improve long-term financial performance.

6. Meets Global Climate Commitments

Countries must significantly increase climate investments to meet their NDC targets under the Paris Agreement. The world cannot keep global warming below 1.5°C, a level needed to avoid serious climate damage, unlesss enough funding is available.

7. Safeguards Public Health

Investments in cleaner energy and reduced pollution directly improve air quality, water security, and overall public health. This lowers healthcare costs and improves people’s quality of life.

8. Attracts Global Capital

International investors increasingly prioritize climate-aligned, low-carbon projects. Countries and companies that lead in climate investment are more likely to attract foreign investment, financing, and strategic partnerships.

9. Reduces Long-Term Costs

While climate investment may require substantial upfront capital, it reduces long-term economic losses from climate-related disasters, supply chain disruptions, and resource scarcity. The cost of inaction is far greater than the cost of investing now.

Key Areas of Climate Investment

The major areas of climate investment include the following:

1. Renewable Energy

Renewable energy remains the largest and most critical area of climate investment. It focuses on replacing fossil fuels with clean, sustainable energy sources. Key components include:

- Solar power (photovoltaic and solar thermal projects)

- Wind energy (onshore and offshore)

- Hydropower

- Geothermal energy

- Bioenergy.

These investments lower carbon emissions, reduce reliance on fossil fuels, and help stabilize long-term energy costs.

2. Energy Efficiency

Improving energy efficiency is a straightforward and cost-effective way to reduce emissions. Investments focus on:

- High-efficiency appliances and industrial equipment

- Green building technologies

- Energy-efficient heating and cooling systems

- Smart meters and intelligent energy management systems

- Upgrading aging infrastructure to reduce energy loss.

Energy efficiency reduces energy consumption, saves operational costs, and enhances overall system performance.

3. Sustainable Transportation

The transportation sector contributes significantly to global emissions, making it a vital area for climate investment. This includes:

- Electric vehicles (EVs) and charging infrastructure

- Public transportation systems (electric buses, metro rail networks)

- Low-emission logistics and freight solutions

- Biofuels and hydrogen-based transportation

- Cycling and pedestrian-friendly urban designs.

Such investments help reduce pollution, improve urban mobility, and support long-term sustainability.

4. Climate-Resilient Infrastructure

As climate impacts intensify, resilient infrastructure investments are essential for safeguarding communities and economies. Key examples include:

- Flood-resistant roads and bridges

- Stormwater management systems

- Coastal defenses and sea walls

- Climate-smart urban planning

- Early-warning and disaster-preparedness systems.

These measures enhance society’s ability to withstand extreme weather events and reduce long-term economic losses.

5. Sustainable Agriculture and Land Use

Agriculture and land use play a dual role in climate mitigation and adaptation. Investments in this area focus on:

- Climate-smart agriculture (CSA)

- Regenerative farming practices

- Sustainable water management

- Agroforestry and soil restoration

- Deforestation control and forest conservation programs.

These initiatives enhance food security, protect biodiversity, and support carbon sequestration.

6. Circular Economy and Waste Management

A circular economy reduces waste, promotes resource efficiency, and fosters sustainable production. Investment areas include:

- Waste reduction and recycling facilities

- Sustainable packaging solutions

- Resource recovery systems

- Composting and anaerobic digestion

- Cleaner industrial production technologies.

Transitioning to circular systems lowers emissions and reduces pressure on natural resources.

7. Carbon Markets and Emissions Reduction Technologies

Climate investment also supports innovative mechanisms and technologies aimed at reducing or offsetting emissions. These include:

- Carbon credit markets that promote emission-reduction projects

- Carbon capture, utilization, and storage (CCUS) technologies

- Direct air capture (DAC) solutions

- Nature-based carbon solutions (reforestation, mangrove restoration).

These tools help countries and companies meet their emissions targets more effectively.

8. Water Management and Climate Adaptation

Investments in water sustainability are essential as climate change disrupts rainfall patterns and water availability. Key areas include:

- Integrated water resource management (IWRM)

- Drought-resistant infrastructure

- Water recycling and desalination technologies

- Protection of watersheds and wetlands.

These investments ensure long-term water security for communities, industries, and ecosystems.

9. Climate-Tech Innovations

Climate investment increasingly supports advanced technologies designed to monitor, mitigate, or adapt to climate impacts. Major innovations include:

- AI-driven climate risk modeling

- Smart grid technologies

- Battery storage and energy management systems

- Green hydrogen production

- Alternative protein production

- Sustainable materials and bio-based products.

These technological advancements accelerate the transition to a low-carbon global economy.

Types of Climate Investments

The major types of climate investments include the following:

1. Public Climate Finance

Public climate finance consists of government-backed funding dedicated to climate-related projects and policies. These funds often target large-scale infrastructure projects, clean energy transitions, and climate resilience initiatives, particularly in developing countries.

Key sources include:

- National and local government budgets

- Climate-focused ministries and agencies

- International climate funds (e.g., Green Climate Fund, Global Environment Facility)

- Development finance institutions (DFIs) and multilateral development banks (MDBs).

Public financing plays a crucial role in mitigating investment risks and facilitating projects that may not initially attract private capital.

2. Private Climate Finance

Private climate finance refers to investments made by individuals, corporations, financial institutions, and private funds. These investments support market-driven climate solutions and drive innovation across climate-tech, clean energy, and sustainable infrastructure.

Key contributors include:

- Corporations and business enterprises

- Private equity firms and venture capital funds

- Big investors, including pension funds and insurance companies.

- Banks and credit institutions

Private capital is essential for scaling climate solutions and accelerating technological advancement.

3. Blended Finance

Blended finance combines government and private funding to support projects that help achieve climate goals. It aims to de-risk investments for private investors, making climate projects more attractive and financially viable.

Common mechanisms include:

- Concessional loans

- Guarantees and risk-sharing instruments

- Grants paired with commercial financing

- Public–private partnerships (PPPs).

Blended finance helps mobilize significant private capital for high-impact projects in emerging markets.

4. Green Bonds and Sustainability-Linked Bonds

Green and sustainability-linked bonds are fixed-income instruments used to raise capital for climate and sustainability projects. Investors receive stable returns while financing environmentally beneficial initiatives.

Types include:

- Green bonds: They specifically support projects that help the environment, such as renewable energy or green buildings.

- Sustainability-linked bonds (SLBs): Bond terms vary based on the issuer’s achievement of sustainability targets.

- Transition bonds: Support companies shifting from high-carbon to low-carbon operations.

These bonds offer transparency, accountability, and measurable climate outcomes.

5. Climate Funds and Investment Vehicles

Climate-specific investment funds pool capital to support low-carbon and climate-resilient projects. These funds are structured to attract investors seeking both financial returns and environmental impact.

Examples include:

- Climate-focused mutual funds and ETFs

- Impact investment funds

- Carbon credit funds

- Clean energy venture funds.

They provide diversified exposure to climate solutions while encouraging responsible investment behavior.

6. Carbon Markets and Emission Trading Systems (ETS)

Carbon markets enable companies and governments to buy and sell carbon credits or allowances to meet emission reduction targets. These markets create financial incentives for cutting emissions.

Types include:

- Compliance markets (e.g., EU Emissions Trading System)

- Voluntary carbon markets

- Nature-based carbon offset programs.

Carbon markets support cost-effective emissions reduction and encourage investment in sustainable projects.

7. Philanthropic and Impact Investments

Philanthropic organizations and impact-focused investors support climate initiatives that prioritize environmental benefits over financial returns. These investments often target community resilience and early-stage innovation.

Common contributors include:

- Foundations and charitable trusts

- Nonprofit organizations

- High-net-worth individuals (HNIs)

- Social impact investors.

These contributions help kick-start innovative, high-risk, or socially focused climate projects.

8. Corporate Climate Investments

Corporations are increasingly investing in climate initiatives to meet their sustainability goals, reduce operational emissions, and enhance competitiveness. Investment areas include:

- Renewable energy procurement (e.g., PPAs)

- Energy efficiency upgrades

- Supply chain decarbonization projects

- Internal carbon pricing mechanisms.

Corporate investments drive large-scale emissions reduction and influence climate behavior across value chains.

Climate Investment Strategies for Organizations

The following are key climate investment strategies organizations can implement to accelerate their transition toward a low-carbon future.

1. Decarbonization and Energy Transition Strategies

Decarbonization is central to climate investment, as it focuses on lowering greenhouse gas emissions across operations, supply chains, and product lifecycles.

Key Investment Areas

- Renewable Energy Adoption: Investing in solar, wind, or hydropower through on-site installations or long-term Power Purchase Agreements (PPAs).

- Energy Efficiency Upgrades: Retrofitting buildings with efficient lighting, HVAC systems, insulation, and smart energy management.

- Electrification of Operations: Shifting from fossil-fuel-based systems to electric equipment, vehicles, and machinery.

- Low-Carbon Manufacturing: Investing in cleaner production technologies, waste heat recovery, and resource-efficient processes.

Benefits

- Lower operating costs

- Reduced exposure to carbon taxes and regulatory changes

- Enhanced brand reputation.

2. Integration of ESG (Environmental, Social, and Governance) Principles

Investing in ESG-aligned financial and operational practices enables organizations to measure and mitigate climate impacts, while also attracting responsible investors.

Key Investment Areas

- ESG Screening: Allocating funds to assets or projects that meet predefined climate and sustainability standards.

- Sustainability-Linked Investments: Using financing instruments such as green bonds, sustainability-linked loans, and climate funds.

- Internal Carbon Pricing: Assigning a monetary value to emissions to guide investment decisions and encourage low-carbon choices.

Benefits

- Better investor confidence

- Stronger long-term resilience

- Improved sustainability ratings.

3. Climate Risk Assessment and Disclosure

Organizations must understand climate risks to make informed investment decisions and meet regulatory expectations.

Key Investment Areas

- Climate Scenario Analysis: Using climate data to assess potential financial, operational, and supply chain impacts under different warming scenarios.

- Adopting TCFD Framework: Implementing recommendations by the Task Force on Climate-related Financial Disclosures (TCFD) for transparency.

- Transition Risk Management: Investing in compliance, clean energy alternatives, and operational changes to address policy and market shifts.

Benefits

- Strong governance and risk management

- Enhanced stakeholder trust

- Improved ability to secure financing.

4. Nature-Based Solutions (NbS)

Nature-based solutions involve investment in natural systems that mitigate climate impacts while supporting biodiversity and ecosystems.

Key Investment Areas

- Reforestation and Afforestation Projects

- Restoration of Wetlands and Mangroves

- Soil Carbon Sequestration Programs

- Sustainable Water Management Systems.

Benefits

- Carbon sequestration

- Climate resilience (flood control, soil protection)

- Alignment with national and global sustainability targets.

5. Technology and Innovation Investments

Climate-tech innovations play a significant role in decarbonization and adaptation efforts.

Key Investment Areas

- AI and Data Analytics for Climate Modeling

- Advanced Battery Storage and Smart Grids

- Hydrogen Technologies

- Carbon Capture, Utilization, and Storage (CCUS)

- IoT-Based Energy Monitoring Systems.

Benefits

- Improved operational efficiency

- Higher accuracy in risk forecasting

- Competitive advantage in green markets.

6. Supply Chain Decarbonization

Organizations are expanding their climate investment beyond internal operations to address emissions across their entire supply chains.

Key Investment Areas

- Supplier Engagement Programs: Sustainability training, incentives, and collaborative projects.

- Green Procurement Policies: Prioritizing low-carbon materials, sustainable packaging, and ethical sourcing.

- Logistics Optimization: Using EV fleets, route optimization, and efficient distribution networks.

Benefits

- Reduced Scope 3 emissions

- Greater supply chain resilience

- Enhanced compliance with emerging global regulations.

7. Workforce Training and Sustainability Culture

Strategic investment in people is crucial for the long-term success of the climate transition.

Key Investment Areas

- Funding climate awareness programs

- Skill development in renewable energy and green technologies

- Leadership training in sustainability governance

- Incentive structures encouraging sustainability-driven performance.

Benefits

- Increased employee engagement

- Better implementation of climate strategies

- Stronger organizational commitment to sustainability.

8. Green Financing and Sustainable Capital Allocation

Organizations can allocate capital specifically for climate-aligned projects.

Key Investment Areas

- Green bonds and Climate Bonds

- Sustainability-Linked Loans (SLLs)

- Impact Investment Funds

- Carbon Credit Investments

- Climate-Aligned Infrastructure Funds.

Benefits

- Access to concessional financing

- Lower financing costs for green projects

- Diversification of investment portfolio.

9. Partnership and Collaboration Models

Collaboration amplifies climate impact and accelerates access to resources.

Key Investment Areas

- Joining global initiatives like the UN Race to Zero, Science Based Targets initiative (SBTi), or sector-specific decarbonization alliances

- Collaborating with research institutions and climate-tech startups

- Partnering with governments on public–private climate initiatives

Benefits

- Shared expertise and innovation

- Reduced project costs

- Faster deployment of climate solutions.

10. Monitoring, Reporting, and Continuous Improvement

Strong monitoring frameworks and performance metrics are crucial for supporting climate investment strategies.

Key Investment Areas

- Establishing climate KPIs such as emissions intensity, renewable energy share, and climate risk exposure

- Annual sustainability and ESG reporting

- Third-party audits for emissions and climate impacts

- Continuous innovation cycle for improved performance.

Benefits

- Data-driven decision-making

- Higher investor transparency

- Better compliance with global disclosure norms.

Challenges in Climate Investment

Understanding these challenges is crucial for developing effective strategies that promote climate-friendly growth.

1. Insufficient Funding and Widening Financing Gap

A significant issue is that there is insufficient funding to meet the goals of the Paris Agreement.

- Developing countries face particularly high financing needs but often lack access to affordable credit.

- Current climate finance flows remain far below the estimated trillions needed annually for mitigation and adaptation.

This gap hinders progress and prevents critical sectors, such as renewable energy, resilient infrastructure, and sustainable agriculture, from scaling effectively.

2. Policy and Regulatory Uncertainty

Investors require stable and predictable policies to commit to large climate-related projects. However:

- Inconsistent climate regulations

- Frequent policy reversals

- Lack of long-term national climate strategies

- Can weaken investor confidence.

Policies related to carbon pricing, subsidies, and renewable energy incentives vary widely across regions, making climate investment less predictable and more complex.

3. High Upfront Costs and Long Payback Periods

Many climate-friendly technologies and infrastructure projects demand substantial upfront capital. Examples include:

- Renewable energy facilities

- Smart grid systems

- Climate-resilient infrastructure

Although these investments provide long-term savings and benefits, the initial costs can deter private investors, especially when alternatives (like fossil fuels) still appear cheaper in the short term.

4. Limited Access to Finance in Developing Economies

Developing countries often face constraints such as:

- Weak financial markets

- Limited credit availability

- Higher perceived investment risks

- Insufficient technical capacity

These limitations restrict the flow of international capital, making it challenging for vulnerable countries, which are often the most affected by climate change, to attract climate-related investment.

5. Challenges in Measuring, Reporting, and Verifying Outcomes

Accurate measurement and reporting of climate impact remain a complex task.

- There is no single agreed-upon way to measure the effects of climate change.

- Companies and governments may use inconsistent reporting methods.

- Greenwashing concerns reduce investor trust.

These issues create uncertainty about the effectiveness of climate investments and complicate performance comparisons across sectors and regions.

6. Technological and Innovation Gaps

While technology is central to climate solutions, several challenges persist:

- Some technologies, like carbon capture or green hydrogen, are still costly or commercially immature.

- Limited access to modern technologies restricts progress in emerging economies.

- Fast-paced technological changes require continuous upgrading of infrastructure and skills.

These gaps hinder the adoption of efficient and scalable climate solutions.

7. Insufficient Risk-Mitigation Mechanisms

Climate-related projects often carry higher perceived risks due to:

- Policy instability

- Market fluctuations

- Natural disaster exposure

- Technology obsolescence.

The lack of robust risk-sharing instruments, such as guarantees, insurance mechanisms, and blended finance structures, discourages private investors from entering climate-sensitive markets.

8. Lack of Data and Climate Risk Assessment Tools

Climate investment requires accurate forecasting of climate risks. However:

- Many organizations lack access to reliable climate data.

- Modelling tools are often expensive or technically complex.

- Data gaps lead to mispricing of assets and underestimation of climate risks.

Better data and analytical tools are crucial for supporting informed decision-making.

9. Socio-Economic and Political Barriers

Broader socio-political dynamics influence climate investment:

- Resistance from fossil-fuel-dependent industries

- Political shifts that deprioritize climate action

- Social opposition to new infrastructure projects

- Economic constraints during downturns.

These factors can delay decision-making and reduce funding flows.

10. Uneven Global Progress and Coordination Challenges

Climate investment requires international cooperation, but:

- Funding distribution remains unequal across regions.

- Developed and developing nations often disagree on financial responsibilities.

- Lack of harmonization in policies, carbon markets, and regulatory frameworks creates fragmentation.

This lack of coordination slows global progress in climate financing and project implementation.

Global Trends in Climate Investment

Below are the major trends influencing climate investment worldwide.

1. Surge in Renewable Energy Investments

Renewable energy continues to dominate global climate finance. Solar and wind projects attract the highest capital due to declining production costs, improved technology, and favorable government policies. Large-scale renewable installations, grid modernization, and energy storage solutions are expanding rapidly, particularly in the Asia-Pacific, Europe, and North America regions.

2. Rapid Growth of Green Bonds and Sustainable Finance Instruments

Green bonds, sustainability-linked bonds, and transition bonds have become essential financing tools for governments and corporations. These instruments fund renewable energy, greener transportation, water management, and other climate-positive initiatives.

- Green bond issuance has grown exponentially, supported by investor demand for ESG-focused products.

- Sustainability-linked loans (SLLs) and blended finance models are helping emerging economies access climate capital.

3. Increasing Focus on Climate Adaptation Finance

While mitigation projects (like renewable energy) have traditionally received the most funding, adaptation finance is now gaining importance as climate impacts intensify. Investors are directing funds toward:

- Flood-resilient infrastructure

- Early-warning systems

- Drought-resistant crops

- Climate-smart agriculture

- Disaster preparedness and recovery systems.

Developing nations, small island states, and coastal economies are prioritizing adaptation to protect livelihoods and infrastructure.

4. Rise of Climate-Tech and Clean Innovation

Climate-tech startups are attracting record investments as they develop next-generation solutions, such as:

- Carbon capture, utilization, and storage (CCUS)

- Hydrogen energy and fuel cells

- Battery storage technologies

- AI-driven climate risk analytics

- Nature-based carbon removal solutions.

Venture capital flows into climate tech have grown steadily due to the rising demand for scalable, high-impact technologies.

5. Corporate Net-Zero and Science-Based Targets

More than 4,000 global companies have committed to net-zero or science-based targets. This shift is driving investments in:

- Decarbonizing supply chains

- Energy-efficient operations

- Green logistics and transportation

- Sustainable manufacturing.

Businesses are also aligning their portfolios with climate commitments, integrating ESG standards into investment decisions.

6. Urban Climate Investment and Sustainable Cities

Cities are disproportionately vulnerable to the impacts of climate change. As a result, governments and urban planners are increasing investments in:

- Electrified public transport systems

- Smart grids and digital energy solutions

- Green buildings and energy-efficient construction

- Nature-based urban solutions (parks, wetlands, mangroves).

Smart, sustainable urban development has become a global priority.

7. Expansion of Carbon Markets and Pricing Mechanisms

Carbon pricing has emerged as a major global trend, with more countries implementing:

- Carbon taxes

- Emissions trading systems (ETS)

- Voluntary carbon markets.

Capital is flowing into high-quality carbon credits, reforestation initiatives, and technologies that support accurate emissions tracking and verification.

8. Growing Role of Multilateral Climate Funds

Global institutions, such as the Green Climate Fund, the World Bank, and the Asian Development Bank, are providing increased climate funding to support developing countries.

These funds are critical for:

- Scaling renewable energy

- Building resilient infrastructure

- Facilitating climate-smart agriculture

- Supporting policy reforms.

Partnerships between governments and multilateral banks are driving large-scale climate investment programs globally.

9. Increased Emphasis on Private Sector Participation

The private sector now plays an important role in closing the climate finance gap. Big investors are putting more money into green projects because they are stable and give reliable returns.

Private climate finance is expanding through:

- Public-private partnerships (PPPs)

- Blended finance initiatives

- Sustainable investment funds

- Corporate green bonds.

10. Digital Transformation of Climate Finance

Digital technologies are reshaping climate investment through:

- Blockchain for transparent tracking of climate funds

- AI and big data for climate risk assessments

- Smart metering and IoT solutions for energy management.

This digital transformation enhances monitoring, accountability, and efficiency in climate projects.

The Future of Climate Investment

The accelerated transition toward low-carbon economies, stronger regulatory frameworks, and technological advancements will define the future of climate investment. As climate risks intensify, investors will continue increasing their investments in mitigation and adaptation. Governments and investors will increasingly prioritize clean energy, sustainable infrastructure, carbon removal technologies, and climate-resilient development.

Utilizing digital tools such as AI, blockchain, and data analytics will enhance climate risk management and generate new funding opportunities. The next decade is likely to see climate investment shift from a sustainability initiative to a core economic strategy.

Final Thoughts

Climate investment is essential for mitigating the impacts of climate change, fostering sustainable economic growth, and building resilient societies. As countries make stronger climate commitments and new technologies grow, climate investment will play a major role in supporting the environment and global development. By mobilizing public and private capital, adopting innovative strategies, and strengthening international cooperation, the world can move closer to achieving a sustainable, low-carbon future.

Frequently Asked Questions (FAQs)

Q1. What is the difference between climate investment and sustainable investment?

Answer: Climate investment specifically focuses on projects and technologies that reduce greenhouse gas emissions, improve climate resilience, and address climate change. Sustainable investment is broader and encompasses environmental, social, and governance (ESG) factors, which may include human rights, labor practices, and corporate governance, as well as climate-related goals.

Q2. Are climate investments profitable?

Answer: Yes, climate investments can provide financial returns while delivering environmental benefits. Renewable energy, energy efficiency, and climate-tech startups often offer long-term growth, lower operational costs, and risk reduction, making them attractive to investors seeking both financial returns and social impact.

Q3. How do carbon credits and offsets work in climate investment?

Answer: Carbon credits and offsets allow organizations or countries to compensate for their emissions by funding emission reduction projects elsewhere. For example, a company can purchase carbon credits from a tree-planting project to offset its CO₂ emissions.

Q4. How can climate investment contribute to meeting net-zero goals?

Answer: By financing renewable energy, energy efficiency, low-carbon transportation, and carbon removal technologies, climate investment helps businesses, governments, and individuals reduce emissions. The widespread adoption of these projects is crucial to achieving global net-zero targets.

Q5. What role do governments play in promoting climate investment?

Answer: Governments create incentives, policies, and regulations to attract climate finance. Examples include subsidies for renewable energy, tax benefits for sustainable projects, carbon pricing mechanisms, and national green funds to de-risk investments and encourage private sector participation.

Recommended Articles

We hope this article on climate investment helps you understand how funding low-carbon projects supports the environment, communities, and economic growth. Explore our related articles to learn more about renewable energy, sustainable finance, and climate-smart technologies.